Your Teacher retirement system of texas images are available in this site. Teacher retirement system of texas are a topic that is being searched for and liked by netizens today. You can Get the Teacher retirement system of texas files here. Find and Download all free photos and vectors.

If you’re looking for teacher retirement system of texas pictures information linked to the teacher retirement system of texas topic, you have visit the ideal site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Teacher Retirement System Of Texas. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). More than 1.6 million public education and higher educatio… All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment. You contribute 7.7% of your salary.

You contribute 7.7% of your salary. Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Participation in trs is mandatory for all eligible public education employees in texas unless you qualify for another benefit plan, such as the. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs. Eligibility benefits eligible employees that are working at least 20 hours per week for 4 1/2 continuous months or more are eligible. Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits.

How the teacher retirement system of texas works.

As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. Students employed in positions that require student status as a condition of employment are […] All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment. Participation in trs is mandatory for all eligible public education employees in texas unless you qualify for another benefit plan, such as the. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs. Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a).

Source: glassdoor.com

Source: glassdoor.com

Employee and employer contributions go into a large trust fund that is managed by knowledgeable. Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Students employed in positions that require student status as a condition of employment are […] Participation in trs is mandatory for all eligible public education employees in texas unless you qualify for another benefit plan, such as the. How the teacher retirement system of texas works.

Source: morebooks.de

Source: morebooks.de

As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits. You contribute 7.7% of your salary. How the teacher retirement system of texas works. Employee and employer contributions go into a large trust fund that is managed by knowledgeable.

Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). Students employed in positions that require student status as a condition of employment are […] Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan.

More than 1.6 million public education and higher educatio… You contribute 7.7% of your salary. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Teacher retirement system of texas (trs) is a public pension plan of the state of texas.

All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). Eligibility benefits eligible employees that are working at least 20 hours per week for 4 1/2 continuous months or more are eligible. Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits.

Source: glassdoor.com

Source: glassdoor.com

All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment. Teacher retirement system of texas (trs) is a public pension plan of the state of texas. How the teacher retirement system of texas works. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income.

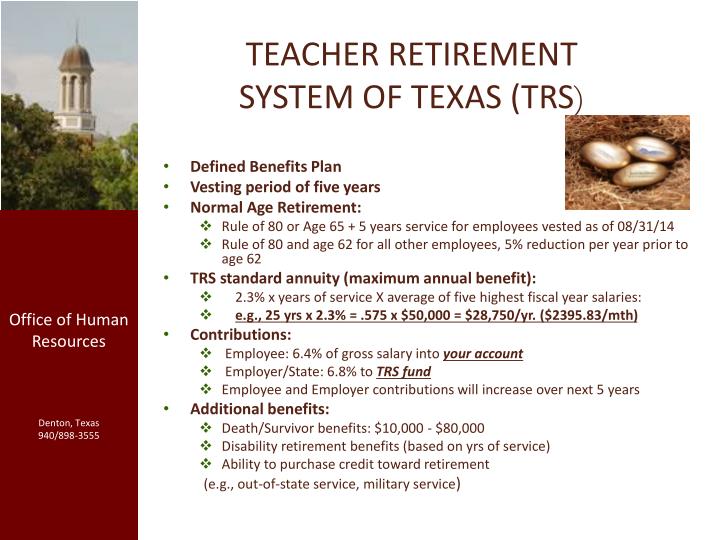

Source: slideserve.com

Source: slideserve.com

Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits. Teacher retirement system of texas (trs) is a public pension plan of the state of texas. Employee and employer contributions go into a large trust fund that is managed by knowledgeable. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs. All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment.

Source: glassdoor.com

Source: glassdoor.com

The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income. Eligibility benefits eligible employees that are working at least 20 hours per week for 4 1/2 continuous months or more are eligible. Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Employee and employer contributions go into a large trust fund that is managed by knowledgeable. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs.

Source: glassdoor.com

Source: glassdoor.com

Eligibility benefits eligible employees that are working at least 20 hours per week for 4 1/2 continuous months or more are eligible. As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. You contribute 7.7% of your salary. Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits. Students employed in positions that require student status as a condition of employment are […]

Source: glassdoor.com

Source: glassdoor.com

More than 1.6 million public education and higher educatio… The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income. Employee and employer contributions go into a large trust fund that is managed by knowledgeable. Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Teacher retirement system of texas (trs) is a public pension plan of the state of texas.

Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits. As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. More than 1.6 million public education and higher educatio… Established in 1937, trs provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the state of texas and manages a $180 billion trust fund established to finance member benefits. The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income.

Source: trademarkia.com

Source: trademarkia.com

Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). Students employed in positions that require student status as a condition of employment are […] As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). More than 1.6 million public education and higher educatio…

Source: youtube.com

Source: youtube.com

Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income. You contribute 7.7% of your salary. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a).

Teacher retirement system of texas (trs) is a public pension plan of the state of texas. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. Employee and employer contributions go into a large trust fund that is managed by knowledgeable.

Source: bankers-anonymous.com

Source: bankers-anonymous.com

The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). More than 1.6 million public education and higher educatio… Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a).

Participation in trs is mandatory for all eligible public education employees in texas unless you qualify for another benefit plan, such as the. As a public school employee in texas, you must participate in the teachers retirement system, a defined benefit pension plan. All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment. More than 1.6 million public education and higher educatio… How the teacher retirement system of texas works.

Source: lifebridgefg.com

Source: lifebridgefg.com

Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the irs. Teacher retirement system of texas (trs) is a public pension plan of the state of texas. Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). The teacher retirement system (trs) is a defined benefit plan that gives public teachers and other eligible employees a lifetime pension income.

Trs is a defined benefit retirement plan governed by internal revenue code section 401 (a). Teacher retirement system of texas (trs) is a defined benefit retirement plan governed by internal revenue code section 401(a). How the teacher retirement system of texas works. All eligible employees of the university of texas system are automatically enrolled in trs on their first day of employment. More than 1.6 million public education and higher educatio…

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title teacher retirement system of texas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.