Your Retirement plan of images are available in this site. Retirement plan of are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement plan of files here. Download all free photos.

If you’re looking for retirement plan of images information linked to the retirement plan of interest, you have pay a visit to the ideal site. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

Retirement Plan Of. Call now 0477 306 776 To define an asset allocation and investment plan to reach that goal. A 401k plan allows you to contribute up to $20,500 per. Retirement planning has five steps:

![]() Retirement Plan Concept. Chart With Keywords And Icons Stock Photo From dreamstime.com

Retirement Plan Concept. Chart With Keywords And Icons Stock Photo From dreamstime.com

Call now 0477 306 776 Call now 0477 306 776 And the key is to start early to take advantage of power of compounding. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. Retirement planning has five steps: To define an asset allocation and investment plan to reach that goal.

Ad work with a team that cares about your financial future.

Retirement planning has five steps: And the key is to start early to take advantage of power of compounding. To define an asset allocation and investment plan to reach that goal. A 401k plan allows you to contribute up to $20,500 per. Ad work with a team that cares about your financial future. Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Ad work with a team that cares about your financial future. Retirement planning has five steps: Ad work with a team that cares about your financial future. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. And the key is to start early to take advantage of power of compounding.

Source: myconfidence.com

Source: myconfidence.com

4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,. Retirement planning has five steps: And the key is to start early to take advantage of power of compounding. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. To define an asset allocation and investment plan to reach that goal.

![4 Major Benefits of a Personal Retirement Plan [Infographic] 4 Major Benefits of a Personal Retirement Plan [Infographic]](http://blog.highlandbrokerage.com/wp-content/uploads/2015/08/4-Major-Benefits-of-a-Personal-Retirement-Plan-Infographic-Revised.png) Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

Individual retirement arrangements (iras) roth iras. A 401k plan allows you to contribute up to $20,500 per. To define an asset allocation and investment plan to reach that goal. Ad work with a team that cares about your financial future. Call now 0477 306 776

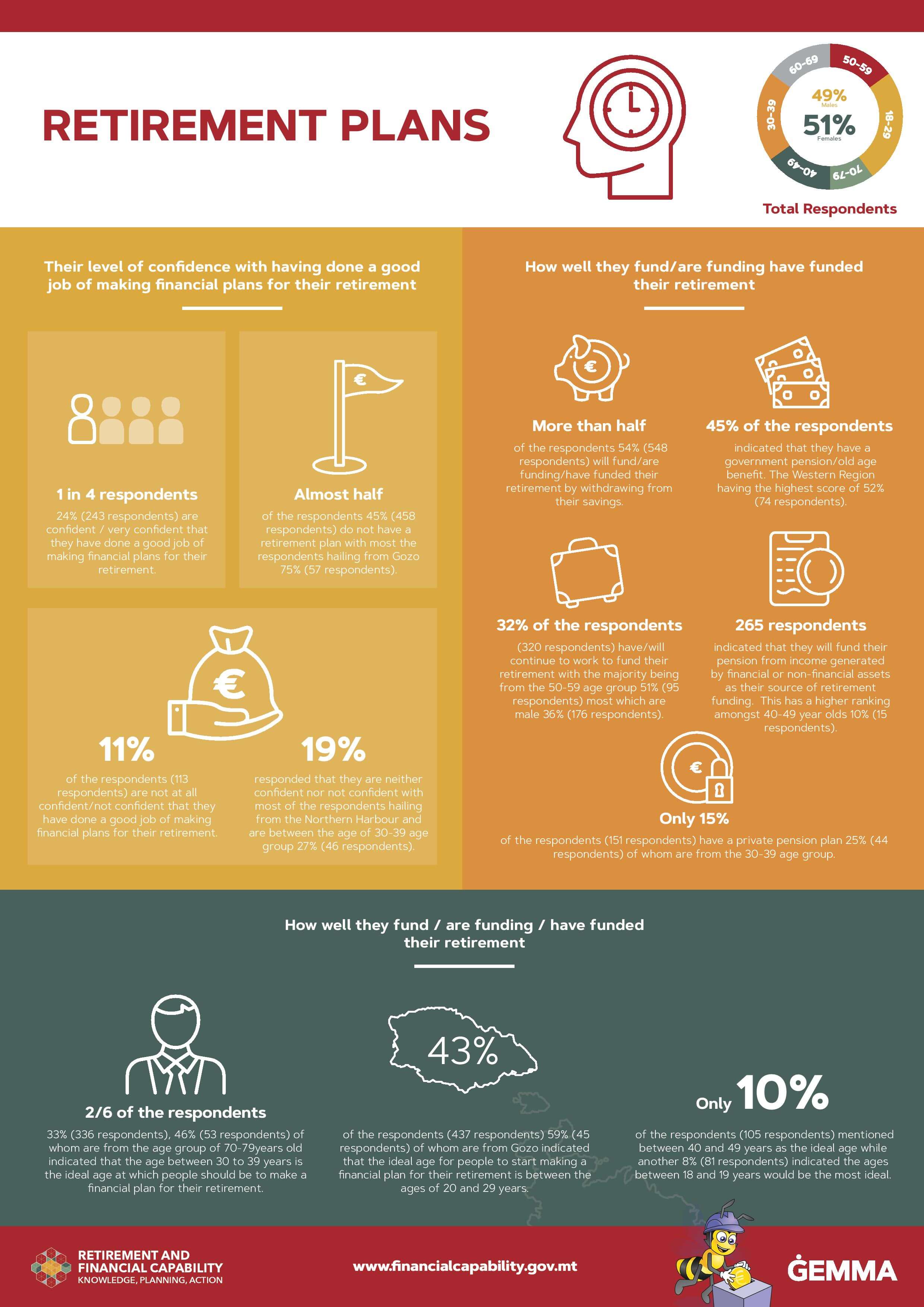

Source: gemma.gov.mt

Source: gemma.gov.mt

Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. Ad work with a team that cares about your financial future. Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. 4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,. To define an asset allocation and investment plan to reach that goal.

![]() Source: dreamstime.com

Source: dreamstime.com

Ad work with a team that cares about your financial future. Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. To lead a secure, independent and peaceful life post retirement you need to plan now. To define an asset allocation and investment plan to reach that goal. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras.

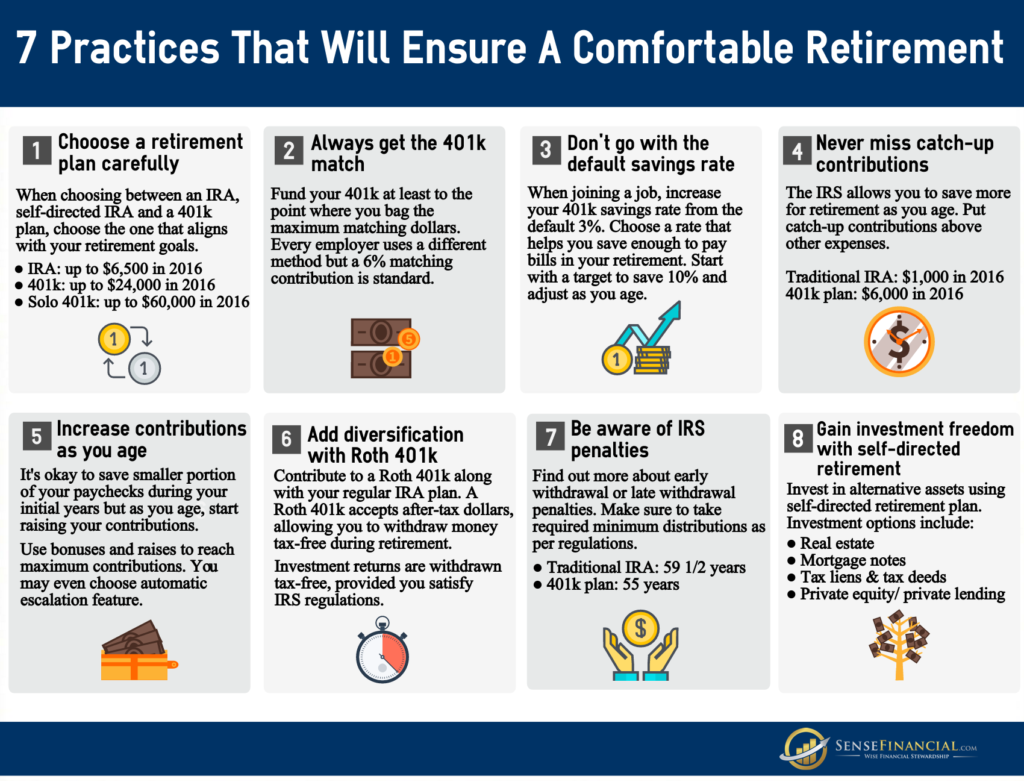

Source: sensefinancial.com

Source: sensefinancial.com

Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. And the key is to start early to take advantage of power of compounding. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. To lead a secure, independent and peaceful life post retirement you need to plan now. Ad work with a team that cares about your financial future.

Source: chartwell-associates.com

Source: chartwell-associates.com

Call now 0477 306 776 Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Retirement planning has five steps: To define an asset allocation and investment plan to reach that goal. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras.

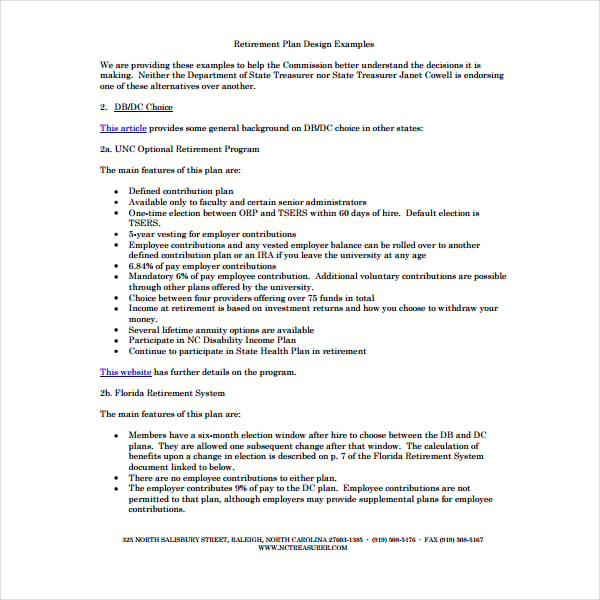

Source: template.net

Source: template.net

Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. 4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. A 401k plan allows you to contribute up to $20,500 per.

Source: pensionsweek.com

Source: pensionsweek.com

Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. Ad work with a team that cares about your financial future. Ad work with a team that cares about your financial future. Retirement planning has five steps: A 401k plan allows you to contribute up to $20,500 per.

Source: advantagewealthplanning.ca

Source: advantagewealthplanning.ca

Individual retirement arrangements (iras) roth iras. Individual retirement arrangements (iras) roth iras. Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. Call now 0477 306 776 Ad work with a team that cares about your financial future.

Source: rebelfinancial.com

Source: rebelfinancial.com

Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. To define an asset allocation and investment plan to reach that goal. 4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,. Ad work with a team that cares about your financial future. A 401k plan allows you to contribute up to $20,500 per.

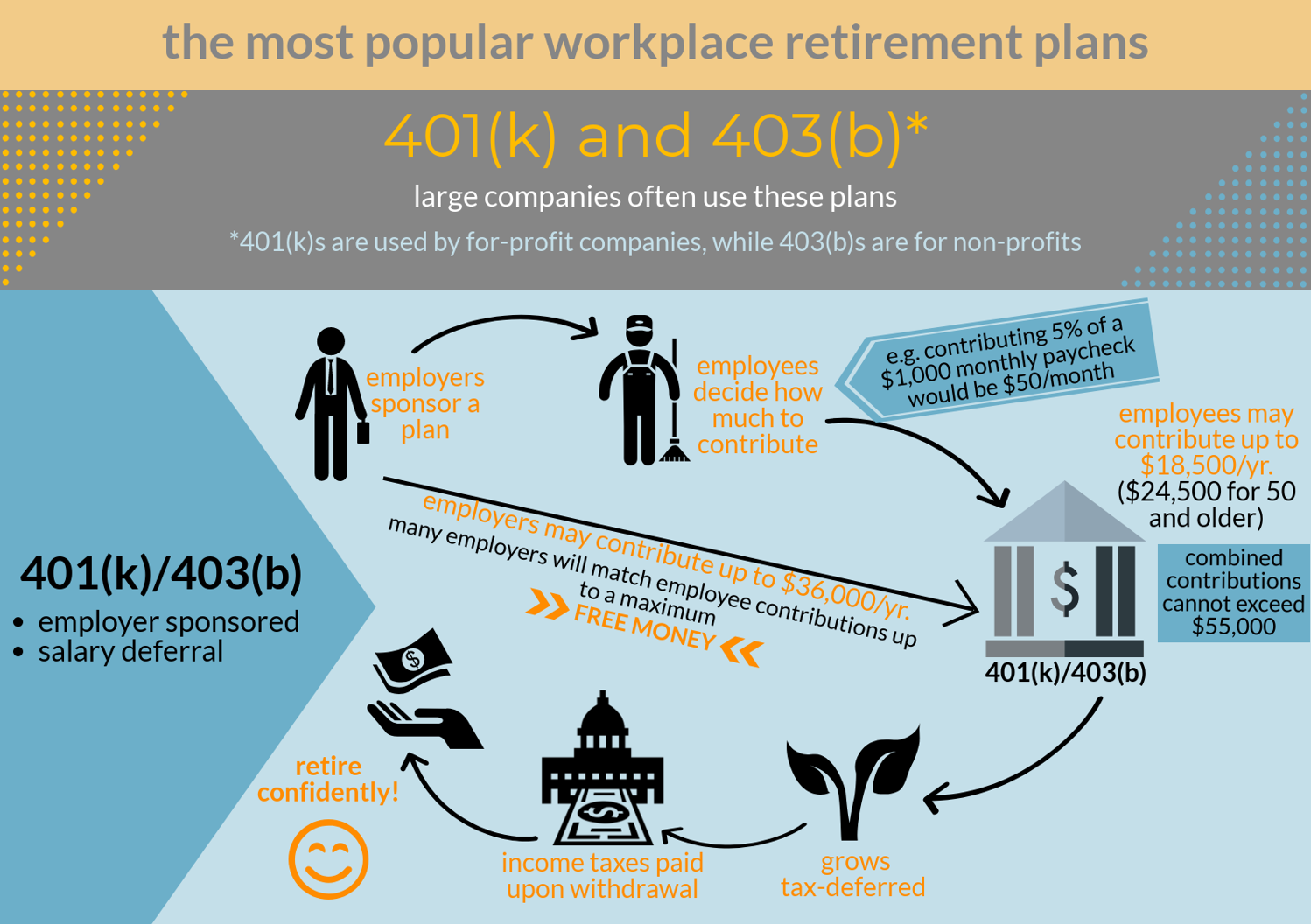

Source: journeypayroll.com

Source: journeypayroll.com

Retirement planning has five steps: To lead a secure, independent and peaceful life post retirement you need to plan now. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. Ad work with a team that cares about your financial future. To define an asset allocation and investment plan to reach that goal.

Source: sensefinancial.com

Source: sensefinancial.com

Ad work with a team that cares about your financial future. Ad work with a team that cares about your financial future. Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. A 401k plan allows you to contribute up to $20,500 per. Retirement planning is the process you put in place to maintain your finances after you leave the workforce.

Source: summaglobal.com

Source: summaglobal.com

Individual retirement arrangements (iras) roth iras. And the key is to start early to take advantage of power of compounding. To define an asset allocation and investment plan to reach that goal. Individual retirement arrangements (iras) roth iras. Call now 0477 306 776

Source: visual.ly

Source: visual.ly

4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,. Call now 0477 306 776 Ad work with a team that cares about your financial future. Call now 0477 306 776 Ad work with a team that cares about your financial future.

Source: issuu.com

Source: issuu.com

Call now 0477 306 776 A 401k plan allows you to contribute up to $20,500 per. Ad work with a team that cares about your financial future. Individual retirement arrangements (iras) roth iras. Retirement planning has five steps:

Source: marottaonmoney.com

Source: marottaonmoney.com

Call now 0477 306 776 To lead a secure, independent and peaceful life post retirement you need to plan now. Ad work with a team that cares about your financial future. And the key is to start early to take advantage of power of compounding. 4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,.

Source: klassenfinancial.com

Source: klassenfinancial.com

4 rows in 2022, the contribution limit for 403 (b) accounts is $20,500, or 100% of your compensation,. Simple ira plans (savings incentive match plans for employees) sep plans (simplified employee pension) sarsep plans (salary reduction simplified employee pension) payroll deduction iras. Ad work with a team that cares about your financial future. Individual retirement arrangements (iras) roth iras. Call now 0477 306 776

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan of by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.