Your Start saving for retirement at 40 images are ready. Start saving for retirement at 40 are a topic that is being searched for and liked by netizens today. You can Get the Start saving for retirement at 40 files here. Download all royalty-free photos and vectors.

If you’re searching for start saving for retirement at 40 pictures information connected with to the start saving for retirement at 40 interest, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Start Saving For Retirement At 40. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Credit card balances can hit new highs in your 40s. That said, you can increase what’s coming to you by waiting to collect until age 70.

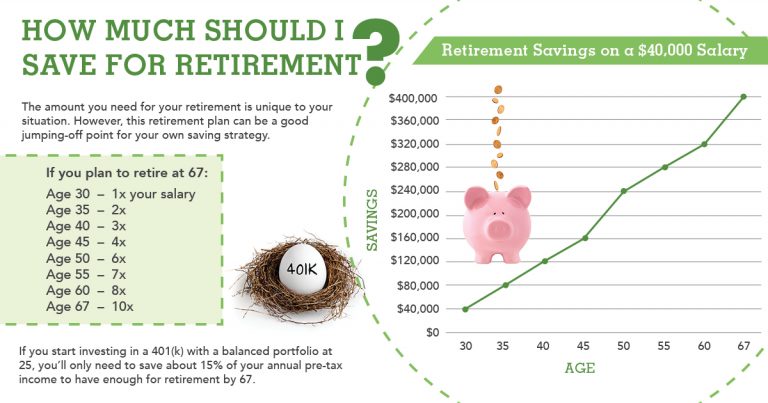

How Much to Save for Retirement From everydollar.com

How Much to Save for Retirement From everydollar.com

Saving for retirement when you’re in your 40s 1. Get rid of debt and reach your savings maximums. Like i said, brutal, but simple. Starting retirement savings at 40 with myconstant. Plan to hold off until then—or at least till you’re 68 or 69—to claim. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety.

Get rid of debt and reach your savings maximums.

If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Starting retirement savings at 40 with myconstant. Get rid of debt and reach your savings maximums. Credit card balances can hit new highs in your 40s. Like i said, brutal, but simple.

Source: retireby40.org

Source: retireby40.org

Starting retirement savings at 40 with myconstant. Like i said, brutal, but simple. We assure to offer you steady returns on your terms that can bypass the banks and allow you to have the freedom to start compound. That said, you can increase what’s coming to you by waiting to collect until age 70. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety.

Source: madammoney.com

Source: madammoney.com

Get rid of debt and reach your savings maximums. Credit card balances can hit new highs in your 40s. Starting retirement savings at 40 with myconstant. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Saving for retirement when you’re in your 40s 1.

Source: blog.woodmenlife.org

Source: blog.woodmenlife.org

Like i said, brutal, but simple. Plan to hold off until then—or at least till you’re 68 or 69—to claim. Like i said, brutal, but simple. Starting retirement savings at 40 with myconstant. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety.

Source: pinterest.com

Source: pinterest.com

If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Plan to hold off until then—or at least till you’re 68 or 69—to claim. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. We assure to offer you steady returns on your terms that can bypass the banks and allow you to have the freedom to start compound.

Source: tomorrowmakers.com

Starting retirement savings at 40 with myconstant. Starting retirement savings at 40 with myconstant. We assure to offer you steady returns on your terms that can bypass the banks and allow you to have the freedom to start compound. Saving for retirement when you’re in your 40s 1. That said, you can increase what’s coming to you by waiting to collect until age 70.

Source: everydollar.com

Source: everydollar.com

Get rid of debt and reach your savings maximums. Like i said, brutal, but simple. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. We assure to offer you steady returns on your terms that can bypass the banks and allow you to have the freedom to start compound. Saving for retirement when you’re in your 40s 1.

Source: time.com

Source: time.com

Get rid of debt and reach your savings maximums. Like i said, brutal, but simple. Starting retirement savings at 40 with myconstant. Saving for retirement when you’re in your 40s 1. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety.

Source: pinterest.com

Source: pinterest.com

Plan to hold off until then—or at least till you’re 68 or 69—to claim. That said, you can increase what’s coming to you by waiting to collect until age 70. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Like i said, brutal, but simple. Plan to hold off until then—or at least till you’re 68 or 69—to claim.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Like i said, brutal, but simple. We assure to offer you steady returns on your terms that can bypass the banks and allow you to have the freedom to start compound. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. Like i said, brutal, but simple. That said, you can increase what’s coming to you by waiting to collect until age 70.

Source: youtube.com

Source: youtube.com

If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Get rid of debt and reach your savings maximums. Credit card balances can hit new highs in your 40s. Plan to hold off until then—or at least till you’re 68 or 69—to claim. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you.

Source: pinterest.com

Source: pinterest.com

That said, you can increase what’s coming to you by waiting to collect until age 70. Credit card balances can hit new highs in your 40s. Saving for retirement when you’re in your 40s 1. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Plan to hold off until then—or at least till you’re 68 or 69—to claim.

Source: pinterest.com

Source: pinterest.com

If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. That said, you can increase what’s coming to you by waiting to collect until age 70. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. Credit card balances can hit new highs in your 40s. Starting retirement savings at 40 with myconstant.

Source: personalprofitability.com

Source: personalprofitability.com

Credit card balances can hit new highs in your 40s. Like i said, brutal, but simple. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. Saving for retirement when you’re in your 40s 1. Credit card balances can hit new highs in your 40s.

Source: sensefinancial.com

Source: sensefinancial.com

Saving for retirement when you’re in your 40s 1. Starting retirement savings at 40 with myconstant. Plan to hold off until then—or at least till you’re 68 or 69—to claim. Saving for retirement when you’re in your 40s 1. Credit card balances can hit new highs in your 40s.

Source: savinghabit.com

Source: savinghabit.com

Credit card balances can hit new highs in your 40s. Credit card balances can hit new highs in your 40s. We assure to offer you steady returns on your terms that can bypass the banks and allow you to have the freedom to start compound. Get rid of debt and reach your savings maximums. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you.

Source: pinterest.com

Source: pinterest.com

Credit card balances can hit new highs in your 40s. Get rid of debt and reach your savings maximums. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. Starting retirement savings at 40 with myconstant. Like i said, brutal, but simple.

Source: pinterest.com

Source: pinterest.com

If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety. Credit card balances can hit new highs in your 40s. If you want to diversify your portfolio for saving for retirement at 40, myconstant, which is a p2p lending platform, is a highly recommended option for you. That said, you can increase what’s coming to you by waiting to collect until age 70. Get rid of debt and reach your savings maximums.

Source: theastuteparent.com

Source: theastuteparent.com

Get rid of debt and reach your savings maximums. Saving for retirement when you’re in your 40s 1. Plan to hold off until then—or at least till you’re 68 or 69—to claim. Credit card balances can hit new highs in your 40s. If those numbers stay unchanged, you would need $50,000 ã· 2% = $2,500,000 to provide your $50,000 in relative safety.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title start saving for retirement at 40 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.