Your Early retirement obamacare images are ready in this website. Early retirement obamacare are a topic that is being searched for and liked by netizens now. You can Find and Download the Early retirement obamacare files here. Find and Download all free photos and vectors.

If you’re looking for early retirement obamacare images information connected with to the early retirement obamacare keyword, you have visit the ideal blog. Our site frequently gives you hints for seeking the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

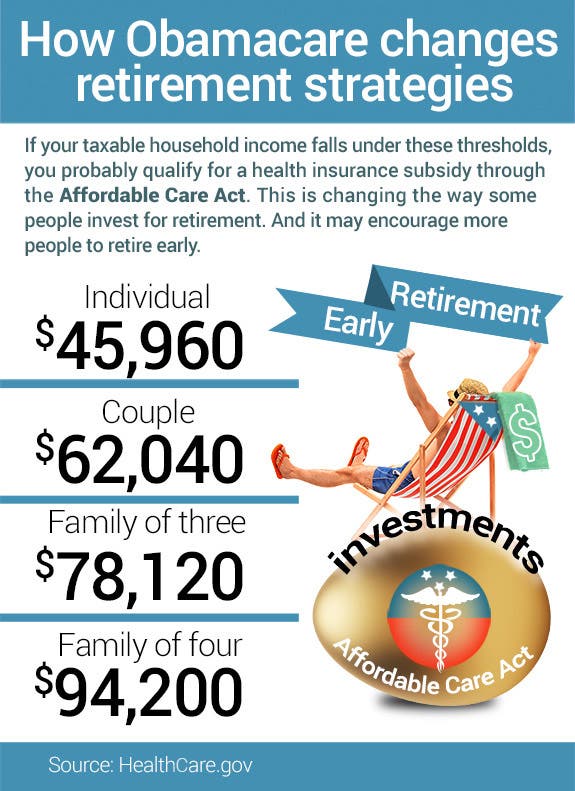

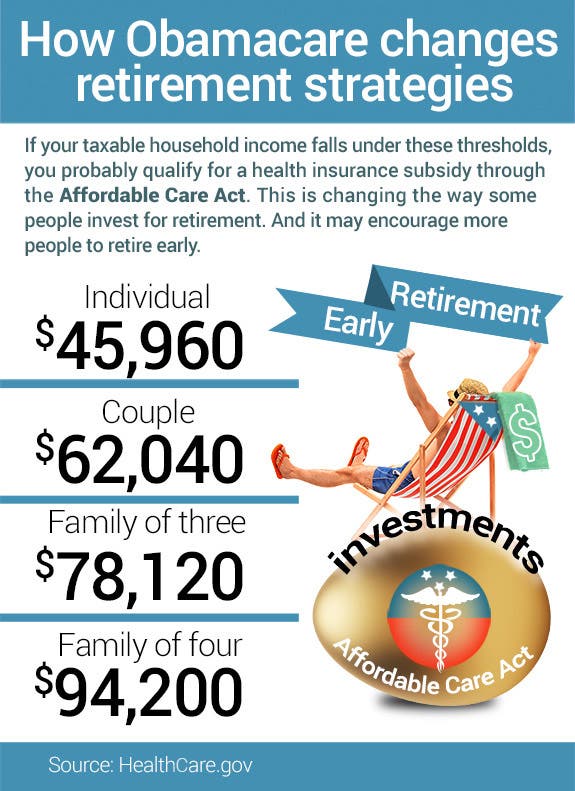

Early Retirement Obamacare. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. The federal poverty level guidelines for 2020 and. The ptc would fully cover the remaining ~$5,700. How to enroll in a plan at the last minute;

Does Obamacare Foster Early Retirement? From bankrate.com

Does Obamacare Foster Early Retirement? From bankrate.com

Open enrollment 2022 dates and deadline; First, the highest household income that can qualify for a. In 2014 and after, you won’t be declined coverage because of your. The ptc would fully cover the remaining ~$5,700. Those who already retired or considering retiring before age 65 should know how the rules will change next year. 2022 obamacare eligibility chart and subsidy calculator;

How to enroll in a plan at the last minute;

If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Open enrollment 2022 dates and deadline; First, the highest household income that can qualify for a. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines;

Source: pinterest.com

Source: pinterest.com

If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. Most provisions of the affordable care act of 2010 (obamacare) take effect jan. In 2014 and after, you won’t be declined coverage because of your. The federal poverty level guidelines for 2020 and. 2022 obamacare eligibility chart and subsidy calculator;

Source: pinterest.com

Source: pinterest.com

Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines; 2022 obamacare eligibility chart and subsidy calculator; Those who already retired or considering retiring before age 65 should know how the rules will change next year. Most provisions of the affordable care act of 2010 (obamacare) take effect jan. In 2014 and after, you won’t be declined coverage because of your.

The federal poverty level guidelines for 2020 and. Open enrollment 2022 dates and deadline; Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines; The federal poverty level guidelines for 2020 and. Those who already retired or considering retiring before age 65 should know how the rules will change next year.

Source: video.foxnews.com

Source: video.foxnews.com

Open enrollment 2022 dates and deadline; 2022 obamacare eligibility chart and subsidy calculator; The federal poverty level guidelines for 2020 and. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines;

Source: mymoneyblog.com

Source: mymoneyblog.com

If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. How to enroll in a plan at the last minute; 2022 obamacare eligibility chart and subsidy calculator;

Source: wtlcfm.com

Source: wtlcfm.com

There are two features of obamacare’s premium tax credits that are important for early retirees to understand. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. 2022 obamacare eligibility chart and subsidy calculator; Those who already retired or considering retiring before age 65 should know how the rules will change next year.

Source: pinterest.com

Source: pinterest.com

Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines; First, the highest household income that can qualify for a. In 2014 and after, you won’t be declined coverage because of your. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Most provisions of the affordable care act of 2010 (obamacare) take effect jan.

Source: nytimes.com

Source: nytimes.com

In 2014 and after, you won’t be declined coverage because of your. 2022 obamacare eligibility chart and subsidy calculator; The ptc would fully cover the remaining ~$5,700. Most provisions of the affordable care act of 2010 (obamacare) take effect jan. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines;

Source: pinterest.com

Source: pinterest.com

There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Open enrollment 2022 dates and deadline; 2022 obamacare eligibility chart and subsidy calculator; The federal poverty level guidelines for 2020 and. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines;

Source: gocurrycracker.com

Source: gocurrycracker.com

The ptc would fully cover the remaining ~$5,700. If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. The federal poverty level guidelines for 2020 and. Open enrollment 2022 dates and deadline; 2022 obamacare eligibility chart and subsidy calculator;

Source: bankrate.com

Source: bankrate.com

Those who already retired or considering retiring before age 65 should know how the rules will change next year. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. Those who already retired or considering retiring before age 65 should know how the rules will change next year. The ptc would fully cover the remaining ~$5,700.

Source: earlyretirementdude.com

Source: earlyretirementdude.com

First, the highest household income that can qualify for a. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines; 2022 obamacare eligibility chart and subsidy calculator; Open enrollment 2022 dates and deadline;

Source: youtube.com

Source: youtube.com

2022 obamacare eligibility chart and subsidy calculator; There are two features of obamacare’s premium tax credits that are important for early retirees to understand. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. The federal poverty level guidelines for 2020 and. In 2014 and after, you won’t be declined coverage because of your.

Source: ournextlife.com

Source: ournextlife.com

The federal poverty level guidelines for 2020 and. First, the highest household income that can qualify for a. Most provisions of the affordable care act of 2010 (obamacare) take effect jan. In 2014 and after, you won’t be declined coverage because of your. How to enroll in a plan at the last minute;

Source: emeryreddy.com

Source: emeryreddy.com

Those who already retired or considering retiring before age 65 should know how the rules will change next year. The ptc would fully cover the remaining ~$5,700. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines; First, the highest household income that can qualify for a. There are two features of obamacare’s premium tax credits that are important for early retirees to understand.

Source: retirementwatch.com

Source: retirementwatch.com

In 2014 and after, you won’t be declined coverage because of your. Open enrollment 2022 dates and deadline; The ptc would fully cover the remaining ~$5,700. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines;

Source: pinterest.com

Source: pinterest.com

There are two features of obamacare’s premium tax credits that are important for early retirees to understand. In 2014 and after, you won’t be declined coverage because of your. If income is higher at 400% of the fpl, the max we pay is 9.5% of income or ~$5,950/year (~$500/month.) the ptc would cover the last $50. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Those who already retired or considering retiring before age 65 should know how the rules will change next year.

Source: mygovcost.org

Source: mygovcost.org

How to enroll in a plan at the last minute; Obamacare mandate’s fee reduced to $0 (some states have their own fee) 2021 federal poverty guidelines; How to enroll in a plan at the last minute; If income is exactly 100% of the fpl, the max we can pay is 2% of income or ~$300/year. Open enrollment 2022 dates and deadline;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement obamacare by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.