Your Retirement plan vs mutual funds images are ready. Retirement plan vs mutual funds are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan vs mutual funds files here. Get all free photos.

If you’re searching for retirement plan vs mutual funds pictures information related to the retirement plan vs mutual funds keyword, you have visit the right blog. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Retirement Plan Vs Mutual Funds. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement. You may choose one or more mutual funds and other investments for your ira or 401(k) plan. Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency.

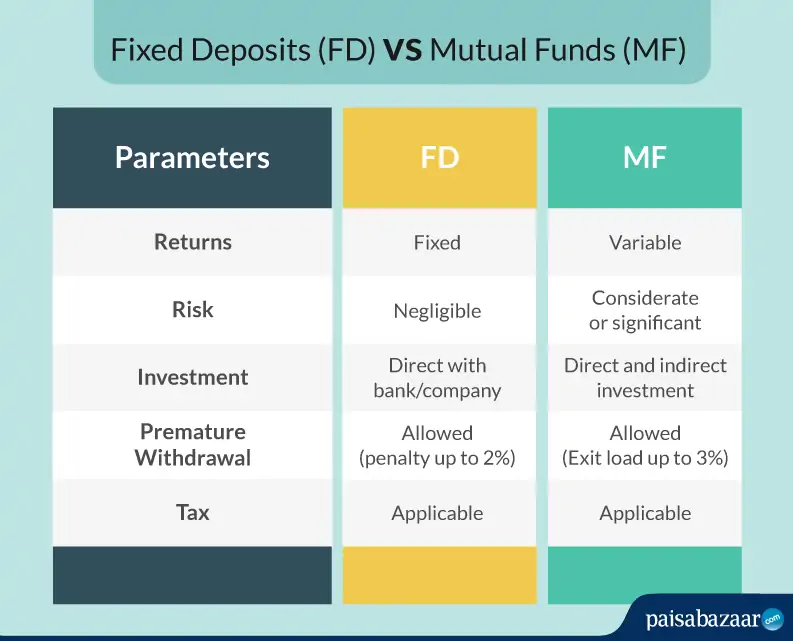

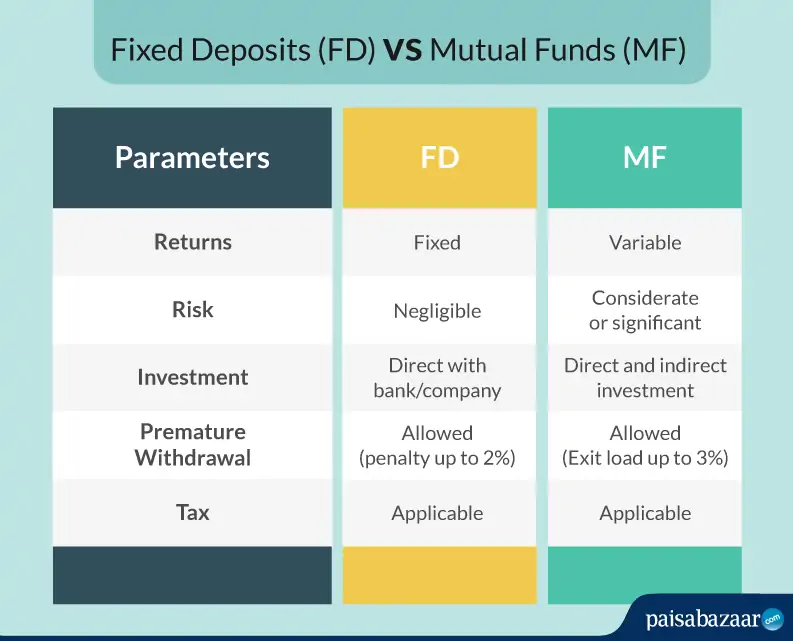

Fixed Deposit (FD) Vs. Mutual Fund (MF) Which is the Best? From paisabazaar.com

Fixed Deposit (FD) Vs. Mutual Fund (MF) Which is the Best? From paisabazaar.com

In any case, there is not much interest in retirement plans from mutual funds. This provides you with liquidity to meet your immediate cash flow requirements. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. By leveraging the wonders of rupee cost averaging, the money you invest grows in value according to prevailing market conditions. I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post. Should you invest in retirement plans from mutual funds?

Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency.

Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency. This provides you with liquidity to meet your immediate cash flow requirements. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan. Since mutual funds, by nature, are long term investment tools. You may choose one or more mutual funds and other investments for your ira or 401(k) plan. Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency.

Source: paisabazaar.com

Source: paisabazaar.com

The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. Should you invest in retirement plans from mutual funds? This provides you with liquidity to meet your immediate cash flow requirements. You get a tax exemption up to rs 1,50,000, under section 80c of the income. Since mutual funds, by nature, are long term investment tools.

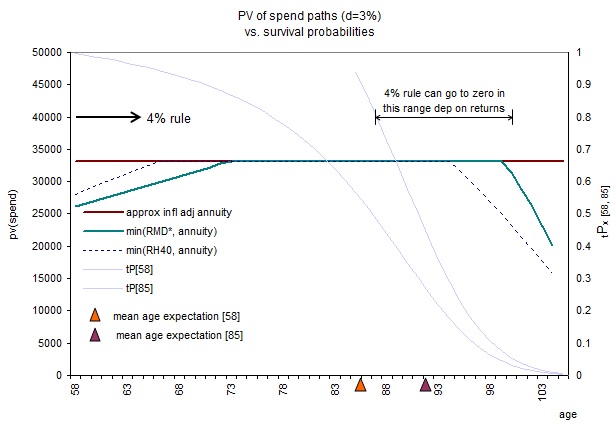

Source: seriousretirement.com

Source: seriousretirement.com

Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan. In any case, there is not much interest in retirement plans from mutual funds. Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement.

Source: personalfinanceplan.in

Source: personalfinanceplan.in

Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement. By leveraging the wonders of rupee cost averaging, the money you invest grows in value according to prevailing market conditions. Since mutual funds, by nature, are long term investment tools. You get a tax exemption up to rs 1,50,000, under section 80c of the income. A retirement account may hold any type of investment, such as etfs, stocks, bonds, commodities, or even.

Source: personalfinanceplan.in

Source: personalfinanceplan.in

I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post. I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post. Should you invest in retirement plans from mutual funds? You get a tax exemption up to rs 1,50,000, under section 80c of the income. You may choose one or more mutual funds and other investments for your ira or 401(k) plan.

Source: indianmoney.com

Source: indianmoney.com

In any case, there is not much interest in retirement plans from mutual funds. You get a tax exemption up to rs 1,50,000, under section 80c of the income. I have written about nps in many posts before. You may choose one or more mutual funds and other investments for your ira or 401(k) plan. Since mutual funds, by nature, are long term investment tools.

Source: tomorrowmakers.com

You get a tax exemption up to rs 1,50,000, under section 80c of the income. I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post. A retirement account may hold any type of investment, such as etfs, stocks, bonds, commodities, or even. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. You get a tax exemption up to rs 1,50,000, under section 80c of the income.

Source: etf.com

Since mutual funds, by nature, are long term investment tools. You get a tax exemption up to rs 1,50,000, under section 80c of the income. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. In any case, there is not much interest in retirement plans from mutual funds. Since mutual funds, by nature, are long term investment tools.

Source: mymoneysage.in

Source: mymoneysage.in

Since mutual funds, by nature, are long term investment tools. This provides you with liquidity to meet your immediate cash flow requirements. Since mutual funds, by nature, are long term investment tools. In any case, there is not much interest in retirement plans from mutual funds. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan.

Source: mymoneyblog.com

Source: mymoneyblog.com

I have written about nps in many posts before. Should you invest in retirement plans from mutual funds? I have written about nps in many posts before. By leveraging the wonders of rupee cost averaging, the money you invest grows in value according to prevailing market conditions. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan.

Source: etf.com

Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement. You may choose one or more mutual funds and other investments for your ira or 401(k) plan. I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post. Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency.

Source: pinterest.ca

Source: pinterest.ca

Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency. In any case, there is not much interest in retirement plans from mutual funds. Should you invest in retirement plans from mutual funds? Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan. I have written about nps in many posts before.

Source: etfmodelsolutions.com

Source: etfmodelsolutions.com

By leveraging the wonders of rupee cost averaging, the money you invest grows in value according to prevailing market conditions. I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post. In any case, there is not much interest in retirement plans from mutual funds. Should you invest in retirement plans from mutual funds? Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement.

Source: policyalternatives.ca

A retirement account may hold any type of investment, such as etfs, stocks, bonds, commodities, or even. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. Since mutual funds, by nature, are long term investment tools. In any case, there is not much interest in retirement plans from mutual funds. I had written about retirement plans from mutual funds and compared such plans against pension plans from insurance companies and nps in an earlier post.

Source: pinterest.com

Source: pinterest.com

You get a tax exemption up to rs 1,50,000, under section 80c of the income. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement. You get a tax exemption up to rs 1,50,000, under section 80c of the income. I have written about nps in many posts before. In any case, there is not much interest in retirement plans from mutual funds.

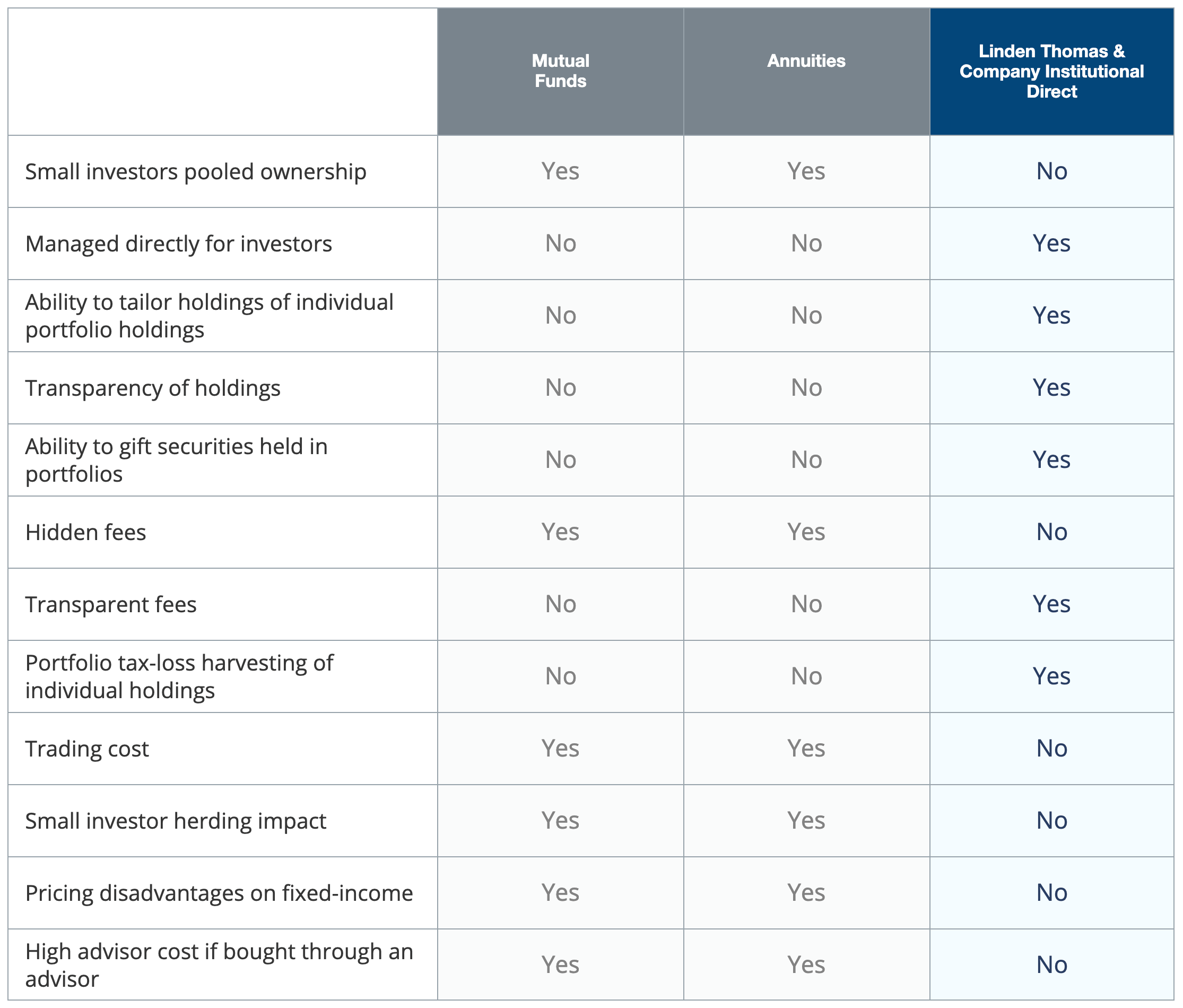

Source: lindenthomas.com

Source: lindenthomas.com

In any case, there is not much interest in retirement plans from mutual funds. Should you invest in retirement plans from mutual funds? In any case, there is not much interest in retirement plans from mutual funds. Since mutual funds, by nature, are long term investment tools. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement.

Source: etfmodelsolutions.com

Source: etfmodelsolutions.com

By leveraging the wonders of rupee cost averaging, the money you invest grows in value according to prevailing market conditions. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan. You may choose one or more mutual funds and other investments for your ira or 401(k) plan. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement.

Source: mymoneysage.in

Source: mymoneysage.in

In any case, there is not much interest in retirement plans from mutual funds. Pension plans offer fixed and steady income, which ensure financial freedom even after your retirement. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan. This provides you with liquidity to meet your immediate cash flow requirements. The main draw of mutual funds is the promise of better returns on investment than traditional fixed income investment options such as fixed deposits.

Source: pinterest.com

Source: pinterest.com

By leveraging the wonders of rupee cost averaging, the money you invest grows in value according to prevailing market conditions. Since mutual funds, by nature, are long term investment tools. Depending on the type of plan you choose, you can opt for an immediate income option that offers returns on your investment immediately after investing in the plan. Sip, or the systematic investment plan, is a scheme to invest a fixed amount regularly at a specific frequency. Should you invest in retirement plans from mutual funds?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan vs mutual funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.