Your Retirement plan example philippines images are available in this site. Retirement plan example philippines are a topic that is being searched for and liked by netizens now. You can Get the Retirement plan example philippines files here. Get all free photos and vectors.

If you’re searching for retirement plan example philippines pictures information linked to the retirement plan example philippines topic, you have pay a visit to the ideal blog. Our site always provides you with hints for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Retirement Plan Example Philippines. However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. Repaying one’s utang na loob is deeply rooted in the filipino culture. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. Related to philippines retirement plan.

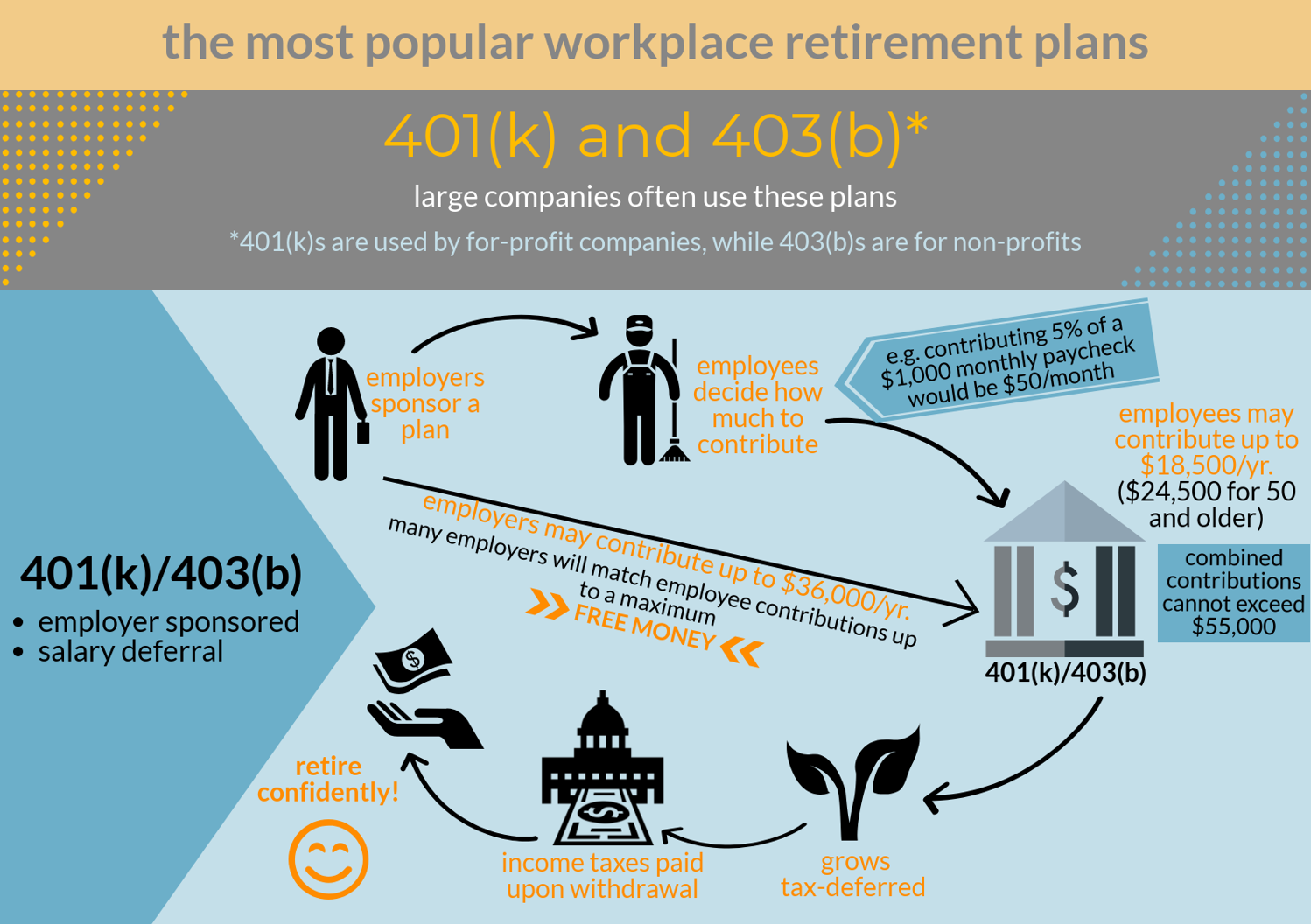

Retirement planning From slideshare.net

Retirement planning From slideshare.net

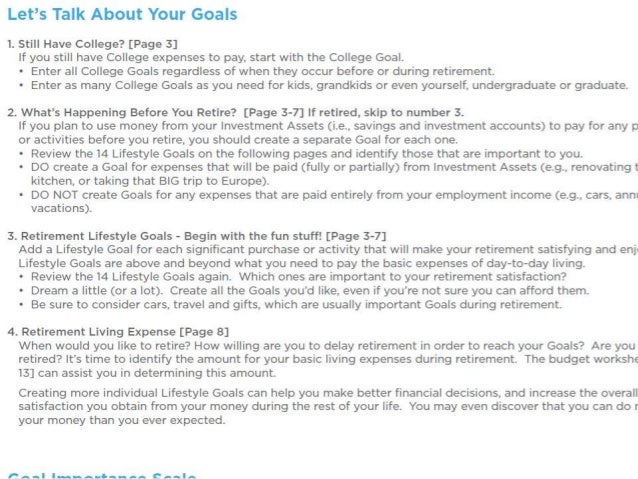

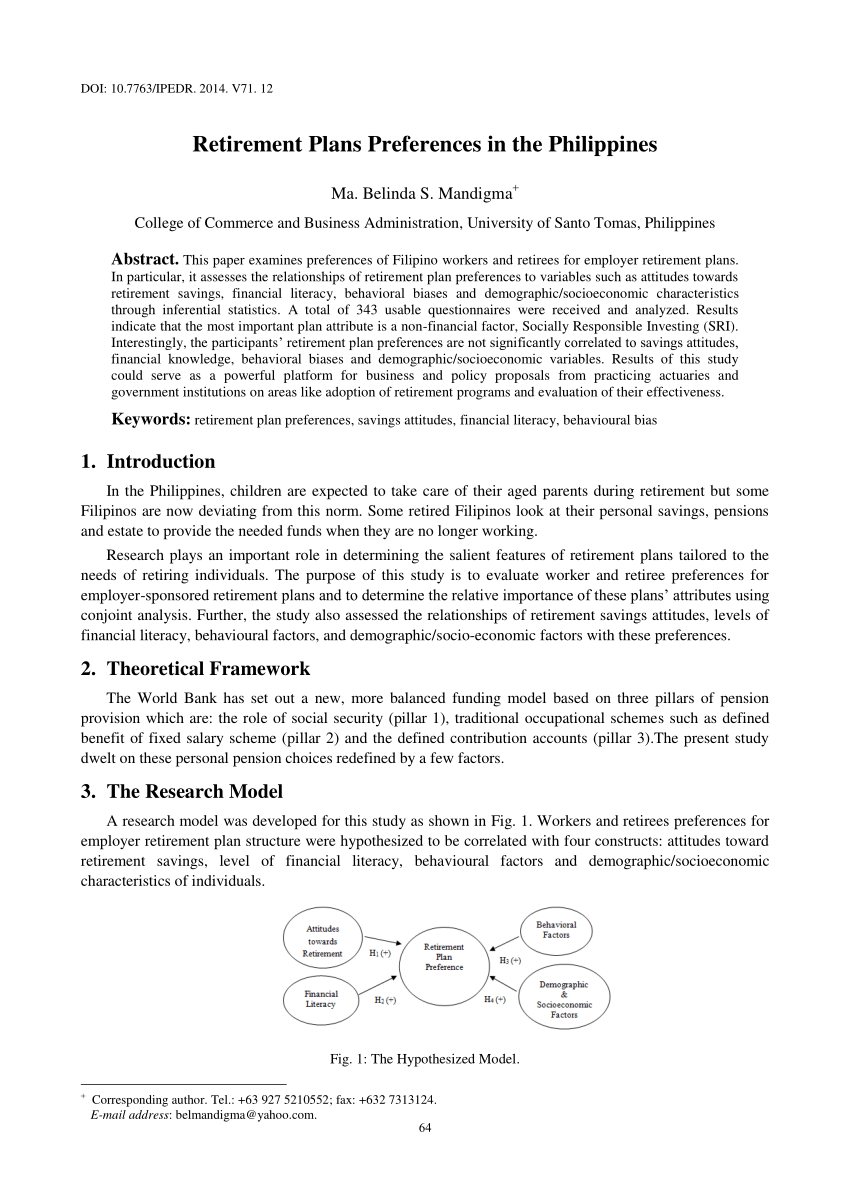

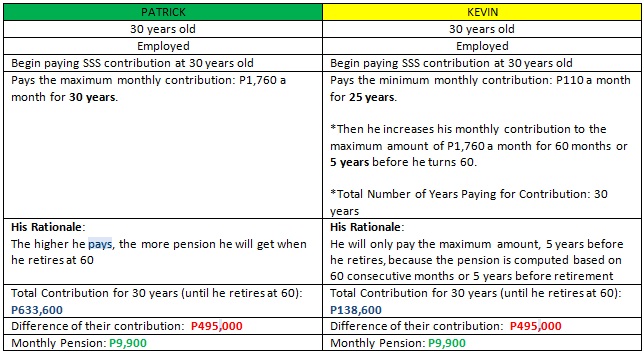

The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. What is pera in the philippines? In the philippines, children are expected to help their parents when they retire. Planning for retirement should be done as early as possible. Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003.

The ultimate guide to planning for your retirement in the philippines.

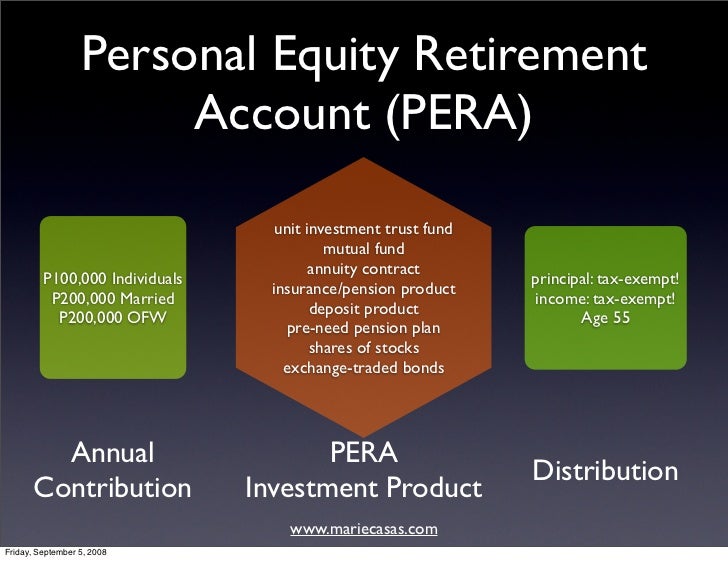

The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. The ultimate guide to planning for your retirement in the philippines. Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. At the same time, early preparation will help you determine which.

Source: pinayinvestor.com

Source: pinayinvestor.com

Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. In the philippines, children are expected to help their parents when they retire. What is pera in the philippines? For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as.

Source: grit.ph

Source: grit.ph

At the same time, early preparation will help you determine which. For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. Repaying one’s utang na loob is deeply rooted in the filipino culture. What is pera in the philippines? At the same time, early preparation will help you determine which.

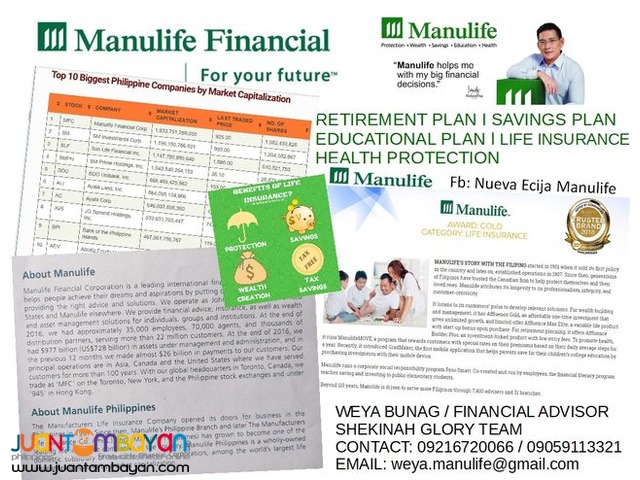

Source: juantambayan.com

Source: juantambayan.com

Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. Avoid becoming your parents’ retirement plan. Related to philippines retirement plan. Repaying one’s utang na loob is deeply rooted in the filipino culture. At the same time, early preparation will help you determine which.

Source: moneytalkph.com

Source: moneytalkph.com

Repaying one’s utang na loob is deeply rooted in the filipino culture. In the philippines, children are expected to help their parents when they retire. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. What is pera in the philippines?

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

Avoid becoming your parents’ retirement plan. However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. Planning for retirement should be done as early as possible. Avoid becoming your parents’ retirement plan. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as.

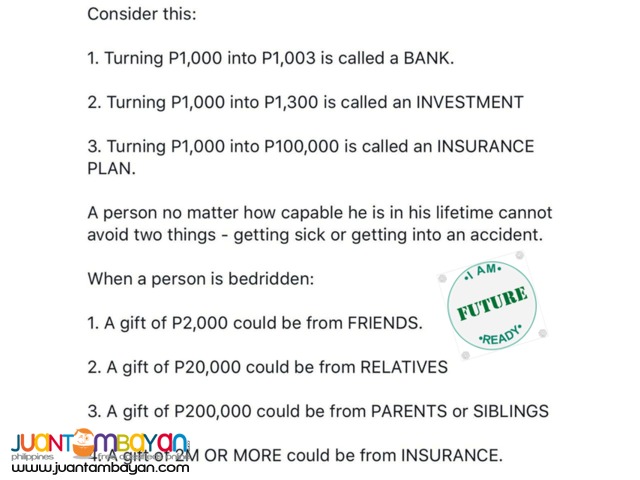

Source: juantambayan.com

Source: juantambayan.com

What is pera in the philippines? Repaying one’s utang na loob is deeply rooted in the filipino culture. However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as.

Source: juantambayan.com

Source: juantambayan.com

For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. Avoid becoming your parents’ retirement plan. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. What is pera in the philippines?

Source: tinainmanila.com

Source: tinainmanila.com

Planning for retirement should be done as early as possible. Avoid becoming your parents’ retirement plan. The ultimate guide to planning for your retirement in the philippines. For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003.

Source: summaglobal.com

Source: summaglobal.com

The ultimate guide to planning for your retirement in the philippines. Planning for retirement should be done as early as possible. Avoid becoming your parents’ retirement plan. Related to philippines retirement plan. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as.

Source: pinayinvestor.com

Source: pinayinvestor.com

At the same time, early preparation will help you determine which. Related to philippines retirement plan. Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. Planning for retirement should be done as early as possible.

Source: pinayinvestor.com

Source: pinayinvestor.com

Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. What is pera in the philippines? For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. Repaying one’s utang na loob is deeply rooted in the filipino culture.

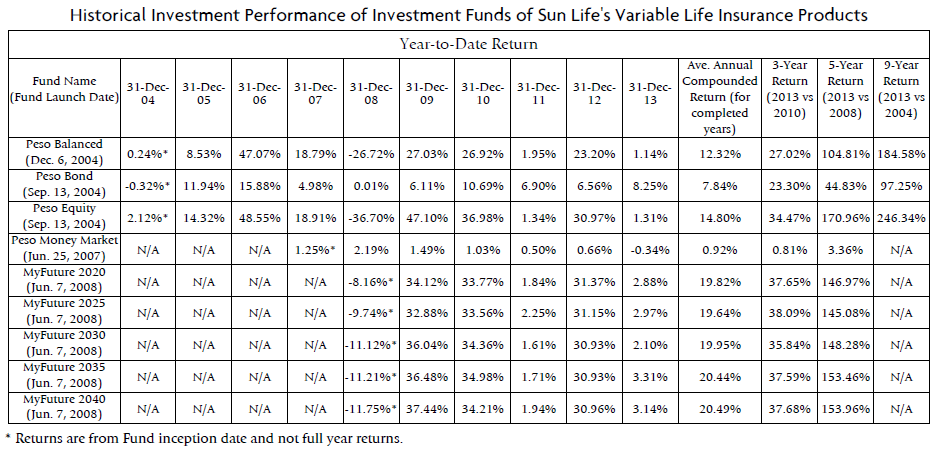

Source: slideshare.net

Source: slideshare.net

The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. Avoid becoming your parents’ retirement plan.

Source: slideshare.net

Source: slideshare.net

Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. At the same time, early preparation will help you determine which. In the philippines, children are expected to help their parents when they retire. Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as.

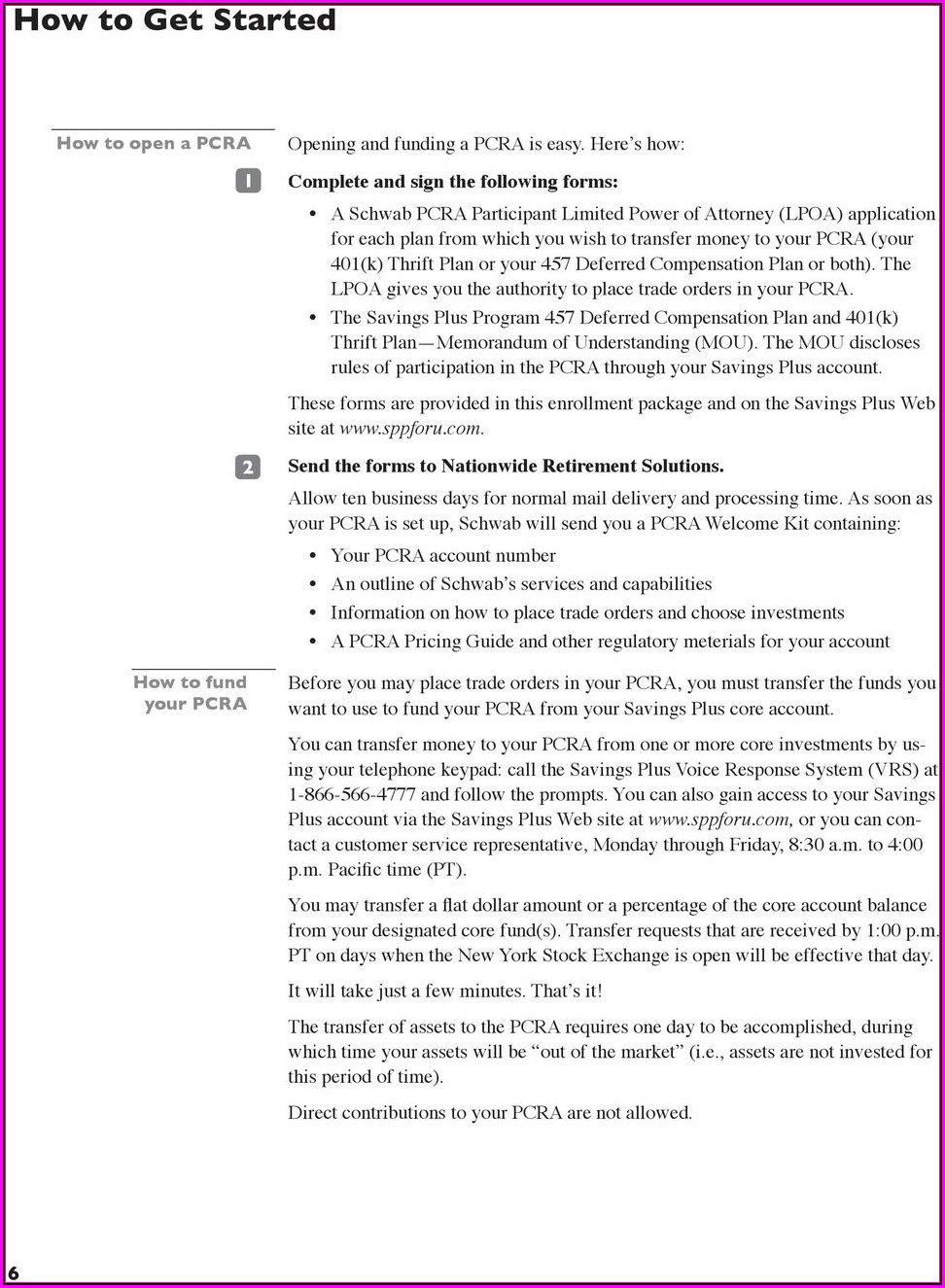

Source: youtube.com

Source: youtube.com

What is pera in the philippines? Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003. The ultimate guide to planning for your retirement in the philippines. Planning for retirement should be done as early as possible. What is pera in the philippines?

Source: researchgate.net

Source: researchgate.net

Repaying one’s utang na loob is deeply rooted in the filipino culture. The ultimate guide to planning for your retirement in the philippines. Related to philippines retirement plan. Planning for retirement should be done as early as possible. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law.

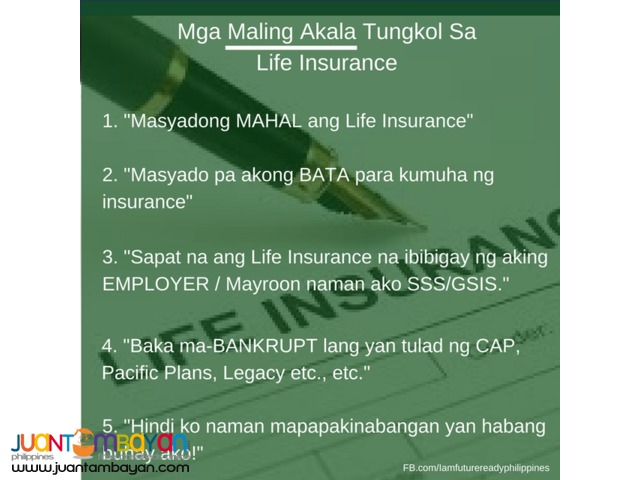

Source: juantambayan.com

Source: juantambayan.com

Repaying one’s utang na loob is deeply rooted in the filipino culture. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. The ultimate guide to planning for your retirement in the philippines. For one, setting aside and investing money today will yield higher returns in the future since compound interest can grow your savings. Related to philippines retirement plan.

Source: grit.ph

Source: grit.ph

Avoid becoming your parents’ retirement plan. The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. What is pera in the philippines? Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. Oregon public service retirement plan pension program members for purposes of this section 2, “employee” means an employee who is employed by the state on or after august 29, 2003 and who is not eligible to receive benefits under ors chapter 238 for service with the state pursuant to section 2 of chapter 733, oregon laws 2003.

Source: pinayinvestor.com

Source: pinayinvestor.com

The personal equity and retirement account (pera) consists of both personal savings and investments.contributions that enable voluntary or exclusive use and benefit from pena investment products in the philippines for voluntary retirement can refer to voluntary retirement accounts established by and for themselves, as. At the same time, early preparation will help you determine which. What is pera in the philippines? However—even if you want to support your aging parents—being their retirement plan at the expense of your own shouldn’t be the case. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan example philippines by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.