Your Early retirement of bonds journal entry images are available. Early retirement of bonds journal entry are a topic that is being searched for and liked by netizens now. You can Download the Early retirement of bonds journal entry files here. Download all royalty-free images.

If you’re looking for early retirement of bonds journal entry pictures information connected with to the early retirement of bonds journal entry topic, you have visit the ideal blog. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

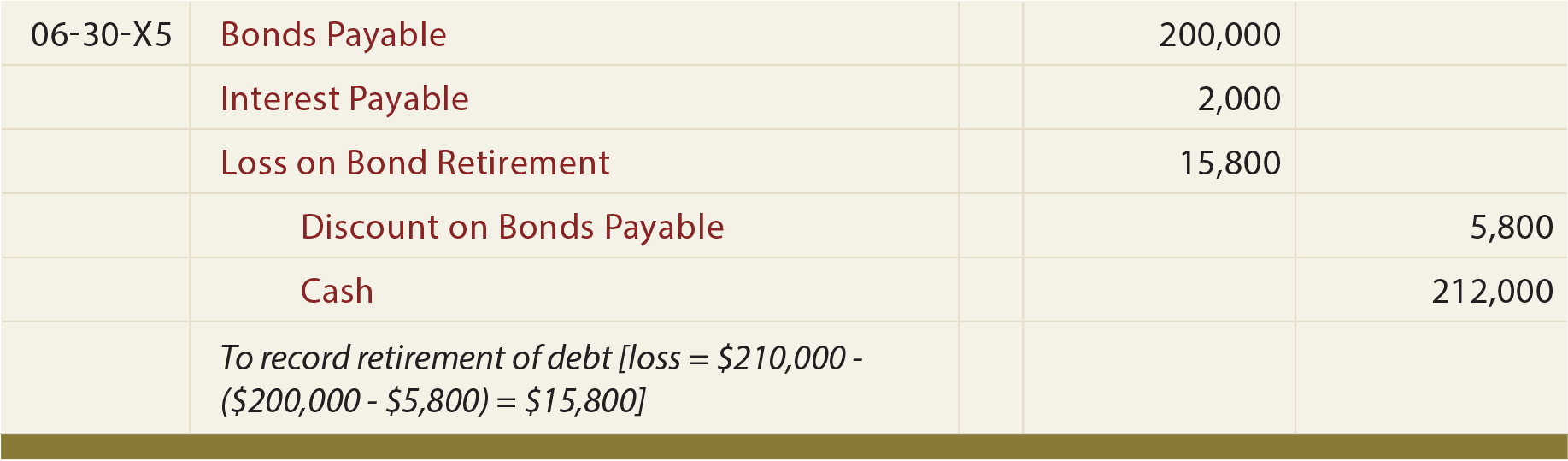

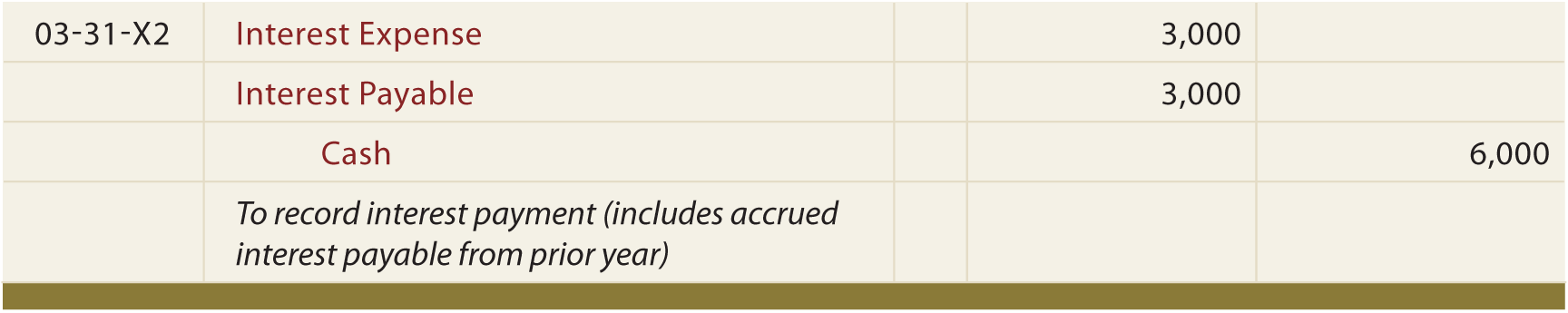

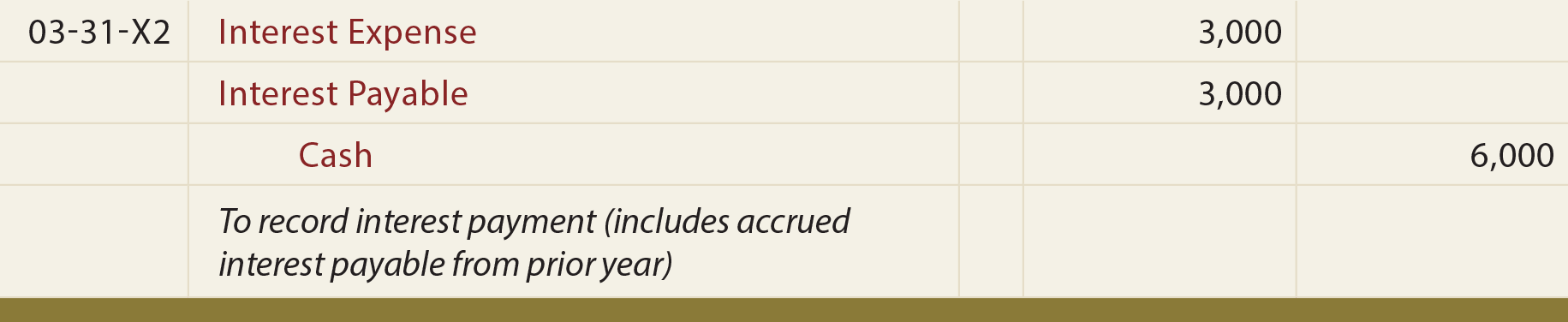

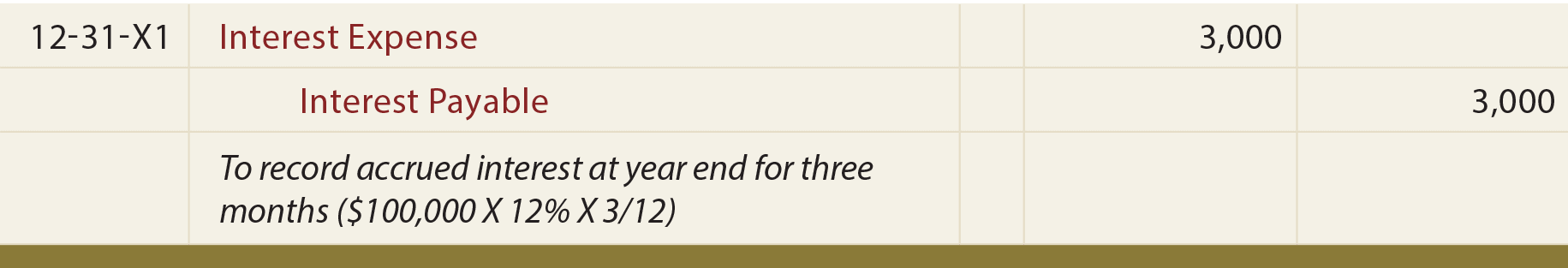

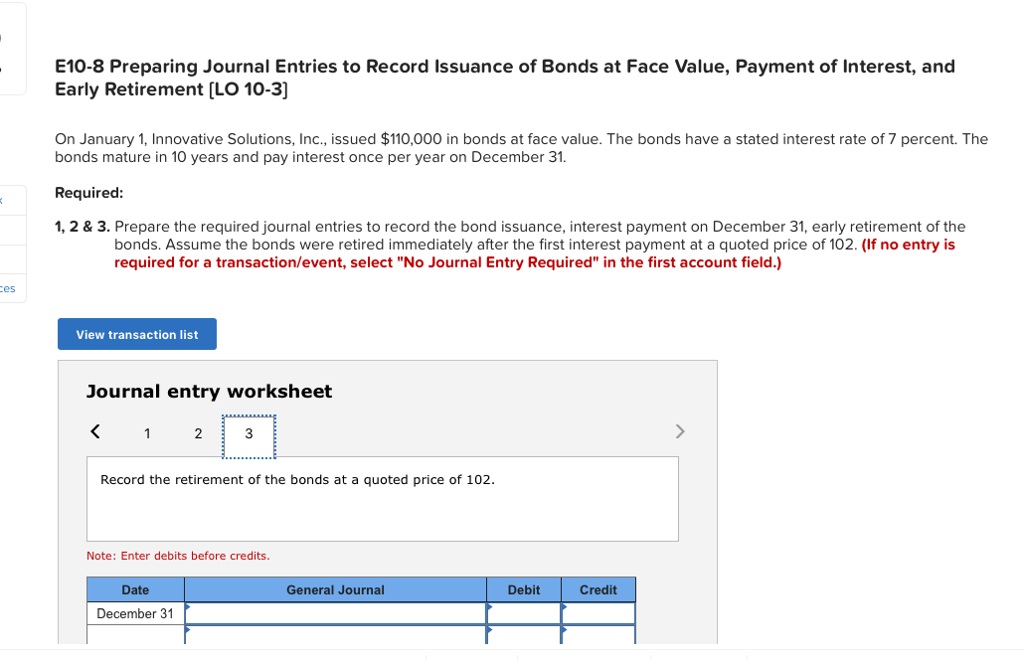

Early Retirement Of Bonds Journal Entry. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: We are almost at the examples and debits and credits. Retirement before the maturity date. When the bond is retired before the maturity date, there can be a.

Exercise 917A Record the early retirement of bonds issued at a premium From homeworklib.com

Exercise 917A Record the early retirement of bonds issued at a premium From homeworklib.com

Discounts, premiums, losses and gains. Bond retirement journal entry retirement at the maturity date. Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: When a bond is retired at the maturity date, there is no gain or loss resulting from. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: When the bond is retired before the maturity date, there can be a.

When the bond is retired before the maturity date, there can be a.

But before getting stuck into an example and the journal entries, we need to cover a few more things; Bond retirement journal entry retirement at the maturity date. Discounts, premiums, losses and gains. When the bond is retired before the maturity date, there can be a. And there are discounts, premiums and losses and against. This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment.

Source: slideserve.com

Source: slideserve.com

And there are discounts, premiums and losses and against. Discounts, premiums, losses and gains. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. But before getting stuck into an example and the journal entries, we need to cover a few more things;

Source: blankmetoloveyou.blogspot.com

Source: blankmetoloveyou.blogspot.com

This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. Discounts, premiums, losses and gains. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500. When the bond is retired before the maturity date, there can be a. And there are discounts, premiums and losses and against.

Source: youtube.com

Source: youtube.com

We are almost at the examples and debits and credits. We are almost at the examples and debits and credits. When a bond is retired at the maturity date, there is no gain or loss resulting from. This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. This is because the company was able to settle the liability for less than its carrying amount.

Source: chegg.com

Source: chegg.com

This is because the company was able to settle the liability for less than its carrying amount. But before getting stuck into an example and the journal entries, we need to cover a few more things; Retirement before the maturity date. This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500.

Source: homeworklib.com

Source: homeworklib.com

But before getting stuck into an example and the journal entries, we need to cover a few more things; Retirement before the maturity date. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500. This is because the company was able to settle the liability for less than its carrying amount. Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry:

Source: principlesofaccounting.com

Source: principlesofaccounting.com

As the cash paid to redeem the bonds ($102,000) is lower than the carrying amount of the bonds ($105,000), there is a gain on retirement. This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: We are almost at the examples and debits and credits. When the bond is retired before the maturity date, there can be a.

Source: selfstudynotes.blogspot.com

Source: selfstudynotes.blogspot.com

Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: This is because the company was able to settle the liability for less than its carrying amount. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: But before getting stuck into an example and the journal entries, we need to cover a few more things; We are almost at the examples and debits and credits.

Source: chegg.com

Source: chegg.com

As the cash paid to redeem the bonds ($102,000) is lower than the carrying amount of the bonds ($105,000), there is a gain on retirement. And there are discounts, premiums and losses and against. Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. When a bond is retired at the maturity date, there is no gain or loss resulting from.

This is because the company was able to settle the liability for less than its carrying amount. But before getting stuck into an example and the journal entries, we need to cover a few more things; When a bond is retired at the maturity date, there is no gain or loss resulting from. We are almost at the examples and debits and credits. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below:

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: We are almost at the examples and debits and credits. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500. As the cash paid to redeem the bonds ($102,000) is lower than the carrying amount of the bonds ($105,000), there is a gain on retirement.

Source: blankmetoloveyou.blogspot.com

Source: blankmetoloveyou.blogspot.com

Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. We are almost at the examples and debits and credits. And there are discounts, premiums and losses and against. Discounts, premiums, losses and gains.

Source: chegg.com

Source: chegg.com

Discounts, premiums, losses and gains. And there are discounts, premiums and losses and against. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: Discounts, premiums, losses and gains. This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment.

Source: chegg.com

Source: chegg.com

We are almost at the examples and debits and credits. Likewise, we can make the journal entry for gain on the retirement of premium bonds before maturity as below: And there are discounts, premiums and losses and against. Company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: We are almost at the examples and debits and credits.

Source: slideshare.net

Source: slideshare.net

But before getting stuck into an example and the journal entries, we need to cover a few more things; When a bond is retired at the maturity date, there is no gain or loss resulting from. But before getting stuck into an example and the journal entries, we need to cover a few more things; This is because the company was able to settle the liability for less than its carrying amount. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Retirement before the maturity date. Discounts, premiums, losses and gains. As the cash paid to redeem the bonds ($102,000) is lower than the carrying amount of the bonds ($105,000), there is a gain on retirement. Bond retirement journal entry retirement at the maturity date. But before getting stuck into an example and the journal entries, we need to cover a few more things;

But before getting stuck into an example and the journal entries, we need to cover a few more things; We are almost at the examples and debits and credits. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500. When a bond is retired at the maturity date, there is no gain or loss resulting from. As the cash paid to redeem the bonds ($102,000) is lower than the carrying amount of the bonds ($105,000), there is a gain on retirement.

Source: chegg.com

Source: chegg.com

This is because there is a big increase in the market interest rate at the time that we call back the bonds for retirment. And there are discounts, premiums and losses and against. 5 rows on july 31, 2020, the carrying value of bonds issued at the premium is $98,500. Discounts, premiums, losses and gains. This is because the company was able to settle the liability for less than its carrying amount.

Source: slideshare.net

Source: slideshare.net

And there are discounts, premiums and losses and against. When the bond is retired before the maturity date, there can be a. Bond retirement journal entry retirement at the maturity date. When a bond is retired at the maturity date, there is no gain or loss resulting from. This is because the company was able to settle the liability for less than its carrying amount.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement of bonds journal entry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.