Your Retirement plan 5500 search images are available in this site. Retirement plan 5500 search are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan 5500 search files here. Download all royalty-free vectors.

If you’re looking for retirement plan 5500 search images information related to the retirement plan 5500 search interest, you have visit the ideal site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Retirement Plan 5500 Search. Information on form 5500 is able to reveal a lot of information about your own retirement plan. Any retirement plan subject to erisa must file form 5500. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. The form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other federal agencies, congress, and the private sector in assessing employee benefit, tax, and economic trends and policies.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic] Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2-1024x369.png) Form 5500EZ Example Complete in a Few Easy Steps! [Infographic] From emparion.com

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic] From emparion.com

Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. The information on the form 5500 can reveal a lot about your retirement plan. Department of labor, the pension benefit guaranty corporation, or the internal revenue service. These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. The form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other federal agencies, congress, and the private sector in assessing employee benefit, tax, and economic trends and policies.

See the csv file data dictionary and form 5500 series data dictionary.

The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. Posting on the web does not constitute acceptance of the filing by the u.s. As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. Department of labor, the pension benefit guaranty corporation, or the internal revenue service. These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans.

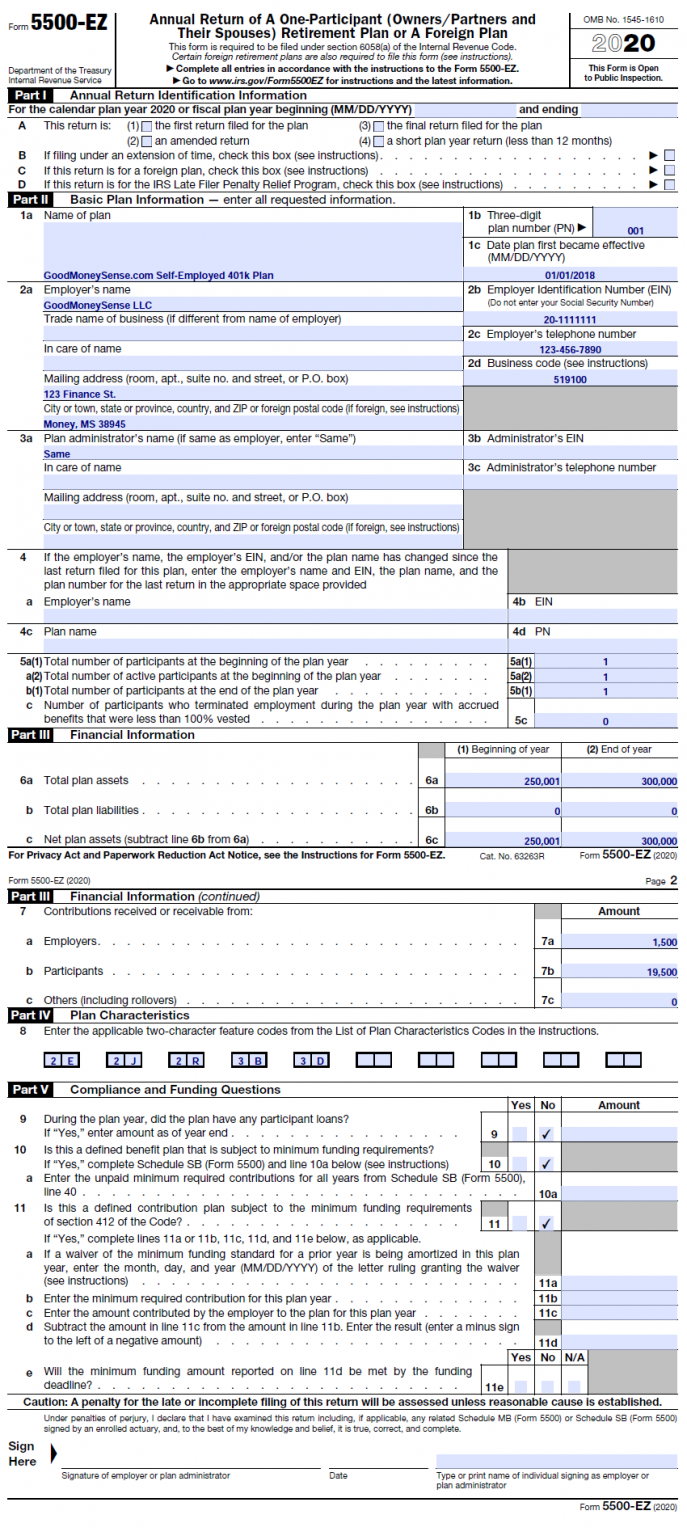

Source: goodmoneysense.com

Source: goodmoneysense.com

Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. Information on form 5500 is able to reveal a lot of information about your own retirement plan. What you need to know about form 5500 search all on one web page. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends.

These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. See the csv file data dictionary and form 5500 series data dictionary.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic] Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2-1024x369.png) Source: emparion.com

Source: emparion.com

The form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other federal agencies, congress, and the private sector in assessing employee benefit, tax, and economic trends and policies. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Department of labor, the pension benefit guaranty corporation, or the internal revenue service. Any retirement plan subject to erisa must file form 5500. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download.

Source: abaretirement.com

Source: abaretirement.com

The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. See the csv file data dictionary and form 5500 series data dictionary. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. What you need to know about form 5500 search all on one web page. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010.

Source: mooresrowland.tax

Source: mooresrowland.tax

What you need to know about form 5500 search all on one web page. Information on form 5500 is able to reveal a lot of information about your own retirement plan. Posting on the web does not constitute acceptance of the filing by the u.s. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. The information on the form 5500 can reveal a lot about your retirement plan.

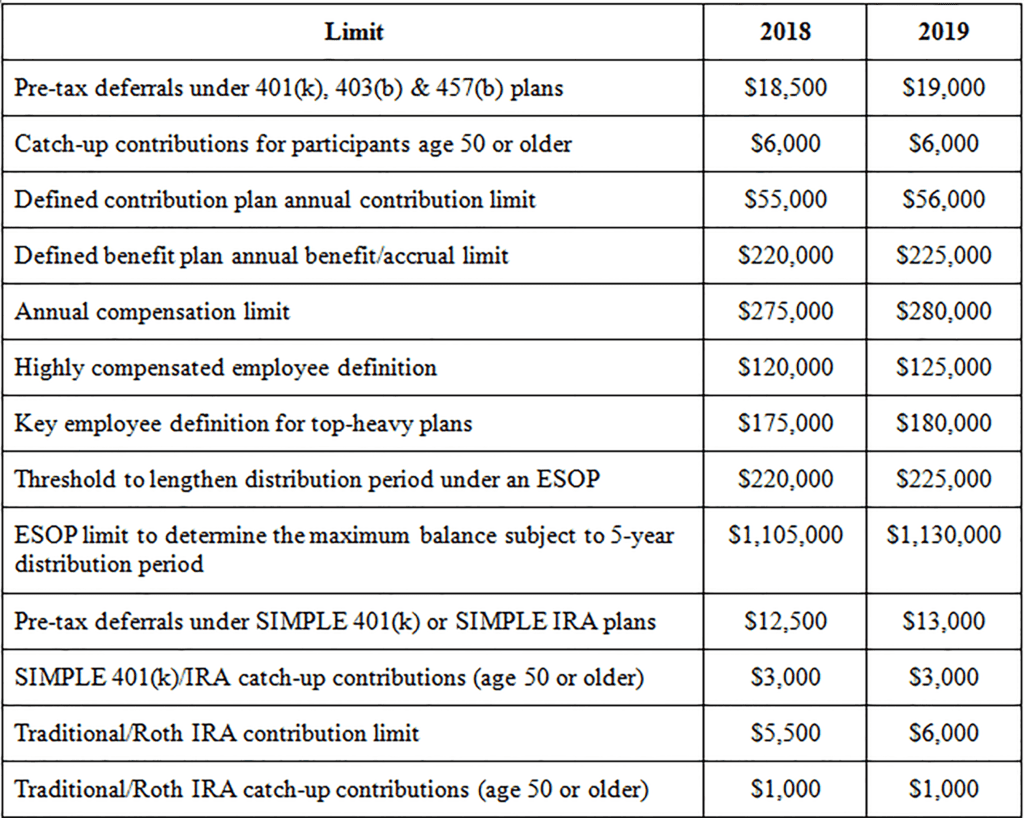

Source: thefinancebuff.com

Source: thefinancebuff.com

The information on the form 5500 can reveal a lot about your retirement plan. Department of labor, the pension benefit guaranty corporation, or the internal revenue service. Posting on the web does not constitute acceptance of the filing by the u.s. See the csv file data dictionary and form 5500 series data dictionary. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download.

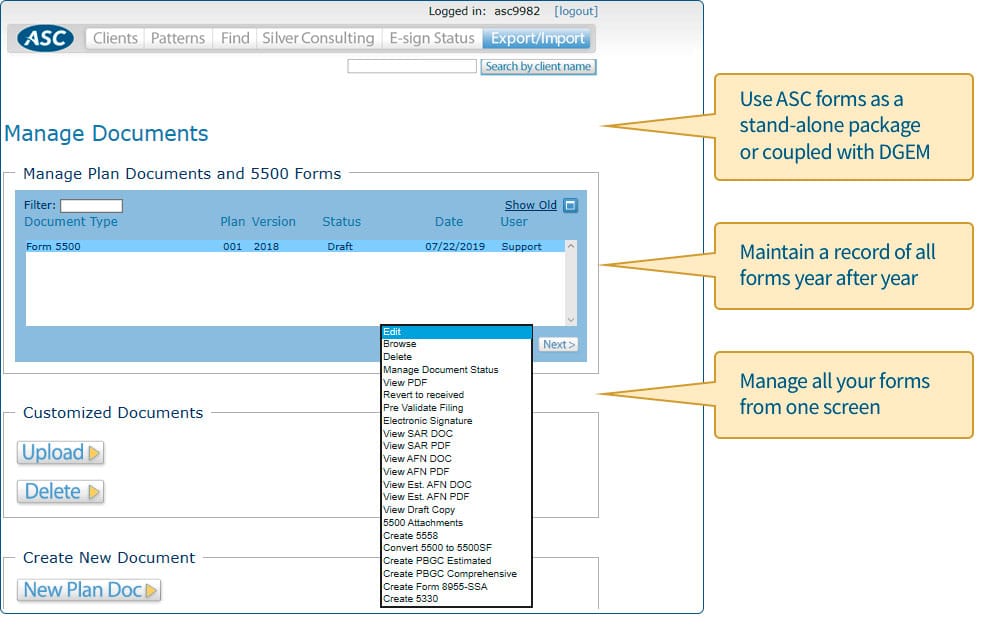

Source: asc-net.com

Source: asc-net.com

Department of labor, the pension benefit guaranty corporation, or the internal revenue service. See the csv file data dictionary and form 5500 series data dictionary. As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. Any retirement plan subject to erisa must file form 5500. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download.

As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. See the csv file data dictionary and form 5500 series data dictionary. Posting on the web does not constitute acceptance of the filing by the u.s. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs.

Source: form-5500ez.pdffiller.com

Source: form-5500ez.pdffiller.com

These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. What you need to know about form 5500 search all on one web page. These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Department of labor, the pension benefit guaranty corporation, or the internal revenue service.

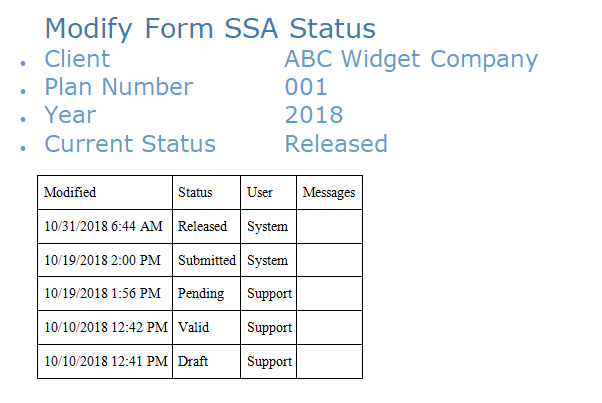

Source: asc-net.com

Source: asc-net.com

Posting on the web does not constitute acceptance of the filing by the u.s. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. See the csv file data dictionary and form 5500 series data dictionary. Posting on the web does not constitute acceptance of the filing by the u.s.

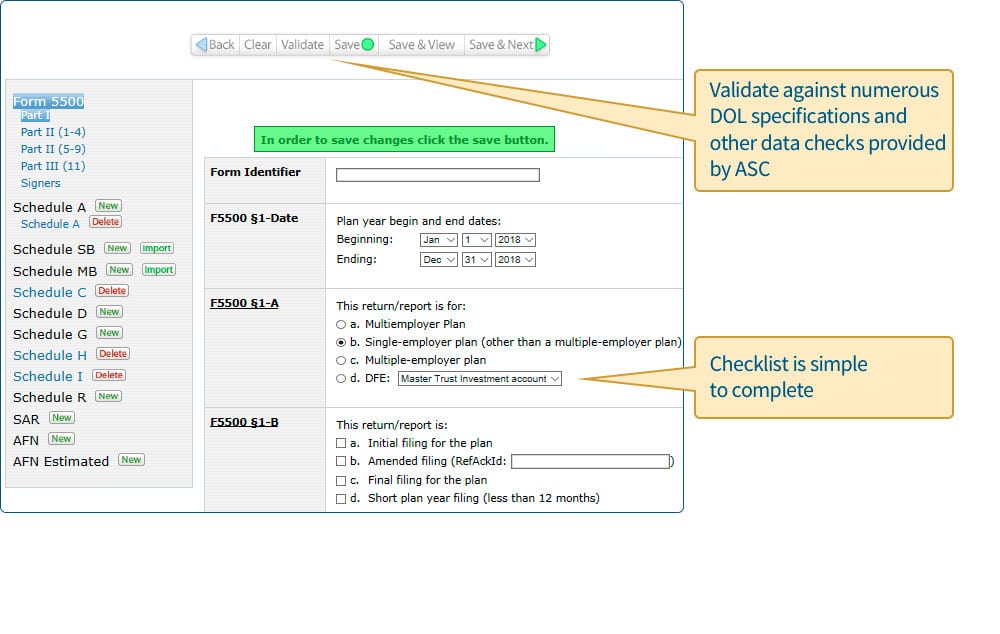

Source: asc-net.com

Source: asc-net.com

Posting on the web does not constitute acceptance of the filing by the u.s. As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. What you need to know about form 5500 search all on one web page. Any retirement plan subject to erisa must file form 5500. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download.

Source: slidesharetrick.blogspot.com

Source: slidesharetrick.blogspot.com

Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. Department of labor, the pension benefit guaranty corporation, or the internal revenue service. As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. Posting on the web does not constitute acceptance of the filing by the u.s.

Source: a36analytics.com

Source: a36analytics.com

As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. Department of labor, the pension benefit guaranty corporation, or the internal revenue service. What you need to know about form 5500 search all on one web page. These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs.

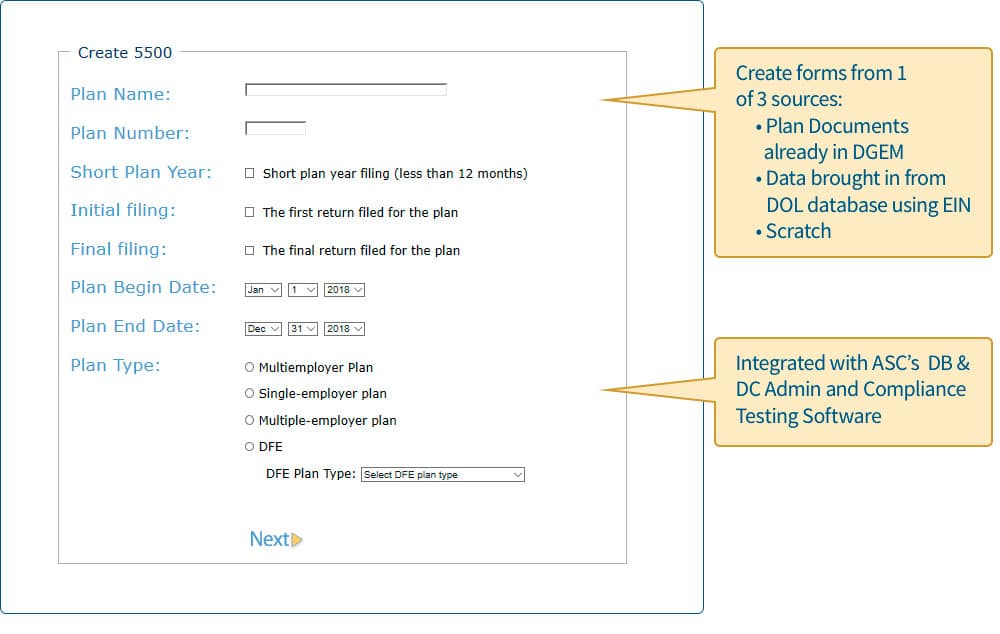

Source: asc-net.com

Source: asc-net.com

Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. What you need to know about form 5500 search all on one web page. The form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other federal agencies, congress, and the private sector in assessing employee benefit, tax, and economic trends and policies.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic] Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-3-1024x348.png) Source: emparion.com

Source: emparion.com

Posting on the web does not constitute acceptance of the filing by the u.s. The form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other federal agencies, congress, and the private sector in assessing employee benefit, tax, and economic trends and policies. As of january 2010, all form 5500’s are filed electronically using the efast2 electronic filing system. Any retirement plan subject to erisa must file form 5500. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends.

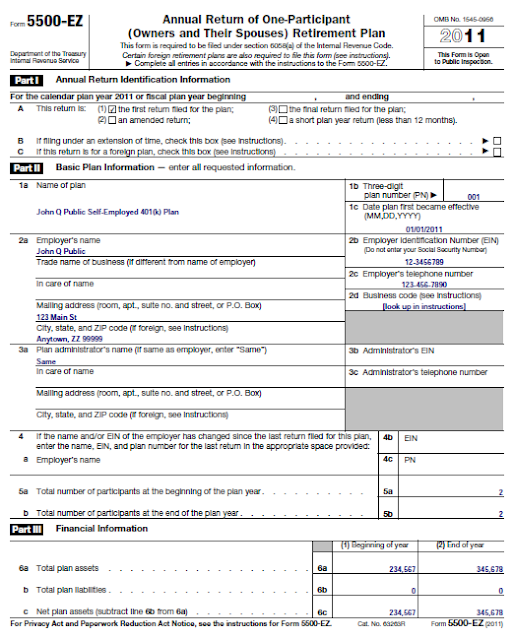

Source: retirementplanblog.com

Source: retirementplanblog.com

Department of labor, the pension benefit guaranty corporation, or the internal revenue service. These include 401(k)s, certain solo 401(k)s, profit sharing plans, and some 403(b) plans. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. What you need to know about form 5500 search all on one web page.

Source: product.ftwilliam.com

Source: product.ftwilliam.com

See the csv file data dictionary and form 5500 series data dictionary. Most people, that include employers or plan sponsors are not aware that the pension retirement plan information on form 5500 is actually public information which is easy to download. See the csv file data dictionary and form 5500 series data dictionary. Any retirement plan subject to erisa must file form 5500. Posting on the web does not constitute acceptance of the filing by the u.s.

The information on the form 5500 can reveal a lot about your retirement plan. The form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other federal agencies, congress, and the private sector in assessing employee benefit, tax, and economic trends and policies. The form 5500 was developed for employee benefit plans to satisfy annual reporting requirements under title i and title iv of erisa and the irs. Any retirement plan subject to erisa must file form 5500. What you need to know about form 5500 search all on one web page.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan 5500 search by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.