Your Retirement plan 501c3 images are available. Retirement plan 501c3 are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan 501c3 files here. Get all free photos.

If you’re searching for retirement plan 501c3 images information connected with to the retirement plan 501c3 interest, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Retirement Plan 501c3. It might not seem obvious, but your retirement plan is a good place to start. Online training for employers and employees about 403 (b) plans at. Employees over age 50 can add $5,500 to the contribution limit. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement.

501c3 Tax Exempt Status for homeschool organizations From homeschoolcpa.com

501c3 Tax Exempt Status for homeschool organizations From homeschoolcpa.com

The irs adjusts the maximum contribution limit each year. Online training for employers and employees about 403 (b) plans at. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. Those that don�t may offer 401 (k) plans instead. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts.

For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account.

Those that don�t may offer 401 (k) plans instead. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. Those that don�t may offer 401 (k) plans instead. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons. Online training for employers and employees about 403 (b) plans at. Employees over age 50 can add $5,500 to the contribution limit.

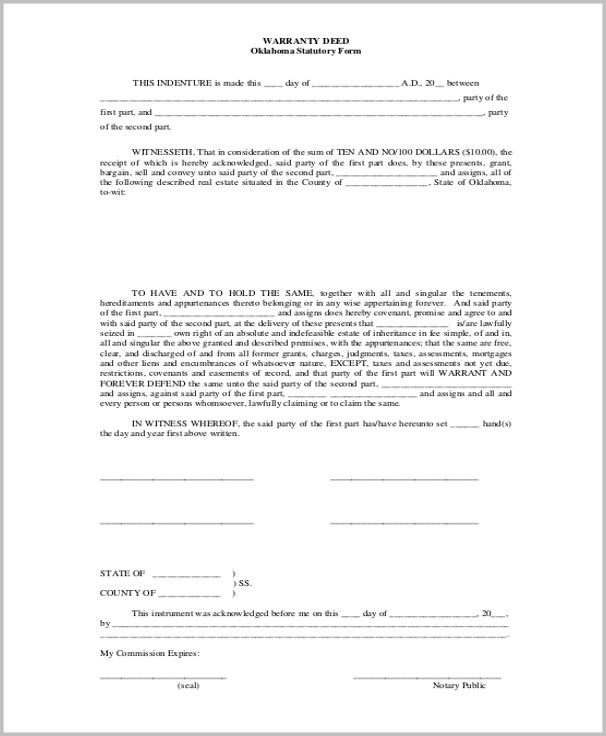

Source: taxw.blogspot.com

Source: taxw.blogspot.com

One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons. The irs adjusts the maximum contribution limit each year. Those that don�t may offer 401 (k) plans instead. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts.

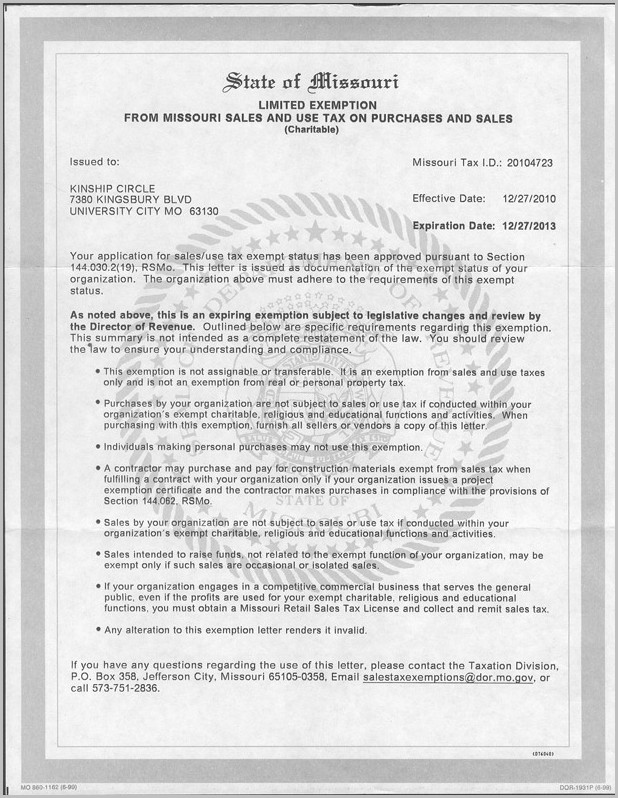

Source: justbcause.com

Source: justbcause.com

Employees over age 50 can add $5,500 to the contribution limit. Those that don�t may offer 401 (k) plans instead. It might not seem obvious, but your retirement plan is a good place to start. Online training for employers and employees about 403 (b) plans at. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account.

Source: finance.zacks.com

Source: finance.zacks.com

For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. Those that don�t may offer 401 (k) plans instead. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons.

Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. Online training for employers and employees about 403 (b) plans at. Employees over age 50 can add $5,500 to the contribution limit. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013.

Source: form1023.org

Source: form1023.org

One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account. Online training for employers and employees about 403 (b) plans at. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts.

Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. The irs adjusts the maximum contribution limit each year. Online training for employers and employees about 403 (b) plans at. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Employees over age 50 can add $5,500 to the contribution limit. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. It might not seem obvious, but your retirement plan is a good place to start. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account.

Source: ualocal136.org

Source: ualocal136.org

One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. It might not seem obvious, but your retirement plan is a good place to start. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. Those that don�t may offer 401 (k) plans instead. Employees over age 50 can add $5,500 to the contribution limit.

Source: thesecularparent.com

Source: thesecularparent.com

Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. Employees over age 50 can add $5,500 to the contribution limit. Online training for employers and employees about 403 (b) plans at.

Source: irishtimesidealab.com

Source: irishtimesidealab.com

The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. The irs adjusts the maximum contribution limit each year. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account. Those that don�t may offer 401 (k) plans instead.

Source: thesecularparent.com

Source: thesecularparent.com

Those that don�t may offer 401 (k) plans instead. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. Online training for employers and employees about 403 (b) plans at. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account.

Source: retirementtimesnewsletter.com

Source: retirementtimesnewsletter.com

It might not seem obvious, but your retirement plan is a good place to start. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account. Those that don�t may offer 401 (k) plans instead. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. Employees over age 50 can add $5,500 to the contribution limit.

Source: prudentfinancialllc.com

Source: prudentfinancialllc.com

One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. Employees over age 50 can add $5,500 to the contribution limit. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013.

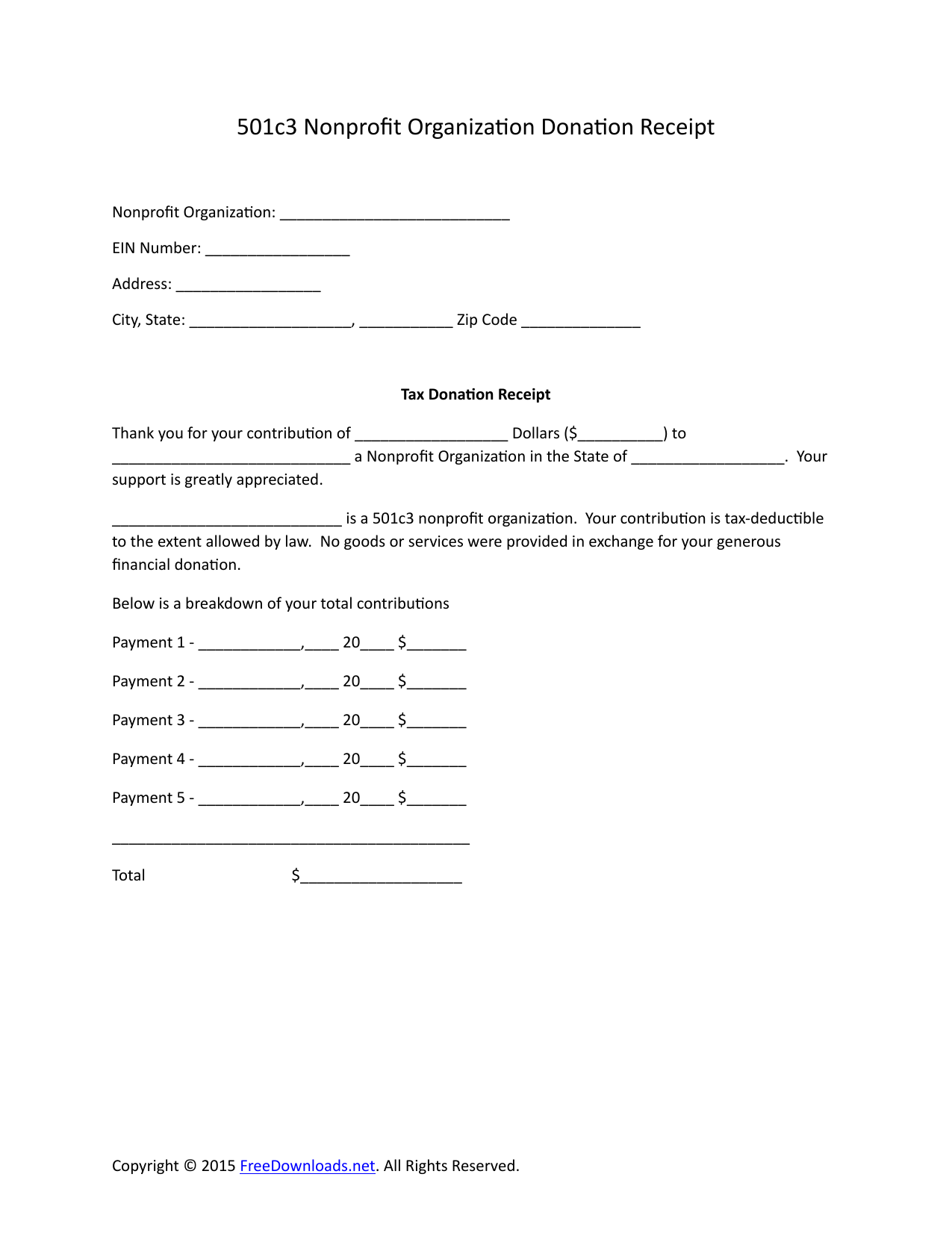

Source: justbcause.com

Source: justbcause.com

It might not seem obvious, but your retirement plan is a good place to start. For 2013, an employee in a 501 (c) (3) can defer up to $17,500 into her 403 (b) account. Online training for employers and employees about 403 (b) plans at. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. The irs adjusts the maximum contribution limit each year.

Source: trelet.blogspot.com

Source: trelet.blogspot.com

It might not seem obvious, but your retirement plan is a good place to start. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. Employees over age 50 can add $5,500 to the contribution limit. The irs adjusts the maximum contribution limit each year. Online training for employers and employees about 403 (b) plans at.

Source: friendshipvillageiowa.com

Source: friendshipvillageiowa.com

It might not seem obvious, but your retirement plan is a good place to start. A 501 (c) (3) nonprofit employee might open a 401 (k) account instead of a 403 (b) retirement account for many reasons. The irs adjusts the maximum contribution limit each year. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013.

The total maximum contribution including employer participation is $51,000 or 100 percent of compensation for 2013. Employees over age 50 can add $5,500 to the contribution limit. The irs adjusts the maximum contribution limit each year. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts.

Source: homeschoolcpa.com

Source: homeschoolcpa.com

Those that don�t may offer 401 (k) plans instead. Also, smaller 501 (c) (3) nonprofits might not offer access to any retirement. Online training for employers and employees about 403 (b) plans at. One is that not all 501 (c) (3) nonprofits qualify to offer their employees 403 (b) accounts. It might not seem obvious, but your retirement plan is a good place to start.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan 501c3 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.