Your Retirement plan 5500 due date images are available in this site. Retirement plan 5500 due date are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement plan 5500 due date files here. Download all royalty-free images.

If you’re searching for retirement plan 5500 due date pictures information related to the retirement plan 5500 due date keyword, you have come to the right site. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

Retirement Plan 5500 Due Date. A 2 ½ month extension is available by filing form 5500. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. File form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan).

PPS”) Sample Design Study (50’s) PPS From pensionplanspecialists.com

As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. The majority of plans are administered on a calendar year, but a good. The form 5500 due date varies based on the plan year end, but is also fixed. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Most dates relating to due dates for retirement plans are dependent on the plan year. The july 31 due date for filing form 5500 with the department of labor (dol) for calendar year retirement plans is rolling around very quickly unless.

The majority of plans are administered on a calendar year, but a good.

As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. Unless an extension is filed the due date is the same date annually. The form 5500 due date varies based on the plan year end, but is also fixed. Form 5500 due date and extension options. Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets.

Source: benefit-resources.com

Source: benefit-resources.com

As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. Most dates relating to due dates for retirement plans are dependent on the plan year. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. The form 5500 due date varies based on the plan year end, but is also fixed.

Source: templateroller.com

Source: templateroller.com

Unless an extension is filed the due date is the same date annually. The majority of plans are administered on a calendar year, but a good. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. A 2 ½ month extension is available by filing form 5500. File form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

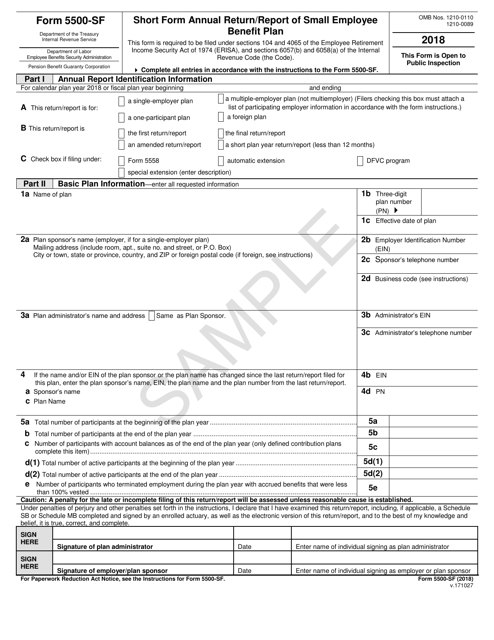

Source: ftwilliam.com

Source: ftwilliam.com

The form 5500 due date varies based on the plan year end, but is also fixed. As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). When is form 5500 due? Must file electronically through efast2.

Source: bc2co.com

Source: bc2co.com

When is form 5500 due? Unless an extension is filed the due date is the same date annually. Form 5500 due date and extension options. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. File form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

PPS”) Source: pensionplanspecialists.com

File form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Most dates relating to due dates for retirement plans are dependent on the plan year. Unless an extension is filed the due date is the same date annually. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. Must file electronically through efast2.

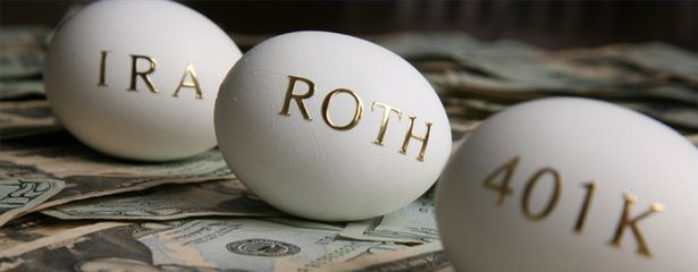

Source: templateroller.com

Source: templateroller.com

Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. Unless an extension is filed the due date is the same date annually. Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. A 2 ½ month extension is available by filing form 5500. File form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

Source: slideshare.net

Source: slideshare.net

Form 5500 due date and extension options. When is form 5500 due? Form 5500 due date and extension options. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Most dates relating to due dates for retirement plans are dependent on the plan year.

Source: solo401k.com

Source: solo401k.com

In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. Unless an extension is filed the due date is the same date annually. When is form 5500 due? Must file electronically through efast2.

Source: retirementplanblog.com

Source: retirementplanblog.com

The july 31 due date for filing form 5500 with the department of labor (dol) for calendar year retirement plans is rolling around very quickly unless. Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. Most dates relating to due dates for retirement plans are dependent on the plan year. A 2 ½ month extension is available by filing form 5500. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan).

Source: teamkaminsky.com

Source: teamkaminsky.com

Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. The july 31 due date for filing form 5500 with the department of labor (dol) for calendar year retirement plans is rolling around very quickly unless. The majority of plans are administered on a calendar year, but a good. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets.

Source: retirementplanadministrators.com

Source: retirementplanadministrators.com

Must file electronically through efast2. Unless an extension is filed the due date is the same date annually. The form 5500 due date varies based on the plan year end, but is also fixed. Must file electronically through efast2. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan).

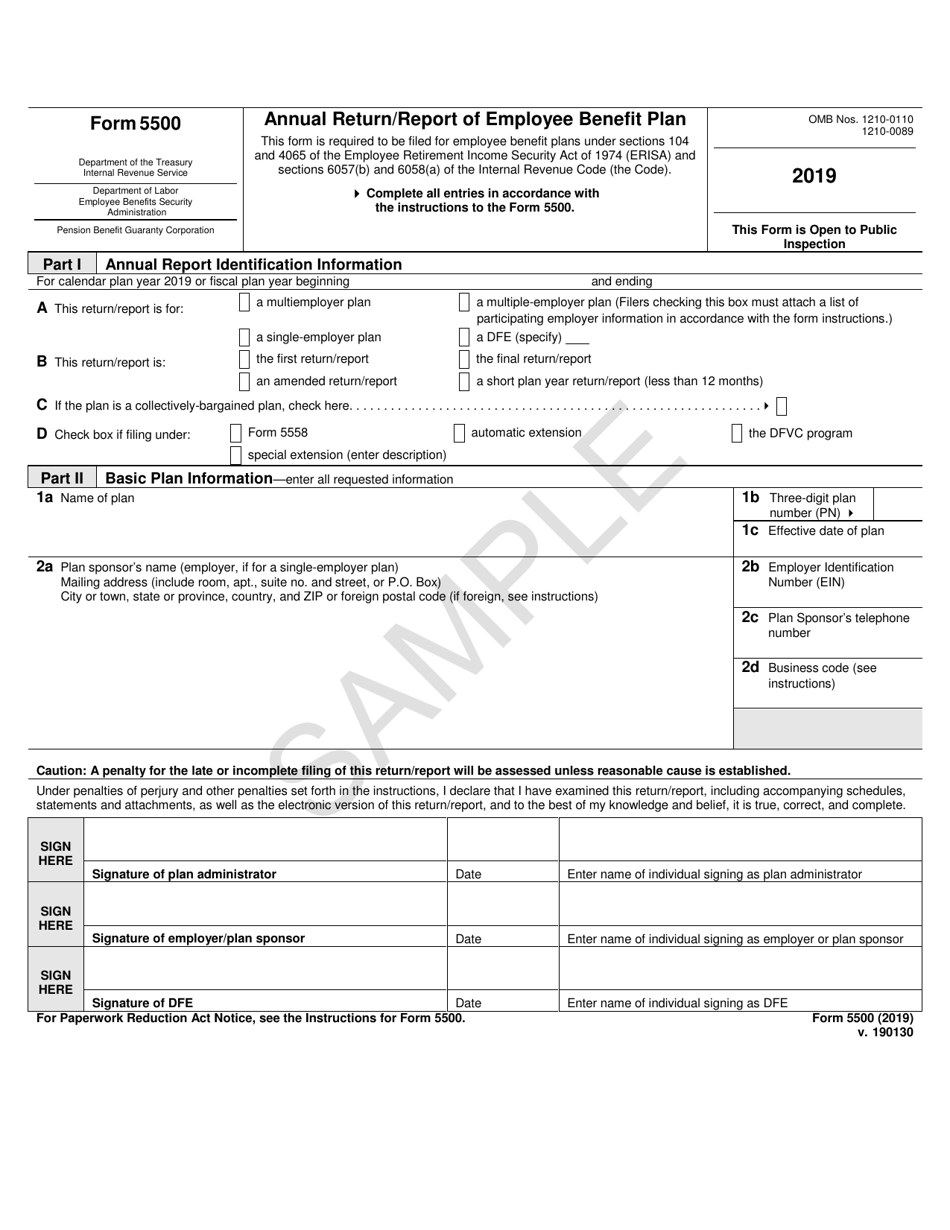

Source: sec.gov

Source: sec.gov

The form 5500 due date varies based on the plan year end, but is also fixed. Unless an extension is filed the due date is the same date annually. Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report. When is form 5500 due? The form 5500 due date varies based on the plan year end, but is also fixed.

Source: asc-net.com

Source: asc-net.com

The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). The july 31 due date for filing form 5500 with the department of labor (dol) for calendar year retirement plans is rolling around very quickly unless. The majority of plans are administered on a calendar year, but a good. A 2 ½ month extension is available by filing form 5500. The form 5500 due date varies based on the plan year end, but is also fixed.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic] Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png) Source: emparion.com

Source: emparion.com

Unless an extension is filed the due date is the same date annually. Form 5500 due date and extension options. As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. The form 5500 due date varies based on the plan year end, but is also fixed.

Source: americanhw.com

Source: americanhw.com

When is form 5500 due? Must file electronically through efast2. The july 31 due date for filing form 5500 with the department of labor (dol) for calendar year retirement plans is rolling around very quickly unless. As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. The majority of plans are administered on a calendar year, but a good.

Source: calendarhuzz.net

Source: calendarhuzz.net

The form 5500 due date varies based on the plan year end, but is also fixed. Unless an extension is filed the due date is the same date annually. When is form 5500 due? The july 31 due date for filing form 5500 with the department of labor (dol) for calendar year retirement plans is rolling around very quickly unless. The form 5500 due date varies based on the plan year end, but is also fixed.

Source: bc2co.com

Source: bc2co.com

In general, all retirement plans, such as 401(k) and 403(b) plans, must file a form 5500 for every year the plan holds assets. A 2 ½ month extension is available by filing form 5500. The form 5500 due date varies based on the plan year end, but is also fixed. Most dates relating to due dates for retirement plans are dependent on the plan year. As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year.

Source: solo401k.com

Source: solo401k.com

The majority of plans are administered on a calendar year, but a good. Most dates relating to due dates for retirement plans are dependent on the plan year. As with due dates for retirement plans, form 5500 must be filed within 7 months after the end of the plan year. The majority of plans are administered on a calendar year, but a good. Just as with a personal tax return, you can file an extension for your organization’s form 5500 annual return/report.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan 5500 due date by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.