Your Retirement plan 30 year old images are ready in this website. Retirement plan 30 year old are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement plan 30 year old files here. Get all royalty-free vectors.

If you’re looking for retirement plan 30 year old pictures information connected with to the retirement plan 30 year old topic, you have come to the right site. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Retirement Plan 30 Year Old. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees. Not only can you receive a tax credit

Should a 30 Year Old Think About Retirement? From barbarafriedbergpersonalfinance.com

Should a 30 Year Old Think About Retirement? From barbarafriedbergpersonalfinance.com

401(k) plans and retirement savings in your 30s. Not only can you receive a tax credit Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds.

A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees.

A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. 401(k) plans and retirement savings in your 30s. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. According to a 2021 pwc report and data from the u.s.

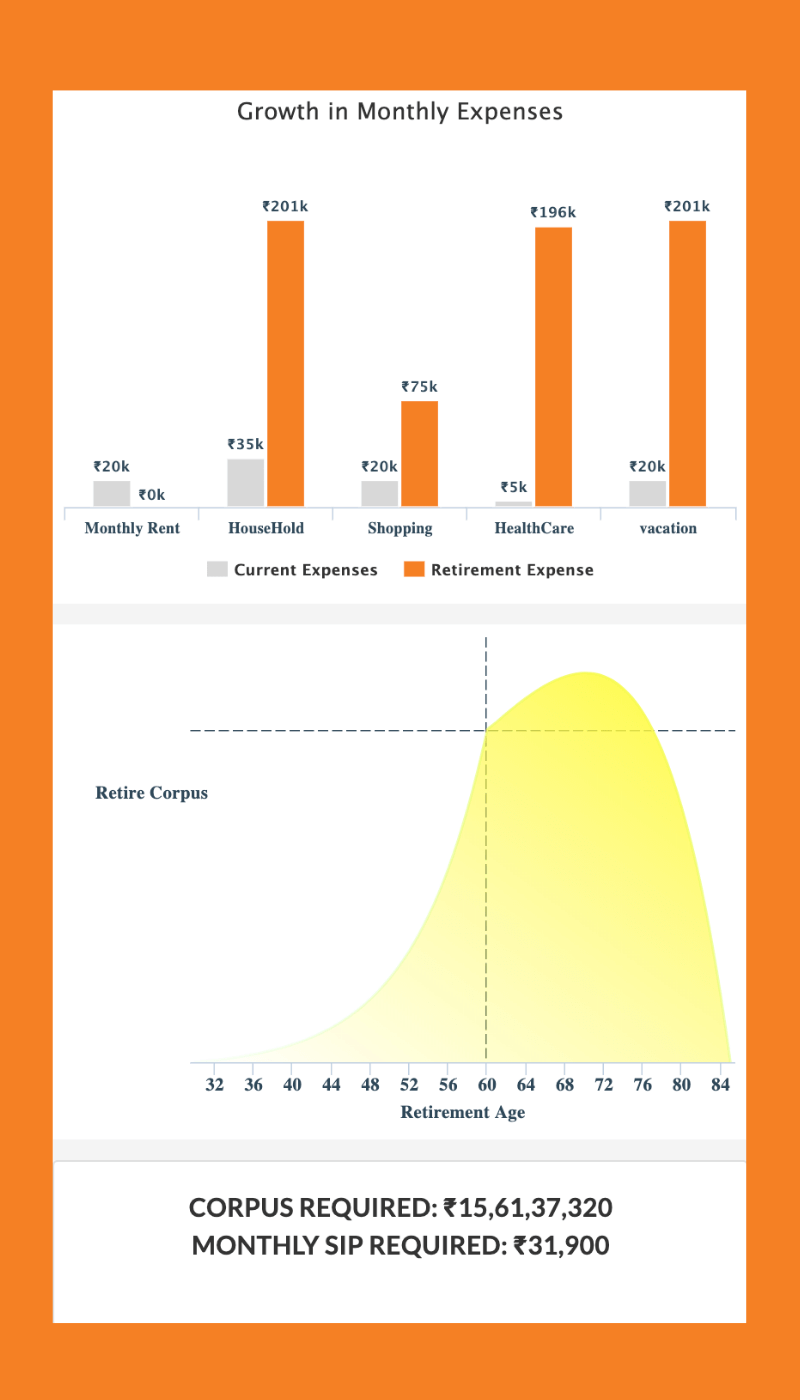

Source: scripbox.com

Source: scripbox.com

401(k) plans and retirement savings in your 30s. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. According to a 2021 pwc report and data from the u.s.

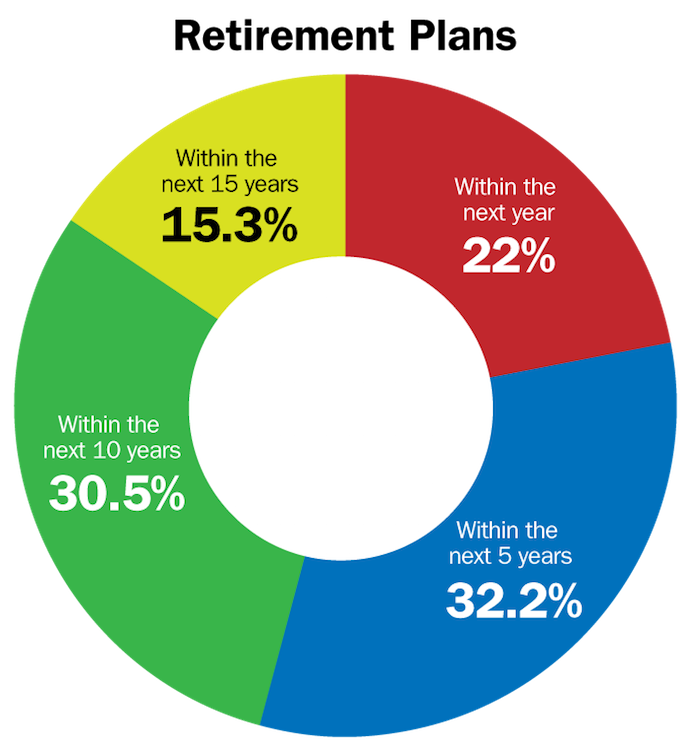

Source: pinterest.com

Source: pinterest.com

Although it is possible to do, it takes a monumental amount of work and planning to accomplish. Adults have no savings for retirement. According to a 2021 pwc report and data from the u.s. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor.

Source: teacherpensions.org

A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees. According to a 2021 pwc report and data from the u.s. Not only can you receive a tax credit That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor.

Source: farm-equipment.com

Source: farm-equipment.com

Not only can you receive a tax credit Adults have no savings for retirement. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. According to a 2021 pwc report and data from the u.s. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds.

Source: strategicwd.com

Source: strategicwd.com

Not only can you receive a tax credit 401(k) plans and retirement savings in your 30s. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. Adults have no savings for retirement.

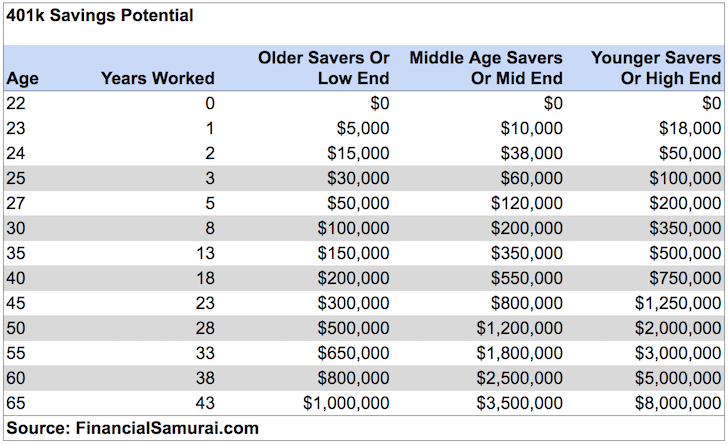

Source: financialsamurai.com

Source: financialsamurai.com

That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. 401(k) plans and retirement savings in your 30s. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Although it is possible to do, it takes a monumental amount of work and planning to accomplish.

Source: barbarafriedbergpersonalfinance.com

Source: barbarafriedbergpersonalfinance.com

Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. Adults have no savings for retirement. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees. Although it is possible to do, it takes a monumental amount of work and planning to accomplish.

Source: binews.org

Source: binews.org

That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. Adults have no savings for retirement. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds.

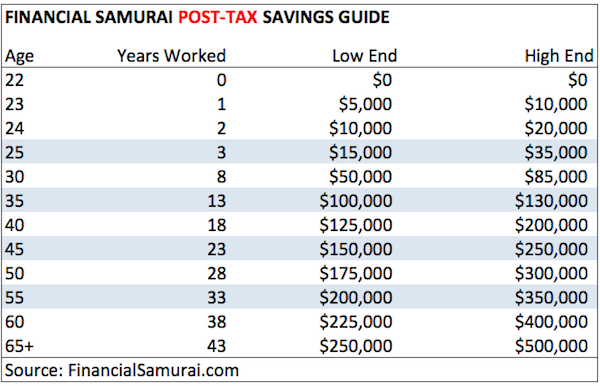

Source: financialsamurai.com

Source: financialsamurai.com

401(k) plans and retirement savings in your 30s. Adults have no savings for retirement. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. 401(k) plans and retirement savings in your 30s. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds.

Source: researchgate.net

Source: researchgate.net

According to a 2021 pwc report and data from the u.s. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. 401(k) plans and retirement savings in your 30s. According to a 2021 pwc report and data from the u.s. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor.

Source: scripbox.com

Source: scripbox.com

Adults have no savings for retirement. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. Adults have no savings for retirement. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. 401(k) plans and retirement savings in your 30s.

Source: standard.com

Source: standard.com

That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. 401(k) plans and retirement savings in your 30s. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30.

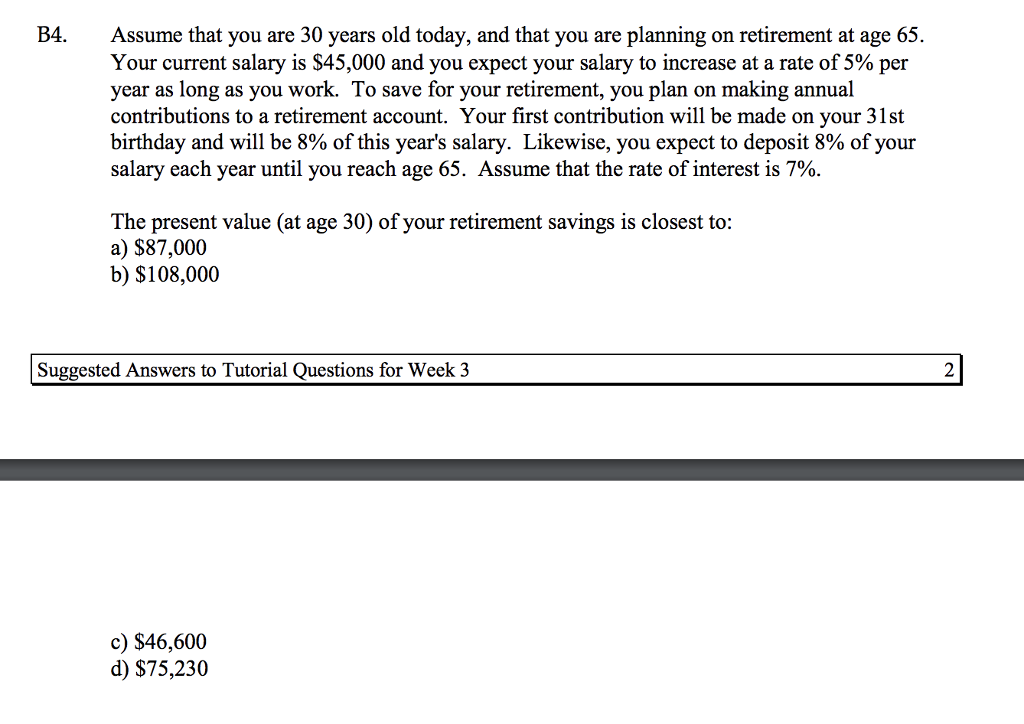

Source: chegg.com

Source: chegg.com

Although it is possible to do, it takes a monumental amount of work and planning to accomplish. A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees. Not only can you receive a tax credit According to a 2021 pwc report and data from the u.s. Adults have no savings for retirement.

Source: iammrfoster.com

Source: iammrfoster.com

According to a 2021 pwc report and data from the u.s. A 401(k) plan is a workplace retirement savings plan that many companies offer to their employees. According to a 2021 pwc report and data from the u.s. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Not only can you receive a tax credit

Source: diamondretirement.com

Source: diamondretirement.com

According to a 2021 pwc report and data from the u.s. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. Adults have no savings for retirement. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor.

Not only can you receive a tax credit Adults have no savings for retirement. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. That means a typical worker earning $50,000 a year should have $50,000 in their retirement savings by the time they reach age 30. Not only can you receive a tax credit

Source: pinterest.com

Source: pinterest.com

You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. According to a 2021 pwc report and data from the u.s. 401(k) plans and retirement savings in your 30s. Adults have no savings for retirement.

Source: woodlandssecurities.com

Source: woodlandssecurities.com

Adults have no savings for retirement. Although it is possible to do, it takes a monumental amount of work and planning to accomplish. You put money into the account before it is taxed and put it in a variety of investment vehicles, generally funds investing in stocks or bonds. Contributing the maximum amount possible to retirement accounts is one way to make your money to work in your favor. Adults have no savings for retirement.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan 30 year old by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.