Your Retirement plan 2 fica images are available in this site. Retirement plan 2 fica are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement plan 2 fica files here. Download all royalty-free images.

If you’re looking for retirement plan 2 fica images information linked to the retirement plan 2 fica interest, you have visit the right site. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

Retirement Plan 2 Fica. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees. Contributions to a fica alternative plan can come from an employee, employer, or both. Funds are invested and bear interest, which means an increased value due to earnings over time;

Many Federal Employees Need to Pay Back Deferred Payroll Taxes Starting From myfederalretirement.com

Many Federal Employees Need to Pay Back Deferred Payroll Taxes Starting From myfederalretirement.com

Contributions to a fica alternative plan can come from an employee, employer, or both. Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. Funds are invested and bear interest, which means an increased value due to earnings over time; 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Think of a fica plan as a substitute when you don’t pay social security taxes. Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan.

Contributions to a fica alternative plan can come from an employee, employer, or both.

It sounds like jamie is putting in the entire 7.5 percent on her own. Funds are invested and bear interest, which means an increased value due to earnings over time; Instead, they contribute pretax payroll deductions equal to. Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan. As a result, temporary employees of a government entity may deposit money Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees.

Source: oncomie.blogspot.com

Source: oncomie.blogspot.com

48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. It sounds like jamie is putting in the entire 7.5 percent on her own. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees.

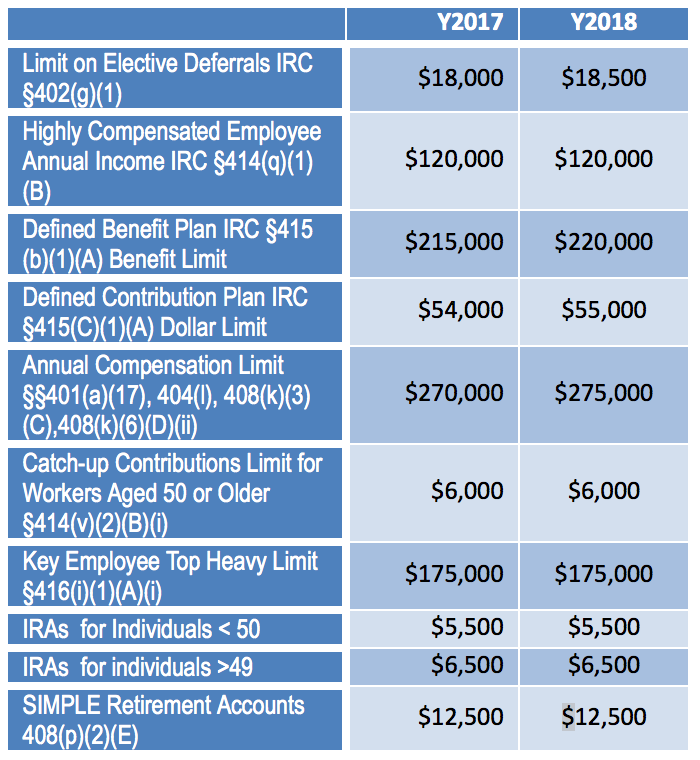

Source: patriotsoftware.com

Source: patriotsoftware.com

It sounds like jamie is putting in the entire 7.5 percent on her own. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees. Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. It sounds like jamie is putting in the entire 7.5 percent on her own. Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan.

Source: us.beyondbullsandbears.com

Source: us.beyondbullsandbears.com

Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees. Instead, they contribute pretax payroll deductions equal to. Funds are invested and bear interest, which means an increased value due to earnings over time; Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan. Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax.

Source: chegg.com

Source: chegg.com

Funds are invested and bear interest, which means an increased value due to earnings over time; As a result, temporary employees of a government entity may deposit money Think of a fica plan as a substitute when you don’t pay social security taxes. It sounds like jamie is putting in the entire 7.5 percent on her own. Funds are invested and bear interest, which means an increased value due to earnings over time;

Source: communitytax.com

Source: communitytax.com

48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. It sounds like jamie is putting in the entire 7.5 percent on her own. Instead, they contribute pretax payroll deductions equal to.

Source: onegroupra.com

Source: onegroupra.com

It sounds like jamie is putting in the entire 7.5 percent on her own. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. It sounds like jamie is putting in the entire 7.5 percent on her own. Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. As a result, temporary employees of a government entity may deposit money

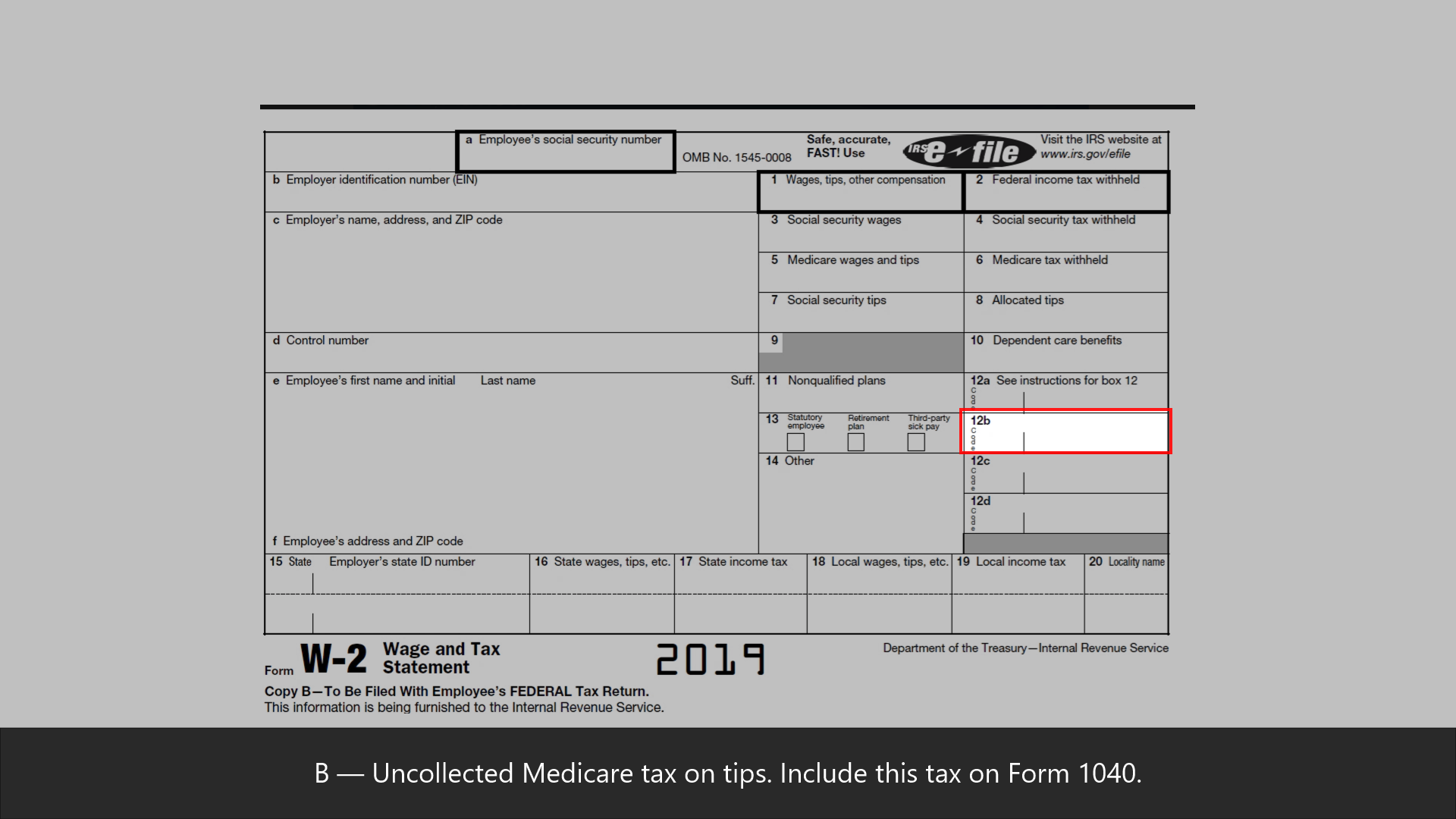

Source: myfederalretirement.com

Source: myfederalretirement.com

Instead, they contribute pretax payroll deductions equal to. Instead, they contribute pretax payroll deductions equal to. Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan. Funds are invested and bear interest, which means an increased value due to earnings over time;

Source: mymidamerica.com

Source: mymidamerica.com

Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. Instead, they contribute pretax payroll deductions equal to. Contributions to a fica alternative plan can come from an employee, employer, or both. As a result, temporary employees of a government entity may deposit money Funds are invested and bear interest, which means an increased value due to earnings over time;

Source: onegroupra.com

Source: onegroupra.com

Instead, they contribute pretax payroll deductions equal to. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Funds are invested and bear interest, which means an increased value due to earnings over time; Contributions to a fica alternative plan can come from an employee, employer, or both. Instead, they contribute pretax payroll deductions equal to.

Source: onegroupra.com

Source: onegroupra.com

It sounds like jamie is putting in the entire 7.5 percent on her own. Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Think of a fica plan as a substitute when you don’t pay social security taxes.

Source: nycers.org

Source: nycers.org

Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. Contributions to a fica alternative plan can come from an employee, employer, or both. Think of a fica plan as a substitute when you don’t pay social security taxes. Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no.

Source: financialsamurai.com

Source: financialsamurai.com

As a result, temporary employees of a government entity may deposit money Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. Funds are invested and bear interest, which means an increased value due to earnings over time; Think of a fica plan as a substitute when you don’t pay social security taxes. Instead, they contribute pretax payroll deductions equal to.

Source: blog.ssa.gov

Source: blog.ssa.gov

Funds are invested and bear interest, which means an increased value due to earnings over time; Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. Contributions to a fica alternative plan can come from an employee, employer, or both. As a result, temporary employees of a government entity may deposit money 48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no.

Source: thebalancesmb.com

Source: thebalancesmb.com

Instead, they contribute pretax payroll deductions equal to. Think of a fica plan as a substitute when you don’t pay social security taxes. It sounds like jamie is putting in the entire 7.5 percent on her own. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees. Funds are invested and bear interest, which means an increased value due to earnings over time;

Source: experientialwealth.com

Source: experientialwealth.com

As a result, temporary employees of a government entity may deposit money Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. Contributions to a fica alternative plan can come from an employee, employer, or both. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees. Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account.

Source: library.myguide.org

Source: library.myguide.org

Under this agreement the state of nevada chose to opt out of fica participation for their employees who qualify for a retirement plan. As a result, temporary employees of a government entity may deposit money Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. Employees enrolled in a fica alternative plan don�t pay the normal 6.2 percent social security tax. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees.

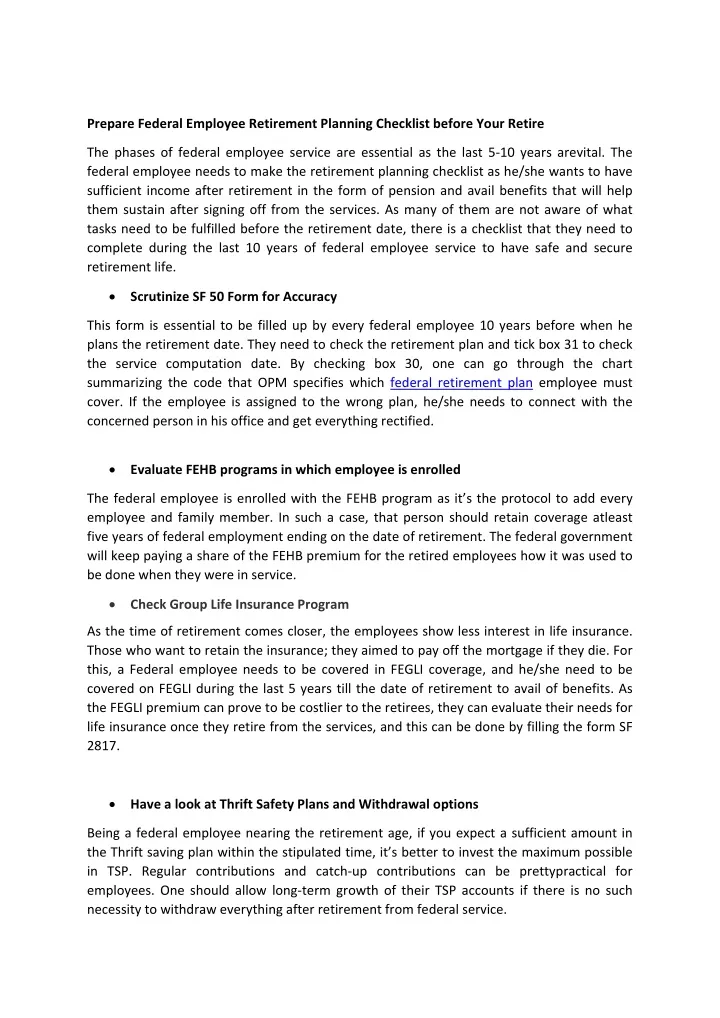

Source: smartfinancialplanning.com

Source: smartfinancialplanning.com

48 rows when the employee�s basic pay exceeds the maximum fica wage base and is no. Think of a fica plan as a substitute when you don’t pay social security taxes. Instead, you’re required to contribute a minimum of 7.5 percent of your wages to a fica plan account. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees. Contributions to a fica alternative plan can come from an employee, employer, or both.

Source: janinhasr.blogspot.com

Source: janinhasr.blogspot.com

Think of a fica plan as a substitute when you don’t pay social security taxes. It sounds like jamie is putting in the entire 7.5 percent on her own. Think of a fica plan as a substitute when you don’t pay social security taxes. Contributions to a fica alternative plan can come from an employee, employer, or both. Employers avoid the matching 6.2% social security contribution, replacing it with an impactful benefit for employees.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan 2 fica by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.