Your What is the difference between gross and net pay images are ready in this website. What is the difference between gross and net pay are a topic that is being searched for and liked by netizens now. You can Get the What is the difference between gross and net pay files here. Find and Download all free vectors.

If you’re searching for what is the difference between gross and net pay pictures information related to the what is the difference between gross and net pay keyword, you have visit the right blog. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

What Is The Difference Between Gross And Net Pay. Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Gross pay and net pay aren’t the same. The method for calculating gross wages largely depends on how the employee is paid. So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000.

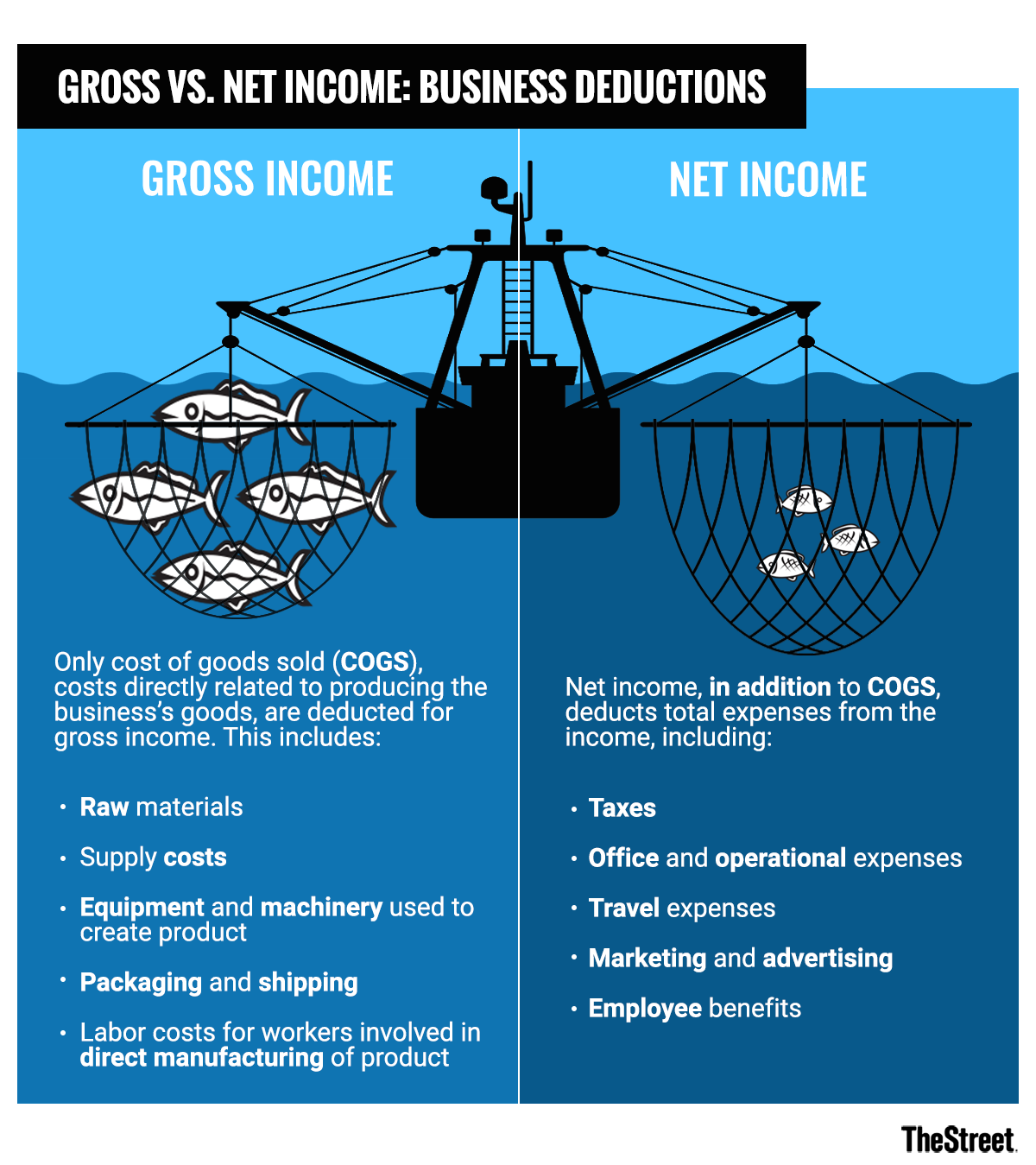

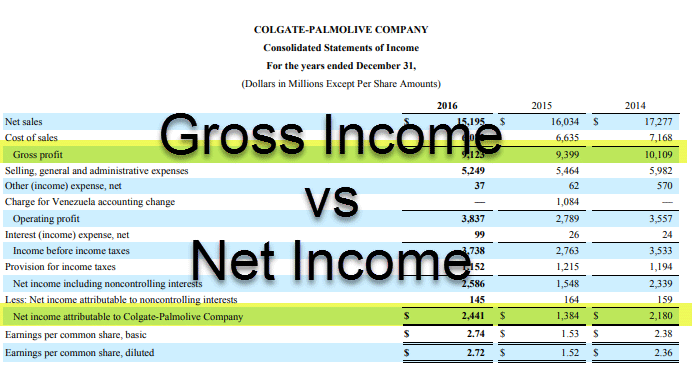

What�s the Difference Between Gross vs. Net TheStreet From thestreet.com

What�s the Difference Between Gross vs. Net TheStreet From thestreet.com

The method for calculating gross wages largely depends on how the employee is paid. Gross pay and net pay aren’t the same. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted.

So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000.

Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Gross pay and net pay aren’t the same. What is the difference between gross and net pay?

Source: economicshelp.org

Source: economicshelp.org

What is the difference between gross and net pay? The method for calculating gross wages largely depends on how the employee is paid. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference. Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions.

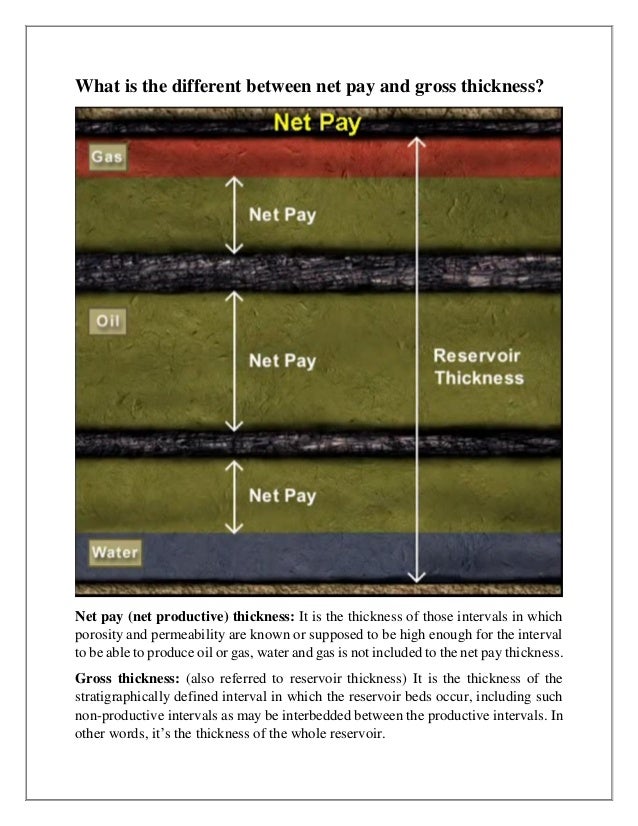

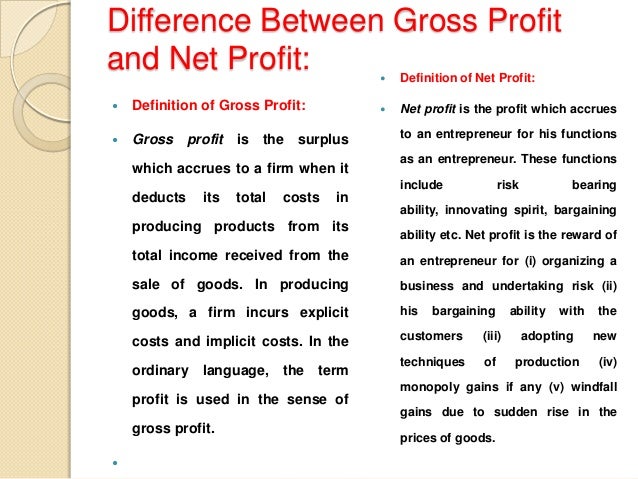

Source: slideshare.net

Source: slideshare.net

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. What is the difference between gross and net pay?

Source: fingercheck.com

Source: fingercheck.com

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. What is the difference between gross and net pay? Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference.

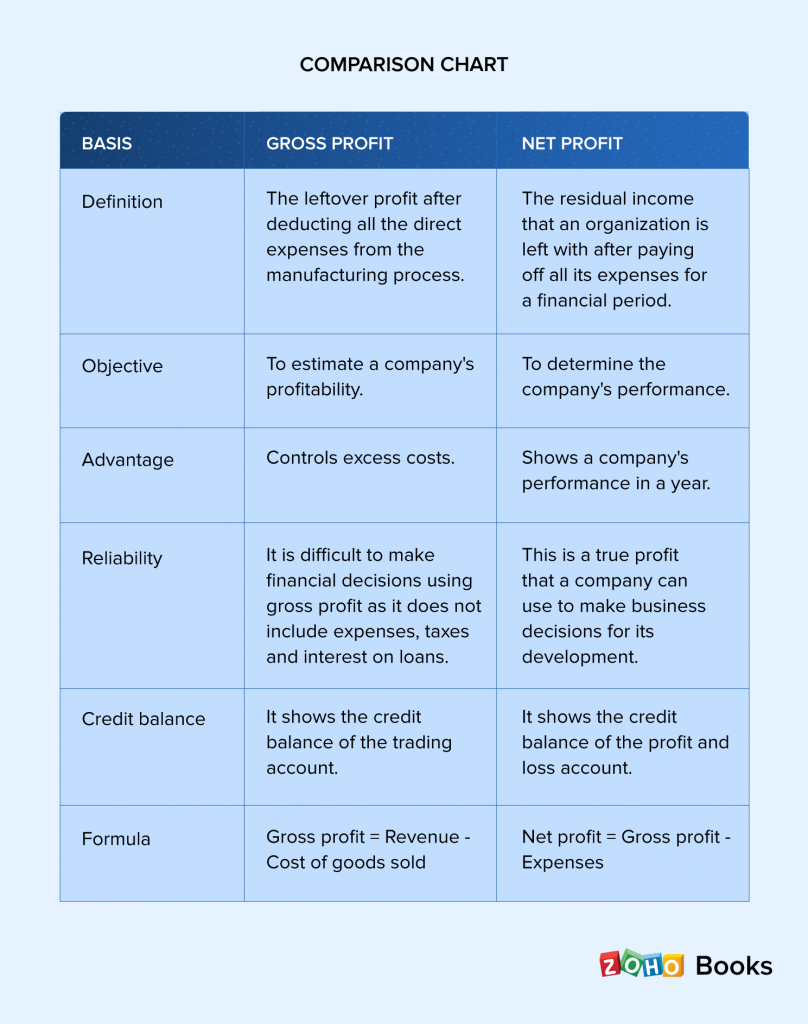

Source: zoho.com

Source: zoho.com

For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). The method for calculating gross wages largely depends on how the employee is paid. Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but.

Source: gusto.com

Source: gusto.com

Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference. So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. What is the difference between gross and net pay?

Source: care.com

Source: care.com

Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). Gross pay and net pay aren’t the same. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but.

2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. What is the difference between gross and net pay?

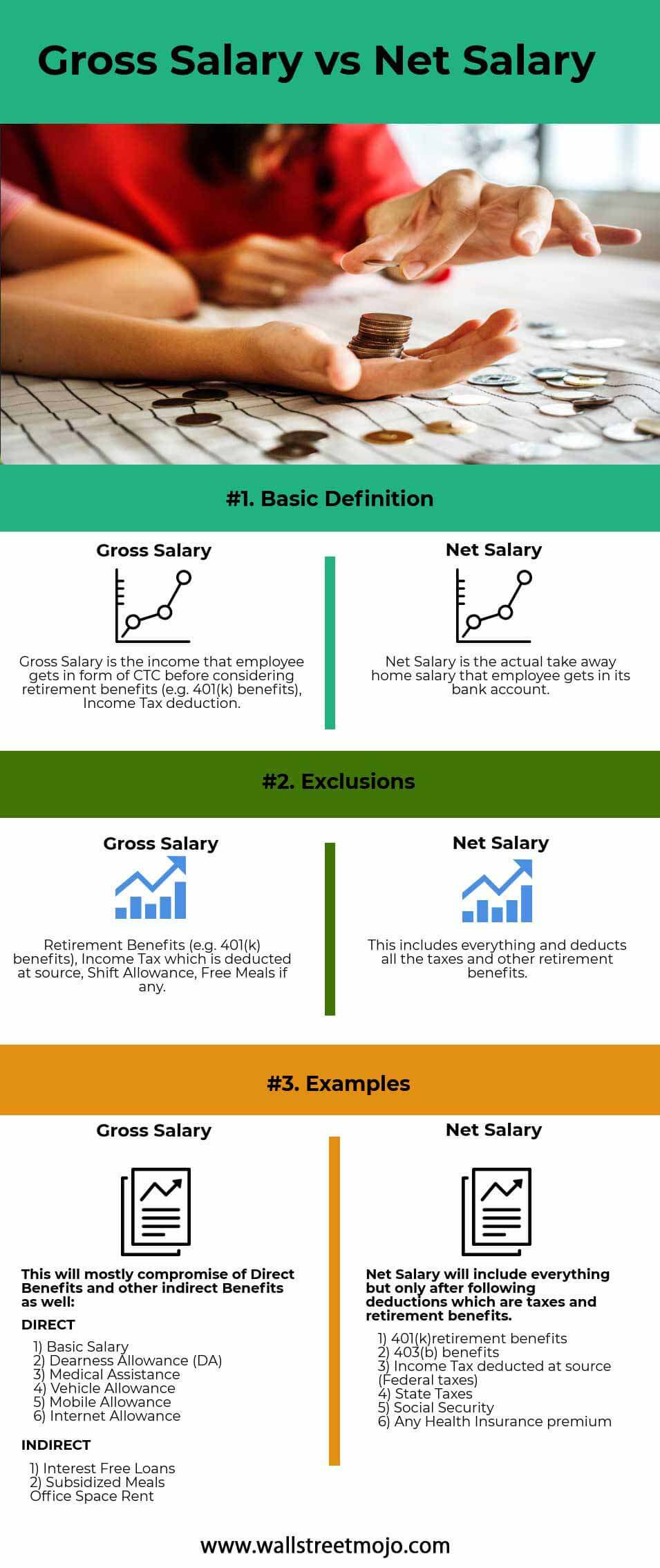

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. What is the difference between gross and net pay? Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference. Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions.

Source: educba.com

Source: educba.com

Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference. Gross pay and net pay aren’t the same. What is the difference between gross and net pay? Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below).

Source: slideshare.net

Source: slideshare.net

Gross pay and net pay aren’t the same. So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions.

Source: 7esl.com

Source: 7esl.com

Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. The method for calculating gross wages largely depends on how the employee is paid.

Source: differencebetween.net

Source: differencebetween.net

For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization.

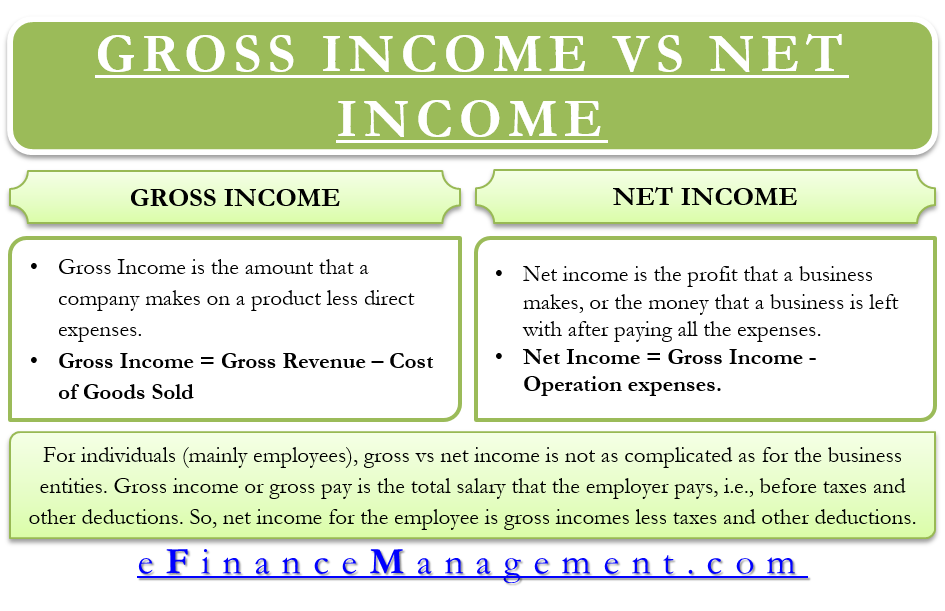

Source: efinancemanagement.com

Source: efinancemanagement.com

Whether an individual is trying to create an annual budget or a company is trying to determine how much to deduct from a paycheck, it can be important for companies and employees to understand the difference. Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions.

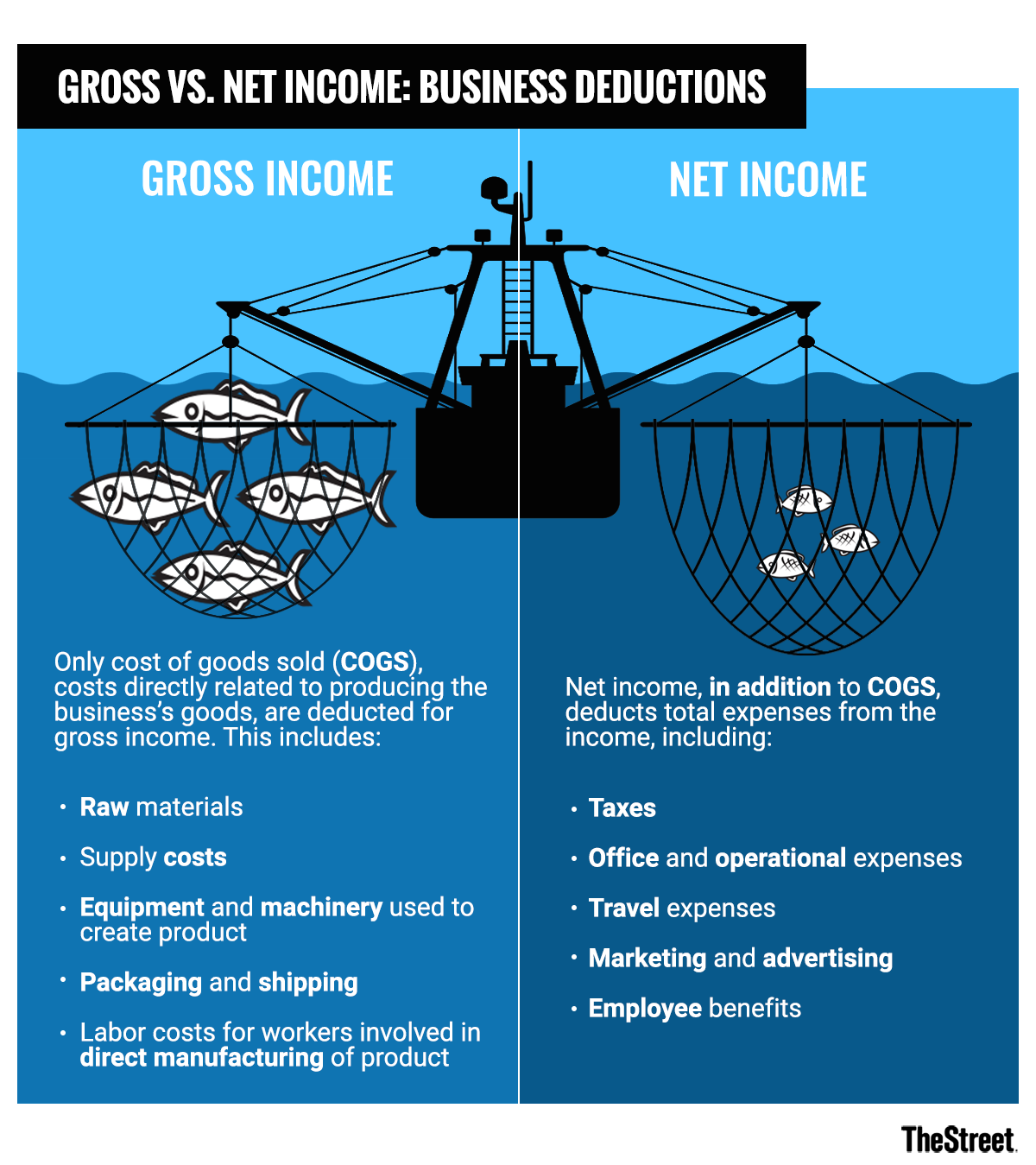

Source: thestreet.com

Source: thestreet.com

Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. Gross pay and net pay aren’t the same. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below).

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Gross pay and net pay aren’t the same.

Source: lakoeps.blogspot.com

Source: lakoeps.blogspot.com

Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. What is the difference between gross and net pay? 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization.

Source: 7esl.com

Source: 7esl.com

Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. Gross pay and net pay aren’t the same. 2 to determine net pay, gross pay is computed based on how an employee is classified by the organization. Gross pay and net pay are two important terms to understand when determining payment calculations and making important financial decisions. What is the difference between gross and net pay?

Source: patriotsoftware.com

Source: patriotsoftware.com

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Simply put, gross pay refers to the amount of money your employees receive before any deductions have been subtracted. Deductions are usually made for income tax, and might also include contributions for health insurance or potential student loans or retirement funds, depending on your employee’s place of residence. What is the difference between gross and net pay?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the difference between gross and net pay by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.