Your Retirement 8 times annual salary images are ready. Retirement 8 times annual salary are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement 8 times annual salary files here. Download all free photos and vectors.

If you’re searching for retirement 8 times annual salary pictures information connected with to the retirement 8 times annual salary interest, you have come to the ideal blog. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Retirement 8 Times Annual Salary. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Even after retirement, there are. Eight times your salary by age 60 and.

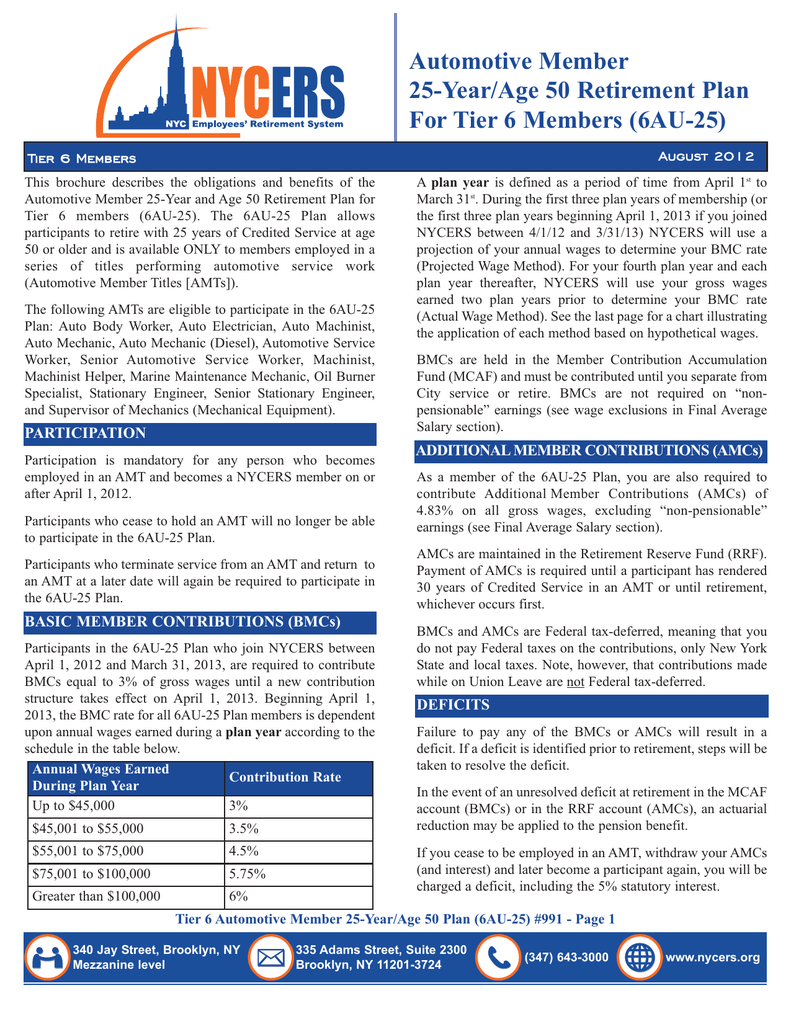

Seattle to change city employee retirement plan in 2017 The Seattle Times From seattletimes.com

Seattle to change city employee retirement plan in 2017 The Seattle Times From seattletimes.com

10 times your salary by age 67. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Its rules are based on. By the time you turn 67, you should have 10 times your annual salary in retirement savings.

This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary.

Eight times your salary by age 60 and. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Eight times your salary by age 60 and. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. 10 times your salary by age 67. Even after retirement, there are.

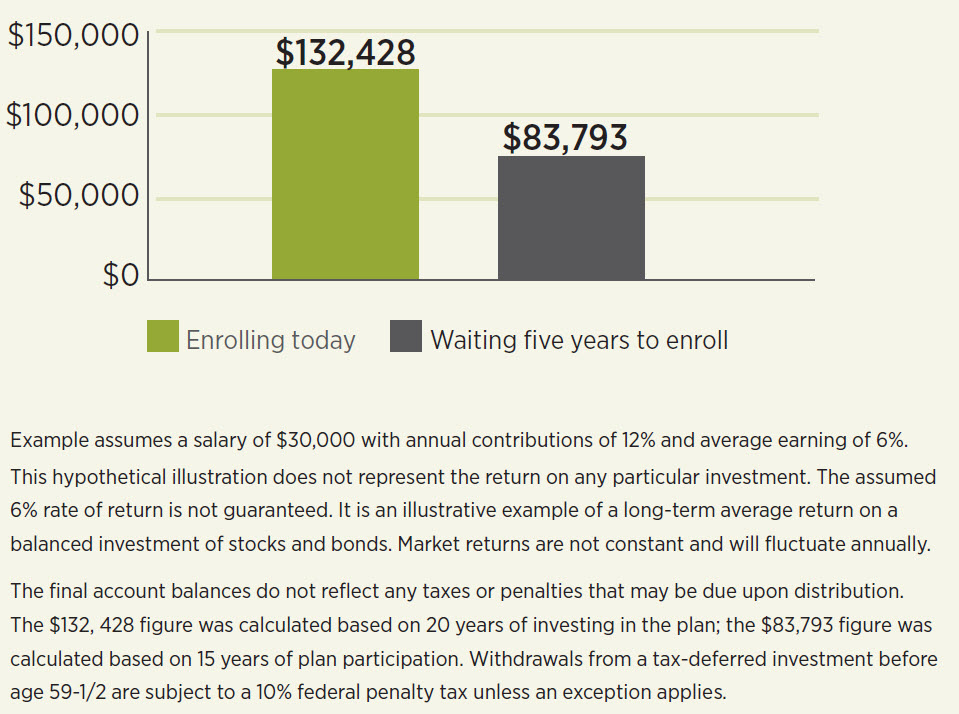

Source: 401ktv.com

Source: 401ktv.com

This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. 10 times your salary by age 67.

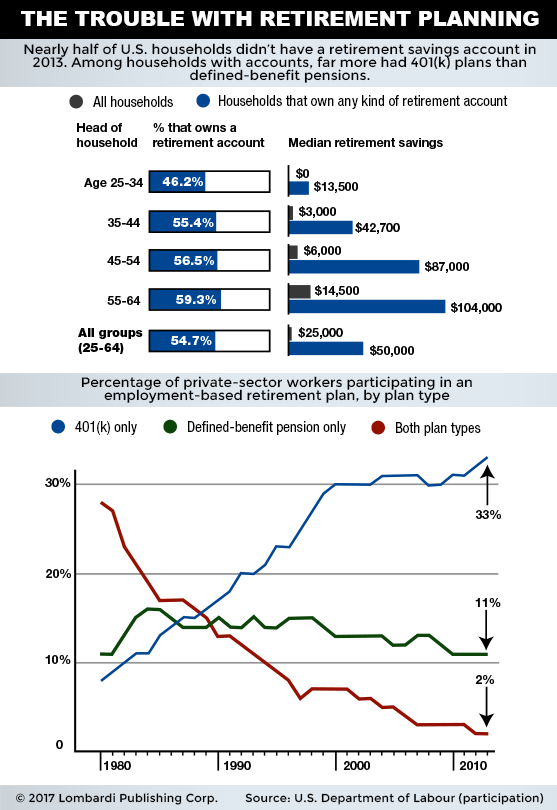

Source: lombardiletter.com

Source: lombardiletter.com

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Even after retirement, there are. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. 10 times your salary by age 67.

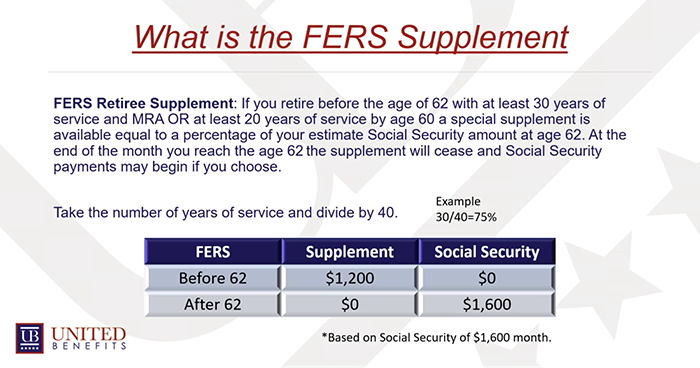

Source: plan-your-federal-retirement.com

Source: plan-your-federal-retirement.com

10 times your salary by age 67. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Its rules are based on.

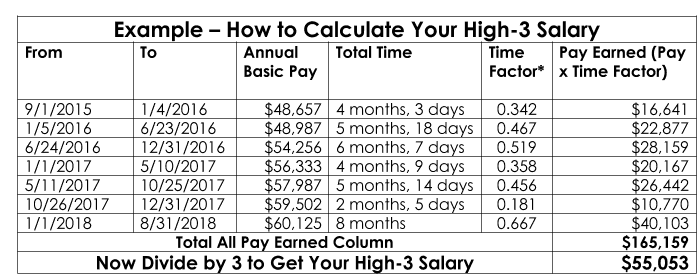

Source: borgwarner.com

Source: borgwarner.com

By the time you turn 67, you should have 10 times your annual salary in retirement savings. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement. Even after retirement, there are. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the.

Source: empirecenter.org

Source: empirecenter.org

Eight times your salary by age 60 and. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement.

Source: quora.com

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. 10 times your salary by age 67. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Eight times your salary by age 60 and.

Source: drugchannels.net

Source: drugchannels.net

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary.

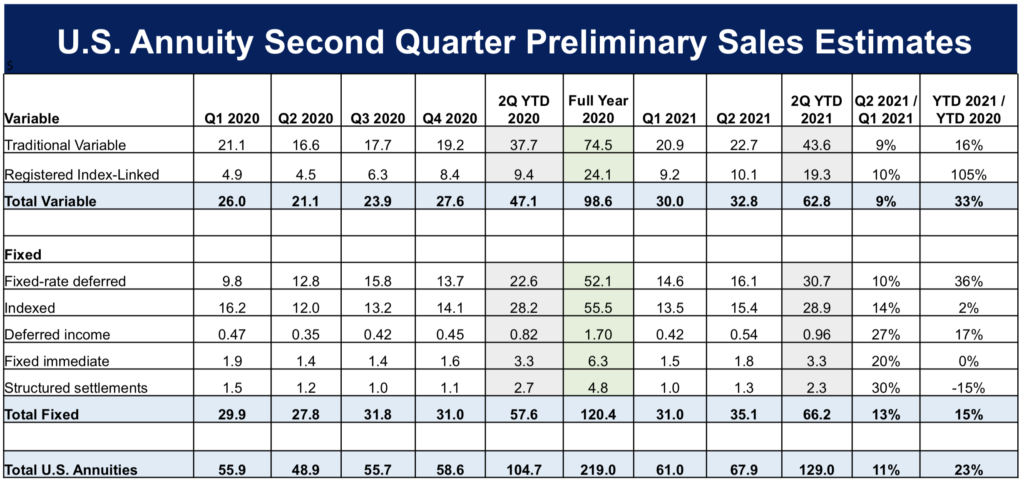

Source: retirementincomejournal.com

Source: retirementincomejournal.com

This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Its rules are based on. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the.

Source: seattletimes.com

Source: seattletimes.com

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. 10 times your salary by age 67. Its rules are based on. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the.

Source: speea.org

Source: speea.org

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Even after retirement, there are.

Source: twocents.lifehacker.com

Source: twocents.lifehacker.com

This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Its rules are based on. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the.

Source: cbc.ca

Source: cbc.ca

Eight times your salary by age 60 and. Even after retirement, there are. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Its rules are based on. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary.

By the time you turn 67, you should have 10 times your annual salary in retirement savings. Eight times your salary by age 60 and. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary.

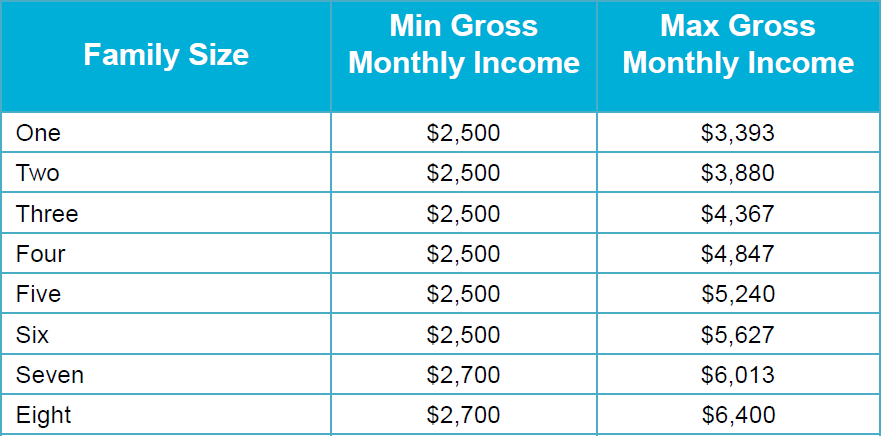

Source: iamexpat.nl

Source: iamexpat.nl

Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Its rules are based on. 10 times your salary by age 67. Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement.

![Average, Median, Top 1 Individual Percentiles [2019] DQYDJ Average, Median, Top 1 Individual Percentiles [2019] DQYDJ](http://cdn.dqydj.com/wp-content/uploads/2019/10/individual_income_percentile_usa_2018_2019-1024x682.png) Source: dqydj.com

Source: dqydj.com

Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement. This means that, on average, most members have a shortfall at retirement of over 8 times their annual pensionable salary. Even after retirement, there are. Its rules are based on. Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement.

Source: forbes.com

Source: forbes.com

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the. Even after retirement, there are. 10 times your salary by age 67. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the.

Source: habitatorlandoosceola.org

Source: habitatorlandoosceola.org

Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. Fidelity assumes you’ll want your standard of living to continue basically unchanged in retirement. By the time you turn 67, you should have 10 times your annual salary in retirement savings. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the. 10 times your salary by age 67.

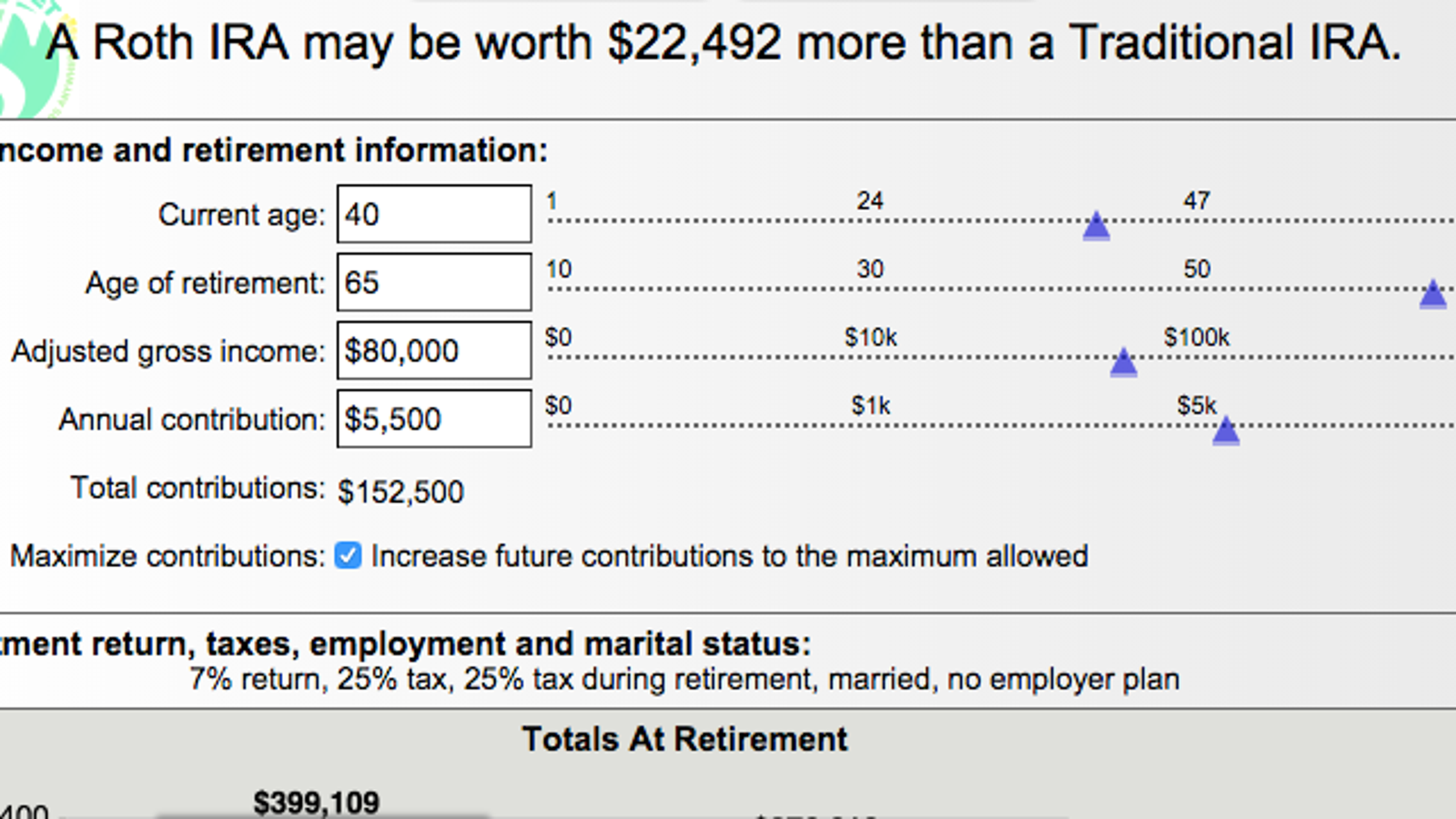

Source: merrilledge.com

Source: merrilledge.com

Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Its rules are based on. Even after retirement, there are. Simply put, they need over 12 times their annual pensionable salary to achieve a replacement ratio of 75% at retirement, but at age 65 the actual average fund credit is only 3.7. Fidelity investments recommends saving for retirement according to age and salary, with a goal of having 8 times your ending salary by the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement 8 times annual salary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.