Your Retirement 15 of gross or net images are available in this site. Retirement 15 of gross or net are a topic that is being searched for and liked by netizens today. You can Download the Retirement 15 of gross or net files here. Download all royalty-free photos.

If you’re looking for retirement 15 of gross or net images information linked to the retirement 15 of gross or net topic, you have visit the ideal site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

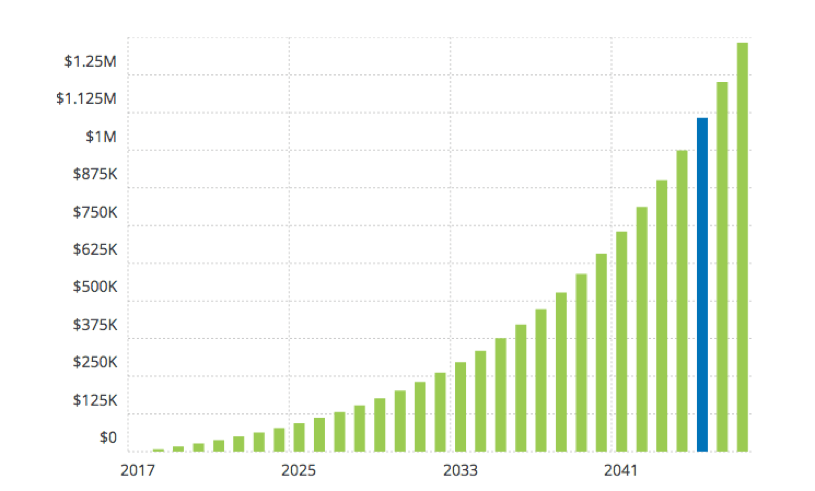

Retirement 15 Of Gross Or Net. Dave ramsey suggests investing 15% of your gross household income. With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with. That means invest 15% of your income before paying taxes. You should notice two things:

GRAPHIC From sec.gov

GRAPHIC From sec.gov

What kind of difference does this. 15% of that is $7,500. Dave ramsey suggests investing 15% of your gross household income. That means invest 15% of your income before paying taxes. And 15% of $35,000 is $5,250. You should notice two things:

With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with.

With the traditional ira, you pay taxes when. And 15% of $35,000 is $5,250. With the traditional ira, you pay taxes when. What kind of difference does this. That means invest 15% of your income before paying taxes. 15% of that is $7,500.

Source: warriortrading.com

Source: warriortrading.com

We know it’s not trendy. That means invest 15% of your income before paying taxes. And 15% of $35,000 is $5,250. We know it’s not trendy. (with the roth ira, you pay taxes right now and not when you take it out.

Source: financialsamurai.com

Source: financialsamurai.com

Let’s say you have an income of $50,000. Socking away 15% of your earnings per year over time will put you in a pretty good position to not only enjoy retirement, but cover the unexpected. First, the 15% is calculated from your annual gross salary You should notice two things: It won’t make headlines or get you on the cover of a magazine.

Let’s say you have an income of $50,000. Let’s say you have an income of $50,000. It won’t make headlines or get you on the cover of a magazine. But there’s an easy approach you can use, and it’s a good rule of thumb. (with the roth ira, you pay taxes right now and not when you take it out.

Source: researchgate.net

Source: researchgate.net

15% of that is $7,500. (with the roth ira, you pay taxes right now and not when you take it out. It won’t make headlines or get you on the cover of a magazine. What kind of difference does this. But there’s an easy approach you can use, and it’s a good rule of thumb.

Source: sec.gov

Source: sec.gov

Dave ramsey suggests investing 15% of your gross household income. We know it’s not trendy. Dave ramsey suggests investing 15% of your gross household income. 15% of that is $7,500. That means invest 15% of your income before paying taxes.

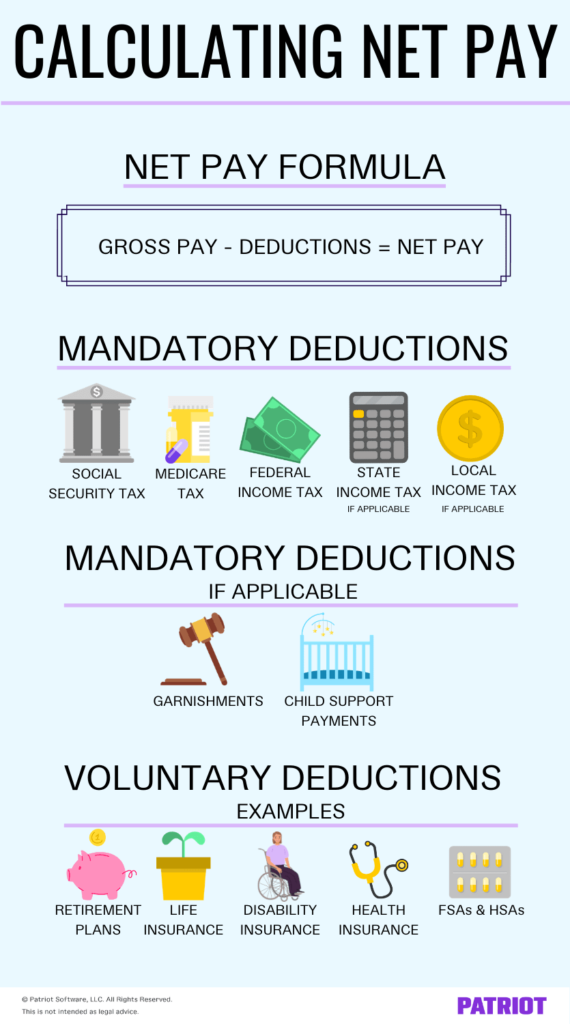

Source: patriotsoftware.com

Source: patriotsoftware.com

First, the 15% is calculated from your annual gross salary With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with. (with the roth ira, you pay taxes right now and not when you take it out. With the traditional ira, you pay taxes when. And 15% of $35,000 is $5,250.

Source: researchgate.net

Source: researchgate.net

With the traditional ira, you pay taxes when. (with the roth ira, you pay taxes right now and not when you take it out. Dave ramsey suggests investing 15% of your gross household income. Let’s say you have an income of $50,000. That means invest 15% of your income before paying taxes.

Source: medscape.com

Source: medscape.com

What kind of difference does this. 15% of that is $7,500. With the traditional ira, you pay taxes when. (with the roth ira, you pay taxes right now and not when you take it out. Dave ramsey suggests investing 15% of your gross household income.

With the traditional ira, you pay taxes when. We know it’s not trendy. 15% of that is $7,500. With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with. That means invest 15% of your income before paying taxes.

Source: investorpolis.com

Source: investorpolis.com

Dave ramsey suggests investing 15% of your gross household income. Dave ramsey suggests investing 15% of your gross household income. But there’s an easy approach you can use, and it’s a good rule of thumb. (with the roth ira, you pay taxes right now and not when you take it out. That means invest 15% of your income before paying taxes.

Source: sec.gov

Source: sec.gov

And 15% of $35,000 is $5,250. That means invest 15% of your income before paying taxes. (with the roth ira, you pay taxes right now and not when you take it out. Dave ramsey suggests investing 15% of your gross household income. But there’s an easy approach you can use, and it’s a good rule of thumb.

![[Solved] WCC Corp. has a 100,000 net operating loss carryover into [Solved] WCC Corp. has a 100,000 net operating loss carryover into](https://earlyretirement.netlify.app/img/placeholder.svg)

You should notice two things: With the traditional ira, you pay taxes when. 15% of that is $7,500. And 15% of $35,000 is $5,250. We know it’s not trendy.

Source: researchgate.net

Source: researchgate.net

(with the roth ira, you pay taxes right now and not when you take it out. First, the 15% is calculated from your annual gross salary Dave ramsey suggests investing 15% of your gross household income. But there’s an easy approach you can use, and it’s a good rule of thumb. With the traditional ira, you pay taxes when.

Source: sec.gov

Source: sec.gov

What kind of difference does this. With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with. (with the roth ira, you pay taxes right now and not when you take it out. And 15% of $35,000 is $5,250. What kind of difference does this.

Source: ramseysolutions.com

Source: ramseysolutions.com

First, the 15% is calculated from your annual gross salary (with the roth ira, you pay taxes right now and not when you take it out. But there’s an easy approach you can use, and it’s a good rule of thumb. With the traditional ira, you pay taxes when. And 15% of $35,000 is $5,250.

Source: gusto.com

Source: gusto.com

What kind of difference does this. Let’s say you have an income of $50,000. With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with. First, the 15% is calculated from your annual gross salary With the traditional ira, you pay taxes when.

Source: pinterest.com

Source: pinterest.com

We know it’s not trendy. 15% of that is $7,500. What kind of difference does this. With the traditional ira, you pay taxes when. Dave ramsey suggests investing 15% of your gross household income.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Let’s say you have an income of $50,000. Dave ramsey suggests investing 15% of your gross household income. With a 4% rate of return, you need to earn $155,086 per year and save $1,938.57 per month (exceeds the $19,000 annual limit on 401 (k) contributions) with. We know it’s not trendy. That means invest 15% of your income before paying taxes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement 15 of gross or net by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.