Your Retirement 72 rule images are available. Retirement 72 rule are a topic that is being searched for and liked by netizens now. You can Download the Retirement 72 rule files here. Download all free images.

If you’re searching for retirement 72 rule pictures information connected with to the retirement 72 rule topic, you have visit the right site. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Retirement 72 Rule. Well, it will take 8 years for the $1 to turn into $2. Rule 72 (t) understanding rule 72 (t). For example, you invest $1 and are enjoying a 9% rate of return. Rule 72 (t) actually refers to code 72 (t), section 2, which specifies exceptions to the.

Use the Real Rule of 72 to Reach FIRE More Money Tips Rule of 72 From pinterest.com

Use the Real Rule of 72 to Reach FIRE More Money Tips Rule of 72 From pinterest.com

Then divide it by your rate of return. For example, you invest $1 and are enjoying a 9% rate of return. Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow: • you must schedule annual payments, at a minimum. You can schedule several sepp installments a year, if you like, but. Interest has existed since ancient times in mathematical and economic studies.

Rule 72 (t) actually refers to code 72 (t), section 2, which specifies exceptions to the.

Calculation for payment amounts under rule 72 (t). In fact, it appears to date as far back as the mesopotamian, roman and greek civilizations. Interest has existed since ancient times in mathematical and economic studies. • you must pay income taxes on money that’s never been taxed. Rule 72 (t) understanding rule 72 (t). Rule 72 (t) actually refers to code 72 (t), section 2, which specifies exceptions to the.

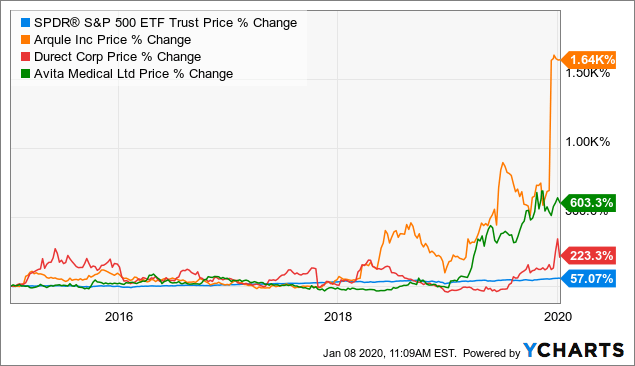

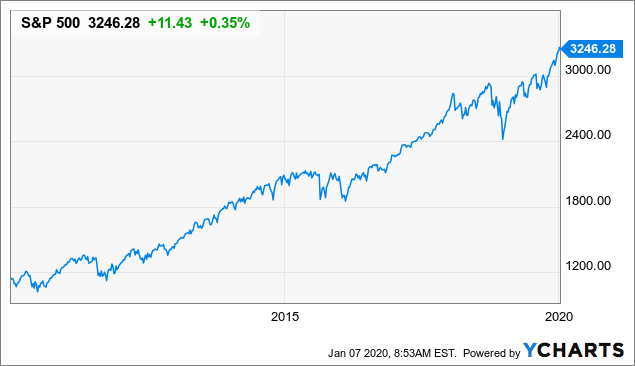

Source: seekingalpha.com

Source: seekingalpha.com

• you must pay income taxes on money that’s never been taxed. • you must pay income taxes on money that’s never been taxed. Rule 72 (t) understanding rule 72 (t). Cautions about using rule 72 (t). Well, it will take 8 years for the $1 to turn into $2.

Source: militarydollar.com

Source: militarydollar.com

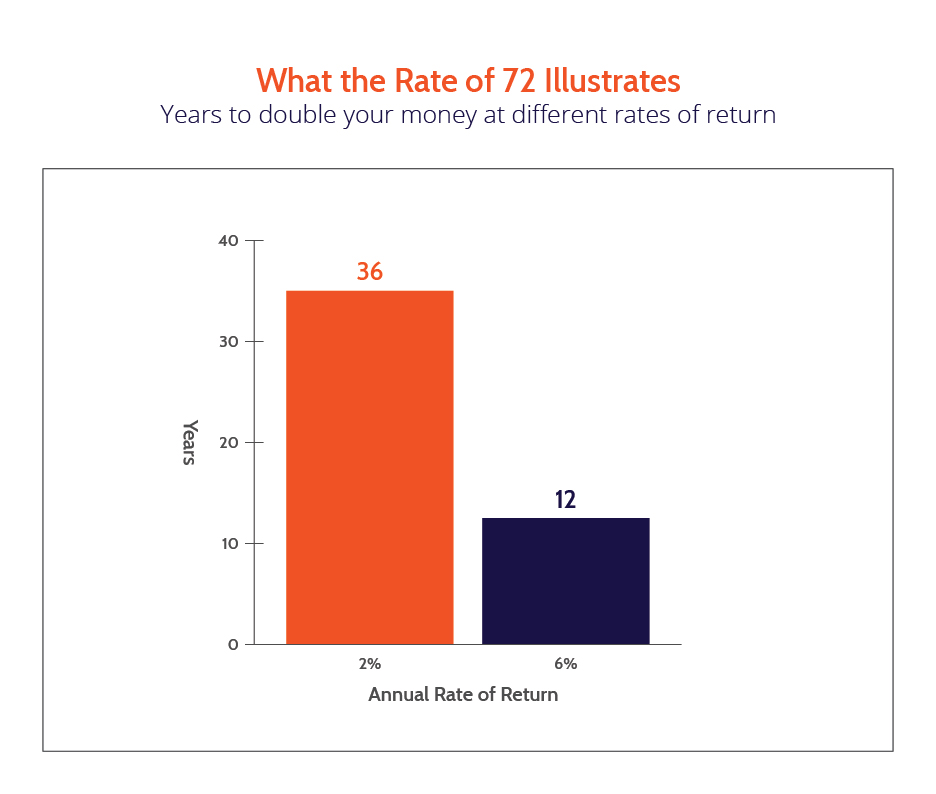

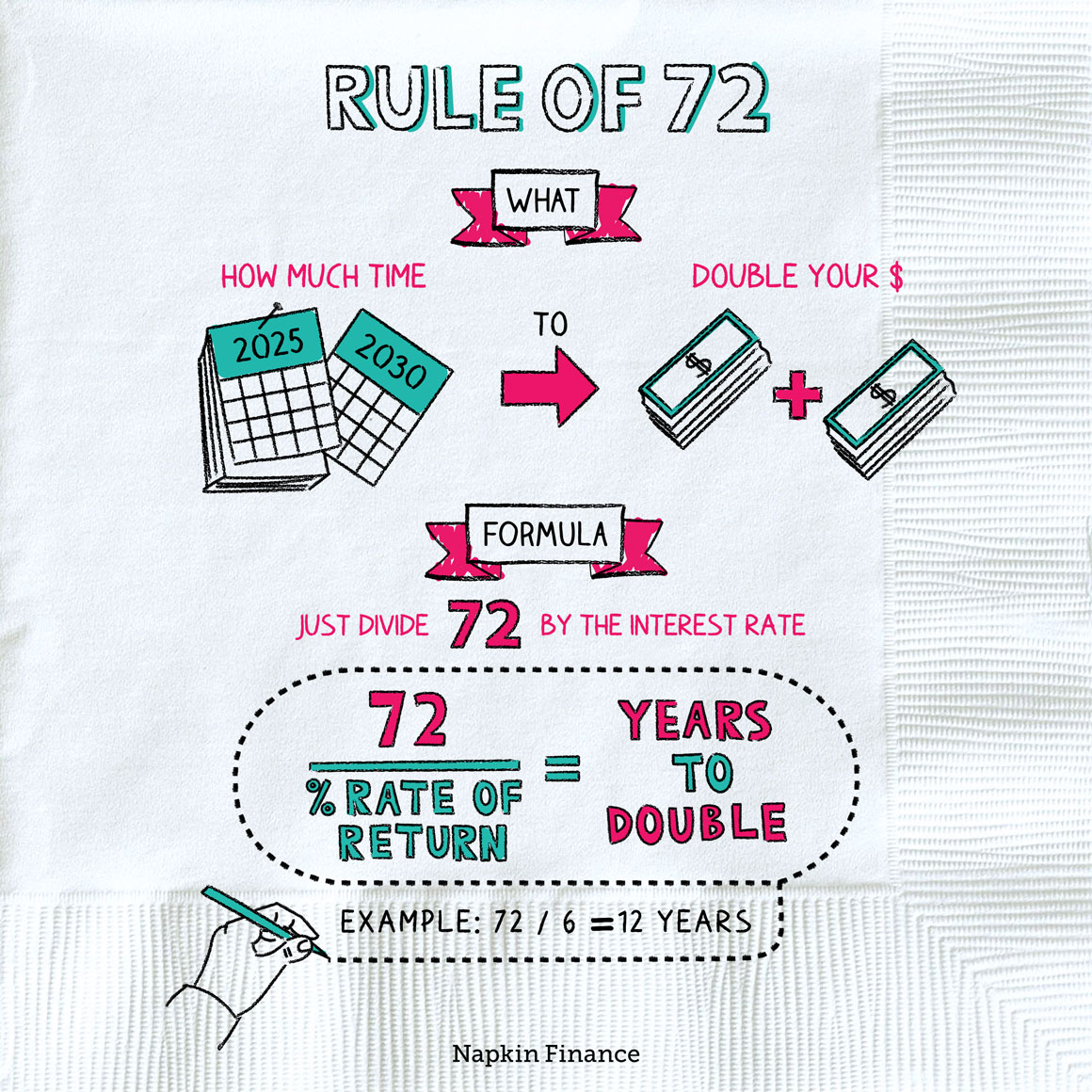

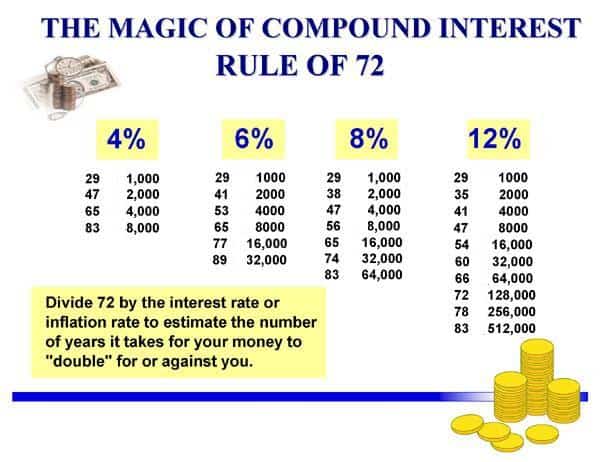

The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. You can schedule several sepp installments a year, if you like, but. Although you’ll also want to use a more. For example, you invest $1 and are enjoying a 9% rate of return.

Source: pinterest.com

Source: pinterest.com

The rule states that you divide the rate, expressed as a. Technically it will take 8.04 years. • you must pay income taxes on money that’s never been taxed. For example, you invest $1 and are enjoying a 9% rate of return. Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow:

Source: alex.fyi

Source: alex.fyi

Well, it will take 8 years for the $1 to turn into $2. Rule 72 (t) understanding rule 72 (t). The amortization method determines yearly payment amounts by. Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow: Rule 72 (t) actually refers to code 72 (t), section 2, which specifies exceptions to the.

Source: militarydollar.com

Source: militarydollar.com

Then divide it by your rate of return. You can schedule several sepp installments a year, if you like, but. Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow: Rule 72 (t) understanding rule 72 (t). For example, you invest $1 and are enjoying a 9% rate of return.

Source: pinterest.com

Source: pinterest.com

Although you’ll also want to use a more. Technically it will take 8.04 years. You can schedule several sepp installments a year, if you like, but. In fact, it appears to date as far back as the mesopotamian, roman and greek civilizations. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return.

Source: pinterest.com

Source: pinterest.com

• you must schedule annual payments, at a minimum. Technically it will take 8.04 years. Calculation for payment amounts under rule 72 (t). Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow: For example, you invest $1 and are enjoying a 9% rate of return.

Source: somethingonmymind.net

Source: somethingonmymind.net

Rule 72 (t) actually refers to code 72 (t), section 2, which specifies exceptions to the. Well, it will take 8 years for the $1 to turn into $2. This will then get you close to how long it will be before your investment has doubled in value. The rule states that you divide the rate, expressed as a. Cautions about using rule 72 (t).

Source: pinterest.com

Source: pinterest.com

The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. Interest has existed since ancient times in mathematical and economic studies. Then divide it by your rate of return. Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow: For example, you invest $1 and are enjoying a 9% rate of return.

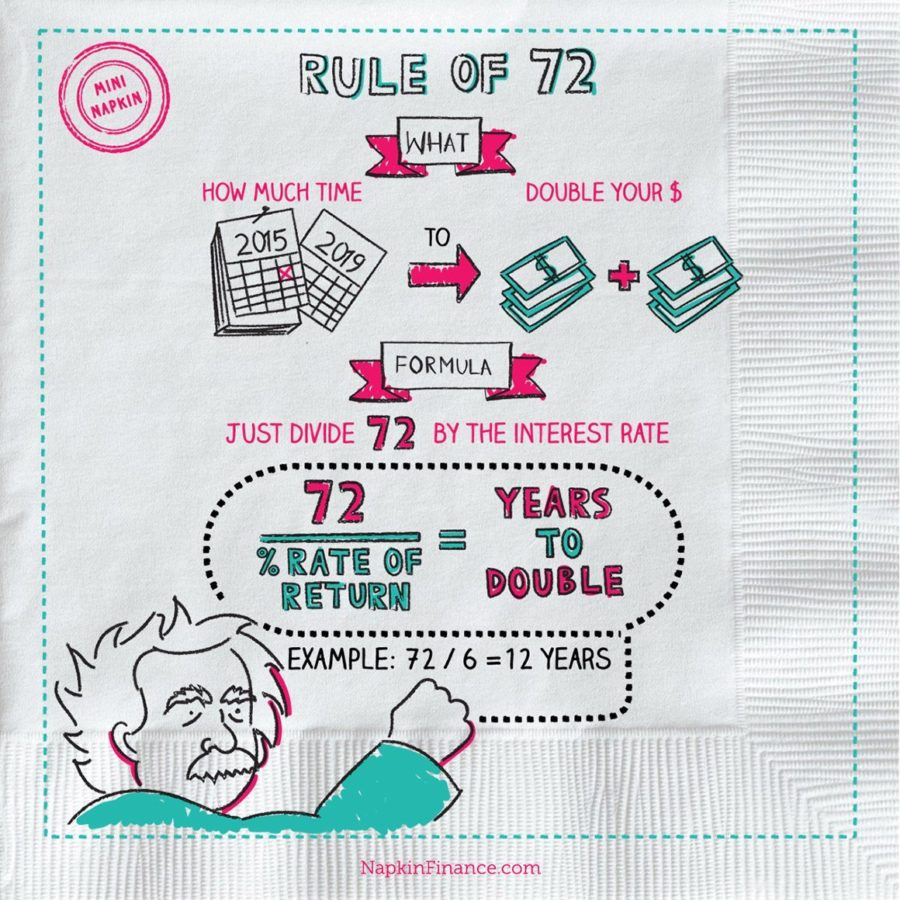

Source: napkinfinance.com

Source: napkinfinance.com

Well, it will take 8 years for the $1 to turn into $2. The amortization method determines yearly payment amounts by. Calculation for payment amounts under rule 72 (t). Then divide it by your rate of return. Rule 72 (t) understanding rule 72 (t).

Source: pinterest.com

Source: pinterest.com

Technically it will take 8.04 years. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow: In fact, it appears to date as far back as the mesopotamian, roman and greek civilizations. The amortization method determines yearly payment amounts by.

Source: drbreatheeasyfinance.com

Source: drbreatheeasyfinance.com

You can schedule several sepp installments a year, if you like, but. Technically it will take 8.04 years. This will then get you close to how long it will be before your investment has doubled in value. Rule 72 (t) actually refers to code 72 (t), section 2, which specifies exceptions to the. Although you’ll also want to use a more.

Source: seekingalpha.com

Source: seekingalpha.com

The amortization method determines yearly payment amounts by. Interest has existed since ancient times in mathematical and economic studies. Although you’ll also want to use a more. Calculation for payment amounts under rule 72 (t). Using rule 72 (t) to set up a schedule of sepps is not a simple process, and there are a number of rules to follow:

Source: napkinfinance.com

Source: napkinfinance.com

The amortization method determines yearly payment amounts by. • you must schedule annual payments, at a minimum. Interest has existed since ancient times in mathematical and economic studies. For example, you invest $1 and are enjoying a 9% rate of return. In fact, it appears to date as far back as the mesopotamian, roman and greek civilizations.

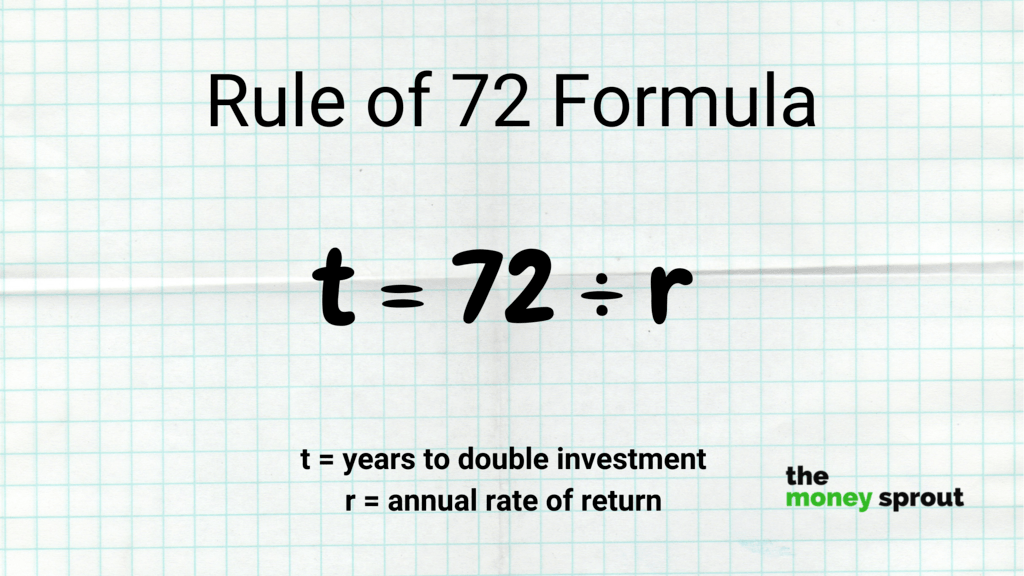

Source: themoneysprout.com

Source: themoneysprout.com

• you must schedule annual payments, at a minimum. Then divide it by your rate of return. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. Although you’ll also want to use a more. • you must pay income taxes on money that’s never been taxed.

Source: pinterest.com

Source: pinterest.com

• you must schedule annual payments, at a minimum. Then divide it by your rate of return. This will then get you close to how long it will be before your investment has doubled in value. The rule states that you divide the rate, expressed as a. You can schedule several sepp installments a year, if you like, but.

Source: fin-telli.blogspot.com

Source: fin-telli.blogspot.com

Calculation for payment amounts under rule 72 (t). Technically it will take 8.04 years. Well, it will take 8 years for the $1 to turn into $2. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. Calculation for payment amounts under rule 72 (t).

Source: pinterest.com

Source: pinterest.com

This will then get you close to how long it will be before your investment has doubled in value. Calculation for payment amounts under rule 72 (t). Well, it will take 8 years for the $1 to turn into $2. • you must schedule annual payments, at a minimum. You can schedule several sepp installments a year, if you like, but.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement 72 rule by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.