Your Private retirement scheme images are available. Private retirement scheme are a topic that is being searched for and liked by netizens today. You can Download the Private retirement scheme files here. Download all royalty-free images.

If you’re looking for private retirement scheme images information connected with to the private retirement scheme keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

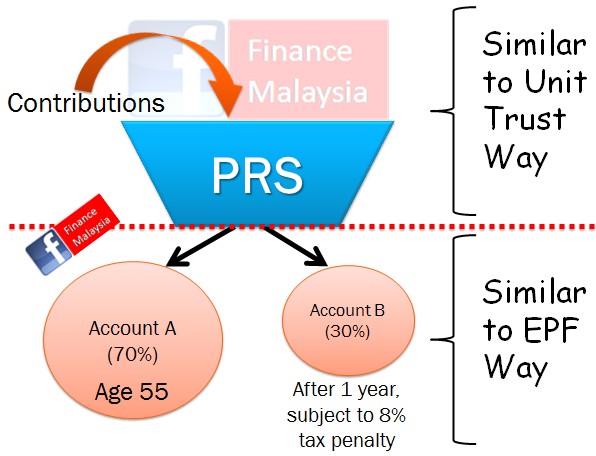

Private Retirement Scheme. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). Prs is a voluntary investment scheme to help you save for retirement. The private pension administrator malaysia (ppa) serves as the central administrator of prs. Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs.

Peminat Produk Halalan Toyyibah Private Retirement Scheme (PRS) From produkhalalantoyyibah.blogspot.com

Peminat Produk Halalan Toyyibah Private Retirement Scheme (PRS) From produkhalalantoyyibah.blogspot.com

What is a private retirement scheme (prs)? The private pension administrator malaysia (ppa) serves as the central administrator of prs. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. Each prs offers a choice.

The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). The private pension administrator malaysia (ppa) serves as the central administrator of prs. Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). What is a private retirement scheme (prs)?

Source: frankleewealthcreation.com

Source: frankleewealthcreation.com

Prs is a voluntary investment scheme to help you save for retirement. Each prs offers a choice. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). What is a private retirement scheme (prs)? What is the private retirement scheme (prs)?

Source: dividendmagic.com.my

Source: dividendmagic.com.my

Each prs offers a choice. Each prs offers a choice. Prs is a voluntary investment scheme to help you save for retirement. The private pension administrator malaysia (ppa) serves as the central administrator of prs. What is a private retirement scheme (prs)?

Source: cimbpreferred.com.my

Source: cimbpreferred.com.my

Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). The private pension administrator malaysia (ppa) serves as the central administrator of prs. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). Prs is a voluntary investment scheme to help you save for retirement. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of.

Source: invest-made-easy.blogspot.com

Source: invest-made-easy.blogspot.com

What is a private retirement scheme (prs)? This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. Each prs offers a choice. What is the private retirement scheme (prs)? The private pension administrator malaysia (ppa) serves as the central administrator of prs.

Source: themalaysianreserve.com

Source: themalaysianreserve.com

What is the private retirement scheme (prs)? Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. What is a private retirement scheme (prs)? Each prs offers a choice. The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

Source: produkhalalantoyyibah.blogspot.com

Source: produkhalalantoyyibah.blogspot.com

This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. Each prs offers a choice. The private pension administrator malaysia (ppa) serves as the central administrator of prs.

Source: fundsupermart.com.my

Source: fundsupermart.com.my

The private pension administrator malaysia (ppa) serves as the central administrator of prs. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). Prs is a voluntary investment scheme to help you save for retirement. The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of.

Source: pencenswasta-prs-terbaik.blogspot.com

Source: pencenswasta-prs-terbaik.blogspot.com

Prs is a voluntary investment scheme to help you save for retirement. What is the private retirement scheme (prs)? Prs is a voluntary investment scheme to help you save for retirement. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.).

Source: ringgitplus.com

Source: ringgitplus.com

What is the private retirement scheme (prs)? The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. What is the private retirement scheme (prs)? This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of.

Source: chiewkeong.blogspot.com

Source: chiewkeong.blogspot.com

The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). What is the private retirement scheme (prs)? The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. What is a private retirement scheme (prs)?

Source: mrjocko.com

Source: mrjocko.com

This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). What is the private retirement scheme (prs)? Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. The private pension administrator malaysia (ppa) serves as the central administrator of prs.

Source: imoney.my

Source: imoney.my

The private pension administrator malaysia (ppa) serves as the central administrator of prs. Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. Prs is a voluntary investment scheme to help you save for retirement. What is a private retirement scheme (prs)? Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.).

Source: cimb.com.my

Source: cimb.com.my

The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. What is the private retirement scheme (prs)? Prs is a voluntary investment scheme to help you save for retirement. The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. Each prs offers a choice.

Source: adibyazid.com

Source: adibyazid.com

The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. The private pension administrator malaysia (ppa) serves as the central administrator of prs. Each prs offers a choice. Prs is a voluntary investment scheme to help you save for retirement.

Source: financemalaysia.blogspot.com

Source: financemalaysia.blogspot.com

What is a private retirement scheme (prs)? The private pension administrator malaysia (ppa) serves as the central administrator of prs. Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. What is a private retirement scheme (prs)? Each prs offers a choice.

Source: arnmandosan.blogspot.com

Source: arnmandosan.blogspot.com

Prs is a voluntary investment scheme to help you save for retirement. The private pension administrator malaysia (ppa) serves as the central administrator of prs. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. Prs is a voluntary investment scheme to help you save for retirement.

Source: aminvest.com

Source: aminvest.com

The private pension administrator malaysia (ppa) serves as the central administrator of prs. Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. This is especially useful for those who wish to grow their retirement fund and invest but aren’t savvy in the area of. The private pension administrator malaysia (ppa) serves as the central administrator of prs. What is a private retirement scheme (prs)?

Source: yongsheauling.blogspot.com

Source: yongsheauling.blogspot.com

What is the private retirement scheme (prs)? Established under the capital markets and services act (cmsa) 2007, prs is regulated and supervised by the securities commission malaysia (sc) to ensure robust regulation and supervision of the prs. Under the scheme, you can invest in approved unit trust funds that are managed by prs providers (public mutual, kenanga, etc.). The private pension administrator malaysia (ppa) serves as the central administrator of prs. The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title private retirement scheme by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.