Your Pre retirement preparation images are ready. Pre retirement preparation are a topic that is being searched for and liked by netizens today. You can Find and Download the Pre retirement preparation files here. Get all royalty-free images.

If you’re searching for pre retirement preparation pictures information connected with to the pre retirement preparation keyword, you have come to the right site. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

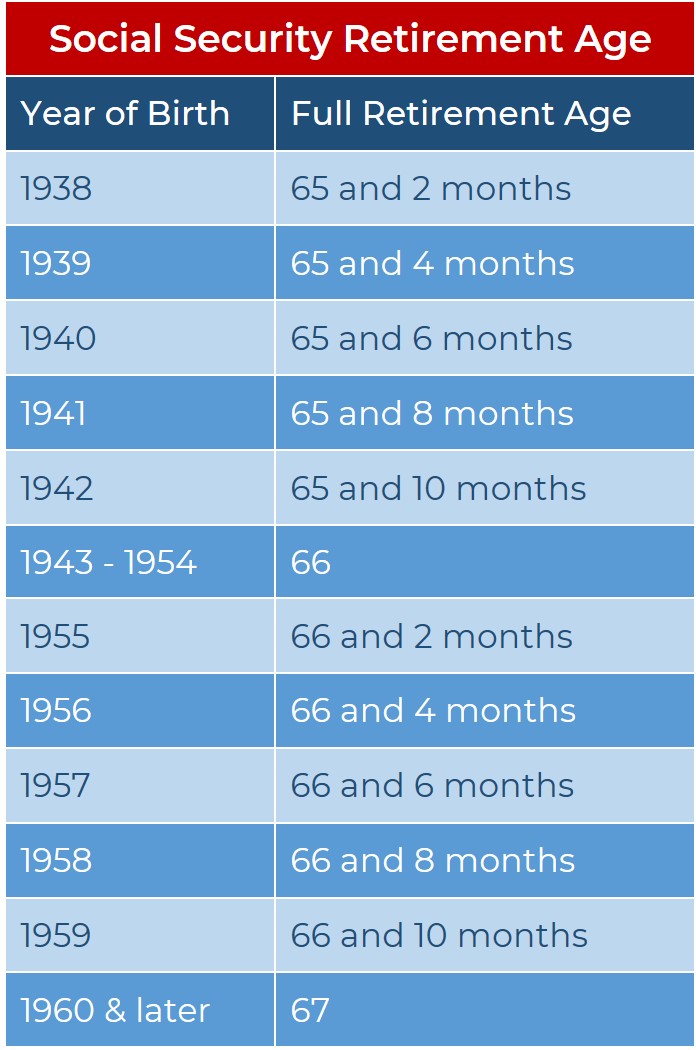

Pre Retirement Preparation. Preventative actions such as regular workout regimens, eating. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Estimate your social security income under various claiming strategies. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years.

Event helps with preretirement planning Tucson Business News From tucson.com

Event helps with preretirement planning Tucson Business News From tucson.com

Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. Estimate your social security income under various claiming strategies. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years. Preventative actions such as regular workout regimens, eating. It covers preparatory activities in financial, health, social life, and psychological domains (law et al.

It covers preparatory activities in financial, health, social life, and psychological domains (law et al.

2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. Develop a plan to eliminate 100% of your debt by retirement. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. 2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. Estimate your social security income under various claiming strategies.

Source: ameriprise.com

Source: ameriprise.com

Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Preventative actions such as regular workout regimens, eating. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures.

Source: blogs.kent.ac.uk

Source: blogs.kent.ac.uk

It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Estimate your social security income under various claiming strategies. Preventative actions such as regular workout regimens, eating. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Develop a plan to eliminate 100% of your debt by retirement.

Source: fortifiedretirement.com

Source: fortifiedretirement.com

2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. Estimate your social security income under various claiming strategies. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. It covers preparatory activities in financial, health, social life, and psychological domains (law et al.

Source: youtube.com

Source: youtube.com

Develop a plan to eliminate 100% of your debt by retirement. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. Develop a plan to eliminate 100% of your debt by retirement. 2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures.

Source: cebla-academy.com

Source: cebla-academy.com

Develop a plan to eliminate 100% of your debt by retirement. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Preventative actions such as regular workout regimens, eating. It covers preparatory activities in financial, health, social life, and psychological domains (law et al.

Source: youtube.com

Source: youtube.com

Estimate your social security income under various claiming strategies. Preventative actions such as regular workout regimens, eating. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures.

![Preretirement Planning [How I did it!] YouTube Preretirement Planning [How I did it!] YouTube](https://i.ytimg.com/vi/ooYq-IxbE74/maxresdefault.jpg) Source: youtube.com

Source: youtube.com

Develop a plan to eliminate 100% of your debt by retirement. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Develop a plan to eliminate 100% of your debt by retirement. Preventative actions such as regular workout regimens, eating. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures.

Source: jarrarcpa.com

Source: jarrarcpa.com

Preventative actions such as regular workout regimens, eating. Estimate your social security income under various claiming strategies. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. 2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. It covers preparatory activities in financial, health, social life, and psychological domains (law et al.

Source: onlineapply.homecredit.co.in

Source: onlineapply.homecredit.co.in

Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. 2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years. Estimate your social security income under various claiming strategies. Develop a plan to eliminate 100% of your debt by retirement.

Source: pai.ie

Source: pai.ie

Estimate your social security income under various claiming strategies. Develop a plan to eliminate 100% of your debt by retirement. Preventative actions such as regular workout regimens, eating. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after.

Source: retirementplanningideas.weebly.com

Source: retirementplanningideas.weebly.com

Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years. Develop a plan to eliminate 100% of your debt by retirement. Estimate your social security income under various claiming strategies.

Source: planprograms.com

Source: planprograms.com

2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or. Estimate your social security income under various claiming strategies. Develop a plan to eliminate 100% of your debt by retirement. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years.

Source: youtube.com

Source: youtube.com

Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Estimate your social security income under various claiming strategies. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after.

Source: richardsmortgagegroup.ca

Source: richardsmortgagegroup.ca

It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Estimate your social security income under various claiming strategies. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after.

Source: tucson.com

Source: tucson.com

Preventative actions such as regular workout regimens, eating. Develop a plan to eliminate 100% of your debt by retirement. Estimate your social security income under various claiming strategies. Preventative actions such as regular workout regimens, eating. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after.

Source: putknowledgetowork.org

Source: putknowledgetowork.org

Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Estimate your social security income under various claiming strategies. It covers preparatory activities in financial, health, social life, and psychological domains (law et al.

Source: falbowealth.com

Source: falbowealth.com

Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after. 2006).financial planning, which is the cornerstone of retirement planning, includes the estimation of living cost after retirement, saving or.

Source: pswealth.com

Source: pswealth.com

Develop a plan to eliminate 100% of your debt by retirement. Per medicare trustees as reported by savvy medicare, a training program for financial planners, part b and part d insurance costs have averaged an annual increase of 5.6% and 7.7% respectively, over the last 5 years and are expected to grow by 6.9% and 10.6% over the next five years. Capture your “large” annual expenses (e.g., real estate taxes), and write down the figures. It covers preparatory activities in financial, health, social life, and psychological domains (law et al. Estimate your social security income under various claiming strategies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pre retirement preparation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.