Your Early retirement withdrawal strategies images are ready. Early retirement withdrawal strategies are a topic that is being searched for and liked by netizens now. You can Get the Early retirement withdrawal strategies files here. Get all royalty-free photos and vectors.

If you’re looking for early retirement withdrawal strategies pictures information linked to the early retirement withdrawal strategies interest, you have come to the right blog. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

Early Retirement Withdrawal Strategies. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up. Many families spend too much and don’t save. Then increase the withdrawal amount to account for inflation rate annually.

What Are The 401K Tax Penalties 2020? 401k withdrawal, 401k, 401k From pinterest.com

What Are The 401K Tax Penalties 2020? 401k withdrawal, 401k, 401k From pinterest.com

For most people, the accumulation phase is the difficult part. Then increase the withdrawal amount to account for inflation rate annually. 1 this approach is combined with starting social security early at age 62. The next year, you take that same 4% along with 2% of that amount, in order to. The timing makes a big difference. At the beginning of your retirement, withdraw 4% from your portfolio.

For most people, the accumulation phase is the difficult part.

The next year, you take that same 4% along with 2% of that amount, in order to. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. Many families spend too much and don’t save. Basically, it’s been shown that your portfolio has an excellent chance of outliving you with this method. However, delaying the start of social security to. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up.

Source: pinterest.com

Source: pinterest.com

The timing makes a big difference. The timing makes a big difference. Many families spend too much and don’t save. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. The 4% retirement withdrawal strategy is a common and popular way for retired individuals to organize their withdrawals.

Source: tacticalfixedincome.com

Source: tacticalfixedincome.com

The 4% safe withdrawal rate. However, delaying the start of social security to. For most people, the accumulation phase is the difficult part. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. Basically, it’s been shown that your portfolio has an excellent chance of outliving you with this method.

Source: pinterest.com

Source: pinterest.com

Then increase the withdrawal amount to account for inflation rate annually. Basically, it’s been shown that your portfolio has an excellent chance of outliving you with this method. Many families spend too much and don’t save. Then increase the withdrawal amount to account for inflation rate annually. However, delaying the start of social security to.

Source: pinterest.com

Source: pinterest.com

In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up. Many families spend too much and don’t save. 1 this approach is combined with starting social security early at age 62. The 4% retirement withdrawal strategy is a common and popular way for retired individuals to organize their withdrawals.

Source: retireby40.org

Source: retireby40.org

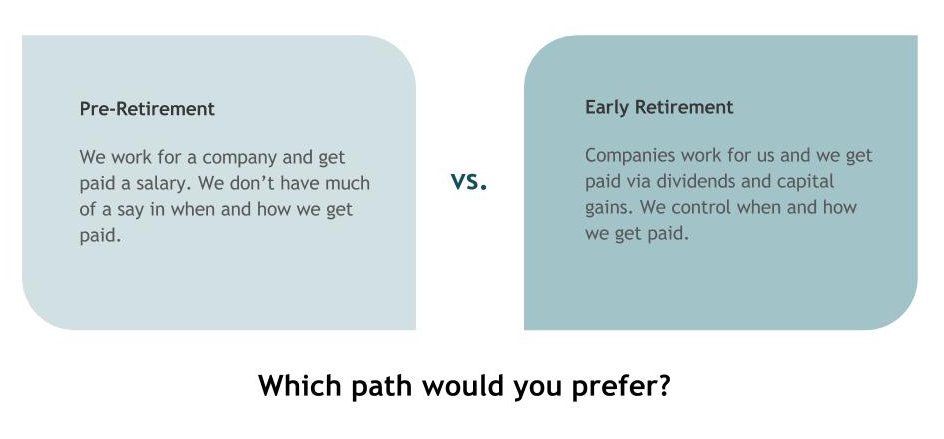

Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. 1 this approach is combined with starting social security early at age 62. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. The timing makes a big difference. However, delaying the start of social security to.

In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. The timing makes a big difference. You probably have heard of the 4% safe withdrawal rate. Many families spend too much and don’t save. Basically, it’s been shown that your portfolio has an excellent chance of outliving you with this method.

Source: crucialwealth.com

Source: crucialwealth.com

Many families spend too much and don’t save. However, delaying the start of social security to. The next year, you take that same 4% along with 2% of that amount, in order to. The 4% safe withdrawal rate. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up.

Source: pinterest.com

Source: pinterest.com

For most people, the accumulation phase is the difficult part. The 4% retirement withdrawal strategy is a common and popular way for retired individuals to organize their withdrawals. However, delaying the start of social security to. Keep in mind that the older you are, the more an early withdrawal will impact you in retirement. 1 this approach is combined with starting social security early at age 62.

Source: insideyourira.com

Source: insideyourira.com

You probably have heard of the 4% safe withdrawal rate. Then increase the withdrawal amount to account for inflation rate annually. Basically, it’s been shown that your portfolio has an excellent chance of outliving you with this method. Keep in mind that the older you are, the more an early withdrawal will impact you in retirement. You probably have heard of the 4% safe withdrawal rate.

Source: trustgroupfinancial.com

Source: trustgroupfinancial.com

The next year, you take that same 4% along with 2% of that amount, in order to. At the beginning of your retirement, withdraw 4% from your portfolio. If you must take an early withdrawal from a retirement account, it’s important to do so wisely. The 4% retirement withdrawal strategy is a common and popular way for retired individuals to organize their withdrawals. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up.

Source: retireby40.org

Source: retireby40.org

Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. The 4% safe withdrawal rate. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. Many families spend too much and don’t save.

Source: pinterest.com

Source: pinterest.com

The timing makes a big difference. Then increase the withdrawal amount to account for inflation rate annually. The 4% safe withdrawal rate. The timing makes a big difference. At the beginning of your retirement, withdraw 4% from your portfolio.

Source: pinterest.com

Source: pinterest.com

Keep in mind that the older you are, the more an early withdrawal will impact you in retirement. Many families spend too much and don’t save. 1 this approach is combined with starting social security early at age 62. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year.

Source: retireby40.org

Source: retireby40.org

If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up. If you must take an early withdrawal from a retirement account, it’s important to do so wisely. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. You probably have heard of the 4% safe withdrawal rate. However, delaying the start of social security to.

Source: compassfinancialnews.com

Source: compassfinancialnews.com

Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. The 4% retirement withdrawal strategy is a common and popular way for retired individuals to organize their withdrawals. If you must take an early withdrawal from a retirement account, it’s important to do so wisely. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. 1 this approach is combined with starting social security early at age 62.

Source: pinterest.com

Source: pinterest.com

The 4% safe withdrawal rate. 1 this approach is combined with starting social security early at age 62. Basically, it’s been shown that your portfolio has an excellent chance of outliving you with this method. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up. However, delaying the start of social security to.

Source: youtube.com

Source: youtube.com

1 this approach is combined with starting social security early at age 62. The next year, you take that same 4% along with 2% of that amount, in order to. If you are in your early 30s and adopting a child, taking out $5,000 from your 401k is a loss you can make up. Many families spend too much and don’t save. Keep in mind that the older you are, the more an early withdrawal will impact you in retirement.

Source: snideradvisors.com

Source: snideradvisors.com

Then increase the withdrawal amount to account for inflation rate annually. However, delaying the start of social security to. In this scenario, as you start to take retirement withdrawals at a certain age, for example, at age 70, you take an initial 4% out the first year. The 4% retirement withdrawal strategy is a common and popular way for retired individuals to organize their withdrawals. Many families spend too much and don’t save.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement withdrawal strategies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.