Your Early retirement planning images are ready in this website. Early retirement planning are a topic that is being searched for and liked by netizens now. You can Find and Download the Early retirement planning files here. Get all free photos.

If you’re looking for early retirement planning pictures information related to the early retirement planning topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Early Retirement Planning. When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. Planning for early retirement in 2020 step #1. It means the first year’s principal amount and the returns accrued for the next 5 years will be paid off in the 6 years. You have been trained to think that a budget is an answer to all your financial problems.

What You Need To Do Now To Achieve Early Retirement From listenmoneymatters.com

What You Need To Do Now To Achieve Early Retirement From listenmoneymatters.com

Download your free guide & tackle 11 retirement issues before it�s too late! When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. Download your free guide & tackle 11 retirement issues before it�s too late! Once you’re clear on the lifestyle you want when you retire early, you need. For simplicity, we have normalized the return on investment value. Early retirement plan step 1:

Before you can start planning for early retirement, you need a.

Planning for early retirement in 2020 step #1. It means the first year’s principal amount and the returns accrued for the next 5 years will be paid off in the 6 years. Create a mock retirement budget. Before you can start planning for early retirement, you need a. Planning for early retirement in 2020 step #1. You have been trained to think that a budget is an answer to all your financial problems.

Source: routetoretire.com

Source: routetoretire.com

The early retirement planning guide: Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. Typically, when you feel that your cash flow is out of control, you turn to budgeting. You will be investing $2000 every month and will not be withdrawing any money for the next 5 years. You have been trained to think that a budget is an answer to all your financial problems.

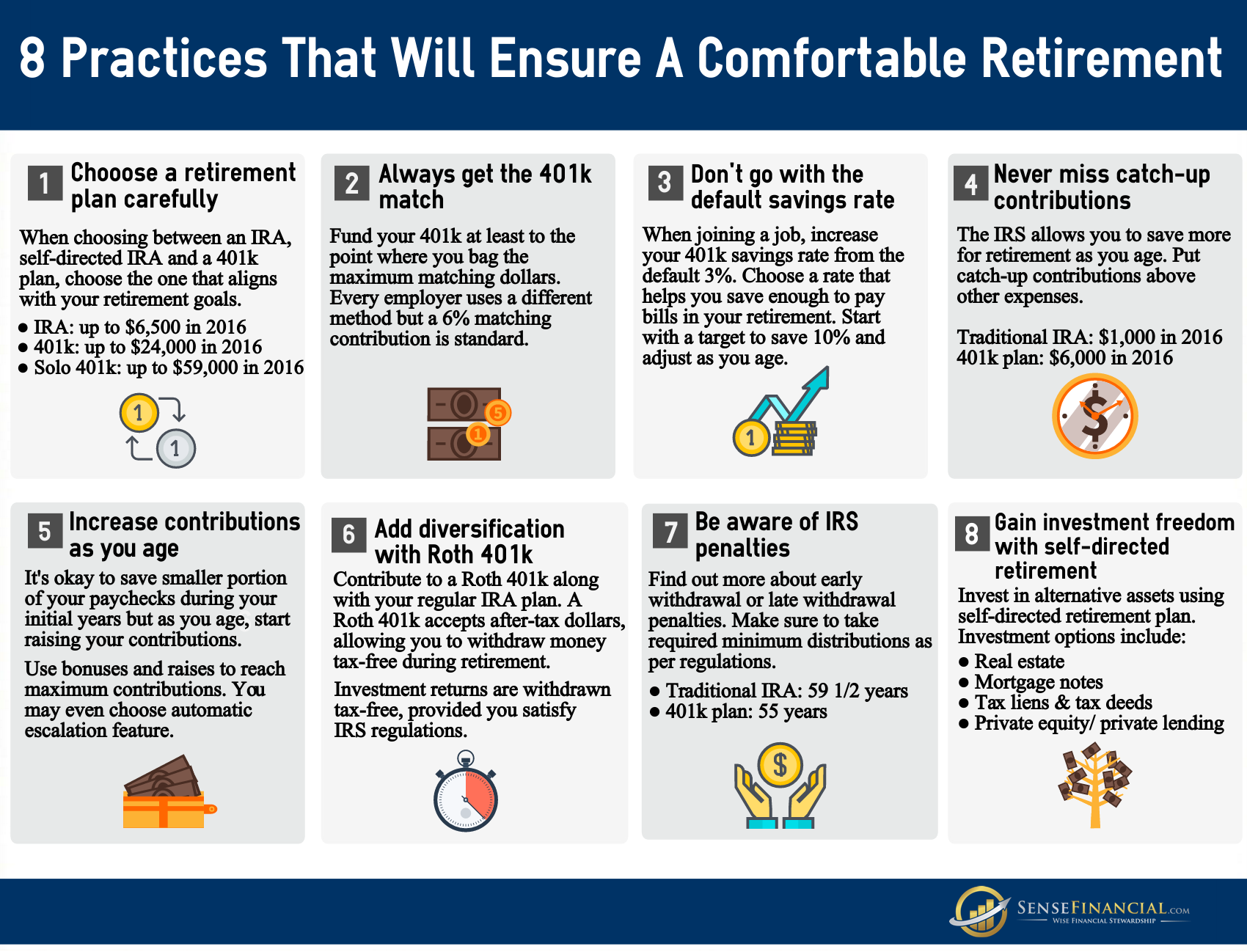

Source: sensefinancial.com

Source: sensefinancial.com

For simplicity, we have normalized the return on investment value. Before you can start planning for early retirement, you need a. Download your free guide & tackle 11 retirement issues before it�s too late! Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. The early retirement planning guide:

Source: heritagefinancialaz.com

Source: heritagefinancialaz.com

Typically, when you feel that your cash flow is out of control, you turn to budgeting. Once you’re clear on the lifestyle you want when you retire early, you need. Higher return on your investments. Download your free guide & tackle 11 retirement issues before it�s too late! When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest.

Source: zricks.com

Create a mock retirement budget. Download your free guide & tackle 11 retirement issues before it�s too late! Planning for early retirement in 2020 step #1. Higher return on your investments. Early retirement plan step 1:

Source: premierinvestmentsofiowa.com

Source: premierinvestmentsofiowa.com

Create a mock retirement budget. Download your free guide & tackle 11 retirement issues before it�s too late! Create a mock retirement budget. That it is the only way to regain control over your financial future. Before you can start planning for early retirement, you need a.

Source: tweakyourbiz.com

Source: tweakyourbiz.com

For simplicity, we have normalized the return on investment value. You will be investing $2000 every month and will not be withdrawing any money for the next 5 years. Download your free guide & tackle 11 retirement issues before it�s too late! Typically, when you feel that your cash flow is out of control, you turn to budgeting. When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest.

Source: listenmoneymatters.com

Source: listenmoneymatters.com

When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. Planning for early retirement in 2020 step #1. Once you’re clear on the lifestyle you want when you retire early, you need. Early retirement plan step 1: Download your free guide & tackle 11 retirement issues before it�s too late!

Source: canarahsbclife.com

Source: canarahsbclife.com

For simplicity, we have normalized the return on investment value. Early retirement plan step 1: Determine the lifestyle you want in retirement. Before you can start planning for early retirement, you need a. Higher return on your investments.

Source: thechinfamily.hk

Source: thechinfamily.hk

Determine the lifestyle you want in retirement. You will be investing $2000 every month and will not be withdrawing any money for the next 5 years. Planning for early retirement in 2020 step #1. Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. For simplicity, we have normalized the return on investment value.

Source: pinterest.com

Source: pinterest.com

That it is the only way to regain control over your financial future. Create a mock retirement budget. Download your free guide & tackle 11 retirement issues before it�s too late! Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. You have been trained to think that a budget is an answer to all your financial problems.

Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. The early retirement planning guide: Before you can start planning for early retirement, you need a. Typically, when you feel that your cash flow is out of control, you turn to budgeting. Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings.

Source: pinterest.com

Source: pinterest.com

The early retirement planning guide: Determine the lifestyle you want in retirement. Download your free guide & tackle 11 retirement issues before it�s too late! The early retirement planning guide: Higher return on your investments.

Source: newretirement.com

Source: newretirement.com

Download your free guide & tackle 11 retirement issues before it�s too late! You will be investing $2000 every month and will not be withdrawing any money for the next 5 years. Early retirement plan step 1: Higher return on your investments. When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest.

Source: moneycrashers.com

Source: moneycrashers.com

Create a mock retirement budget. You have been trained to think that a budget is an answer to all your financial problems. It means the first year’s principal amount and the returns accrued for the next 5 years will be paid off in the 6 years. Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. Create a mock retirement budget.

Source: jmbfinmgrs.com

Source: jmbfinmgrs.com

Determine the lifestyle you want in retirement. It means the first year’s principal amount and the returns accrued for the next 5 years will be paid off in the 6 years. When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. The early retirement planning guide: Download your free guide & tackle 11 retirement issues before it�s too late!

Source: skillincubator.com

Source: skillincubator.com

Typically, when you feel that your cash flow is out of control, you turn to budgeting. Download your free guide & tackle 11 retirement issues before it�s too late! The early retirement planning guide: Download your free guide & tackle 11 retirement issues before it�s too late! Before you can start planning for early retirement, you need a.

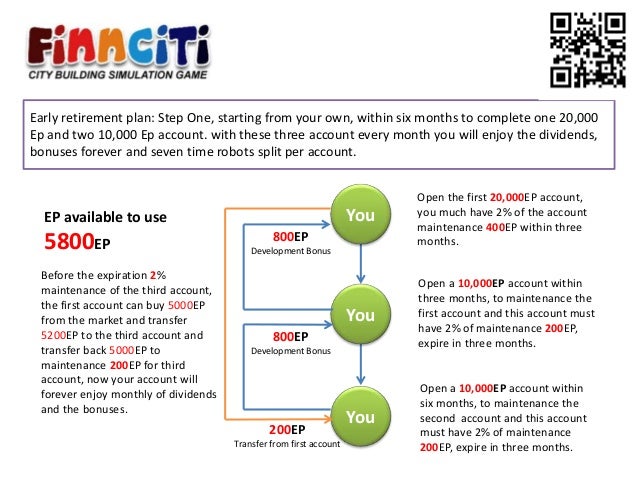

Source: slideshare.net

Source: slideshare.net

It means the first year’s principal amount and the returns accrued for the next 5 years will be paid off in the 6 years. Planning for early retirement in 2020 step #1. When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. Download your free guide & tackle 11 retirement issues before it�s too late! Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings.

![3 Reasons To Retire Early [INFOGRAPHIC] Early retirement, Retirement 3 Reasons To Retire Early [INFOGRAPHIC] Early retirement, Retirement](https://i.pinimg.com/originals/a6/ea/b2/a6eab2d3a164bdcb11496ca777a501ed.png) Source: pinterest.com

Source: pinterest.com

When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. Compound interest is the interest you earn on your principal sum plus previously accumulated interest or earnings. For simplicity, we have normalized the return on investment value. When you start saving for retirement early, you have more time for those investments to grow and benefit from compound interest. Higher return on your investments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement planning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.