Your Early retirement withdrawal covid images are ready in this website. Early retirement withdrawal covid are a topic that is being searched for and liked by netizens today. You can Find and Download the Early retirement withdrawal covid files here. Find and Download all royalty-free images.

If you’re looking for early retirement withdrawal covid pictures information related to the early retirement withdrawal covid interest, you have come to the ideal site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

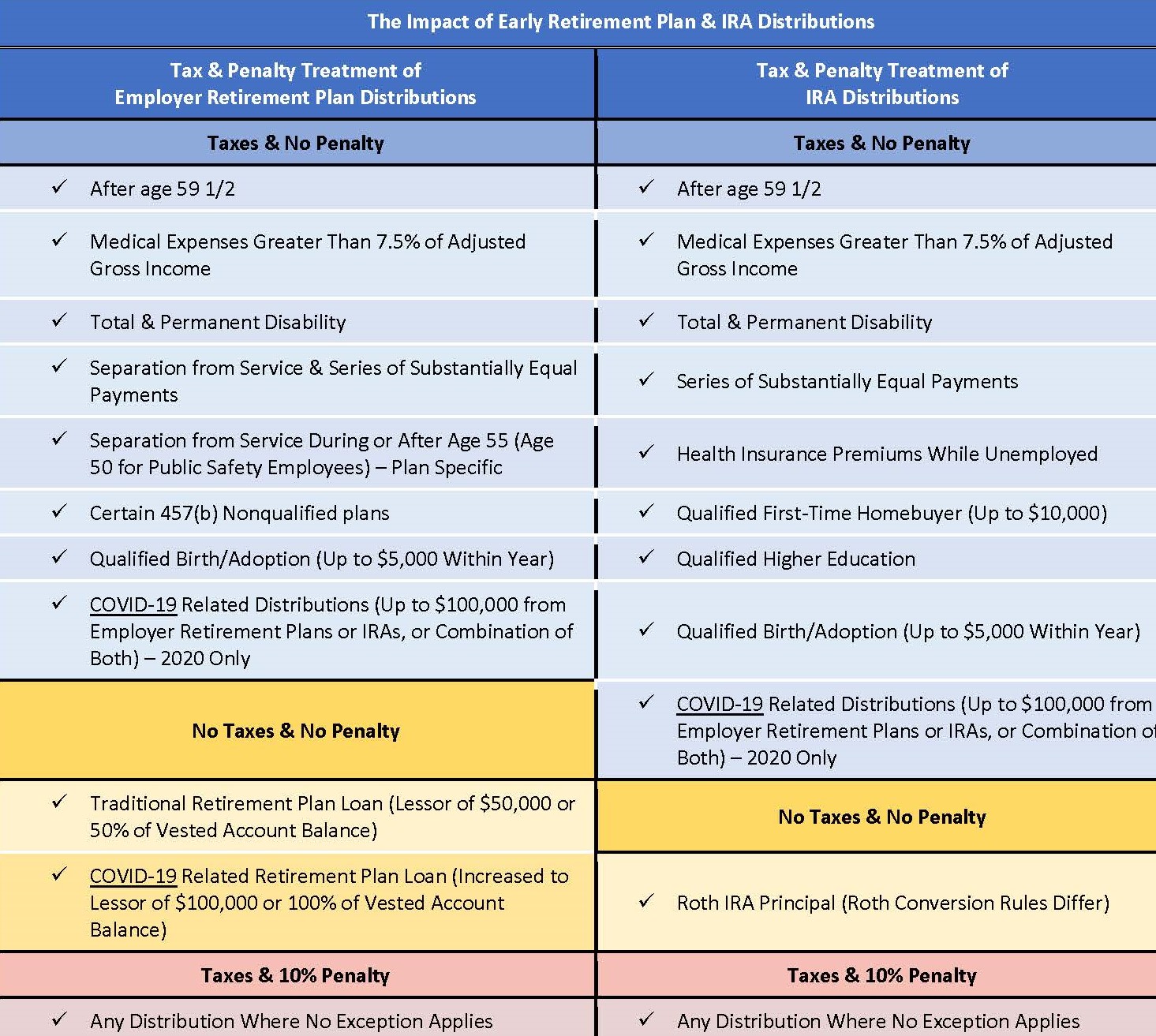

Early Retirement Withdrawal Covid. How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How covid retirement plan withdrawals affect your taxes. Note that these withdrawals had to be made before dec.

Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How covid retirement plan withdrawals affect your taxes. How early retirement plan withdrawals work under normal circumstances. Note that these withdrawals had to be made before dec. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal.

Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal.

Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Note that these withdrawals had to be made before dec. How covid retirement plan withdrawals affect your taxes. How early retirement plan withdrawals work under normal circumstances.

Source: capitalone.com

Source: capitalone.com

How covid retirement plan withdrawals affect your taxes. How early retirement plan withdrawals work under normal circumstances. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. How covid retirement plan withdrawals affect your taxes.

How covid retirement plan withdrawals affect your taxes. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How early retirement plan withdrawals work under normal circumstances. How covid retirement plan withdrawals affect your taxes. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe.

Source: henssler.com

Source: henssler.com

This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Note that these withdrawals had to be made before dec. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. How covid retirement plan withdrawals affect your taxes. How early retirement plan withdrawals work under normal circumstances.

Source: pfallc.com

Source: pfallc.com

How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How covid retirement plan withdrawals affect your taxes. Note that these withdrawals had to be made before dec.

Source: azcentral.com

Source: azcentral.com

This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How covid retirement plan withdrawals affect your taxes. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How early retirement plan withdrawals work under normal circumstances.

How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. Note that these withdrawals had to be made before dec. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal.

Source: aotax.com

Source: aotax.com

Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How early retirement plan withdrawals work under normal circumstances. How covid retirement plan withdrawals affect your taxes. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe.

Source: expressnews.com

Source: expressnews.com

How early retirement plan withdrawals work under normal circumstances. Note that these withdrawals had to be made before dec. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How early retirement plan withdrawals work under normal circumstances. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal.

How early retirement plan withdrawals work under normal circumstances. How covid retirement plan withdrawals affect your taxes. Note that these withdrawals had to be made before dec. How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans.

Source: triagecancer.org

Source: triagecancer.org

Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How covid retirement plan withdrawals affect your taxes. How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe.

Source: smartasset.com

Source: smartasset.com

How covid retirement plan withdrawals affect your taxes. How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. Note that these withdrawals had to be made before dec.

Source: duckettlawllc.com

Source: duckettlawllc.com

Note that these withdrawals had to be made before dec. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe.

Source: moneytalksnews.com

Source: moneytalksnews.com

Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How covid retirement plan withdrawals affect your taxes. Note that these withdrawals had to be made before dec.

Source: stratatrust.com

Source: stratatrust.com

Note that these withdrawals had to be made before dec. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. Note that these withdrawals had to be made before dec. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe.

Source: riversedgeadvisors.com

Source: riversedgeadvisors.com

Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How covid retirement plan withdrawals affect your taxes. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How early retirement plan withdrawals work under normal circumstances. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe.

Source: hubinternational.com

Source: hubinternational.com

Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How early retirement plan withdrawals work under normal circumstances. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. This includes allowing retirement investors affected by the coronavirus to gain access to up to $100,000 of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal.

Source: shepherdelderlaw.com

Source: shepherdelderlaw.com

Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. Section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for retirement plans and iras and expands permissible loans from certain retirement plans. How covid retirement plan withdrawals affect your taxes. Note that these withdrawals had to be made before dec. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal.

Note that these withdrawals had to be made before dec. Note that these withdrawals had to be made before dec. How covid retirement plan withdrawals affect your taxes. Whether you�ve lost your job, your income has decreased, or you�re grappling with higher expenses, you may be desperate to increase your personal. How early retirement plan withdrawals work under normal circumstances.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement withdrawal covid by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.