Your Early retirement bucket strategy images are available in this site. Early retirement bucket strategy are a topic that is being searched for and liked by netizens now. You can Find and Download the Early retirement bucket strategy files here. Find and Download all free images.

If you’re searching for early retirement bucket strategy pictures information linked to the early retirement bucket strategy topic, you have come to the right site. Our site always gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

Early Retirement Bucket Strategy. Creating a cash cushion for the early years of retirement, while maximizing the. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. Pros and cons of the retirement bucket strategy. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time.

What Investments go in Which Account for Tax Avoidance? Investing From pinterest.com

What Investments go in Which Account for Tax Avoidance? Investing From pinterest.com

So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach. Creating a cash cushion for the early years of retirement, while maximizing the. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. Planning how you will use your money in advance may help you stick to your budget better. Pros and cons of the retirement bucket strategy. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”.

Pros and cons of the retirement bucket strategy.

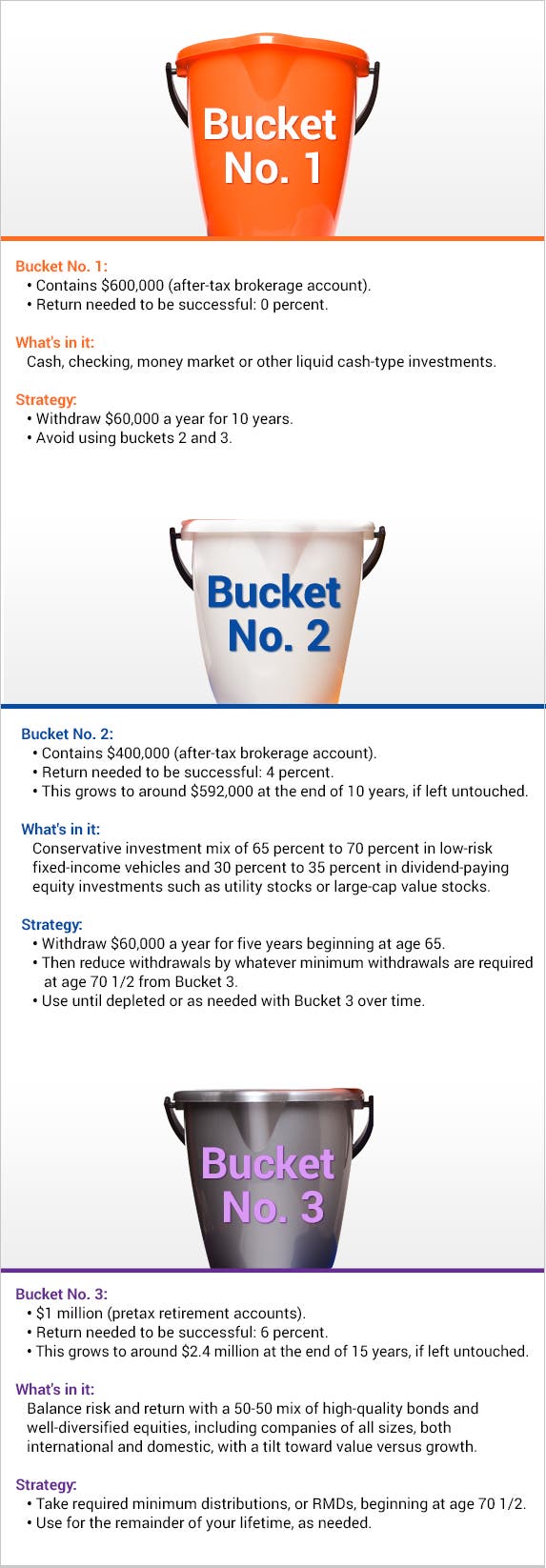

The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. And why it’s likely not suitable for today’s early retirees. It aims to provide retirees. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”. Pros and cons of the retirement bucket strategy. Furthermore, a strategy that works well early in retirement might be less satisfactory later on.

Source: bankrate.com

Source: bankrate.com

Creating a cash cushion for the early years of retirement, while maximizing the. Planning how you will use your money in advance may help you stick to your budget better. Creating a cash cushion for the early years of retirement, while maximizing the. It aims to provide retirees. And why it’s likely not suitable for today’s early retirees.

Source: mrfirestation.com

Source: mrfirestation.com

So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach. Pros and cons of the retirement bucket strategy. Creating a cash cushion for the early years of retirement, while maximizing the. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time.

Source: pinterest.com

Source: pinterest.com

And why it’s likely not suitable for today’s early retirees. Pros and cons of the retirement bucket strategy. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street.

Source: freefincal.com

Source: freefincal.com

Furthermore, a strategy that works well early in retirement might be less satisfactory later on. The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”. So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach. It aims to provide retirees.

Source: pinterest.com

Source: pinterest.com

Pros and cons of the retirement bucket strategy. It aims to provide retirees. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. Pros and cons of the retirement bucket strategy. And why it’s likely not suitable for today’s early retirees.

Source: pinterest.com

Source: pinterest.com

Furthermore, a strategy that works well early in retirement might be less satisfactory later on. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. Creating a cash cushion for the early years of retirement, while maximizing the. So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach.

Source: pinterest.com

Source: pinterest.com

A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time. And why it’s likely not suitable for today’s early retirees. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. Creating a cash cushion for the early years of retirement, while maximizing the. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time.

Source: pinterest.com

Source: pinterest.com

Creating a cash cushion for the early years of retirement, while maximizing the. Pros and cons of the retirement bucket strategy. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time. Planning how you will use your money in advance may help you stick to your budget better.

Source: pinterest.com

Source: pinterest.com

The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”. So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach. And why it’s likely not suitable for today’s early retirees. Planning how you will use your money in advance may help you stick to your budget better.

Source: retirementstewardship.com

Source: retirementstewardship.com

Planning how you will use your money in advance may help you stick to your budget better. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time. Pros and cons of the retirement bucket strategy. It aims to provide retirees. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”.

Source: forbes.com

Source: forbes.com

Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. And why it’s likely not suitable for today’s early retirees. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”.

Source: leisurefreak.com

Source: leisurefreak.com

Furthermore, a strategy that works well early in retirement might be less satisfactory later on. And why it’s likely not suitable for today’s early retirees. Pros and cons of the retirement bucket strategy. Planning how you will use your money in advance may help you stick to your budget better. Furthermore, a strategy that works well early in retirement might be less satisfactory later on.

Source: freefincal.com

Source: freefincal.com

“using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. Pros and cons of the retirement bucket strategy. The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. And why it’s likely not suitable for today’s early retirees.

Source: bankrate.com

Source: bankrate.com

And why it’s likely not suitable for today’s early retirees. Creating a cash cushion for the early years of retirement, while maximizing the. Planning how you will use your money in advance may help you stick to your budget better. The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. Furthermore, a strategy that works well early in retirement might be less satisfactory later on.

Source: youtube.com

Source: youtube.com

“using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”. Creating a cash cushion for the early years of retirement, while maximizing the. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. Planning how you will use your money in advance may help you stick to your budget better.

Source: pinterest.com

Source: pinterest.com

Creating a cash cushion for the early years of retirement, while maximizing the. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”. Planning how you will use your money in advance may help you stick to your budget better. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. And why it’s likely not suitable for today’s early retirees.

Source: keepingitrreal.blogspot.com

Source: keepingitrreal.blogspot.com

So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. Creating a cash cushion for the early years of retirement, while maximizing the. A bucket strategy requires you to map out how much you will spend each year in retirement ahead of time. So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach.

Source: walmart.com

Source: walmart.com

The bucket strategy relies on segmenting your sources of income into different groups or “buckets,” each with a set time horizon and corresponding risk level. So, before you allocate your money according to the retirement bucket strategy, weigh the pros and cons of this approach. Then again, retirees who use the bucket strategy for investing and withdrawing their assets may be better insulated from the recent turmoil on wall street. Furthermore, a strategy that works well early in retirement might be less satisfactory later on. “using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement bucket strategy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.