Your Early retirement tax calculator images are ready. Early retirement tax calculator are a topic that is being searched for and liked by netizens today. You can Get the Early retirement tax calculator files here. Get all royalty-free photos and vectors.

If you’re searching for early retirement tax calculator images information connected with to the early retirement tax calculator topic, you have pay a visit to the right blog. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

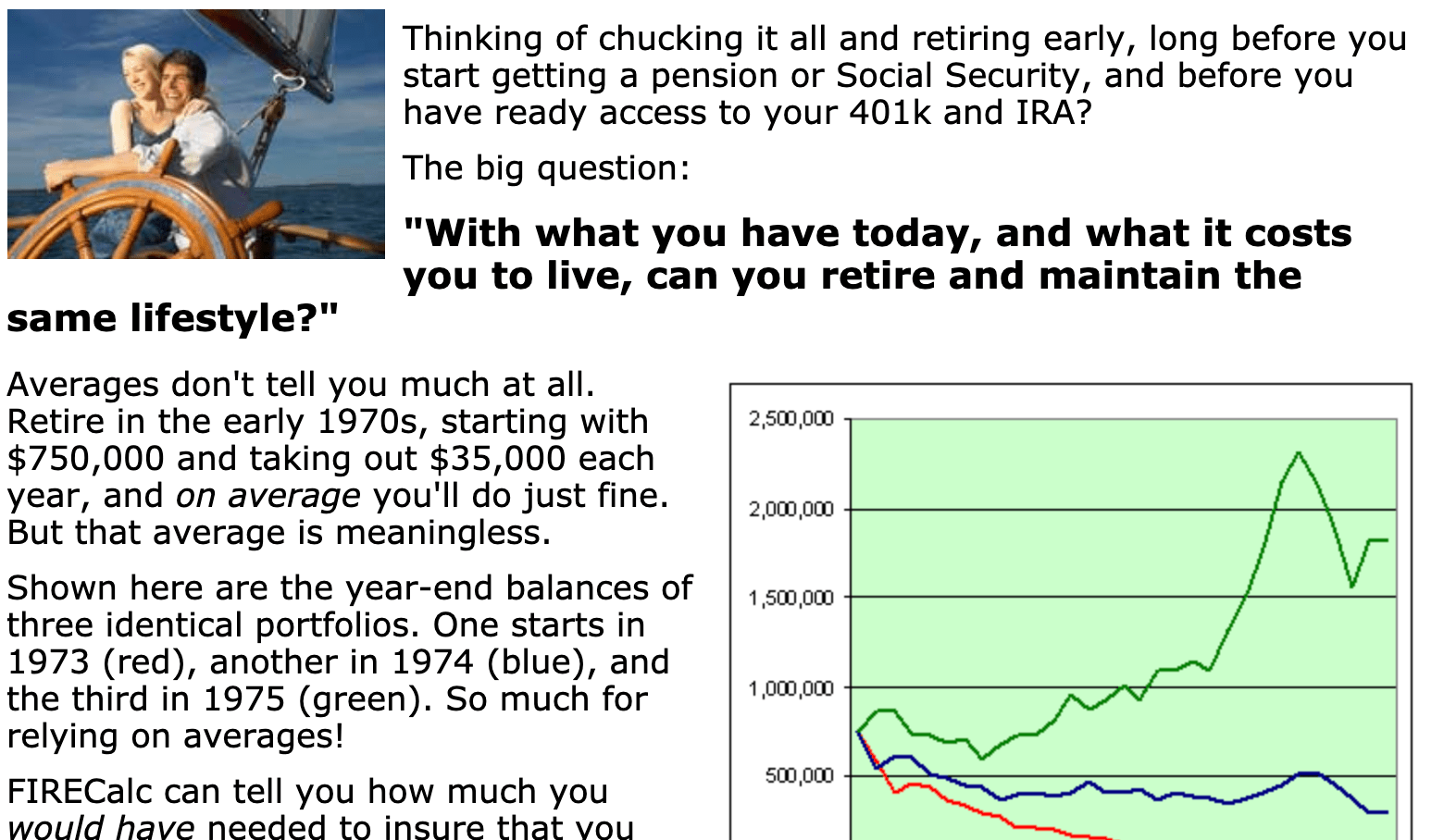

Early Retirement Tax Calculator. You will never draw down the principal. Your current annual expenses equal your annual expenses in retirement. Your annual income after taxes. Your net worth will never shrink.

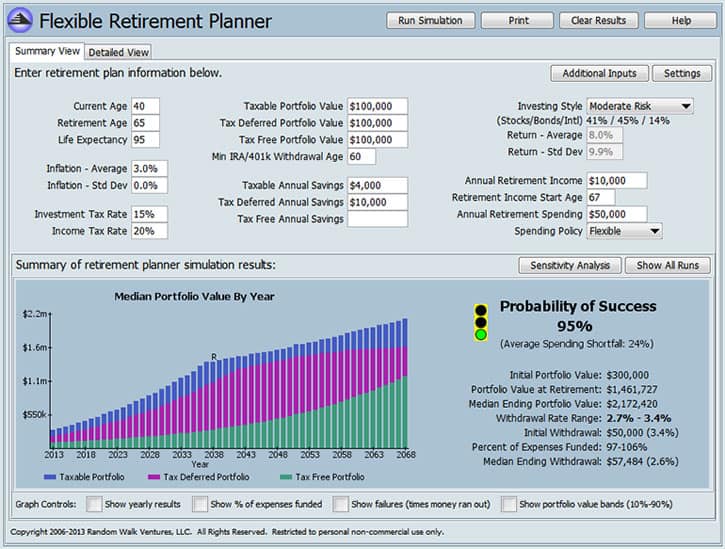

Retirement Savings Calculator Explained Geoff Thompson From geoffreyjthompson.wordpress.com

Retirement Savings Calculator Explained Geoff Thompson From geoffreyjthompson.wordpress.com

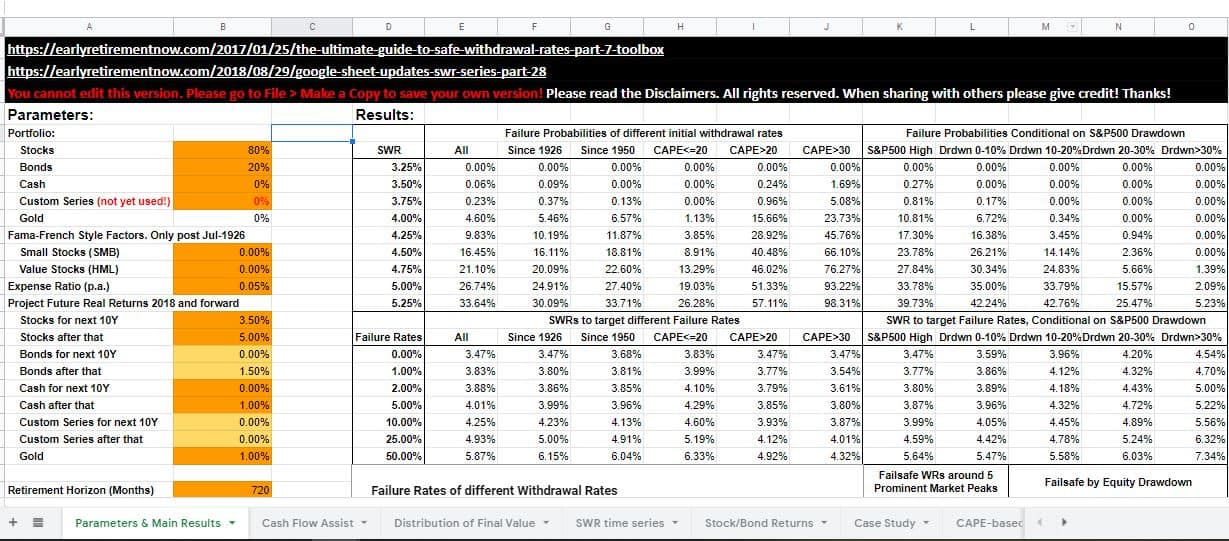

You will never draw down the principal. If you�re considering switching to a new job for a higher salary, but aren�t sure what the income will be after tax, check out our income tax calculators to get a quick estimate. To calculate your fire number, you will need to enter the following information into our calculator: If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. Making use of an early retirement calculator to estimate different.

Making use of an early retirement calculator to estimate different.

If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. Percentage of your income you contribute to savings. If you return the cash to your ira within 3 years you will not owe the tax payment. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. Your annual income after taxes. Annual return on investment is after taxes and inflation.

Source: raa.com

Source: raa.com

Your net worth will never shrink. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. You will never draw down the principal. Your net worth will never shrink. To calculate your fire number, you will need to enter the following information into our calculator:

Source: pinterest.com

Source: pinterest.com

Annual return on investment is after taxes and inflation. To calculate your fire number, you will need to enter the following information into our calculator: You can take the salary after tax number and plug it into this early retirement fire calculator. Your annual expenses (usually around 70% of your income) current savings account balance. Making use of an early retirement calculator to estimate different.

Source: financialfreedomcountdown.com

Source: financialfreedomcountdown.com

Your net worth will never shrink. To calculate your fire number, you will need to enter the following information into our calculator: Current annual income is after taxes. 401k and other retirement plans. Your net worth will never shrink.

Source: va-kreeg.blogspot.com

Source: va-kreeg.blogspot.com

401k and other retirement plans. The tool assumes that you will incur this 10%. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. If you return the cash to your ira within 3 years you will not owe the tax payment. 401k and other retirement plans.

Source: geoffreyjthompson.wordpress.com

Source: geoffreyjthompson.wordpress.com

Percentage of your income you contribute to savings. The early withdrawal penalty, if any, is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Your annual expenses (usually around 70% of your income) current savings account balance. Your annual income after taxes. 401k and other retirement plans.

Source: expensivity.com

Source: expensivity.com

Your net worth will never shrink. Annual return on investment is after taxes and inflation. Your annual expenses (usually around 70% of your income) current savings account balance. Making use of an early retirement calculator to estimate different. 401k and other retirement plans.

Source: budgetsaresexy.com

Source: budgetsaresexy.com

Your annual income after taxes. If you�re considering switching to a new job for a higher salary, but aren�t sure what the income will be after tax, check out our income tax calculators to get a quick estimate. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. Current annual income is after taxes. You can take the salary after tax number and plug it into this early retirement fire calculator.

Source: pinterest.com

Source: pinterest.com

If you return the cash to your ira within 3 years you will not owe the tax payment. 401k and other retirement plans. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. The tool assumes that you will incur this 10%. If you�re considering switching to a new job for a higher salary, but aren�t sure what the income will be after tax, check out our income tax calculators to get a quick estimate.

Source: retireby40.org

Source: retireby40.org

Current annual income is after taxes. The tool assumes that you will incur this 10%. Your annual income after taxes. If you return the cash to your ira within 3 years you will not owe the tax payment. Current annual income is after taxes.

![IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center Irs, Making IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center Irs, Making](https://i.pinimg.com/originals/d1/5a/28/d15a2819d963f816355a19a1b21acd5f.jpg) Source: pinterest.com

Source: pinterest.com

Percentage of your income you contribute to savings. You can take the salary after tax number and plug it into this early retirement fire calculator. If you return the cash to your ira within 3 years you will not owe the tax payment. You will never draw down the principal. Your annual income after taxes.

Source: pasivinco.blogspot.com

To calculate your fire number, you will need to enter the following information into our calculator: Making use of an early retirement calculator to estimate different. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. You will never draw down the principal. Your annual expenses (usually around 70% of your income) current savings account balance.

Source: financialmentor.com

Source: financialmentor.com

Your current annual expenses equal your annual expenses in retirement. Your annual expenses (usually around 70% of your income) current savings account balance. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. The early withdrawal penalty, if any, is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

Source: qatax.blogspot.com

Source: qatax.blogspot.com

Percentage of your income you contribute to savings. 401k and other retirement plans. Percentage of your income you contribute to savings. Making use of an early retirement calculator to estimate different. You can take the salary after tax number and plug it into this early retirement fire calculator.

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

401k and other retirement plans. You can take the salary after tax number and plug it into this early retirement fire calculator. 401k and other retirement plans. To calculate your fire number, you will need to enter the following information into our calculator: The tool assumes that you will incur this 10%.

Source: financialmentor.com

Source: financialmentor.com

Your net worth will never shrink. Making use of an early retirement calculator to estimate different. Annual return on investment is after taxes and inflation. Your net worth will never shrink. 401k and other retirement plans.

Source: newretirement.com

Source: newretirement.com

The early withdrawal penalty, if any, is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Percentage of your income you contribute to savings. Annual return on investment is after taxes and inflation. Making use of an early retirement calculator to estimate different. If you return the cash to your ira within 3 years you will not owe the tax payment.

Source: moneysmartguides.com

Source: moneysmartguides.com

Current annual income is after taxes. If you return the cash to your ira within 3 years you will not owe the tax payment. Current annual income is after taxes. To calculate your fire number, you will need to enter the following information into our calculator: If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax.

Source: ourdebtfreelives.com

Source: ourdebtfreelives.com

The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. If you�re considering switching to a new job for a higher salary, but aren�t sure what the income will be after tax, check out our income tax calculators to get a quick estimate. You can take the salary after tax number and plug it into this early retirement fire calculator. Your annual income after taxes. The tool assumes that you will incur this 10%.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement tax calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.