Your Early retirement kiwisaver images are ready. Early retirement kiwisaver are a topic that is being searched for and liked by netizens today. You can Download the Early retirement kiwisaver files here. Get all free vectors.

If you’re searching for early retirement kiwisaver images information linked to the early retirement kiwisaver topic, you have visit the ideal blog. Our site always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

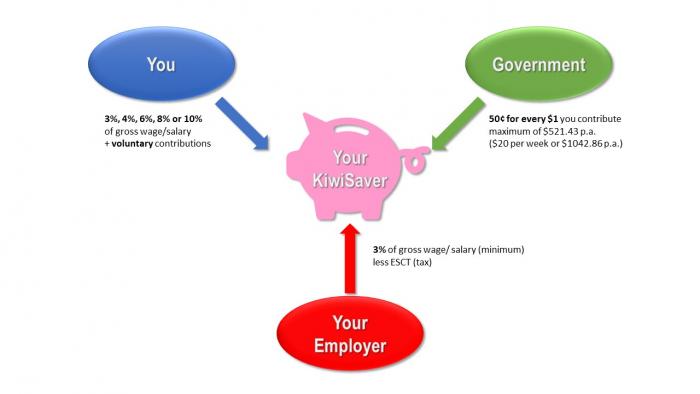

Early Retirement Kiwisaver. Currently, that age is 65. Getting my funds when i move overseas if you move permanently to australia you can transfer your kiwisaver funds to an australian superannuation scheme. If you have been living overseas (not australia) for 1 year, you can take out most of. Your annual withdrawal rate 4%.

Do you need KiwiSaver if you plan to retire early? The Smart and Lazy From thesmartandlazy.com

Do you need KiwiSaver if you plan to retire early? The Smart and Lazy From thesmartandlazy.com

Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year. This, to access your kiwisaver early. As this suggests, you get access to it when you’re of retirement age. From 1 april 2020 you can now either: Your annual withdrawal rate 4%. Include kiwisaver fund into your early retirement number.

Currently, that age is 65.

40% of kiwisaver members have a balance of less than $10,000. Kiwisaver is a superannuation or retirement scheme. This, to access your kiwisaver early. As this suggests, you get access to it when you’re of retirement age. We assume you need 1 million portfolios to retire early, $300k in kiwisaver and $700k in a normal investment fund. From 1 april 2020 you can now either:

Source: pinterest.com

Source: pinterest.com

Currently, that age is 65. New research commissioned by taao from mjw shows the range of kiwisaver balances by age and sex. Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year. Currently, that age is 65. 19% of those with less than $10,000 are aged 17 and under.

Source: kevinhickland.co.nz

Source: kevinhickland.co.nz

If you have been living overseas (not australia) for 1 year, you can take out most of. We assume you need 1 million portfolios to retire early, $300k in kiwisaver and $700k in a normal investment fund. Getting my funds when i move overseas if you move permanently to australia you can transfer your kiwisaver funds to an australian superannuation scheme. Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year. 40% of kiwisaver members have a balance of less than $10,000.

Source: goodlifeadvice.co.nz

Source: goodlifeadvice.co.nz

As this suggests, you get access to it when you’re of retirement age. This, to access your kiwisaver early. Getting my kiwisaver for my first home if you have been in kiwisaver for 3 years you can take out some of your savings for your first home.; This is the first time such detailed data have been available and there are two key findings. If you have been living overseas (not australia) for 1 year, you can take out most of.

Source: rede.co.nz

Source: rede.co.nz

New research commissioned by taao from mjw shows the range of kiwisaver balances by age and sex. To clarify, you don’t have to actually be retired, so you can keep on working well into your golden years and still have access to your kiwisaver fund. 19% of those with less than $10,000 are aged 17 and under. From 1 april 2020 you can now either: As this suggests, you get access to it when you’re of retirement age.

Source: rede.co.nz

Source: rede.co.nz

Include kiwisaver fund into your early retirement number. Being locked in meant you could not withdraw your funds when you were 65. This, to access your kiwisaver early. To clarify, you don’t have to actually be retired, so you can keep on working well into your golden years and still have access to your kiwisaver fund. New research commissioned by taao from mjw shows the range of kiwisaver balances by age and sex.

Source: newstalkzb.co.nz

Source: newstalkzb.co.nz

Your annual withdrawal rate 4%. New research commissioned by taao from mjw shows the range of kiwisaver balances by age and sex. Being locked in meant you could not withdraw your funds when you were 65. Your annual withdrawal rate 4%. Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year.

Source: kiwiwealth.co.nz

Source: kiwiwealth.co.nz

Being locked in meant you could not withdraw your funds when you were 65. 19% of those with less than $10,000 are aged 17 and under. Your annual withdrawal rate 4%. Getting my funds when i move overseas if you move permanently to australia you can transfer your kiwisaver funds to an australian superannuation scheme. This is the first time such detailed data have been available and there are two key findings.

Source: magic.co.nz

Source: magic.co.nz

19% of those with less than $10,000 are aged 17 and under. This is the first time such detailed data have been available and there are two key findings. We assume you need 1 million portfolios to retire early, $300k in kiwisaver and $700k in a normal investment fund. 40% of kiwisaver members have a balance of less than $10,000. New research commissioned by taao from mjw shows the range of kiwisaver balances by age and sex.

Source: fisherfunds.co.nz

Source: fisherfunds.co.nz

Currently, that age is 65. This, to access your kiwisaver early. We assume you need 1 million portfolios to retire early, $300k in kiwisaver and $700k in a normal investment fund. If you have been living overseas (not australia) for 1 year, you can take out most of. 40% of kiwisaver members have a balance of less than $10,000.

Source: asb.co.nz

Source: asb.co.nz

From 1 april 2020 you can now either: Being locked in meant you could not withdraw your funds when you were 65. 19% of those with less than $10,000 are aged 17 and under. If you have been living overseas (not australia) for 1 year, you can take out most of. To clarify, you don’t have to actually be retired, so you can keep on working well into your golden years and still have access to your kiwisaver fund.

Source: newshub.co.nz

Source: newshub.co.nz

Currently, that age is 65. 40% of kiwisaver members have a balance of less than $10,000. Include kiwisaver fund into your early retirement number. Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year. To clarify, you don’t have to actually be retired, so you can keep on working well into your golden years and still have access to your kiwisaver fund.

Source: stuff.co.nz

Source: stuff.co.nz

From 1 april 2020 you can now either: You just need to stack up your investment and put kiwisaver at the bottom and only draw the fund at the top. Look at the graph below. If you have been living overseas (not australia) for 1 year, you can take out most of. 40% of kiwisaver members have a balance of less than $10,000.

![]() Source: amp.co.nz

Source: amp.co.nz

Kiwisaver is a superannuation or retirement scheme. Being locked in meant you could not withdraw your funds when you were 65. This is the first time such detailed data have been available and there are two key findings. This, to access your kiwisaver early. Getting my funds when i move overseas if you move permanently to australia you can transfer your kiwisaver funds to an australian superannuation scheme.

Source: futuresecure.nz

Source: futuresecure.nz

Getting my funds when i move overseas if you move permanently to australia you can transfer your kiwisaver funds to an australian superannuation scheme. Getting my kiwisaver for my first home if you have been in kiwisaver for 3 years you can take out some of your savings for your first home.; Your annual withdrawal rate 4%. As this suggests, you get access to it when you’re of retirement age. 40% of kiwisaver members have a balance of less than $10,000.

Source: colemurray.co.nz

Source: colemurray.co.nz

Kiwisaver is a superannuation or retirement scheme. Include kiwisaver fund into your early retirement number. This is the first time such detailed data have been available and there are two key findings. Your annual withdrawal rate 4%. Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year.

Source: newshub.co.nz

Source: newshub.co.nz

Getting my kiwisaver for my first home if you have been in kiwisaver for 3 years you can take out some of your savings for your first home.; Look at the graph below. Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year. As this suggests, you get access to it when you’re of retirement age. From 1 april 2020 you can now either:

Source: passiveincomenz.com

Source: passiveincomenz.com

Currently, that age is 65. As this suggests, you get access to it when you’re of retirement age. From 1 april 2020 you can now either: Opt out anytime after you�re 65 (and withdraw your savings) keep your funds in kiwisaver for the full 5 year. You just need to stack up your investment and put kiwisaver at the bottom and only draw the fund at the top.

Source: colemurray.co.nz

Source: colemurray.co.nz

We assume you need 1 million portfolios to retire early, $300k in kiwisaver and $700k in a normal investment fund. Kiwisaver is a superannuation or retirement scheme. You just need to stack up your investment and put kiwisaver at the bottom and only draw the fund at the top. Getting my funds when i move overseas if you move permanently to australia you can transfer your kiwisaver funds to an australian superannuation scheme. 40% of kiwisaver members have a balance of less than $10,000.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement kiwisaver by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.