Your Early retirement canada at 60 images are ready in this website. Early retirement canada at 60 are a topic that is being searched for and liked by netizens now. You can Download the Early retirement canada at 60 files here. Get all royalty-free vectors.

If you’re looking for early retirement canada at 60 images information connected with to the early retirement canada at 60 topic, you have pay a visit to the right blog. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

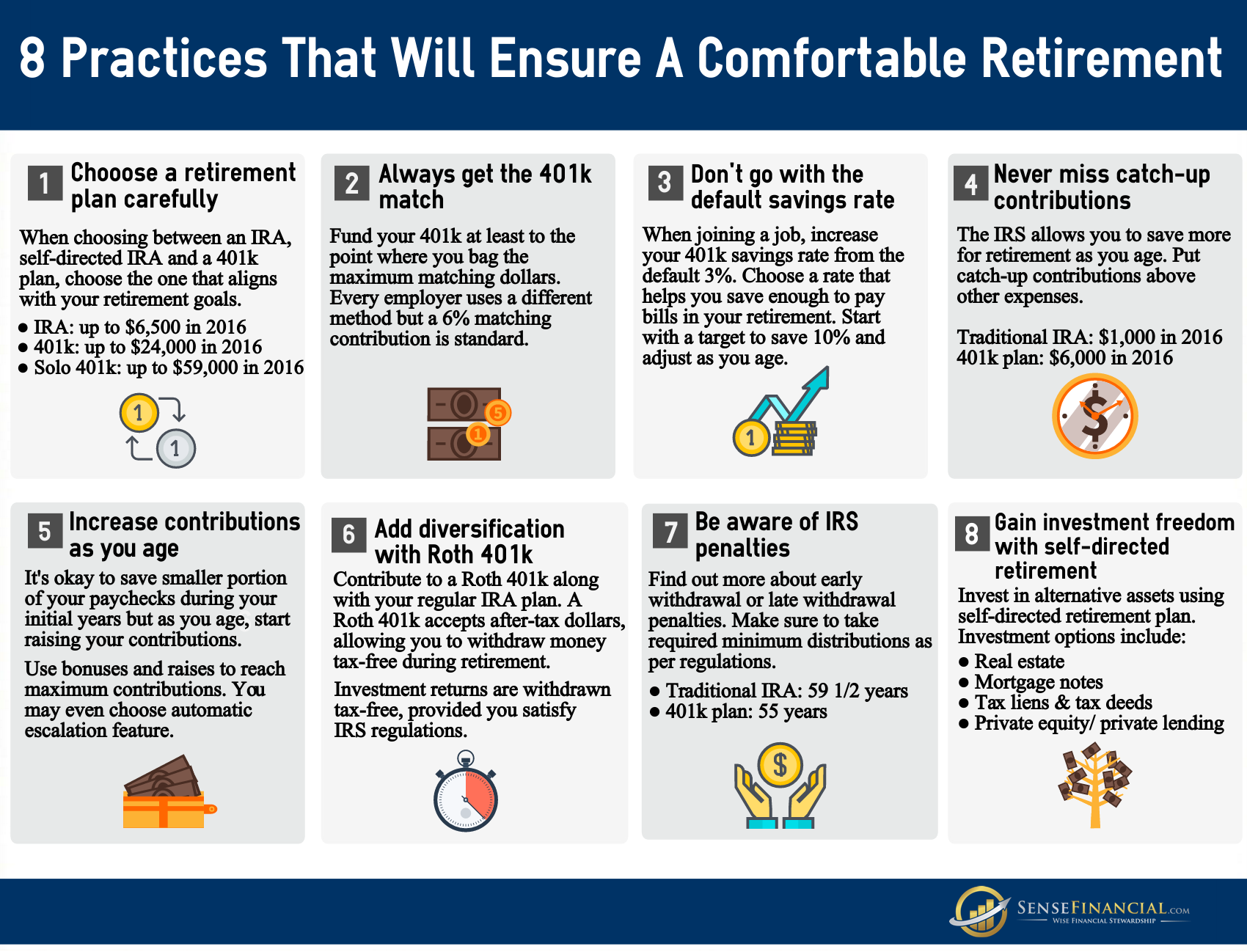

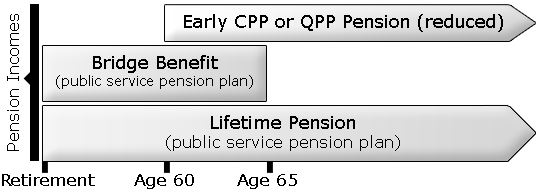

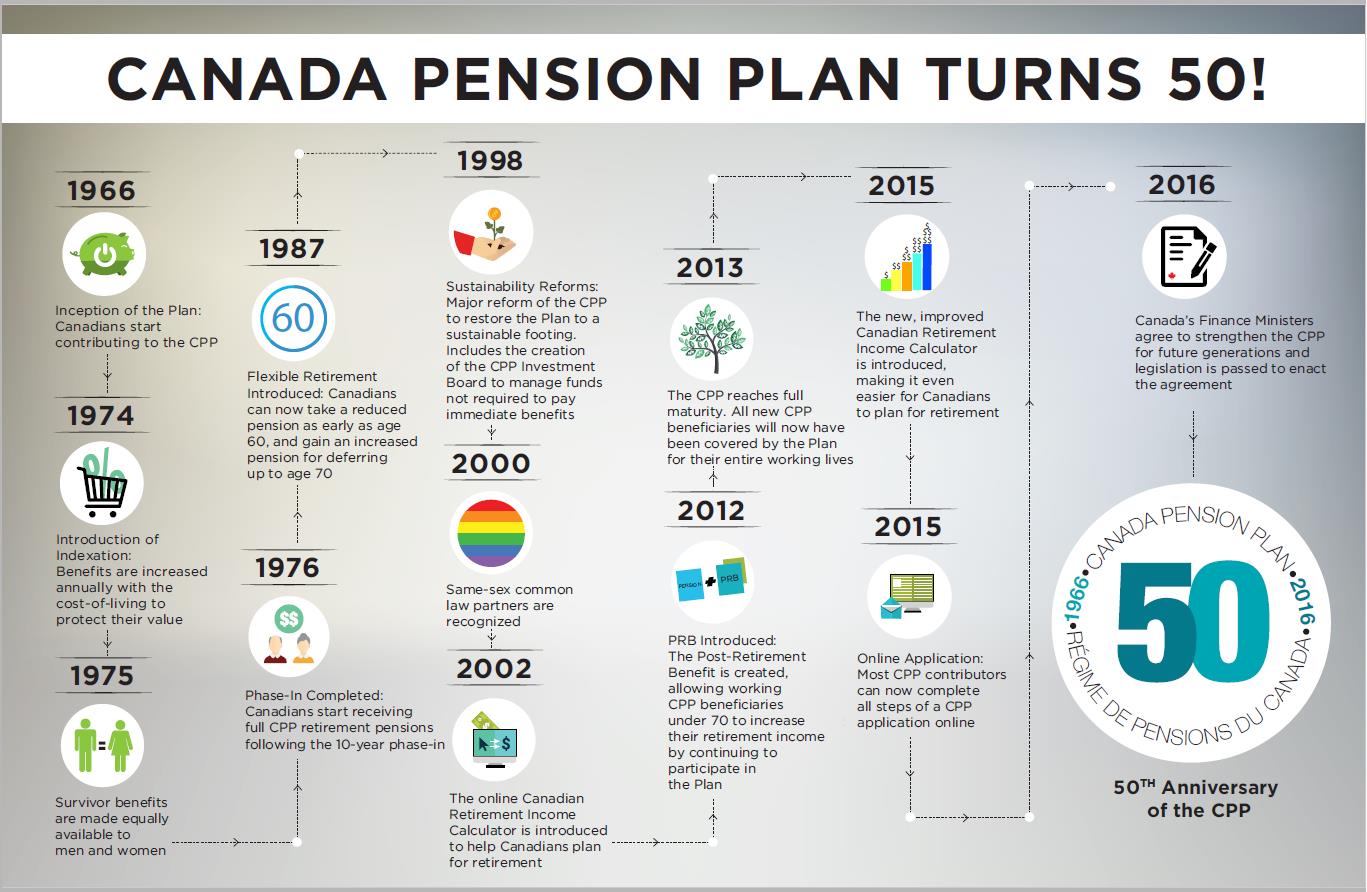

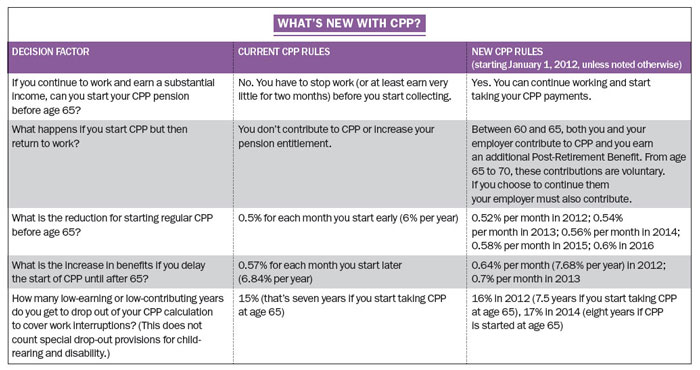

Early Retirement Canada At 60. There’s no benefit to wait after age 70 to start. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level. The following table illustrates the contribution rates for 2022. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller.

Old age pension early application canada 60 From alexisfraser.com

Old age pension early application canada 60 From alexisfraser.com

You can start taking the cpp as early as age 60 or as late as age 70. The standard age to start the pension is 65. In 2022, you will contribute. The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. Certain conditions must be satisfied in order to receive cpp before age 65.

You should consider your health, life expectancy, financial situation and plans for your retirement before deciding.

However, you can start receiving it as early as age 60 or as late as age 70. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level. You can start taking the cpp as early as age 60 or as late as age 70. However, you can start receiving it as early as age 60 or as late as age 70.

Source: canada.ca

Source: canada.ca

The standard age to start the pension is 65. There’s no benefit to wait after age 70 to start. The standard age to start the pension is 65. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level. You should consider your health, life expectancy, financial situation and plans for your retirement before deciding.

Source: advisorsavvy.com

Source: advisorsavvy.com

Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. You should consider your health, life expectancy, financial situation and plans for your retirement before deciding. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level. Certain conditions must be satisfied in order to receive cpp before age 65. The following table illustrates the contribution rates for 2022.

Source: pay2day.ca

Source: pay2day.ca

If you decide to start later, you’ll receive a larger monthly amount. You can start taking the cpp as early as age 60 or as late as age 70. Certain conditions must be satisfied in order to receive cpp before age 65. There’s no benefit to wait after age 70 to start. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level.

Source: pinterest.com

Source: pinterest.com

The following table illustrates the contribution rates for 2022. The standard age to start the pension is 65. You should consider your health, life expectancy, financial situation and plans for your retirement before deciding. You can start taking the cpp as early as age 60 or as late as age 70. The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period.

Source: financialpost.com

Source: financialpost.com

However, you can start receiving it as early as age 60 or as late as age 70. If you decide to start later, you’ll receive a larger monthly amount. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. The following table illustrates the contribution rates for 2022. The standard age to start the pension is 65.

Source: fool.ca

Source: fool.ca

You should consider your health, life expectancy, financial situation and plans for your retirement before deciding. The standard age to start the pension is 65. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level. If you decide to start later, you’ll receive a larger monthly amount. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70.

Source: wsj.com

Source: wsj.com

In 2022, you will contribute. If you decide to start later, you’ll receive a larger monthly amount. In 2022, you will contribute. You can start taking the cpp as early as age 60 or as late as age 70. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller.

Source: nbc.ca

Source: nbc.ca

However, you can start receiving it as early as age 60 or as late as age 70. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. Certain conditions must be satisfied in order to receive cpp before age 65. However, you can start receiving it as early as age 60 or as late as age 70.

Source: canada.ca

Source: canada.ca

The standard age to start the pension is 65. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level. Up to the year’s maximum pensionable earnings ($64,900 in 2022) 9.53%. The following table illustrates the contribution rates for 2022. The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period.

Source: savvynewcanadians.com

Source: savvynewcanadians.com

If you decide to start later, you’ll receive a larger monthly amount. If you decide to start later, you’ll receive a larger monthly amount. In 2022, you will contribute. The following table illustrates the contribution rates for 2022. There’s no benefit to wait after age 70 to start.

Source: advisorsavvy.com

Source: advisorsavvy.com

You can start taking the cpp as early as age 60 or as late as age 70. Certain conditions must be satisfied in order to receive cpp before age 65. You should consider your health, life expectancy, financial situation and plans for your retirement before deciding. If you decide to start later, you’ll receive a larger monthly amount. There’s no benefit to wait after age 70 to start.

Source: tridelta.ca

Source: tridelta.ca

The standard age to start the pension is 65. There’s no benefit to wait after age 70 to start. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period. If you decide to start later, you’ll receive a larger monthly amount.

Source: alexisfraser.com

Source: alexisfraser.com

Up to the year’s maximum pensionable earnings ($64,900 in 2022) 9.53%. However, you can start receiving it as early as age 60 or as late as age 70. The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period. You can start taking the cpp as early as age 60 or as late as age 70. Certain conditions must be satisfied in order to receive cpp before age 65.

Source: csus.edu

Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. However, you can start receiving it as early as age 60 or as late as age 70. Up to the year’s maximum pensionable earnings ($64,900 in 2022) 9.53%. There’s no benefit to wait after age 70 to start.

Source: liberal.ca

Source: liberal.ca

You can start taking the cpp as early as age 60 or as late as age 70. There’s no benefit to wait after age 70 to start. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level.

Source: noeimage.org

Source: noeimage.org

There’s no benefit to wait after age 70 to start. The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period. There’s no benefit to wait after age 70 to start. You can start taking the cpp as early as age 60 or as late as age 70. To qualify for cpp benefits between the ages of 60 and 65 you must have either stopped working or have earnings below a specified income level.

Source: www150.statcan.gc.ca

Source: www150.statcan.gc.ca

Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. There’s no benefit to wait after age 70 to start. You should consider your health, life expectancy, financial situation and plans for your retirement before deciding. If you decide to start later, you’ll receive a larger monthly amount. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller.

Source: alexisfraser.com

Source: alexisfraser.com

The earlier you begin receiving the cpp, the less you’ll receive each month, but you may potentially receive it for a longer period. Up to the year’s maximum pensionable earnings ($64,900 in 2022) 9.53%. Certain conditions must be satisfied in order to receive cpp before age 65. Although age 65 is a popular retirement age, it is possible to commence receiving cpp as early as age 60 or as late as age 70. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement canada at 60 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.