Your Retirement benefits images are ready. Retirement benefits are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement benefits files here. Download all free photos and vectors.

If you’re looking for retirement benefits pictures information linked to the retirement benefits interest, you have visit the right site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

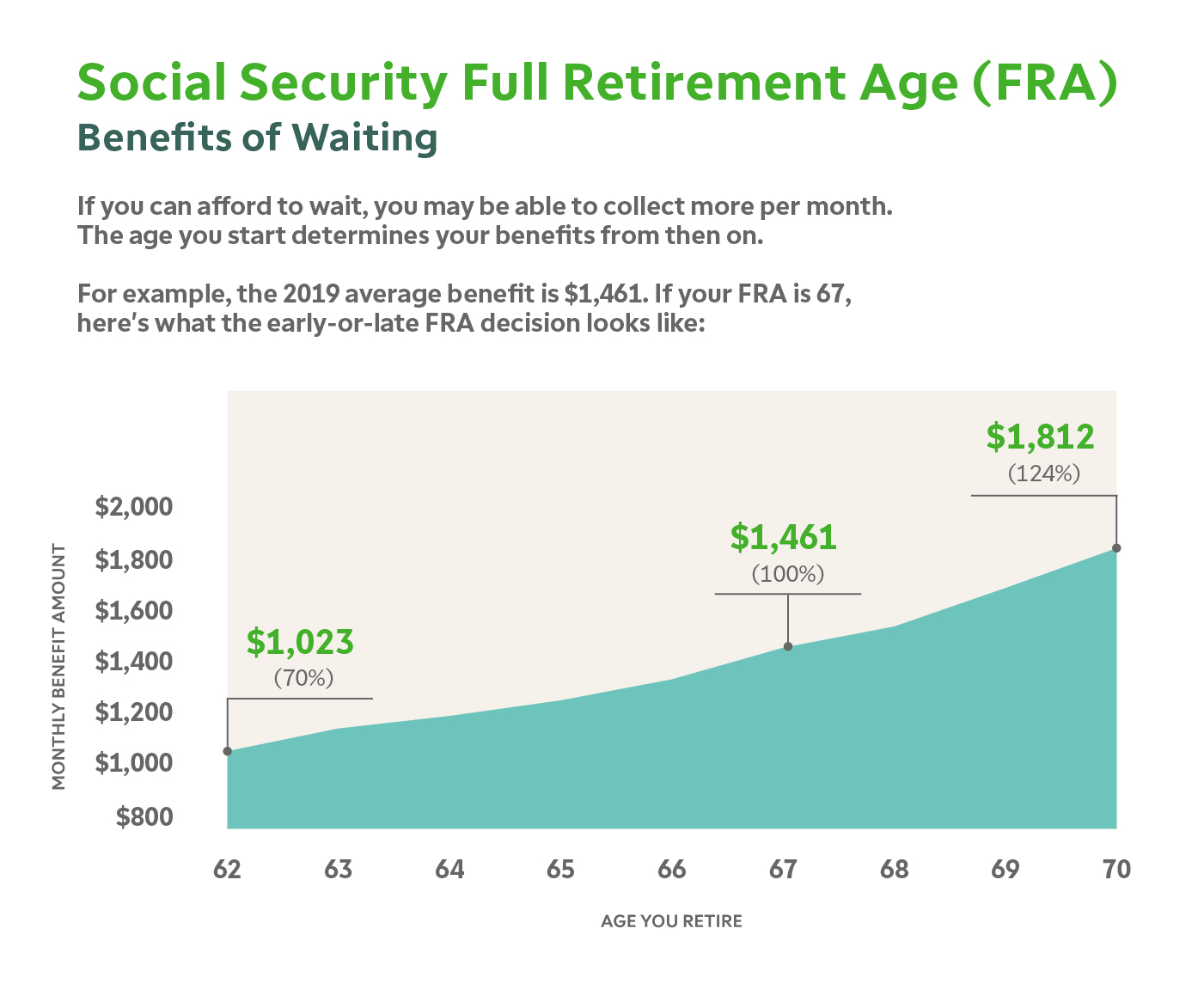

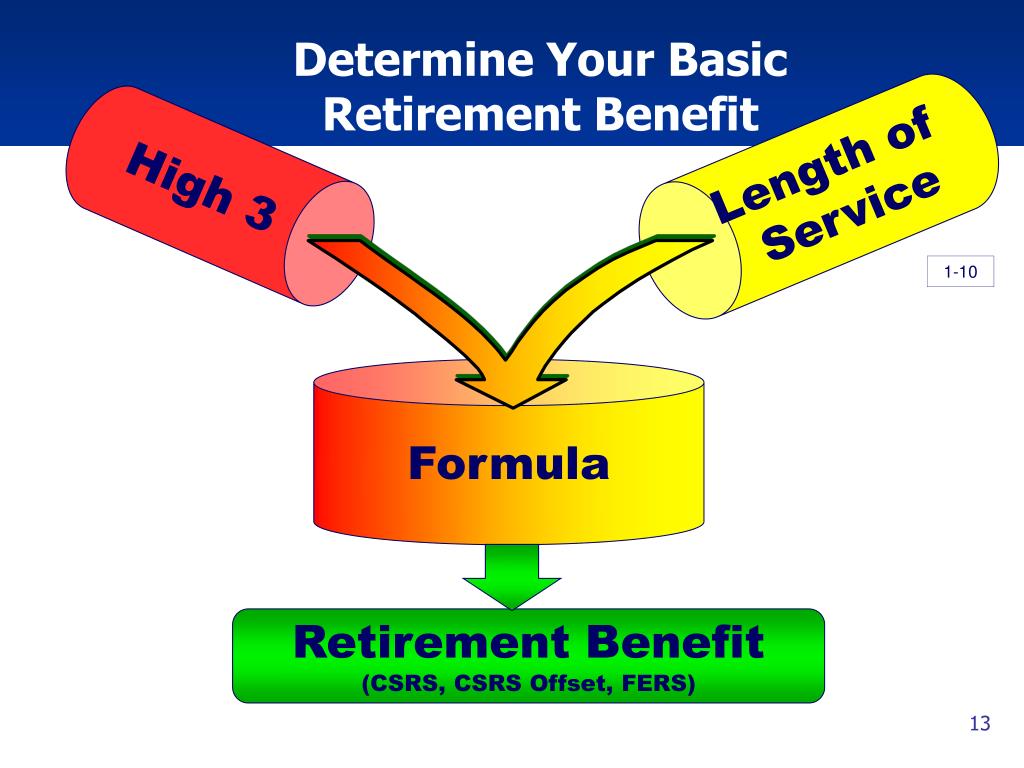

Retirement Benefits. It provides replacement income for qualified retirees and their families. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. You can start your retirement benefits as early as age 62 or as late as age 70.

Retirement Planning JamaPunji From jamapunji.pk

If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you. Retirement benefits are the money or other incentives that a person collects after their employment ends. Social security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. This leaves approximately 40 percent to be replaced by retirement savings. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement.

Retirement benefits are the money or other incentives that a person collects after their employment ends.

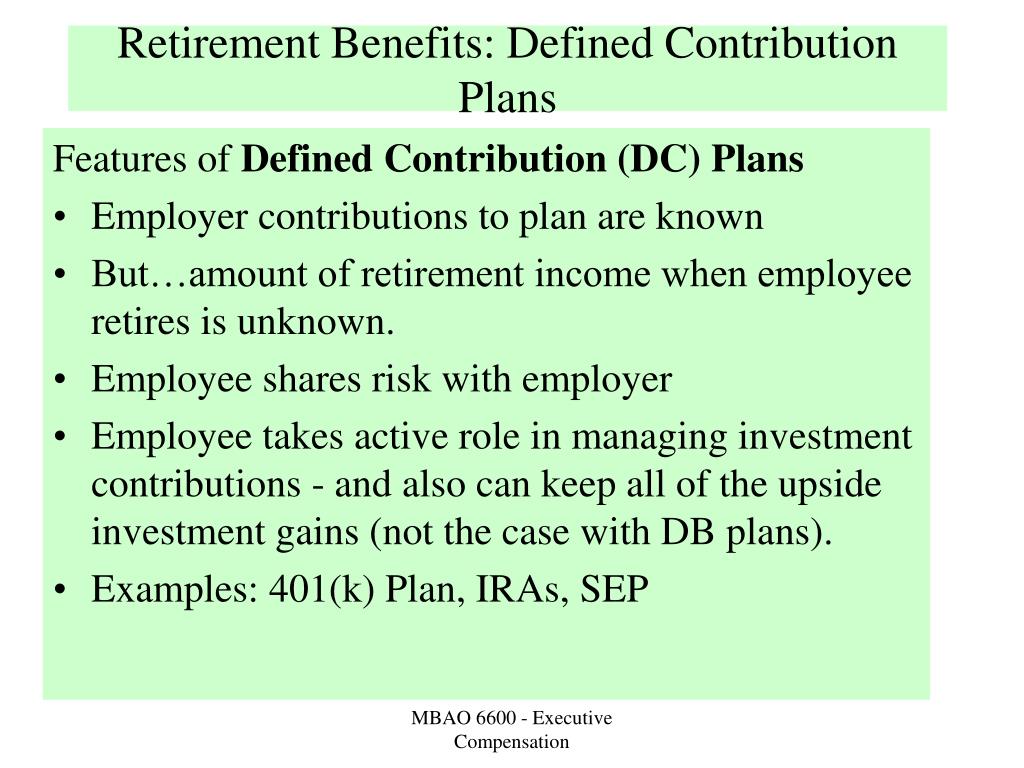

Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. It provides replacement income for qualified retirees and their families. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you. Social security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. Retirement benefits are the money or other incentives that a person collects after their employment ends.

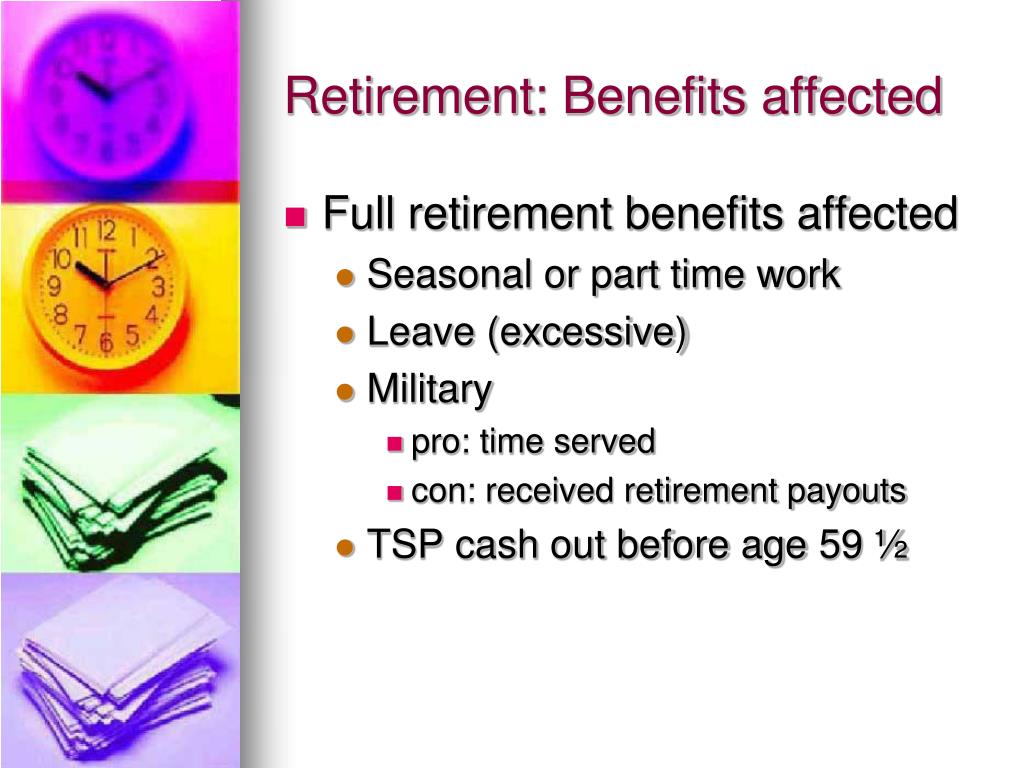

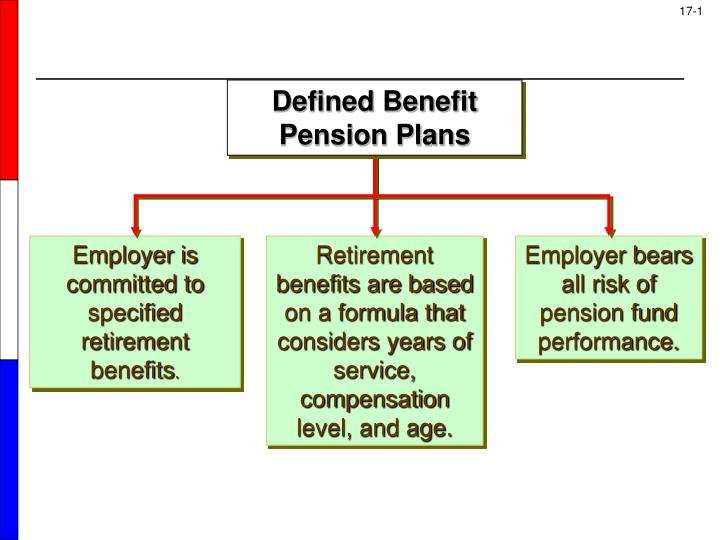

Source: slideserve.com

Source: slideserve.com

Retirement benefits are the money or other incentives that a person collects after their employment ends. Retirement benefits are the money or other incentives that a person collects after their employment ends. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. Social security is part of the retirement plan for almost every american worker.

Source: cbivsincometax.in

Source: cbivsincometax.in

The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. You can start your retirement benefits as early as age 62 or as late as age 70. Social security is part of the retirement plan for almost every american worker. Retirement benefits are the money or other incentives that a person collects after their employment ends.

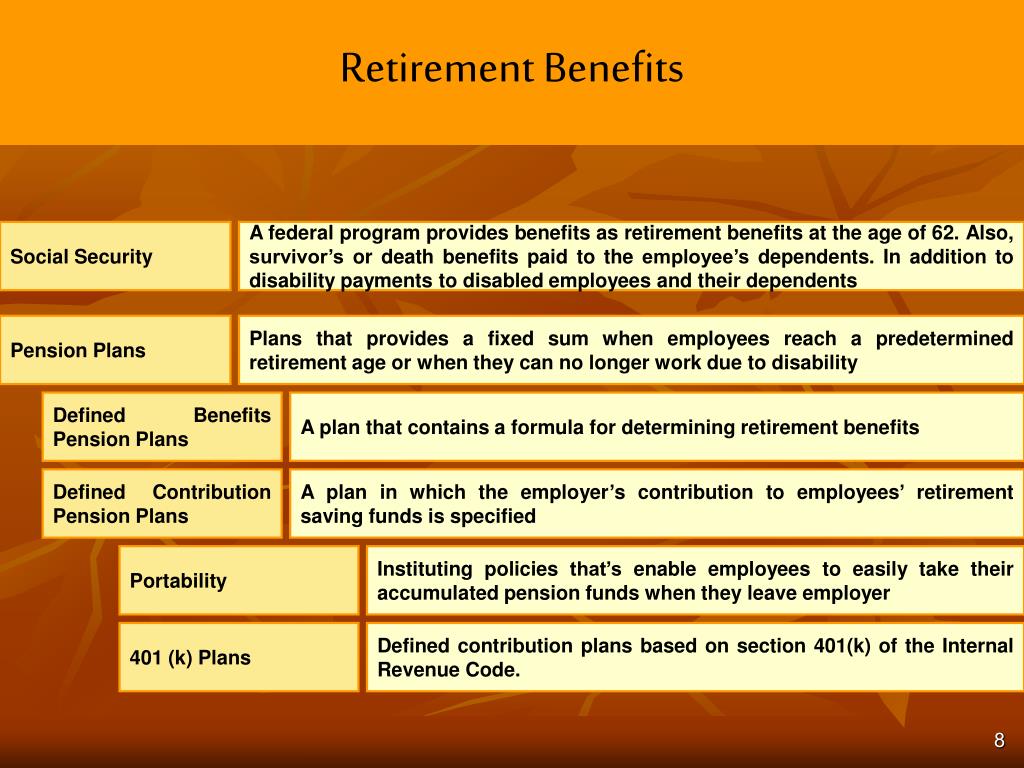

Source: slideserve.com

Source: slideserve.com

Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. It provides replacement income for qualified retirees and their families. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you.

Source: slideserve.com

Source: slideserve.com

Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. You can start your retirement benefits as early as age 62 or as late as age 70. This leaves approximately 40 percent to be replaced by retirement savings. Social security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can.

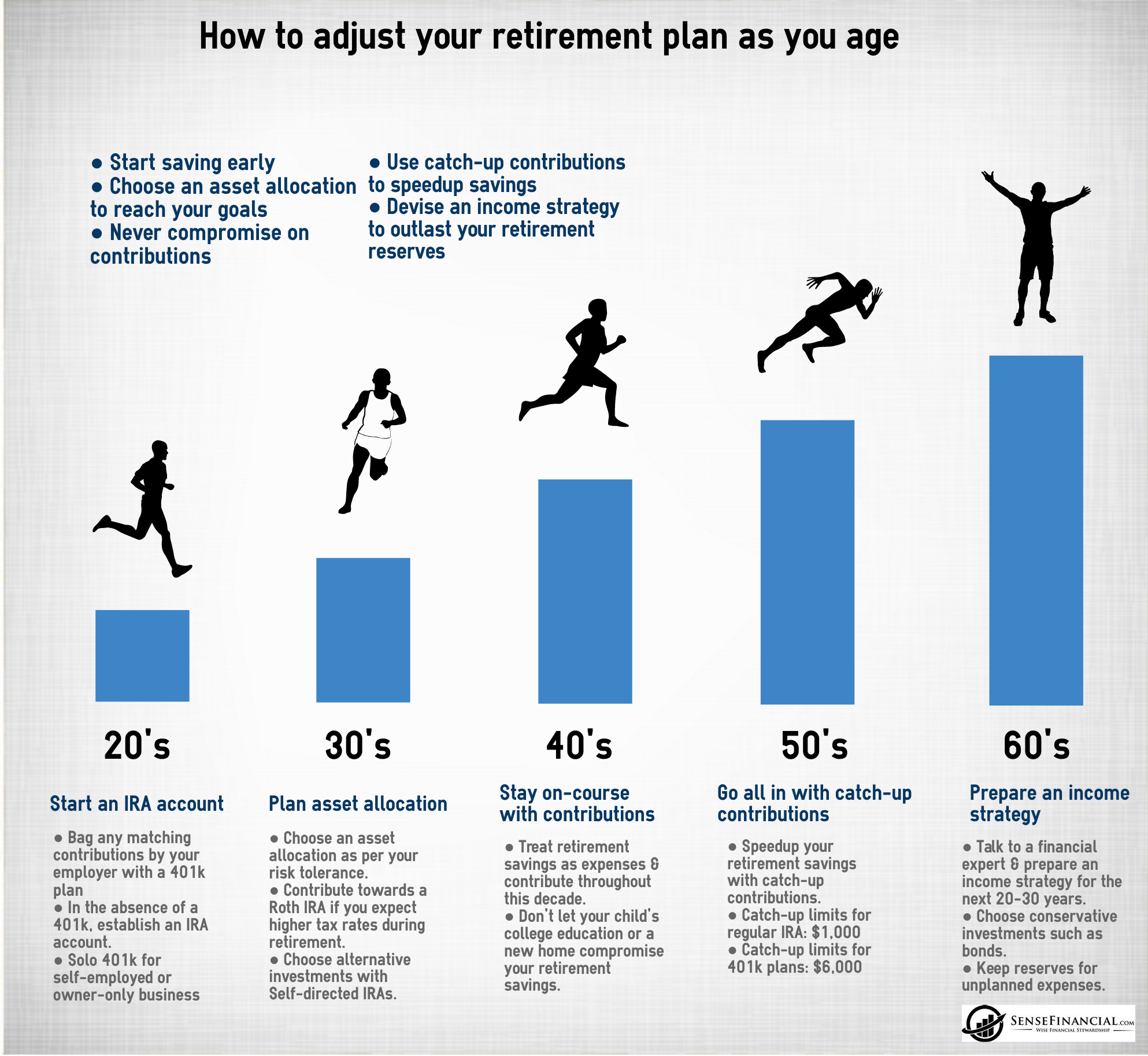

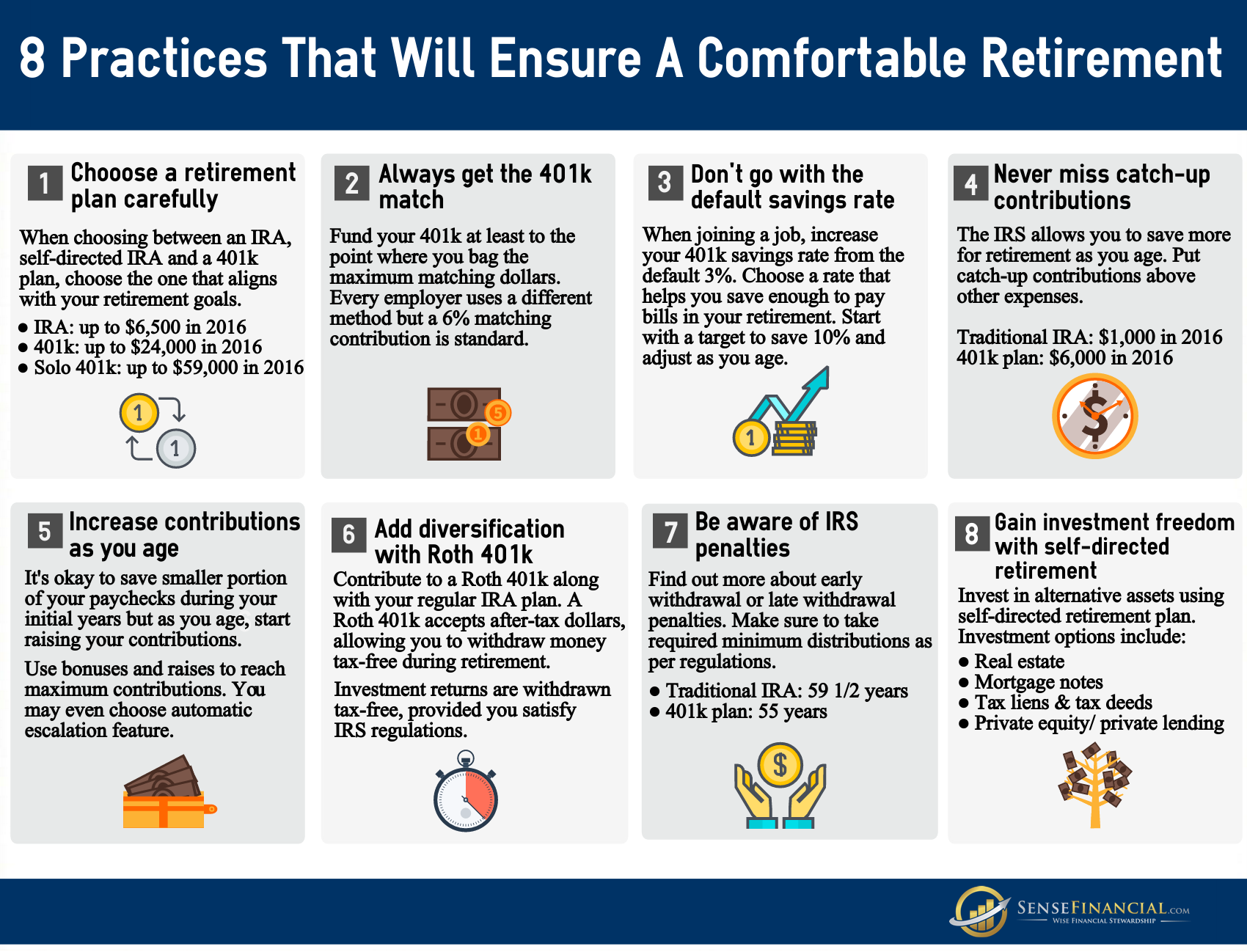

Source: sensefinancial.com

Source: sensefinancial.com

Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can.

Source: kcpsrs.org

Source: kcpsrs.org

This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. This leaves approximately 40 percent to be replaced by retirement savings. If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. It provides replacement income for qualified retirees and their families.

Source: psretirement.com

Source: psretirement.com

It provides replacement income for qualified retirees and their families. Social security is part of the retirement plan for almost every american worker. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. You can start your retirement benefits as early as age 62 or as late as age 70.

Source: housebuyers4u.co.uk

Source: housebuyers4u.co.uk

The ira contribution limit is $5,500 in 2015, and savers age 50 and older can. This leaves approximately 40 percent to be replaced by retirement savings. Retirement benefits are the money or other incentives that a person collects after their employment ends. It provides replacement income for qualified retirees and their families. Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower.

Source: progressivecutt.com

Source: progressivecutt.com

It provides replacement income for qualified retirees and their families. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can. It provides replacement income for qualified retirees and their families. If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you. Social security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring.

Source: jamapunji.pk

This leaves approximately 40 percent to be replaced by retirement savings. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. You can start your retirement benefits as early as age 62 or as late as age 70. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can.

Source: slideserve.com

Source: slideserve.com

Retirement benefits are the money or other incentives that a person collects after their employment ends. You can start your retirement benefits as early as age 62 or as late as age 70. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can. It provides replacement income for qualified retirees and their families. Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower.

Source: kcpsrs.org

Source: kcpsrs.org

You can start your retirement benefits as early as age 62 or as late as age 70. Social security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. It provides replacement income for qualified retirees and their families. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. Social security is part of the retirement plan for almost every american worker.

![4 Major Benefits of a Personal Retirement Plan [Infographic] 4 Major Benefits of a Personal Retirement Plan [Infographic]](http://blog.highlandbrokerage.com/wp-content/uploads/2015/08/4-Major-Benefits-of-a-Personal-Retirement-Plan-Infographic-Revised.png) Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement. Social security is part of the retirement plan for almost every american worker. Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances. Retirement benefits are the money or other incentives that a person collects after their employment ends.

Source: slideserve.com

Source: slideserve.com

Social security is part of the retirement plan for almost every american worker. Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you. You can start your retirement benefits as early as age 62 or as late as age 70. The ira contribution limit is $5,500 in 2015, and savers age 50 and older can.

Source: dreamstime.com

Source: dreamstime.com

This leaves approximately 40 percent to be replaced by retirement savings. You can start your retirement benefits as early as age 62 or as late as age 70. Social security is part of the retirement plan for almost every american worker. It provides replacement income for qualified retirees and their families. This leaves approximately 40 percent to be replaced by retirement savings.

Source: sensefinancial.com

Source: sensefinancial.com

You can start your retirement benefits as early as age 62 or as late as age 70. Retirement benefits are the money or other incentives that a person collects after their employment ends. It provides replacement income for qualified retirees and their families. This leaves approximately 40 percent to be replaced by retirement savings. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you.

Source: slideserve.com

Source: slideserve.com

Social security is part of the retirement plan for almost every american worker. Individual retirement accounts offer similar tax treatments to 401(k)s, but the contribution limits are lower. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. Social security is part of the retirement plan for almost every american worker. The plan to receive them is put in place while the employee is still working, and a portion of their salary, along with a contribution from the employer, is collected periodically until their retirement.

Source: sensefinancial.com

Source: sensefinancial.com

It provides replacement income for qualified retirees and their families. If you’re preparing to apply for retirement benefits, knowing when you’re eligible to apply and how the system works are the first steps in choosing what age is right for you. You can start your retirement benefits as early as age 62 or as late as age 70. This leaves approximately 40 percent to be replaced by retirement savings. Social security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement benefits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.