Your Early retirement 40 images are available in this site. Early retirement 40 are a topic that is being searched for and liked by netizens today. You can Download the Early retirement 40 files here. Download all free photos and vectors.

If you’re looking for early retirement 40 images information linked to the early retirement 40 interest, you have pay a visit to the ideal site. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Early Retirement 40. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. By planning for each phase, you can move toward an early retirement with a greater level of confidence.

Lessons learnt from COVID Lockdown A personal view Early Retirement From earlyretireby40.com

Lessons learnt from COVID Lockdown A personal view Early Retirement From earlyretireby40.com

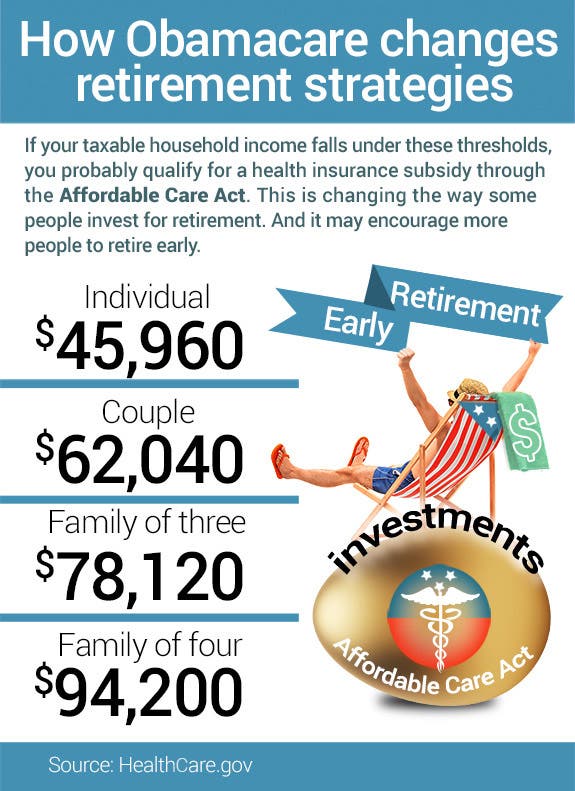

Take your monthly expenses and multiply by 12 to get a yearly estimate. By planning for each phase, you can move toward an early retirement with a greater level of confidence. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year.

By planning for each phase, you can move toward an early retirement with a greater level of confidence.

For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. By planning for each phase, you can move toward an early retirement with a greater level of confidence. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years.

Source: pinterest.com

Source: pinterest.com

Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. By planning for each phase, you can move toward an early retirement with a greater level of confidence. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash.

.png “InvestorQ I am in my early 40’s and want to build up a retirement”) Source: investorq.com

Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. Take your monthly expenses and multiply by 12 to get a yearly estimate. By planning for each phase, you can move toward an early retirement with a greater level of confidence. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year.

Source: earlyretireby40.com

Source: earlyretireby40.com

By planning for each phase, you can move toward an early retirement with a greater level of confidence. By planning for each phase, you can move toward an early retirement with a greater level of confidence. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to.

Source: pinterest.com

Source: pinterest.com

Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. By planning for each phase, you can move toward an early retirement with a greater level of confidence. Take your monthly expenses and multiply by 12 to get a yearly estimate.

Source: retireby40.org

Source: retireby40.org

By planning for each phase, you can move toward an early retirement with a greater level of confidence. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. Take your monthly expenses and multiply by 12 to get a yearly estimate. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years.

Source: retireby40.org

Source: retireby40.org

By planning for each phase, you can move toward an early retirement with a greater level of confidence. By planning for each phase, you can move toward an early retirement with a greater level of confidence. Take your monthly expenses and multiply by 12 to get a yearly estimate. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash.

Source: retireby40.org

Source: retireby40.org

Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. Take your monthly expenses and multiply by 12 to get a yearly estimate. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to.

Source: retireby40.org

Source: retireby40.org

With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. By planning for each phase, you can move toward an early retirement with a greater level of confidence. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash.

Source: pinterest.com

Source: pinterest.com

The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. Take your monthly expenses and multiply by 12 to get a yearly estimate. By planning for each phase, you can move toward an early retirement with a greater level of confidence.

Source: pinterest.com

Source: pinterest.com

By planning for each phase, you can move toward an early retirement with a greater level of confidence. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. Take your monthly expenses and multiply by 12 to get a yearly estimate. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year.

Source: pinterest.com

Source: pinterest.com

Take your monthly expenses and multiply by 12 to get a yearly estimate. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to.

Source: retireby40.org

Source: retireby40.org

For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years.

Source: retireby40.org

Source: retireby40.org

With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to.

Source: retireby40.org

Source: retireby40.org

For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. Take your monthly expenses and multiply by 12 to get a yearly estimate. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. With this approach, $48,000 multiplied by 25 to 30 means you will need to save between $1.2 million and $1.44 million, with an additional $48,000 in cash.

Source: pinterest.com

Source: pinterest.com

Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. Take your monthly expenses and multiply by 12 to get a yearly estimate. By planning for each phase, you can move toward an early retirement with a greater level of confidence. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year.

Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year. By planning for each phase, you can move toward an early retirement with a greater level of confidence. Take your monthly expenses and multiply by 12 to get a yearly estimate. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years.

Source: pinterest.com

Source: pinterest.com

Take your monthly expenses and multiply by 12 to get a yearly estimate. The fire movement, short for “financial independence, retire early,” has many people dreaming of an early retirement.but while some people think “early retirement” means calling it a career at 55, some have far more ambitious retirement goals, aiming to. Retiring at 40 means you will have to wait 25 years before you�re eligible for medicare—and you�ll only get it if you or your spouse paid medicare payroll taxes for at least 10 years. By planning for each phase, you can move toward an early retirement with a greater level of confidence. For example, let’s assume your monthly expenses will be $4,000 a month or $48,000 a year.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement 40 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.