Your Retirement plan beneficiary images are ready in this website. Retirement plan beneficiary are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan beneficiary files here. Find and Download all royalty-free vectors.

If you’re looking for retirement plan beneficiary pictures information related to the retirement plan beneficiary keyword, you have come to the right blog. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly search and find more informative video content and images that match your interests.

Retirement Plan Beneficiary. If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. 1) name of the beneficiary (s); In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. If there is a a designated.

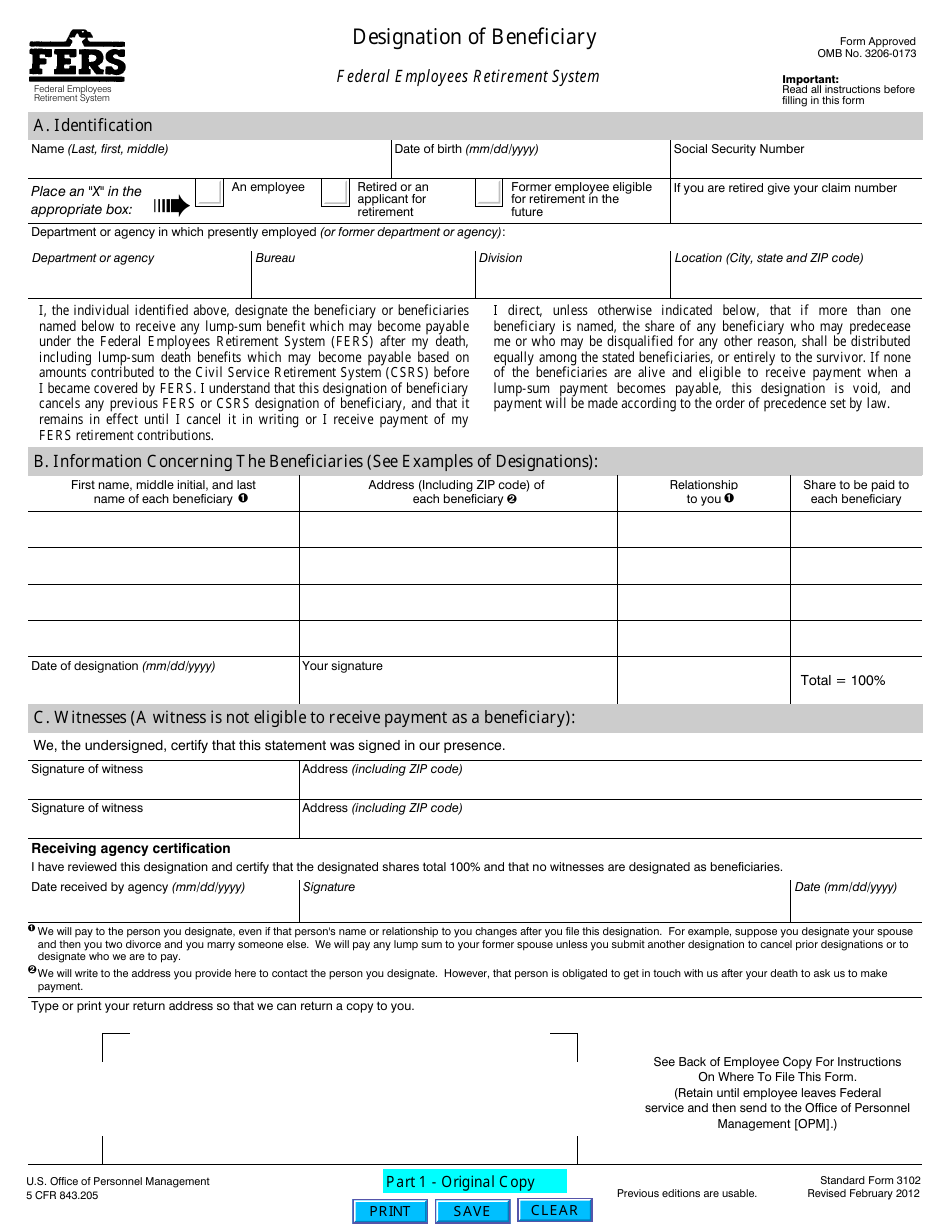

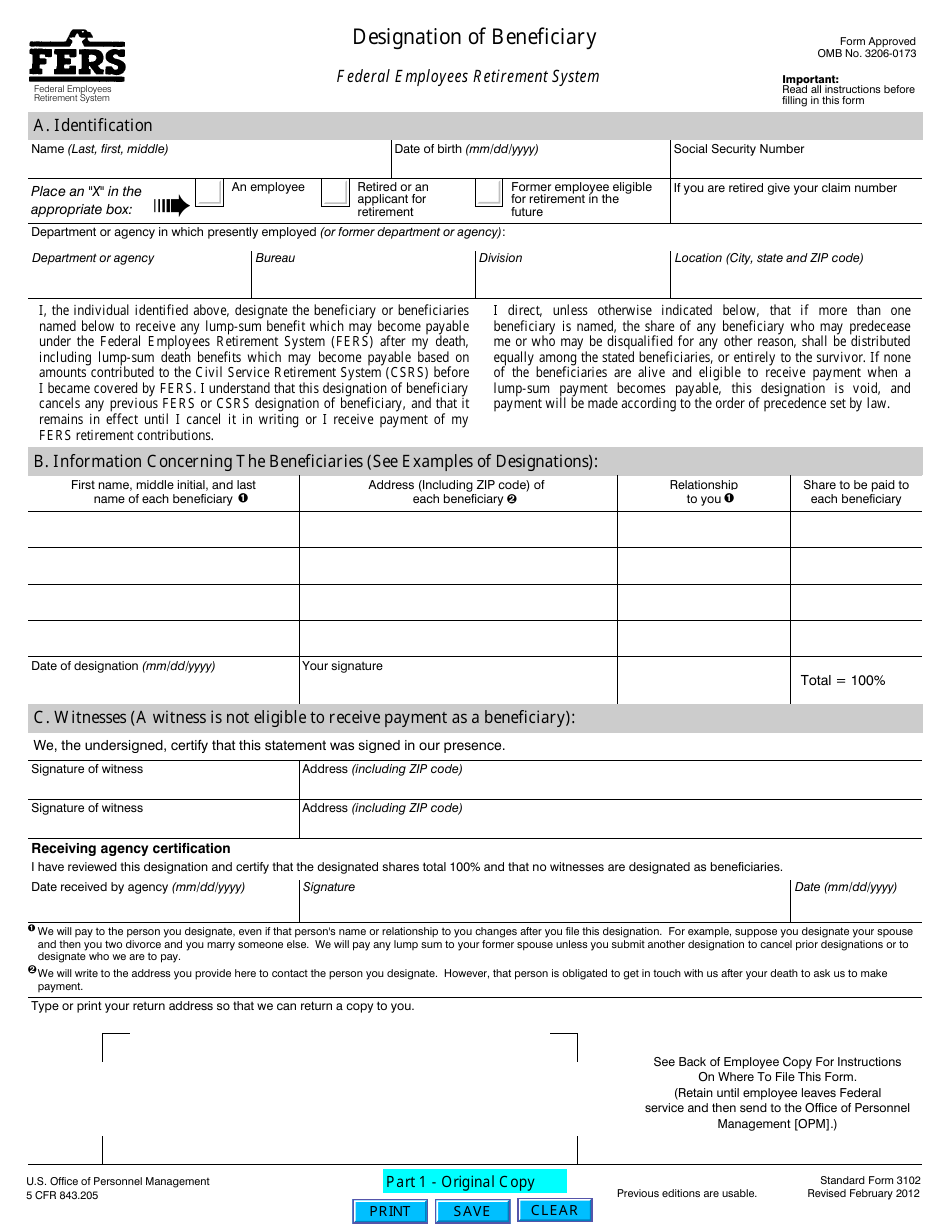

OPM Form SF3102 Download Fillable PDF or Fill Online Designation of From templateroller.com

OPM Form SF3102 Download Fillable PDF or Fill Online Designation of From templateroller.com

A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. 2) amount that each beneficiary would receive; 1) name of the beneficiary (s); If there is a a designated. If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death.

In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death.

If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death. Generally, the entire interest in a roth ira must be distributed. Treat it as his or her own ira by designating himself or herself as the. 3) relationship between the plan participant and the beneficiary. 1) name of the beneficiary (s); In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death.

Source: nysretirementnews.com

Source: nysretirementnews.com

In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. 3) relationship between the plan participant and the beneficiary. If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death. If there is a a designated. A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant.

Source: fool.com

Source: fool.com

Typically, the forms will request the following: A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. 3) relationship between the plan participant and the beneficiary. 2) amount that each beneficiary would receive; In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death.

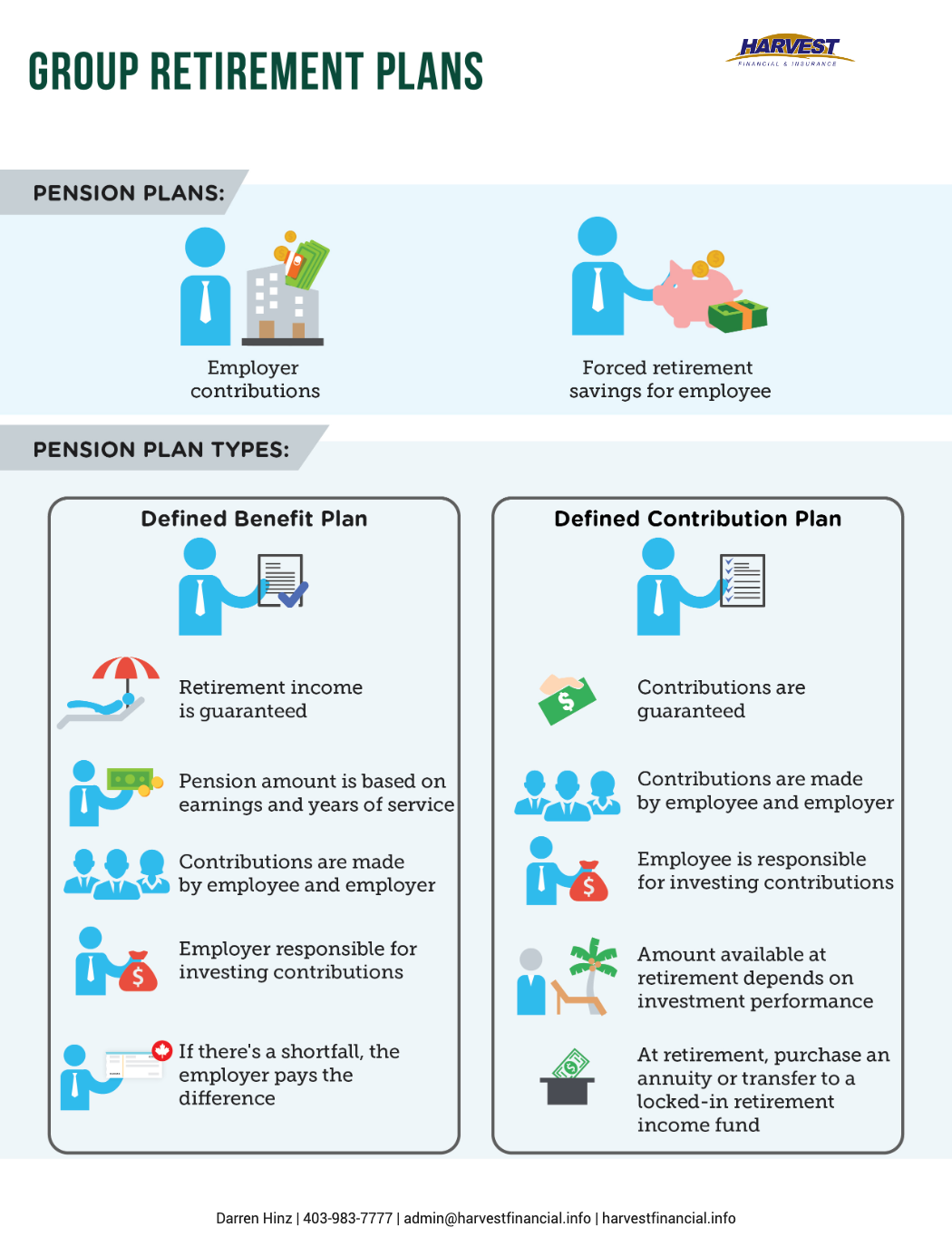

Source: harvest-financial.ca

Source: harvest-financial.ca

- amount that each beneficiary would receive; If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. 1) name of the beneficiary (s); In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. If there is a a designated.

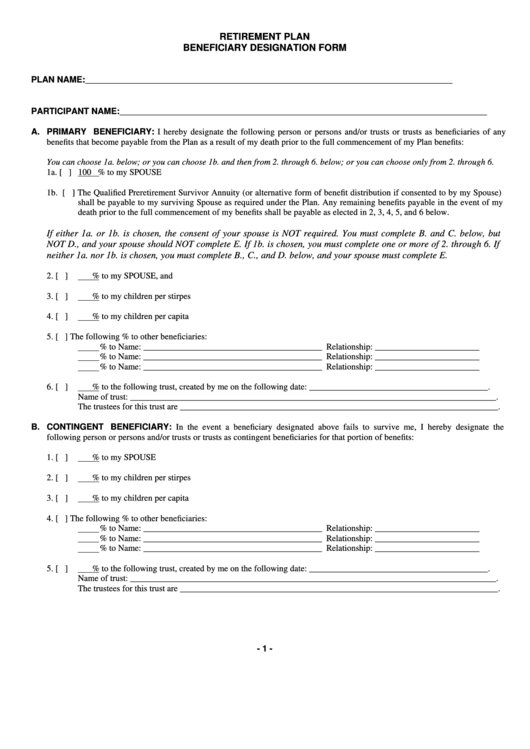

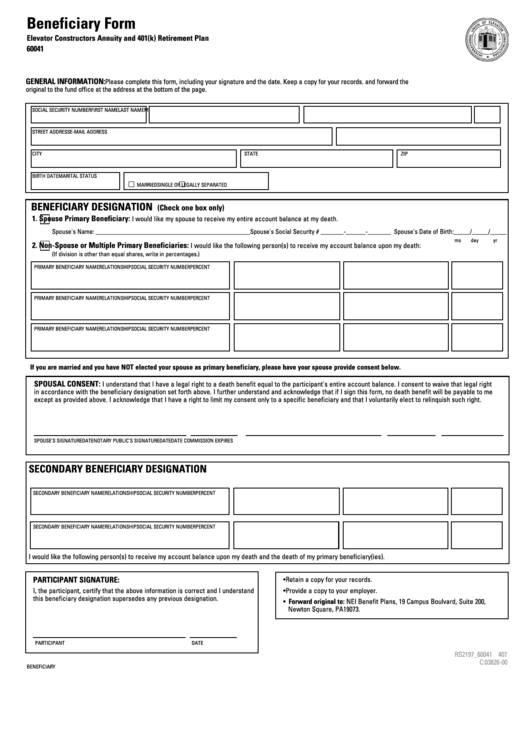

Source: formsbank.com

Source: formsbank.com

If there is a a designated. Typically, the forms will request the following: Generally, the entire interest in a roth ira must be distributed. If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death. In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death.

Source: pinterest.com

Source: pinterest.com

- relationship between the plan participant and the beneficiary. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. If there is a a designated. Typically, the forms will request the following: 3) relationship between the plan participant and the beneficiary.

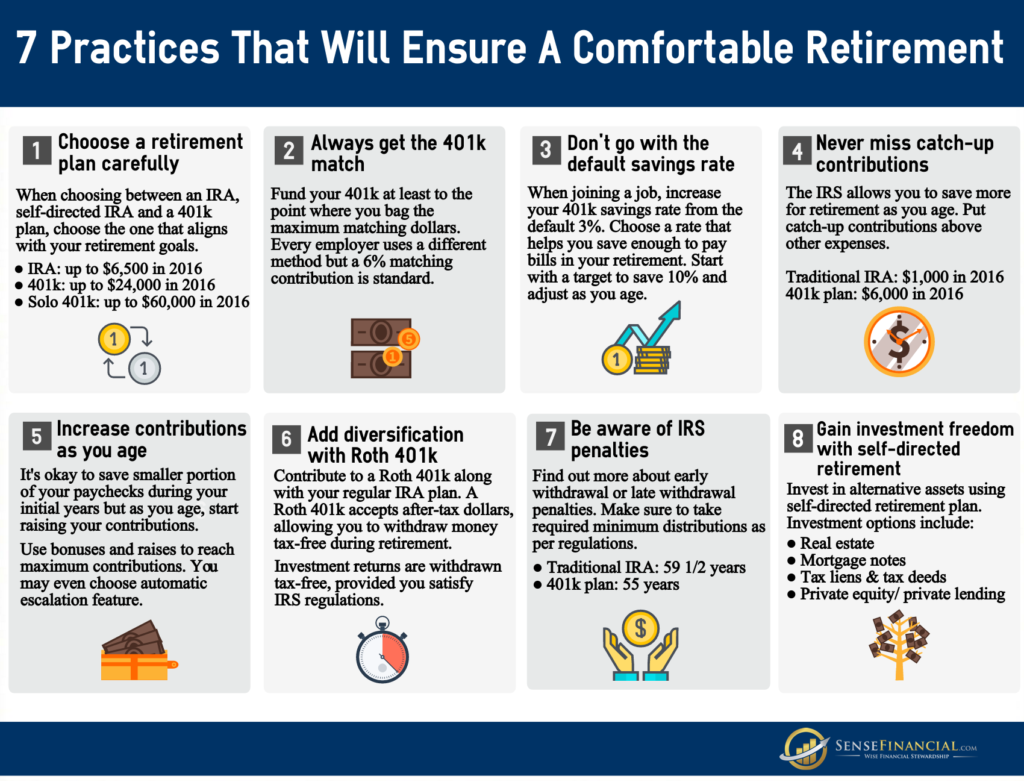

Source: sensefinancial.com

Source: sensefinancial.com

If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. Treat it as his or her own ira by designating himself or herself as the. In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. Generally, the entire interest in a roth ira must be distributed. 1) name of the beneficiary (s);

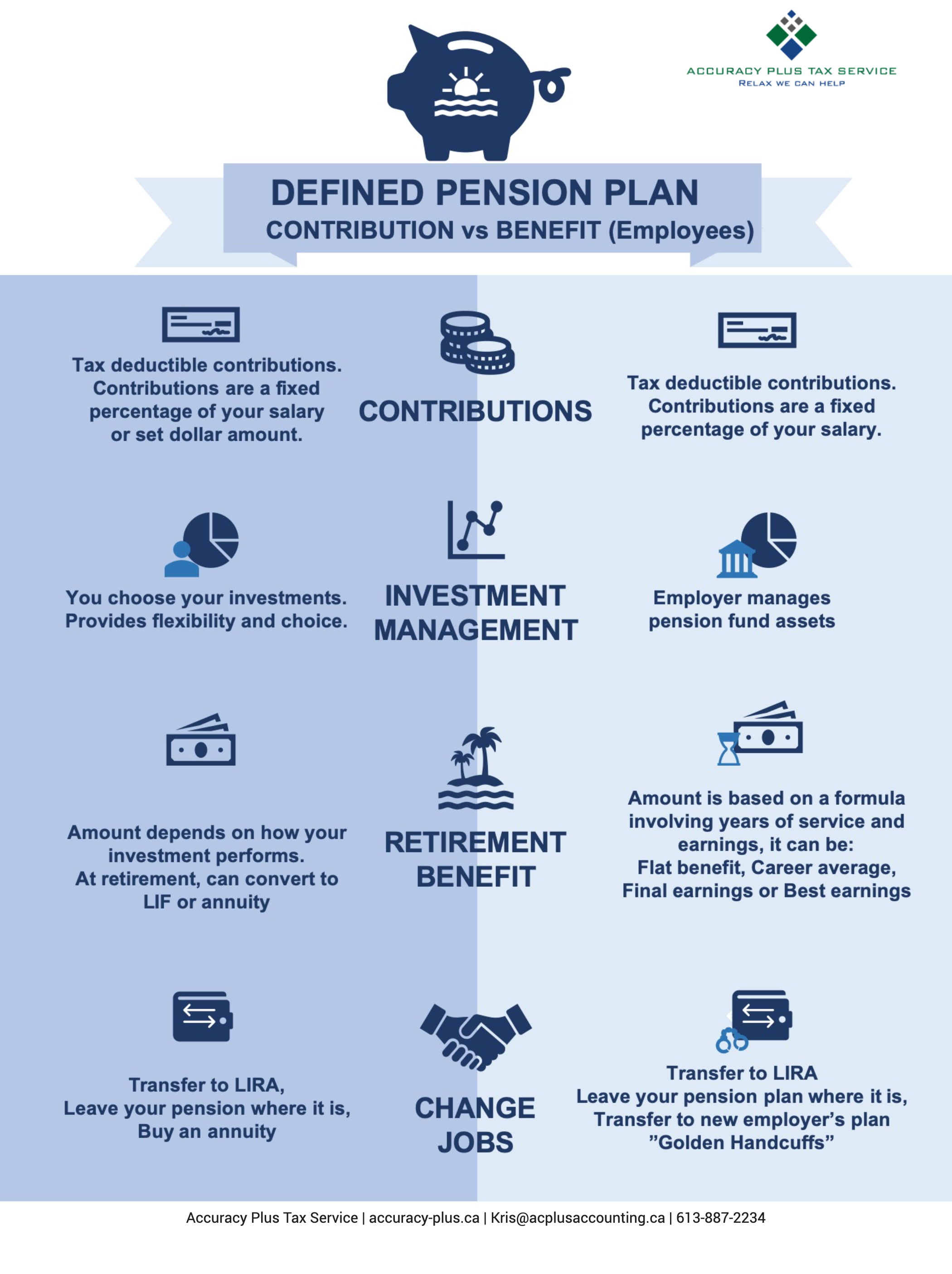

Source: accuracy-plus.ca

Source: accuracy-plus.ca

- amount that each beneficiary would receive; A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. 1) name of the beneficiary (s); Typically, the forms will request the following: If there is a a designated.

![4 Major Benefits of a Personal Retirement Plan [Infographic] 4 Major Benefits of a Personal Retirement Plan [Infographic]](http://blog.highlandbrokerage.com/wp-content/uploads/2015/08/4-Major-Benefits-of-a-Personal-Retirement-Plan-Infographic-Revised.png) Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

- amount that each beneficiary would receive; If there is a a designated. 1) name of the beneficiary (s); 3) relationship between the plan participant and the beneficiary. Treat it as his or her own ira by designating himself or herself as the.

Source: templateroller.com

Source: templateroller.com

A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. If there is a a designated. A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. 2) amount that each beneficiary would receive;

Source: progressivecutt.com

Source: progressivecutt.com

- relationship between the plan participant and the beneficiary. If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death.

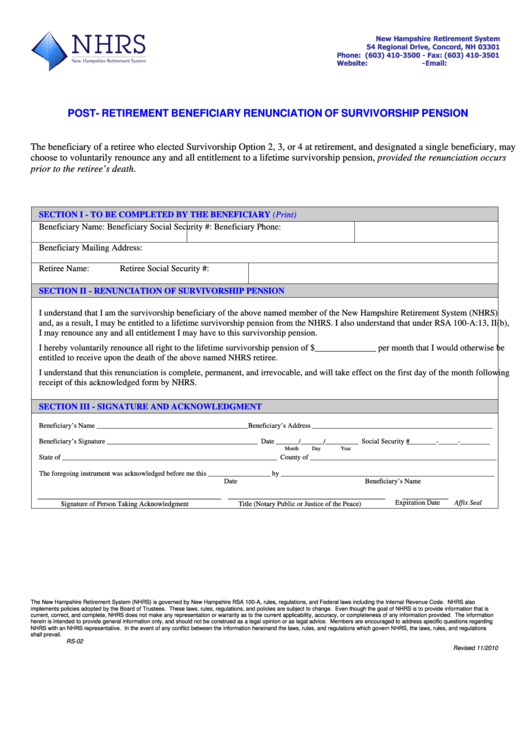

Source: formsbank.com

Source: formsbank.com

A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. 1) name of the beneficiary (s); In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. If there is a a designated. 2) amount that each beneficiary would receive;

Source: advantagewealthplanning.ca

Source: advantagewealthplanning.ca

- relationship between the plan participant and the beneficiary. If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. Typically, the forms will request the following: If there is a a designated.

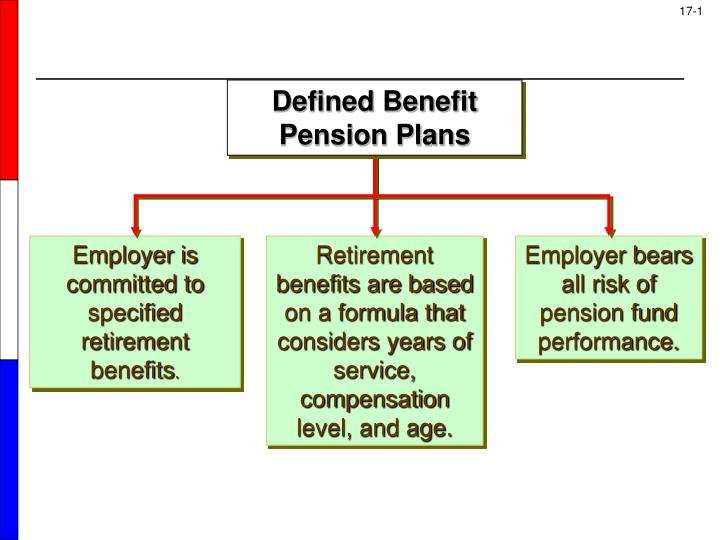

Source: slideserve.com

Source: slideserve.com

- relationship between the plan participant and the beneficiary. Generally, the entire interest in a roth ira must be distributed. If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death.

Source: benefitcorp.com

Source: benefitcorp.com

- name of the beneficiary (s); In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. Treat it as his or her own ira by designating himself or herself as the.

Source: nbsbenefits.com

Source: nbsbenefits.com

A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. If there is a a designated. If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death. A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. 1) name of the beneficiary (s);

Source: formsbank.com

Source: formsbank.com

Typically, the forms will request the following: A beneficiary is a person (or nonperson) who is designated by a participant, or by the plan, and may become entitled to a benefit under a qualified retirement plan after the death of the participant. Typically, the forms will request the following: A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira. 3) relationship between the plan participant and the beneficiary.

Source: sensefinancial.com

Source: sensefinancial.com

- name of the beneficiary (s); In all cases, whether there is a designated beneficiary must be determined by september 30 of the year after the retirement account owner’s death. Treat it as his or her own ira by designating himself or herself as the. If a participant has a last will and testament, should the plan administrator distribute retirement plan assets to the person designated on a plan. A beneficiary can be essentially any person or entity the owner chooses to receive the benefits of the retirement account or an ira.

Source: fill.io

Source: fill.io

Typically, the forms will request the following: Generally, the entire interest in a roth ira must be distributed. 1) name of the beneficiary (s); If there is a a designated. If the retirement owner dies before the rbd and there is no designated beneficiary, then the retirement account must be distributed within 5 years after death.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan beneficiary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.