Your Cpp early retirement age 55 images are ready in this website. Cpp early retirement age 55 are a topic that is being searched for and liked by netizens now. You can Get the Cpp early retirement age 55 files here. Get all free photos.

If you’re searching for cpp early retirement age 55 pictures information linked to the cpp early retirement age 55 interest, you have visit the right site. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

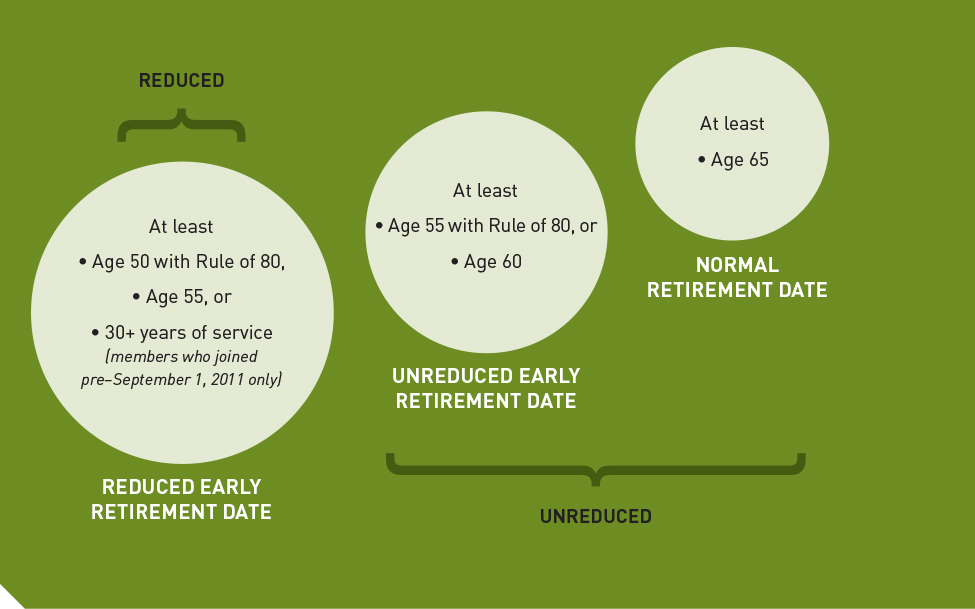

Cpp Early Retirement Age 55. If you delay taking it past age 65 you will earn an additional. So, if you take it at age 60 that means your cheque will be 36% less than if you wait until age 65. If you instead chose cpp early retirement at age 60, you would only draw $449.77. When to start your retirement pension.

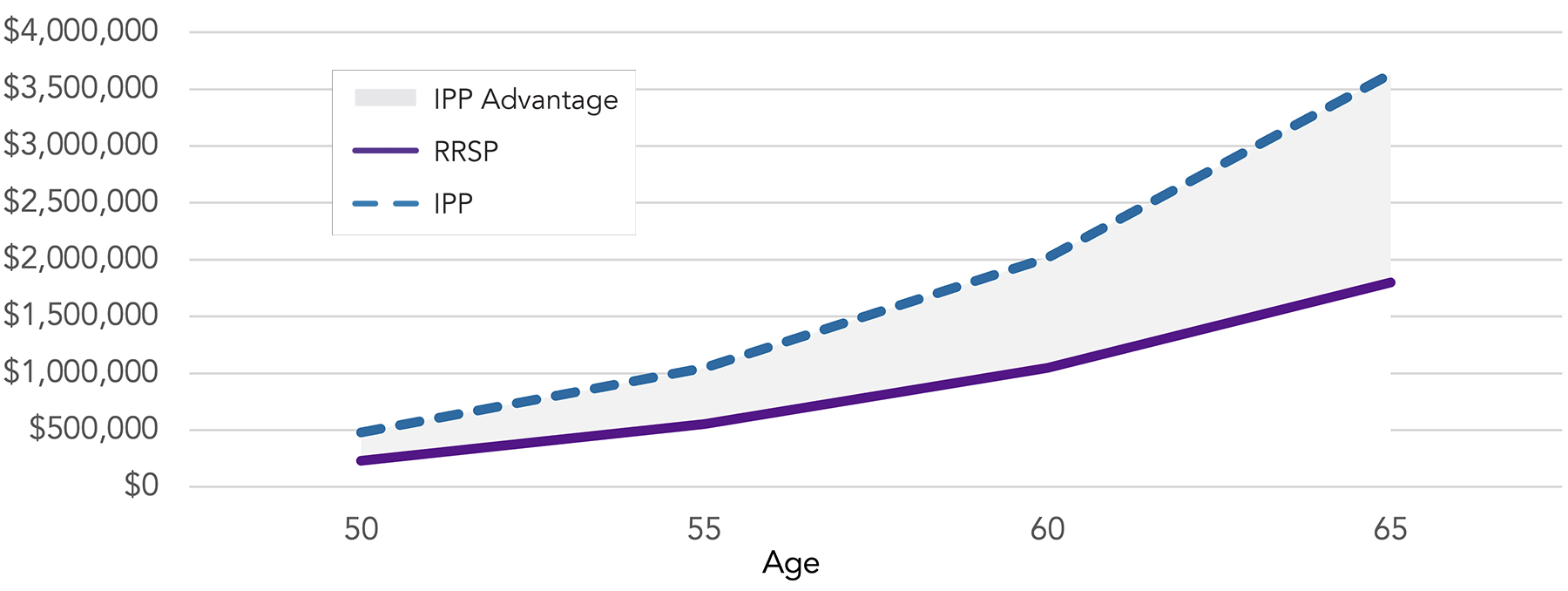

Retirement Discover & Learn RBC Royal Bank From discover.rbcroyalbank.com

Retirement Discover & Learn RBC Royal Bank From discover.rbcroyalbank.com

For every month you take your cpp before age 65 you will lose. However, the longer you delay your cpp, the higher the payments you will receive. So, if you take it at age 60 that means your cheque will be 36% less than if you wait until age 65. As you can see, cpp benefits in early retirement are substantially reduced. Your retirement funds will include the canada pension plan (cpp) and old age security (oas). If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller.

However, the longer you delay your cpp, the higher the payments you will receive.

6% of your cpp benefit. However, you can start receiving it as early as age 60 or as late as age 70. As you can see, cpp benefits in early retirement are substantially reduced. If you instead chose cpp early retirement at age 60, you would only draw $449.77. 6% of your cpp benefit. When to start your retirement pension.

Source: canadalife.com

Source: canadalife.com

For every month you take your cpp before age 65 you will lose. When to start your retirement pension. Cpp early retirement at age 55. Many canadians choose to retire in this age range because it makes sense. The standard age to start the pension is 65.

Source: pinterest.com

Source: pinterest.com

Given that the earliest age to collect cpp is 60, currently you can’t take cpp early retirement at age 55. For every month you take your cpp before age 65 you will lose. Considering the average canadian in retirement pulls in approximately $14,865 a year* from these pensions ($29,730 per couple), early retirement may actually seem viable for some baby boomers who are on the fence about when to retire. Does early retirement affect cpp? 6% of your cpp benefit.

Source: wcebp.ca

Source: wcebp.ca

You can begin collecting your canada pension plan (cpp) payments at 60. If you delay taking it past age 65 you will earn an additional. The standard age to start the pension is 65. Cpp early retirement at age 55. Many canadians choose to retire in this age range because it makes sense.

Source: investmentexecutive.com

Source: investmentexecutive.com

Many canadians choose to retire in this age range because it makes sense. Cpp early retirement at age 55. Your retirement funds will include the canada pension plan (cpp) and old age security (oas). You can begin collecting your canada pension plan (cpp) payments at 60. Many canadians choose to retire in this age range because it makes sense.

However, the longer you delay your cpp, the higher the payments you will receive. 6% of your cpp benefit. If you decide to start later, you’ll receive a larger monthly amount. So, if you take it at age 60 that means your cheque will be 36% less than if you wait until age 65. If you delay taking it past age 65 you will earn an additional.

Source: reversethecrush.com

Source: reversethecrush.com

When to start your retirement pension. If you instead chose cpp early retirement at age 60, you would only draw $449.77. So, if you take it at age 60 that means your cheque will be 36% less than if you wait until age 65. If you decide to start later, you’ll receive a larger monthly amount. Your retirement funds will include the canada pension plan (cpp) and old age security (oas).

Source: pinterest.com

Source: pinterest.com

However, you can start receiving it as early as age 60 or as late as age 70. Does early retirement affect cpp? The most common age range for retirees in canada is between 60 and 70 years old. Your retirement funds will include the canada pension plan (cpp) and old age security (oas). So, if you take it at age 60 that means your cheque will be 36% less than if you wait until age 65.

Source: myownadvisor.ca

Source: myownadvisor.ca

When to start your retirement pension. You can begin collecting your canada pension plan (cpp) payments at 60. The most common age range for retirees in canada is between 60 and 70 years old. The standard age to start the pension is 65. Given that the earliest age to collect cpp is 60, currently you can’t take cpp early retirement at age 55.

Source: cdspi.com

Source: cdspi.com

For every month you take your cpp before age 65 you will lose. You can begin collecting your canada pension plan (cpp) payments at 60. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. Many canadians choose to retire in this age range because it makes sense. Your retirement funds will include the canada pension plan (cpp) and old age security (oas).

Source: alexisfraser.com

Source: alexisfraser.com

Does early retirement affect cpp? The standard age to start the pension is 65. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. When to start your retirement pension. Considering the average canadian in retirement pulls in approximately $14,865 a year* from these pensions ($29,730 per couple), early retirement may actually seem viable for some baby boomers who are on the fence about when to retire.

Source: readersdigest.ca

Source: readersdigest.ca

The most common age range for retirees in canada is between 60 and 70 years old. The standard age to start the pension is 65. Considering the average canadian in retirement pulls in approximately $14,865 a year* from these pensions ($29,730 per couple), early retirement may actually seem viable for some baby boomers who are on the fence about when to retire. Cpp early retirement at age 55. As you can see, cpp benefits in early retirement are substantially reduced.

Source: alexisfraser.com

Source: alexisfraser.com

The most common age range for retirees in canada is between 60 and 70 years old. Considering the average canadian in retirement pulls in approximately $14,865 a year* from these pensions ($29,730 per couple), early retirement may actually seem viable for some baby boomers who are on the fence about when to retire. As you can see, cpp benefits in early retirement are substantially reduced. Many canadians choose to retire in this age range because it makes sense. Does early retirement affect cpp?

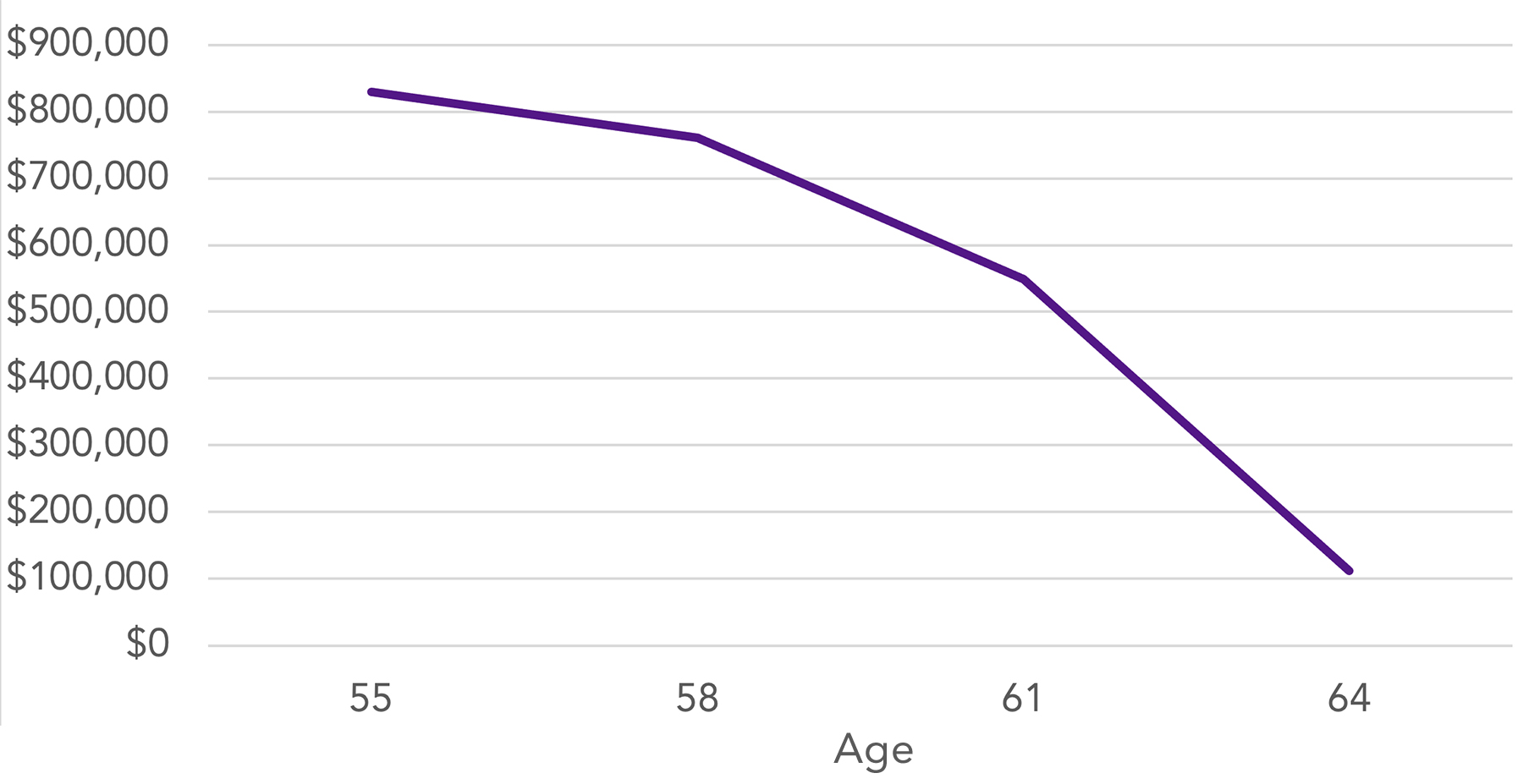

Source: langfordfinancial.ca

Source: langfordfinancial.ca

For every month you take your cpp before age 65 you will lose. As you can see, cpp benefits in early retirement are substantially reduced. Does early retirement affect cpp? The standard age to start the pension is 65. Many canadians choose to retire in this age range because it makes sense.

Source: wildpineresidence.ca

Source: wildpineresidence.ca

Considering the average canadian in retirement pulls in approximately $14,865 a year* from these pensions ($29,730 per couple), early retirement may actually seem viable for some baby boomers who are on the fence about when to retire. So, if you take it at age 60 that means your cheque will be 36% less than if you wait until age 65. However, the longer you delay your cpp, the higher the payments you will receive. If you delay taking it past age 65 you will earn an additional. If you decide to start later, you’ll receive a larger monthly amount.

Source: discover.rbcroyalbank.com

Source: discover.rbcroyalbank.com

Your retirement funds will include the canada pension plan (cpp) and old age security (oas). Is cpp early retirement at age 55 possible? However, the longer you delay your cpp, the higher the payments you will receive. Given that the earliest age to collect cpp is 60, currently you can’t take cpp early retirement at age 55. You can begin collecting your canada pension plan (cpp) payments at 60.

For every month you take your cpp before age 65 you will lose. If you instead chose cpp early retirement at age 60, you would only draw $449.77. 6% of your cpp benefit. If you start receiving your pension earlier, the monthly amount you’ll receive will be smaller. Your retirement funds will include the canada pension plan (cpp) and old age security (oas).

Source: wealthawesome.com

Source: wealthawesome.com

For every month you take your cpp before age 65 you will lose. Is cpp early retirement at age 55 possible? If you delay taking it past age 65 you will earn an additional. As you can see, cpp benefits in early retirement are substantially reduced. However, you can start receiving it as early as age 60 or as late as age 70.

Source: cdspi.com

Source: cdspi.com

Is cpp early retirement at age 55 possible? Considering the average canadian in retirement pulls in approximately $14,865 a year* from these pensions ($29,730 per couple), early retirement may actually seem viable for some baby boomers who are on the fence about when to retire. As you can see, cpp benefits in early retirement are substantially reduced. If you decide to start later, you’ll receive a larger monthly amount. 6% of your cpp benefit.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cpp early retirement age 55 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.