Your 7702 retirement plan images are ready in this website. 7702 retirement plan are a topic that is being searched for and liked by netizens now. You can Download the 7702 retirement plan files here. Download all free vectors.

If you’re looking for 7702 retirement plan pictures information connected with to the 7702 retirement plan interest, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

7702 Retirement Plan. The 7702 plan is in the internal revenue code (irc) under section 7702. It means that the policy has a cash. The death benefit plays an important role. How does a 7702 plan work?

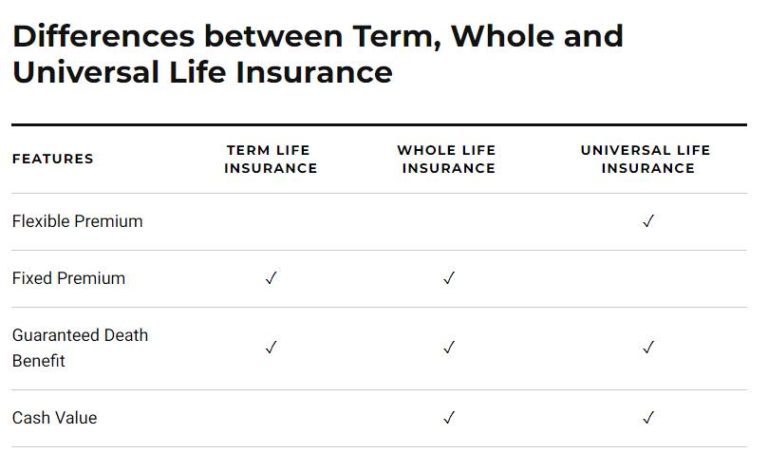

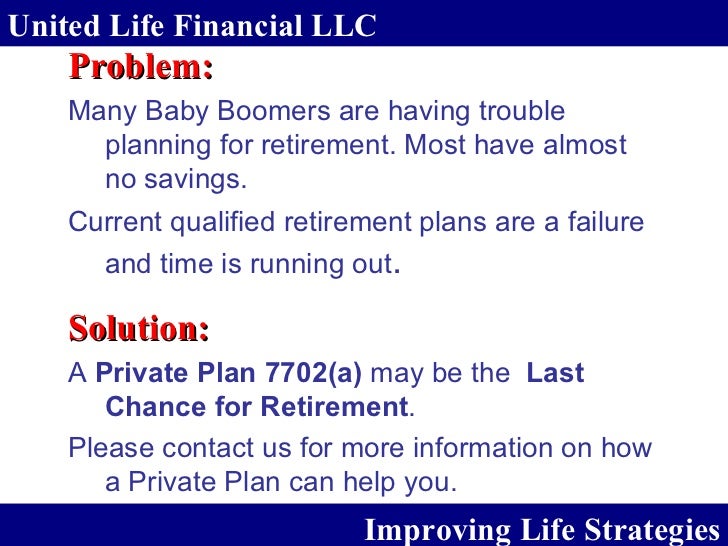

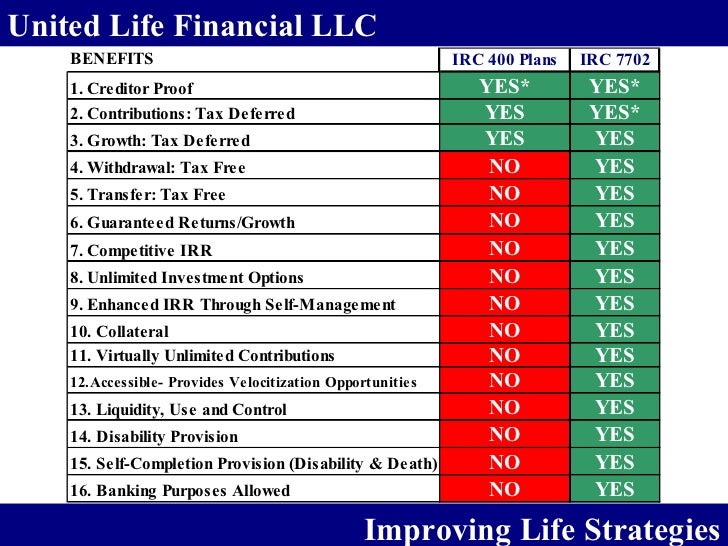

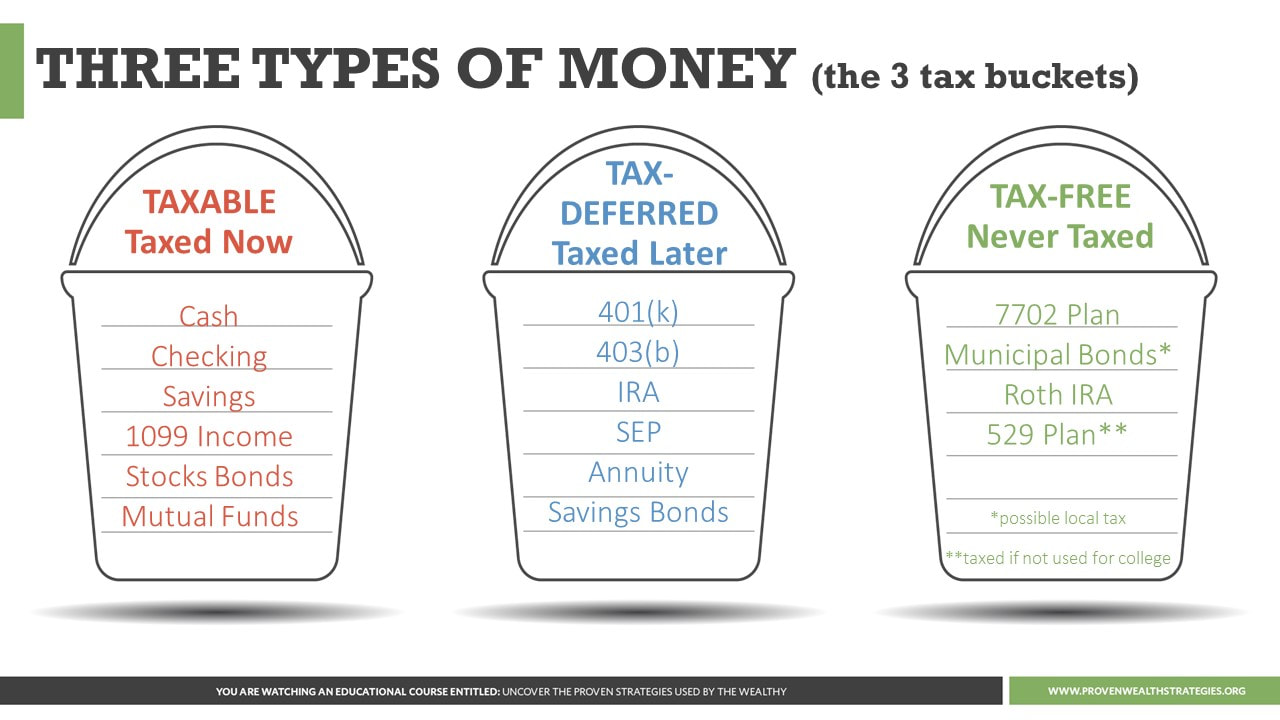

The section is an insurance policy that you can use for certain tax benefits. As with any life insurance policy, it has a death benefit. Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan. The 7702 plan is in the internal revenue code (irc) under section 7702. There’s no such thing as 7702 traditional retirement plans. There are tons of 7702 plan pros and cons which we will discuss below.

You can borrow against your 7702 plan in retirement without paying any taxes.

What is a 7702 plan? A 7702 plan is an insurance policy used to set aside part of your income for retirement. What is a 7702 plan? Tax code 7702 determines how the federal government taxes proceeds. The section is an insurance policy that you can use for certain tax benefits. It means that the policy has a cash.

Source: incidental2point0.blogspot.com

Source: incidental2point0.blogspot.com

Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan. The 7702 plan is an insurance policy with a cash life value. The death benefit plays an important role. A 7702 plan is an insurance policy used to set aside part of your income for retirement. It’s a life insurance policy.

Source: 7702taxfreeplan.com

Source: 7702taxfreeplan.com

In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc). 7702 plan pros and cons. It means that the policy has a cash. Tax code 7702 determines how the federal government taxes proceeds. How does a 7702 plan work?

Source: incidental2point0.blogspot.com

Source: incidental2point0.blogspot.com

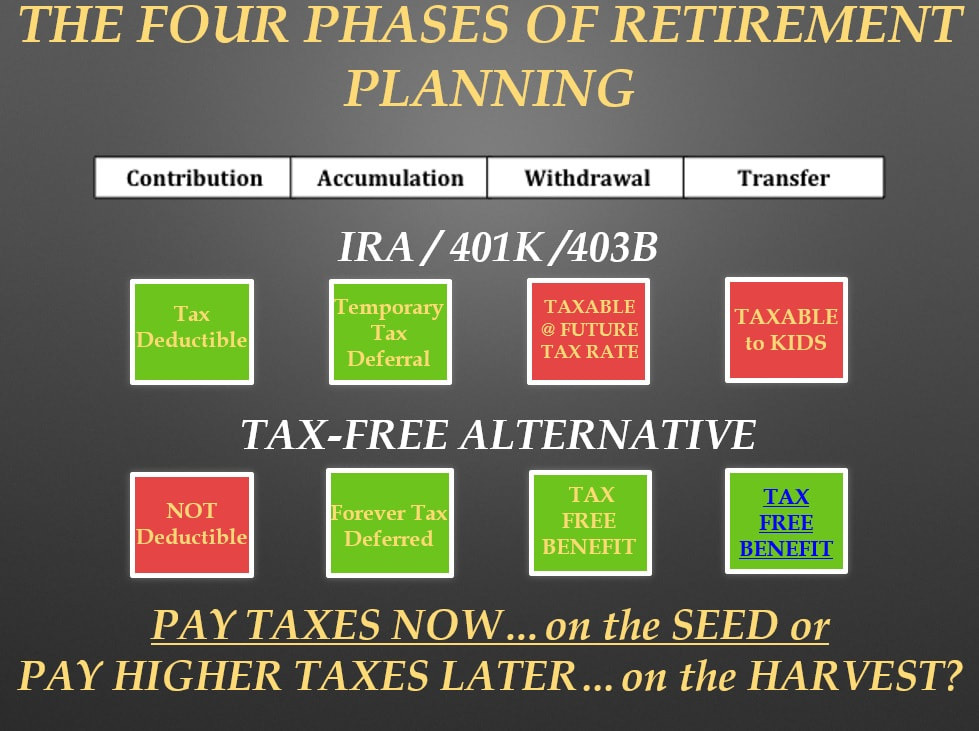

The “plan” part of the name is merely a marketing term that some financial planning & insurance companies use to sell life insurance as a retirement plan alternative, comparing it to the typical retirement plans like 401 (k) or ira. The section is an insurance policy that you can use for certain tax benefits. As with any life insurance policy, it has a death benefit. There are tons of 7702 plan pros and cons which we will discuss below. The 7702 plan is an insurance policy with a cash life value.

Source: tonyisola.com

Source: tonyisola.com

7702 plan pros and cons. It means that the policy has a cash. Tax code 7702 determines how the federal government taxes proceeds. The 7702 plan is an insurance policy with a cash life value. The 7702 plan is in the internal revenue code (irc) under section 7702.

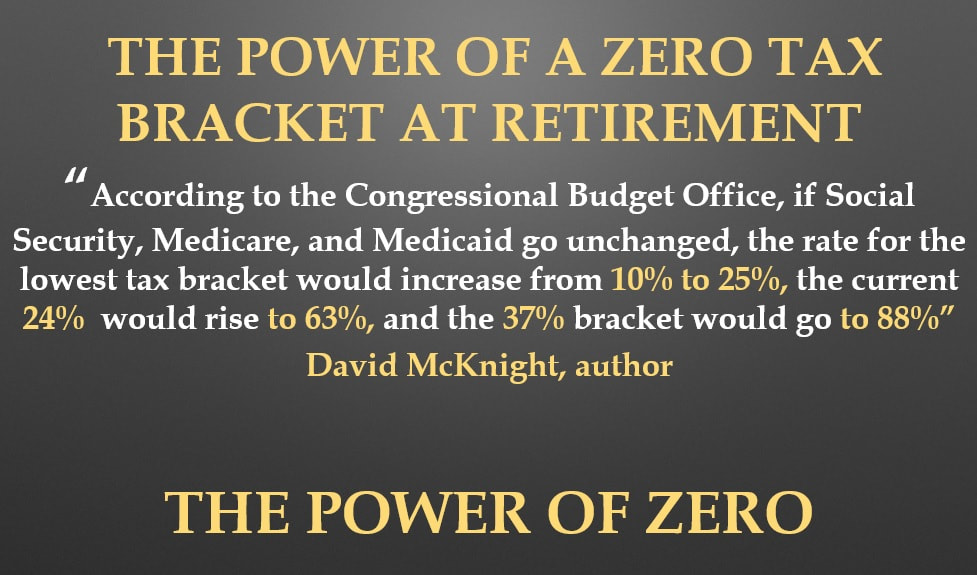

The death benefit plays an important role. You can borrow against your 7702 plan in retirement without paying any taxes. There are tons of 7702 plan pros and cons which we will discuss below. Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan. This tax advantage distinguishes 7702 plans from iras and 401 (k) plans, many of which require you to pay taxes when you withdraw funds.

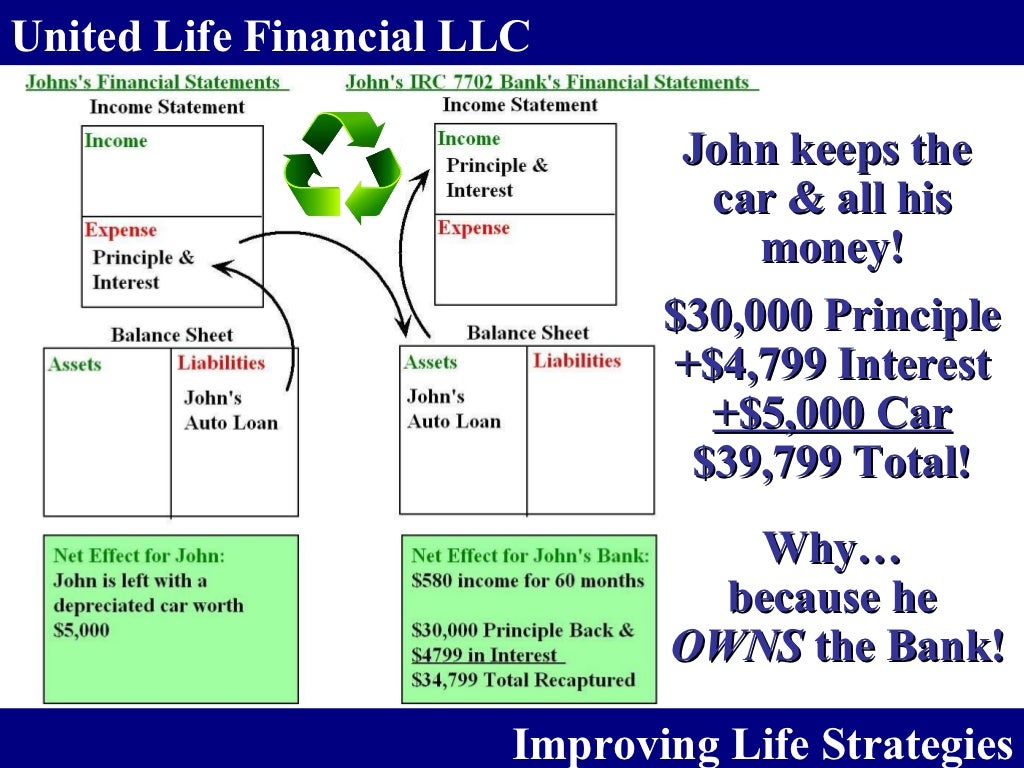

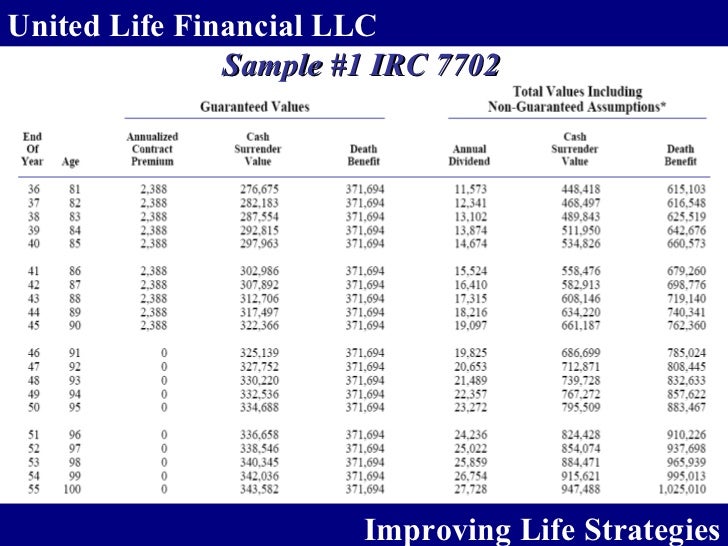

Source: slideshare.net

Source: slideshare.net

If you pass before retirement, the death benefit will protect your. Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan. As with any life insurance policy, it has a death benefit. The “plan” part of the name is merely a marketing term that some financial planning & insurance companies use to sell life insurance as a retirement plan alternative, comparing it to the typical retirement plans like 401 (k) or ira. How does a 7702 plan work?

Source: thelifetank.com

Source: thelifetank.com

There’s no such thing as 7702 traditional retirement plans. Tax code 7702 determines how the federal government taxes proceeds. The death benefit plays an important role. How does a 7702 plan work? The 7702 plan is in the internal revenue code (irc) under section 7702.

Source: 7702taxfreeplan.com

Source: 7702taxfreeplan.com

7702 plan pros and cons. You can borrow against your 7702 plan in retirement without paying any taxes. In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc). The 7702 plan is in the internal revenue code (irc) under section 7702. A 7702 plan is an insurance policy used to set aside part of your income for retirement.

Source: slideshare.net

Source: slideshare.net

In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc). You can borrow against your 7702 plan in retirement without paying any taxes. Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan. The death benefit plays an important role. There’s no such thing as 7702 traditional retirement plans.

Source: slideshare.net

Source: slideshare.net

What is a 7702 plan? What is a 7702 plan? In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc). A 7702 plan is an insurance policy used to set aside part of your income for retirement. The section is an insurance policy that you can use for certain tax benefits.

Source: slideshare.net

Source: slideshare.net

There’s no such thing as 7702 traditional retirement plans. It’s a life insurance policy. The section is an insurance policy that you can use for certain tax benefits. This tax advantage distinguishes 7702 plans from iras and 401 (k) plans, many of which require you to pay taxes when you withdraw funds. As with any life insurance policy, it has a death benefit.

Source: slideshare.net

Source: slideshare.net

There are tons of 7702 plan pros and cons which we will discuss below. How does a 7702 plan work? You can borrow against your 7702 plan in retirement without paying any taxes. The death benefit plays an important role. In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc).

Source: slideshare.net

Source: slideshare.net

There’s no such thing as 7702 traditional retirement plans. The section is an insurance policy that you can use for certain tax benefits. Tax code 7702 determines how the federal government taxes proceeds. In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc). The 7702 plan is in the internal revenue code (irc) under section 7702.

Source: slideshare.net

Source: slideshare.net

It means that the policy has a cash. This tax advantage distinguishes 7702 plans from iras and 401 (k) plans, many of which require you to pay taxes when you withdraw funds. 7702 plan pros and cons. The death benefit plays an important role. In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc).

Source: 7702taxfreeplan.com

Source: 7702taxfreeplan.com

What is a 7702 plan? There’s no such thing as 7702 traditional retirement plans. A 7702 plan is an insurance policy used to set aside part of your income for retirement. 7702 plan pros and cons. The 7702 plan is an insurance policy with a cash life value.

Source: slideshare.net

Source: slideshare.net

The section is an insurance policy that you can use for certain tax benefits. This tax advantage distinguishes 7702 plans from iras and 401 (k) plans, many of which require you to pay taxes when you withdraw funds. It’s a life insurance policy. The “plan” part of the name is merely a marketing term that some financial planning & insurance companies use to sell life insurance as a retirement plan alternative, comparing it to the typical retirement plans like 401 (k) or ira. Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan.

Source: 7702taxfreeplan.com

Source: 7702taxfreeplan.com

The death benefit plays an important role. The section is an insurance policy that you can use for certain tax benefits. If you pass before retirement, the death benefit will protect your. The “plan” part of the name is merely a marketing term that some financial planning & insurance companies use to sell life insurance as a retirement plan alternative, comparing it to the typical retirement plans like 401 (k) or ira. In fact, all life insurance policies could be called “ 7702 plan s” because all life insurance policies are covered by section 7702 of the internal revenue code (irc).

Source: youtube.com

Source: youtube.com

There are tons of 7702 plan pros and cons which we will discuss below. It means that the policy has a cash. Though some may say “7702 retirement plan,” a 7702 plan is not a retirement plan. If you pass before retirement, the death benefit will protect your. As with any life insurance policy, it has a death benefit.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 7702 retirement plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.