Your 85 rule for retirement images are ready. 85 rule for retirement are a topic that is being searched for and liked by netizens today. You can Get the 85 rule for retirement files here. Download all free photos and vectors.

If you’re searching for 85 rule for retirement pictures information linked to the 85 rule for retirement interest, you have come to the right site. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

85 Rule For Retirement. The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. What is the rule of 85 with retirement? And even if your company does use the rule of 85, there may be a minimum age you need. A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62.

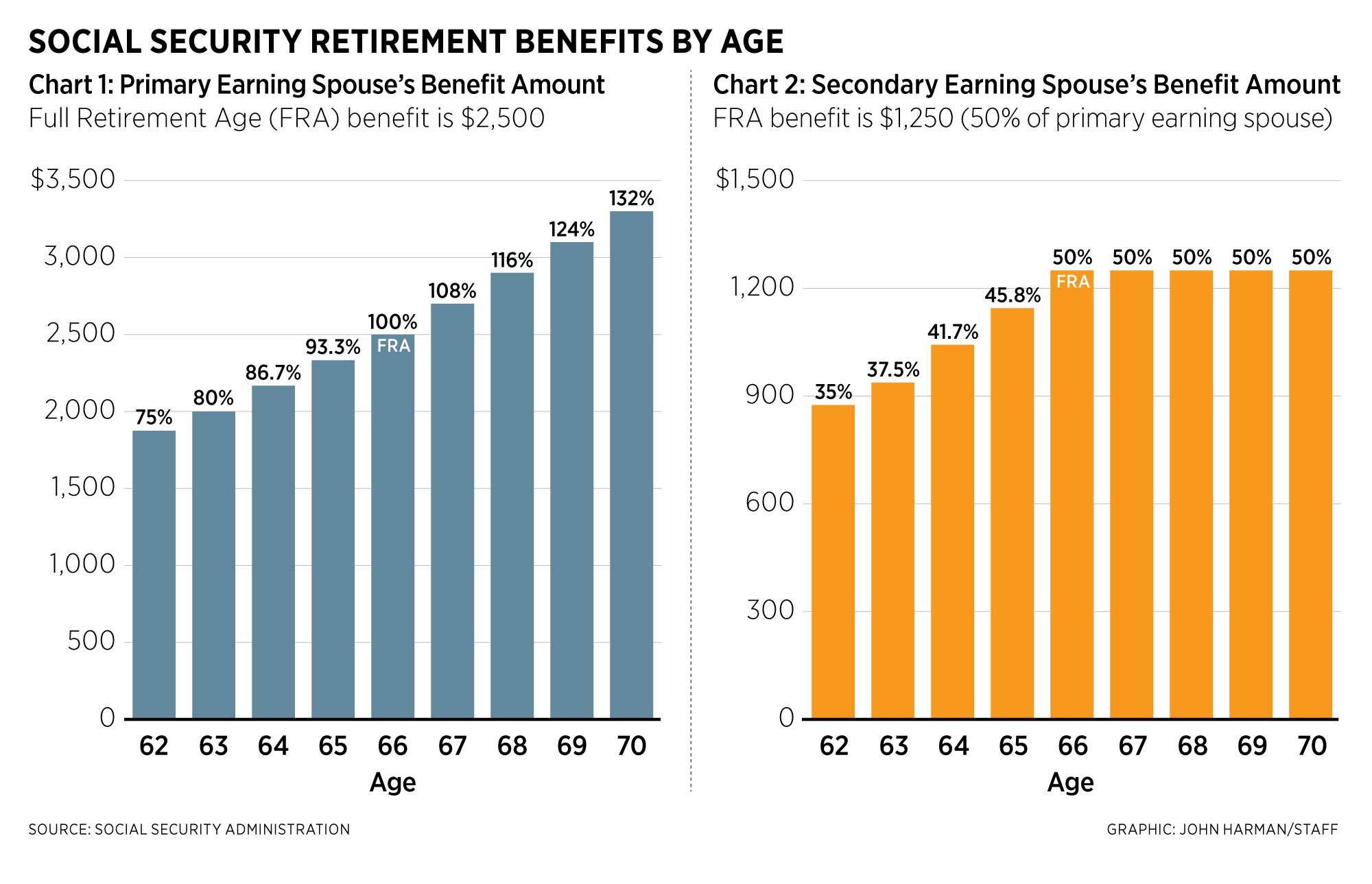

How Is the Rule of 85 Applied to Retirement? SmartAsset From smartasset.com

How Is the Rule of 85 Applied to Retirement? SmartAsset From smartasset.com

So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule. Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. If those numbers add up to 85, you are eligible for early retirement. What is the rule of 85? Pension plans reduce the benefits for workers who retire early because those workers can be expected. A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62.

Employers that offer defined benefit pension plans aren’t required to follow the rule of 85.

To calculate the rule of 85, companies take your age and add it to your years of service. To calculate the rule of 85, companies take your age and add it to your years of service. The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. And even if your company does use the rule of 85, there may be a minimum age you need.

Source: fool.com

Source: fool.com

To calculate the rule of 85, companies take your age and add it to your years of service. If those numbers add up to 85, you are eligible for early retirement. So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule. To calculate the rule of 85, companies take your age and add it to your years of service. And even if your company does use the rule of 85, there may be a minimum age you need.

Source: retirementcalculatortoday.blogspot.com

Source: retirementcalculatortoday.blogspot.com

So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule. So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule. The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. Employers that offer defined benefit pension plans aren’t required to follow the rule of 85.

Source: fool.com

Source: fool.com

To calculate the rule of 85, companies take your age and add it to your years of service. To calculate the rule of 85, companies take your age and add it to your years of service. And even if your company does use the rule of 85, there may be a minimum age you need. If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule.

Source: fool.com

Source: fool.com

Pension plans reduce the benefits for workers who retire early because those workers can be expected. And even if your company does use the rule of 85, there may be a minimum age you need. What is the rule of 85 with retirement? What is the rule of 85? If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85.

Source: retirementcalculatortoday.blogspot.com

Source: retirementcalculatortoday.blogspot.com

So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule. If those numbers add up to 85, you are eligible for early retirement. To calculate the rule of 85, companies take your age and add it to your years of service. A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. Employers that offer defined benefit pension plans aren’t required to follow the rule of 85.

Source: finance.zacks.com

Source: finance.zacks.com

The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. What is the rule of 85? To calculate the rule of 85, companies take your age and add it to your years of service. If those numbers add up to 85, you are eligible for early retirement. A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62.

What is the rule of 85 with retirement? If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. To calculate the rule of 85, companies take your age and add it to your years of service. What is the rule of 85? Employers that offer defined benefit pension plans aren’t required to follow the rule of 85.

Source: nespf.org.uk

Source: nespf.org.uk

A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. Pension plans reduce the benefits for workers who retire early because those workers can be expected. What is the rule of 85? To calculate the rule of 85, companies take your age and add it to your years of service. If those numbers add up to 85, you are eligible for early retirement.

Source: smartasset.com

Source: smartasset.com

And even if your company does use the rule of 85, there may be a minimum age you need. What is the rule of 85 with retirement? Pension plans reduce the benefits for workers who retire early because those workers can be expected. The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. If those numbers add up to 85, you are eligible for early retirement.

If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. What is the rule of 85 with retirement? If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. What is the rule of 85?

Source: sports.ndtv.com

Source: sports.ndtv.com

What is the rule of 85? To calculate the rule of 85, companies take your age and add it to your years of service. And even if your company does use the rule of 85, there may be a minimum age you need. A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85.

Source: sapling.com

Source: sapling.com

Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. To calculate the rule of 85, companies take your age and add it to your years of service. Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. If those numbers add up to 85, you are eligible for early retirement. Pension plans reduce the benefits for workers who retire early because those workers can be expected.

Source: dailymail.co.uk

Source: dailymail.co.uk

A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. To calculate the rule of 85, companies take your age and add it to your years of service. And even if your company does use the rule of 85, there may be a minimum age you need. The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85.

And even if your company does use the rule of 85, there may be a minimum age you need. What is the rule of 85? A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. To calculate the rule of 85, companies take your age and add it to your years of service. So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule.

Source: soundcloud.com

Source: soundcloud.com

Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. If those numbers add up to 85, you are eligible for early retirement. What is the rule of 85? So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule.

Source: pocketsense.com

Source: pocketsense.com

If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. What is the rule of 85? Employers that offer defined benefit pension plans aren’t required to follow the rule of 85. So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule. To calculate the rule of 85, companies take your age and add it to your years of service.

Source: fool.com

Source: fool.com

What is the rule of 85? A person who retires prior to age 62 and meets the rule of 85 receives full retirement benefits at age 62. If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. To calculate the rule of 85, companies take your age and add it to your years of service. So if your company doesn’t, the rule won’t be of benefit to you should you decide you’d like to retire a few years ahead of schedule.

Source: youtube.com

Source: youtube.com

The rule of 85 is a common variation on retirement provisions letting people collect pensions after their years of age plus years of employment cross a certain threshold. What is the rule of 85? To calculate the rule of 85, companies take your age and add it to your years of service. If the person retires prior to age 62 and draws benefits at retirement, the amount of retirement money received is reduced by 0.5 percent per month until age 62, even if the retiree meets the requirements of the rule of 85. What is the rule of 85 with retirement?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 85 rule for retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.