Your Early retirement 401k withdrawal images are available. Early retirement 401k withdrawal are a topic that is being searched for and liked by netizens today. You can Find and Download the Early retirement 401k withdrawal files here. Find and Download all royalty-free photos and vectors.

If you’re looking for early retirement 401k withdrawal images information related to the early retirement 401k withdrawal topic, you have visit the right blog. Our website frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Early Retirement 401k Withdrawal. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. In this case, your withdrawal is subject to the vesting reduction. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k).

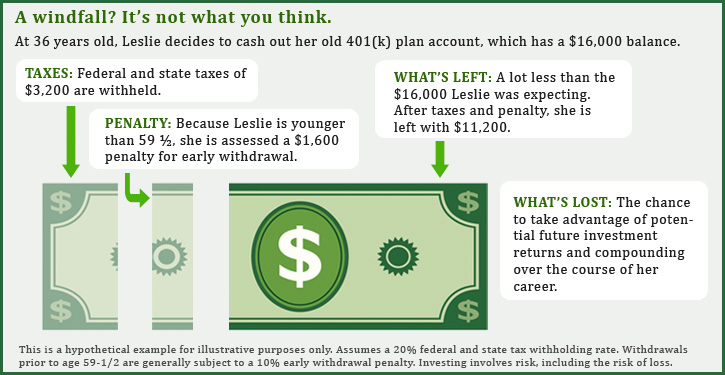

Beware of cashing out a 401(k) Toro Wealth Management From torowealth.com

Beware of cashing out a 401(k) Toro Wealth Management From torowealth.com

Starting to receive benefits after normal retirement age may result in. You will also be required to pay regular income taxes on the withdrawn funds. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,.

Starting to receive benefits after normal retirement age may result in.

You will also be required to pay regular income taxes on the withdrawn funds. In this case, your withdrawal is subject to the vesting reduction. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. You will also be required to pay regular income taxes on the withdrawn funds. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%.

Source: erisacase.com

Source: erisacase.com

As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. In this case, your withdrawal is subject to the vesting reduction. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%.

Source: radwadesigns.blogspot.com

Source: radwadesigns.blogspot.com

Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. Starting to receive benefits after normal retirement age may result in. In this case, your withdrawal is subject to the vesting reduction. Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%.

Source: torowealth.com

Source: torowealth.com

Starting to receive benefits after normal retirement age may result in. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. In this case, your withdrawal is subject to the vesting reduction. You will also be required to pay regular income taxes on the withdrawn funds.

Source: advisoryhq.com

Source: advisoryhq.com

If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). Starting to receive benefits after normal retirement age may result in. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty.

Source: affordablecremationurns.com

Source: affordablecremationurns.com

Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. Starting to receive benefits after normal retirement age may result in. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). In this case, your withdrawal is subject to the vesting reduction.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. You will also be required to pay regular income taxes on the withdrawn funds. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent.

Source: megaincomestream.com

Source: megaincomestream.com

If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in. Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,.

Source: exactcpa.blogspot.com

Source: exactcpa.blogspot.com

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. You will also be required to pay regular income taxes on the withdrawn funds. Starting to receive benefits after normal retirement age may result in. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%.

If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). Starting to receive benefits after normal retirement age may result in. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. In this case, your withdrawal is subject to the vesting reduction.

Source: affordablecremationurns.com

Source: affordablecremationurns.com

In this case, your withdrawal is subject to the vesting reduction. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. You will also be required to pay regular income taxes on the withdrawn funds. Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. Starting to receive benefits after normal retirement age may result in.

Source: mymoneydesign.com

Source: mymoneydesign.com

Starting to receive benefits after normal retirement age may result in. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. Starting to receive benefits after normal retirement age may result in.

Source: synchronybank.com

Source: synchronybank.com

Starting to receive benefits after normal retirement age may result in. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. Starting to receive benefits after normal retirement age may result in. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent.

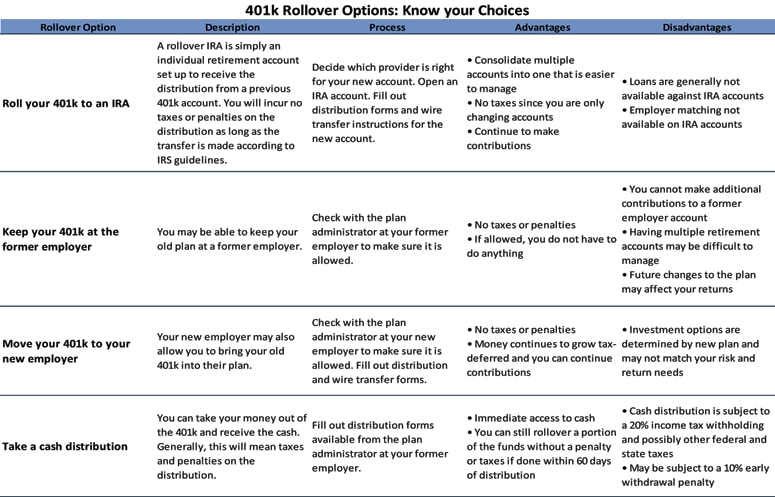

Source: 401krollover.com

Source: 401krollover.com

You will also be required to pay regular income taxes on the withdrawn funds. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%.

Source: 401kcalculator.net

Source: 401kcalculator.net

Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

Source: pinterest.com

Source: pinterest.com

Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,.

Source: gobankingrates.com

Source: gobankingrates.com

Starting to receive benefits after normal retirement age may result in. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. You will also be required to pay regular income taxes on the withdrawn funds.

Source: smartasset.com

Source: smartasset.com

Starting to receive benefits after normal retirement age may result in. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401(k). If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Assume the 401 (k) in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20%. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived. As of 2021, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement 401k withdrawal by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.