Your 401k withdrawal strategy for early retirement images are ready. 401k withdrawal strategy for early retirement are a topic that is being searched for and liked by netizens today. You can Find and Download the 401k withdrawal strategy for early retirement files here. Get all free photos and vectors.

If you’re looking for 401k withdrawal strategy for early retirement images information connected with to the 401k withdrawal strategy for early retirement topic, you have visit the right site. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

401k Withdrawal Strategy For Early Retirement. Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. The timing makes a big difference. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. Withdraw what keeps you in a low tax bracket.

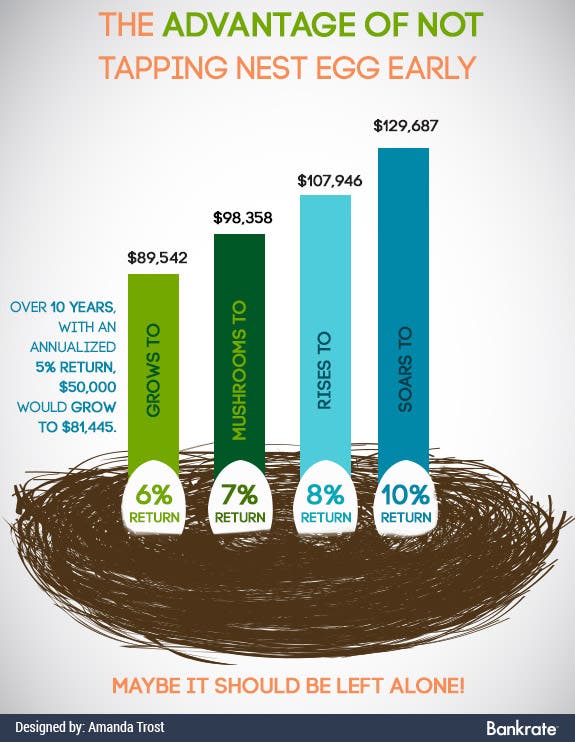

Retirement Plan Withdrawal Can Penalty Be Avoided? From bankrate.com

Retirement Plan Withdrawal Can Penalty Be Avoided? From bankrate.com

Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. If you withdraw $5,000, for. In most cases, you’ll take a big hit for tapping your 401 (k) early. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. The specialty of this plan is that your employer may even match your payments up to a certain limit. If you do pull from your funds early, the irs will withhold 20% for taxes.

Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are.

If you withdraw $5,000, for. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. If you do pull from your funds early, the irs will withhold 20% for taxes. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. Many families spend too much and don’t save. The specialty of this plan is that your employer may even match your payments up to a certain limit.

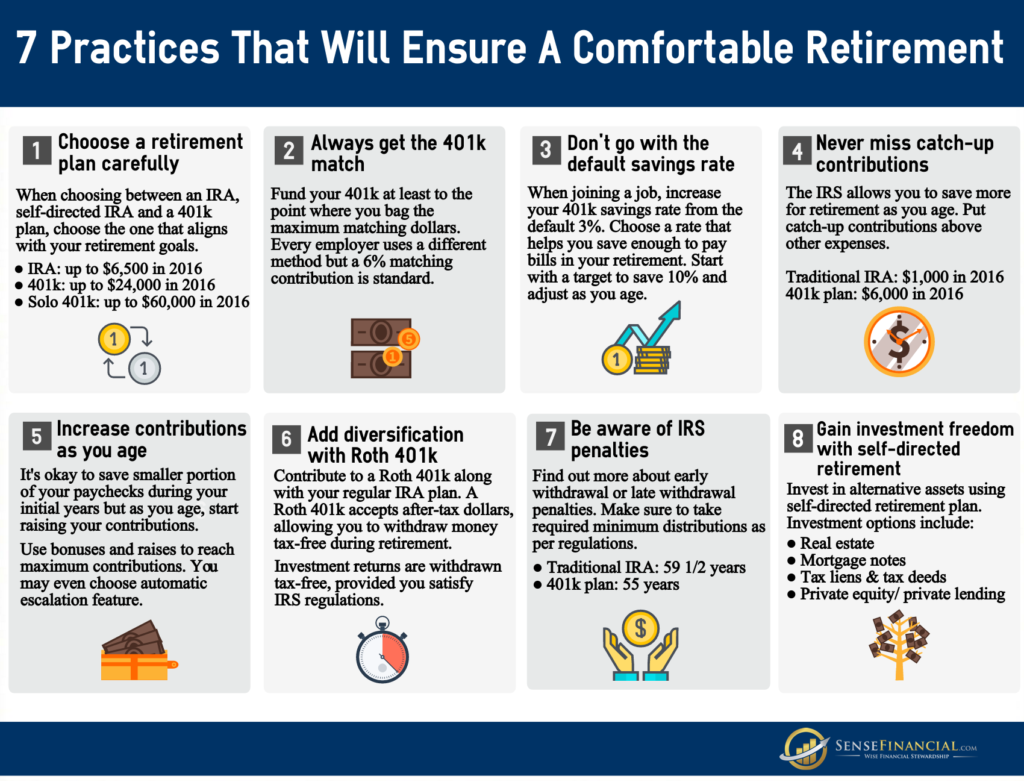

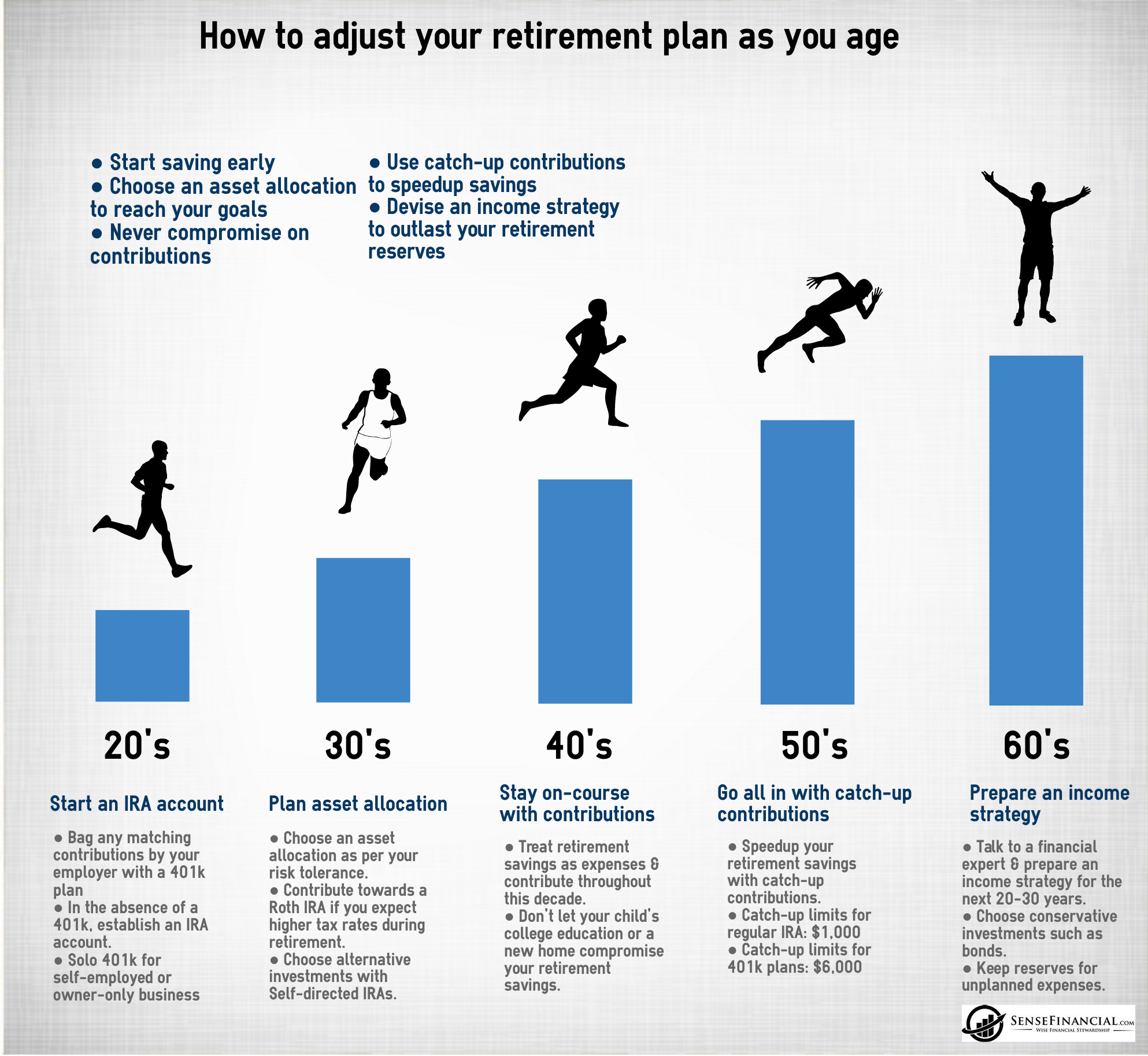

Source: sensefinancial.com

Source: sensefinancial.com

Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. For most people, the accumulation phase is the difficult part. Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. Withdraw what keeps you in a low tax bracket.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

For most people, the accumulation phase is the difficult part. If you withdraw $5,000, for. If you do pull from your funds early, the irs will withhold 20% for taxes. Many families spend too much and don’t save. Withdraw what keeps you in a low tax bracket.

Source: gobankingrates.com

Source: gobankingrates.com

The timing makes a big difference. Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. The timing makes a big difference. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. The specialty of this plan is that your employer may even match your payments up to a certain limit.

Source: smartasset.com

Source: smartasset.com

Withdraw what keeps you in a low tax bracket. Many families spend too much and don’t save. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. If you withdraw $5,000, for. If you do pull from your funds early, the irs will withhold 20% for taxes.

Source: pinterest.com

Source: pinterest.com

Withdraw what keeps you in a low tax bracket. If you withdraw $5,000, for. In most cases, you’ll take a big hit for tapping your 401 (k) early. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. Many families spend too much and don’t save.

Source: redrocksecured.com

Source: redrocksecured.com

Many families spend too much and don’t save. In most cases, you’ll take a big hit for tapping your 401 (k) early. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. If you withdraw $5,000, for.

Source: pinterest.com

Source: pinterest.com

In most cases, you’ll take a big hit for tapping your 401 (k) early. If you withdraw $5,000, for. The timing makes a big difference. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. The specialty of this plan is that your employer may even match your payments up to a certain limit.

Source: llbathmagic.co

Source: llbathmagic.co

In most cases, you’ll take a big hit for tapping your 401 (k) early. Many families spend too much and don’t save. The specialty of this plan is that your employer may even match your payments up to a certain limit. Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account.

Source: sensefinancial.com

Source: sensefinancial.com

In most cases, you’ll take a big hit for tapping your 401 (k) early. If you do pull from your funds early, the irs will withhold 20% for taxes. For most people, the accumulation phase is the difficult part. Many families spend too much and don’t save. The timing makes a big difference.

Source: sdretirementplans.com

Source: sdretirementplans.com

The specialty of this plan is that your employer may even match your payments up to a certain limit. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. Withdraw what keeps you in a low tax bracket. The specialty of this plan is that your employer may even match your payments up to a certain limit. The timing makes a big difference.

Source: pinterest.com

Source: pinterest.com

Many families spend too much and don’t save. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. If you withdraw $5,000, for. Withdraw what keeps you in a low tax bracket. In most cases, you’ll take a big hit for tapping your 401 (k) early.

Source: radwadesigns.blogspot.com

Source: radwadesigns.blogspot.com

Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. If you do pull from your funds early, the irs will withhold 20% for taxes. If you withdraw $5,000, for. Withdraw what keeps you in a low tax bracket.

Source: pinterest.com

Source: pinterest.com

Many families spend too much and don’t save. If you do pull from your funds early, the irs will withhold 20% for taxes. The specialty of this plan is that your employer may even match your payments up to a certain limit. If you withdraw $5,000, for. The timing makes a big difference.

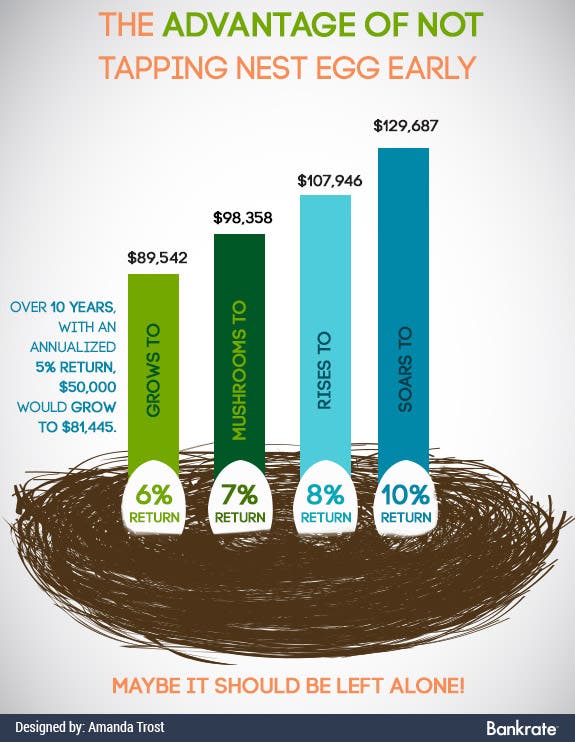

Source: bankrate.com

Source: bankrate.com

Many families spend too much and don’t save. The timing makes a big difference. The specialty of this plan is that your employer may even match your payments up to a certain limit. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. In most cases, you’ll take a big hit for tapping your 401 (k) early.

Source: 401kcalculator.net

Source: 401kcalculator.net

If you withdraw $5,000, for. If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up. If you withdraw $5,000, for.

Source: advisoryhq.com

Source: advisoryhq.com

Many families spend too much and don’t save. The timing makes a big difference. Between ages 59 1/2 and 72, you are allowed to withdraw money from retirement accounts without triggering the 10% early withdrawal penalty, but are. The specialty of this plan is that your employer may even match your payments up to a certain limit. Early retirement is difficult to achieve because there is less time to build wealth and more time to use it up.

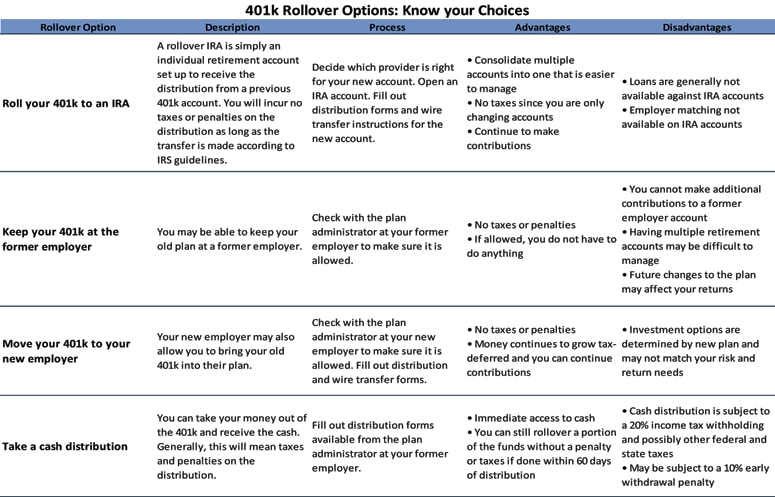

Source: 401krollover.com

Source: 401krollover.com

If your benefits package includes a 401, you may choose to contribute a portion of your salary to the account. The timing makes a big difference. If you withdraw $5,000, for. Many families spend too much and don’t save. For most people, the accumulation phase is the difficult part.

Source: mymoneydesign.com

Source: mymoneydesign.com

Many families spend too much and don’t save. For most people, the accumulation phase is the difficult part. In most cases, you’ll take a big hit for tapping your 401 (k) early. If you do pull from your funds early, the irs will withhold 20% for taxes. Many families spend too much and don’t save.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 401k withdrawal strategy for early retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.