Your Retirement preparation canada images are ready in this website. Retirement preparation canada are a topic that is being searched for and liked by netizens today. You can Download the Retirement preparation canada files here. Get all free photos.

If you’re searching for retirement preparation canada pictures information connected with to the retirement preparation canada topic, you have visit the right site. Our site always gives you hints for seeing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Retirement Preparation Canada. Many experts recommend the 70% rule” when planning for retirement. Update your budget as a retiree. Your spending habits and expenses may be different than they were before you retired. If you have medical and dental insurance where you work, have any treatments.

Retirement Planning Canada Tips ID3059792484, Retirement party From pinterest.com

Retirement Planning Canada Tips ID3059792484, Retirement party From pinterest.com

It’s important to regularly review your budget as your needs and lifestyle change. If you have medical and dental insurance where you work, have any treatments. Many experts recommend the 70% rule” when planning for retirement. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement. It can help to think of what percentage of your income you want to replace when you retire.

Use this checklist to get your financial house in order before you retire.

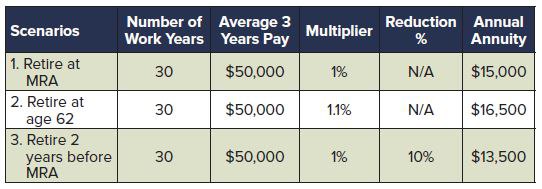

It depends on factors like what you want to do, where you want to live and the lifestyle you want. It depends on factors like what you want to do, where you want to live and the lifestyle you want. Many experts recommend the 70% rule” when planning for retirement. Your spending habits and expenses may be different than they were before you retired. If you have medical and dental insurance where you work, have any treatments. The canada pension plan (cpp), old age security (oas) pension and other income allowances and benefits.

Source: canada.ca

Source: canada.ca

It’s important to regularly review your budget as your needs and lifestyle change. The canada pension plan (cpp), old age security (oas) pension and other income allowances and benefits. Pay off your debts as soon as you can. Your spending habits and expenses may be different than they were before you retired. Many experts recommend the 70% rule” when planning for retirement.

Source: investopedia.com

Source: investopedia.com

If you have medical and dental insurance where you work, have any treatments. This means that your retirement savings should replace 70% of your income per year. Many experts recommend the 70% rule” when planning for retirement. Find out which insurance benefit plans continue after retirement by. Find out the amount of each of your pension options.

Source: advisorsavvy.com

Source: advisorsavvy.com

Find out which insurance benefit plans continue after retirement by. It depends on factors like what you want to do, where you want to live and the lifestyle you want. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. This means that your retirement savings should replace 70% of your income per year. Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement.

Source: reversemortgageapproval.ca

Source: reversemortgageapproval.ca

If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. Your spending habits and expenses may be different than they were before you retired. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. Find out which insurance benefit plans continue after retirement by. Use this checklist to get your financial house in order before you retire.

Source: wealthawesome.com

Source: wealthawesome.com

Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement. It can help to think of what percentage of your income you want to replace when you retire. Many experts recommend the 70% rule” when planning for retirement. Find out which insurance benefit plans continue after retirement by. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working.

Source: thestar.com

Source: thestar.com

Use this checklist to get your financial house in order before you retire. Visit public service pension options for more information. Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement. It can help to think of what percentage of your income you want to replace when you retire. It depends on factors like what you want to do, where you want to live and the lifestyle you want.

Source: ativa.com

Source: ativa.com

Visit public service pension options for more information. It’s important to regularly review your budget as your needs and lifestyle change. Find out which insurance benefit plans continue after retirement by. Many experts recommend the 70% rule” when planning for retirement. Find out the amount of each of your pension options.

Source: pinterest.com

Source: pinterest.com

Your spending habits and expenses may be different than they were before you retired. If you have medical and dental insurance where you work, have any treatments. Find out the amount of each of your pension options. It’s important to regularly review your budget as your needs and lifestyle change. The canada pension plan (cpp), old age security (oas) pension and other income allowances and benefits.

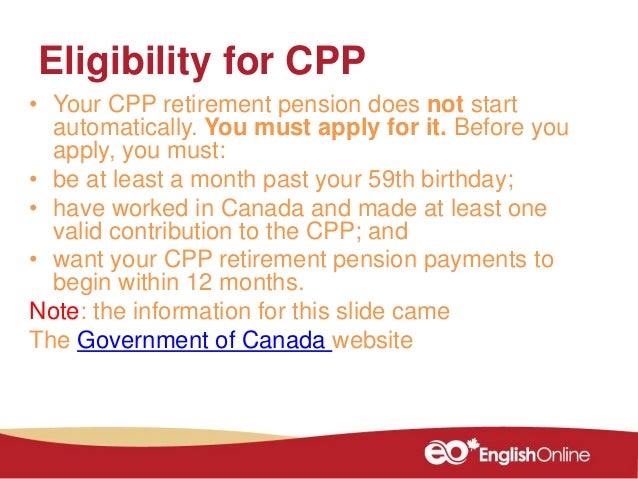

Source: slideshare.net

Source: slideshare.net

The canada pension plan (cpp), old age security (oas) pension and other income allowances and benefits. This means that your retirement savings should replace 70% of your income per year. It’s important to regularly review your budget as your needs and lifestyle change. Update your budget as a retiree. Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement.

Source: blogto.com

Source: blogto.com

It’s important to regularly review your budget as your needs and lifestyle change. Update your budget as a retiree. Find out which insurance benefit plans continue after retirement by. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. Pay off your debts as soon as you can.

Source: savvynewcanadians.com

Source: savvynewcanadians.com

Find out which insurance benefit plans continue after retirement by. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. Find out the amount of each of your pension options. This means that your retirement savings should replace 70% of your income per year. Use this checklist to get your financial house in order before you retire.

Source: canada.ca

Source: canada.ca

Update your budget as a retiree. It’s important to regularly review your budget as your needs and lifestyle change. Get tips on budgeting during retirement. The canada pension plan (cpp), old age security (oas) pension and other income allowances and benefits. Find out the amount of each of your pension options.

Source: benefitstrategiesinc.ca

Source: benefitstrategiesinc.ca

If you have medical and dental insurance where you work, have any treatments. Get tips on budgeting during retirement. Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement. Pay off your debts as soon as you can. It can help to think of what percentage of your income you want to replace when you retire.

Source: livingsmartandthrifty.ca

Source: livingsmartandthrifty.ca

It’s important to regularly review your budget as your needs and lifestyle change. Get tips on budgeting during retirement. Find out the amount of each of your pension options. Use this checklist to get your financial house in order before you retire. It depends on factors like what you want to do, where you want to live and the lifestyle you want.

Use this checklist to get your financial house in order before you retire. Living and travelling abroad when you retire the potential implications for your taxes, benefits and insurance when living abroad during your retirement. Pay off your debts as soon as you can. Many experts recommend the 70% rule” when planning for retirement. This means that your retirement savings should replace 70% of your income per year.

![Retirement Planning in Canada [currentyear] Ultimate Guide in 2021 Retirement Planning in Canada [currentyear] Ultimate Guide in 2021](https://i.pinimg.com/originals/87/c5/78/87c57809f33331ced01dfb5f246cec29.jpg) Source: pinterest.com

Source: pinterest.com

Your spending habits and expenses may be different than they were before you retired. The canada pension plan (cpp), old age security (oas) pension and other income allowances and benefits. If you have medical and dental insurance where you work, have any treatments. It’s important to regularly review your budget as your needs and lifestyle change. Find out the amount of each of your pension options.

Source: wealthawesome.com

Source: wealthawesome.com

If you have medical and dental insurance where you work, have any treatments. If there are costly items you need, such as a car or a new roof for your home, buy them while you are still working. It can help to think of what percentage of your income you want to replace when you retire. Use this checklist to get your financial house in order before you retire. Update your budget as a retiree.

Source: savvynewcanadians.com

Source: savvynewcanadians.com

Visit public service pension options for more information. Pay off your debts as soon as you can. Your spending habits and expenses may be different than they were before you retired. Get tips on budgeting during retirement. It’s important to regularly review your budget as your needs and lifestyle change.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement preparation canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.