Your 401k early retirement 55 images are available in this site. 401k early retirement 55 are a topic that is being searched for and liked by netizens now. You can Get the 401k early retirement 55 files here. Download all royalty-free images.

If you’re searching for 401k early retirement 55 pictures information connected with to the 401k early retirement 55 interest, you have pay a visit to the right blog. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

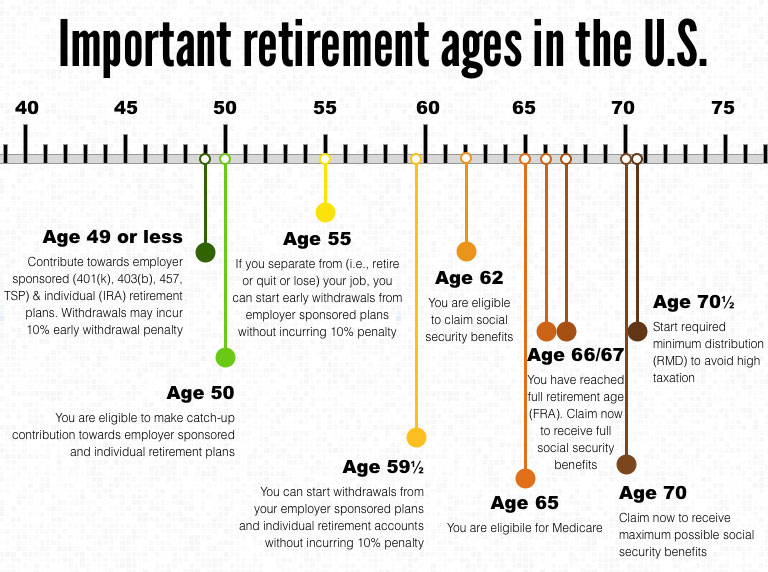

401k Early Retirement 55. Whether an early retirement is right for you depends largely on your goals and overall financial situation. The rule of 55 is an irs provision that allows those 55. Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for.

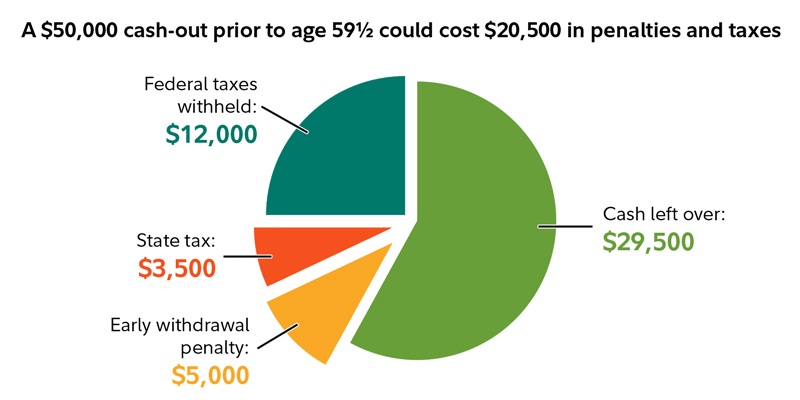

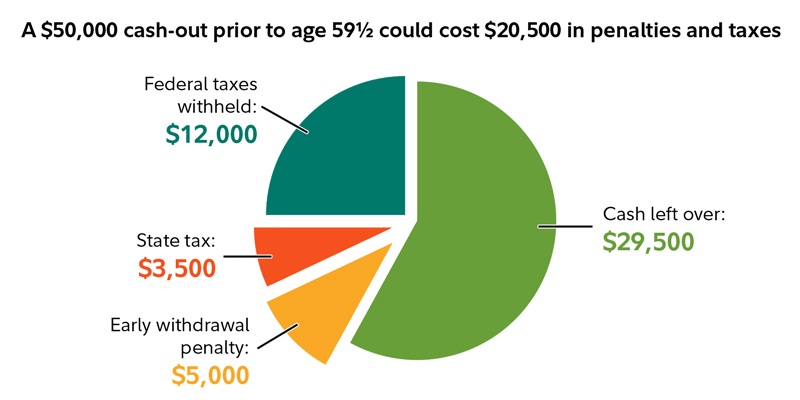

Beware of cashing out a 401(k) Toro Wealth Management From torowealth.com

Beware of cashing out a 401(k) Toro Wealth Management From torowealth.com

But that doesn’t necessarily mean you should. “retiring earlier than 62 means no social security income,” lowell. Therefore, you’d have to pay the 10% penalty. The rule of 55 is an irs provision that allows those 55. You leave your job at age 56. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5.

You leave your job at age 56.

Whether an early retirement is right for you depends largely on your goals and overall financial situation. Under the age 55 rule, you are too young to qualify. You get laid off from your job at age 54 and don’t turn 55 until next year. But that doesn’t necessarily mean you should. Whether an early retirement is right for you depends largely on your goals and overall financial situation. Therefore, you’d have to pay the 10% penalty.

Source: mymoneydesign.com

Source: mymoneydesign.com

But that doesn’t necessarily mean you should. The rule of 55 is an irs provision that allows those 55. You get laid off from your job at age 54 and don’t turn 55 until next year. “retiring earlier than 62 means no social security income,” lowell. But that doesn’t necessarily mean you should.

Source: mymoneydesign.com

Source: mymoneydesign.com

You get laid off from your job at age 54 and don’t turn 55 until next year. You leave your job at age 56. “retiring earlier than 62 means no social security income,” lowell. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for. Therefore, you’d have to pay the 10% penalty.

Source: 401kcalculator.net

Source: 401kcalculator.net

If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. You leave your job at age 56. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. But that doesn’t necessarily mean you should.

Source: torowealth.com

Source: torowealth.com

The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. The rule of 55 is an irs provision that allows those 55. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for. But that doesn’t necessarily mean you should. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,.

Source: pinterest.com

Source: pinterest.com

You get laid off from your job at age 54 and don’t turn 55 until next year. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. You get laid off from your job at age 54 and don’t turn 55 until next year. But that doesn’t necessarily mean you should. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5.

Source: mcclurewealth.com

Source: mcclurewealth.com

You leave your job at age 56. Whether an early retirement is right for you depends largely on your goals and overall financial situation. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for. But that doesn’t necessarily mean you should. You leave your job at age 56.

Source: pinterest.com

Source: pinterest.com

If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. Therefore, you’d have to pay the 10% penalty. You get laid off from your job at age 54 and don’t turn 55 until next year. But that doesn’t necessarily mean you should. You leave your job at age 56.

Source: time.com

Source: time.com

Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. Under the age 55 rule, you are too young to qualify. You leave your job at age 56. “retiring earlier than 62 means no social security income,” lowell. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5.

Source: radwadesigns.blogspot.com

Source: radwadesigns.blogspot.com

If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. The rule of 55 is an irs provision that allows those 55. Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. You leave your job at age 56. Therefore, you’d have to pay the 10% penalty.

Source: businessinsider.com.au

If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. You get laid off from your job at age 54 and don’t turn 55 until next year. Whether an early retirement is right for you depends largely on your goals and overall financial situation. But that doesn’t necessarily mean you should.

Source: thebalance.com

Source: thebalance.com

Whether an early retirement is right for you depends largely on your goals and overall financial situation. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. Therefore, you’d have to pay the 10% penalty.

Source: pinterest.com

Source: pinterest.com

Whether an early retirement is right for you depends largely on your goals and overall financial situation. Therefore, you’d have to pay the 10% penalty. You leave your job at age 56. The rule of 55 is an irs provision that allows those 55. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5.

Source: tickertape.tdameritrade.com

Source: tickertape.tdameritrade.com

The rule of 55 is an irs provision that allows those 55. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. Therefore, you’d have to pay the 10% penalty. If you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty.however,. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for.

Source: financialsamurai.com

Source: financialsamurai.com

But that doesn’t necessarily mean you should. You leave your job at age 56. You get laid off from your job at age 54 and don’t turn 55 until next year. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for. But that doesn’t necessarily mean you should.

Source: smartasset.com

Source: smartasset.com

The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. “retiring earlier than 62 means no social security income,” lowell. The rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for. Therefore, you’d have to pay the 10% penalty.

Source: thebalance.com

Source: thebalance.com

But that doesn’t necessarily mean you should. You leave your job at age 56. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. The rule of 55 is an irs provision that allows those 55. But that doesn’t necessarily mean you should.

Source: tickertape.tdameritrade.com

Source: tickertape.tdameritrade.com

But that doesn’t necessarily mean you should. Whether an early retirement is right for you depends largely on your goals and overall financial situation. The rule of 55 is an irs provision that allows those 55. Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. You get laid off from your job at age 54 and don’t turn 55 until next year.

Source: kiplinger.com

Source: kiplinger.com

Under the age 55 rule, you can start withdrawing from your 401 (k) plan without fear of the 10% penalty. The rule of 55 allows you to take money from your employer’s retirement plan without a tax penalty before age 59.5. You leave your job at age 56. The rule of 55 is an irs provision that allows those 55. Whether an early retirement is right for you depends largely on your goals and overall financial situation.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 401k early retirement 55 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.