Your Retirement plan 101 images are available. Retirement plan 101 are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement plan 101 files here. Get all royalty-free photos.

If you’re looking for retirement plan 101 pictures information connected with to the retirement plan 101 interest, you have pay a visit to the right site. Our website always gives you hints for seeing the highest quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

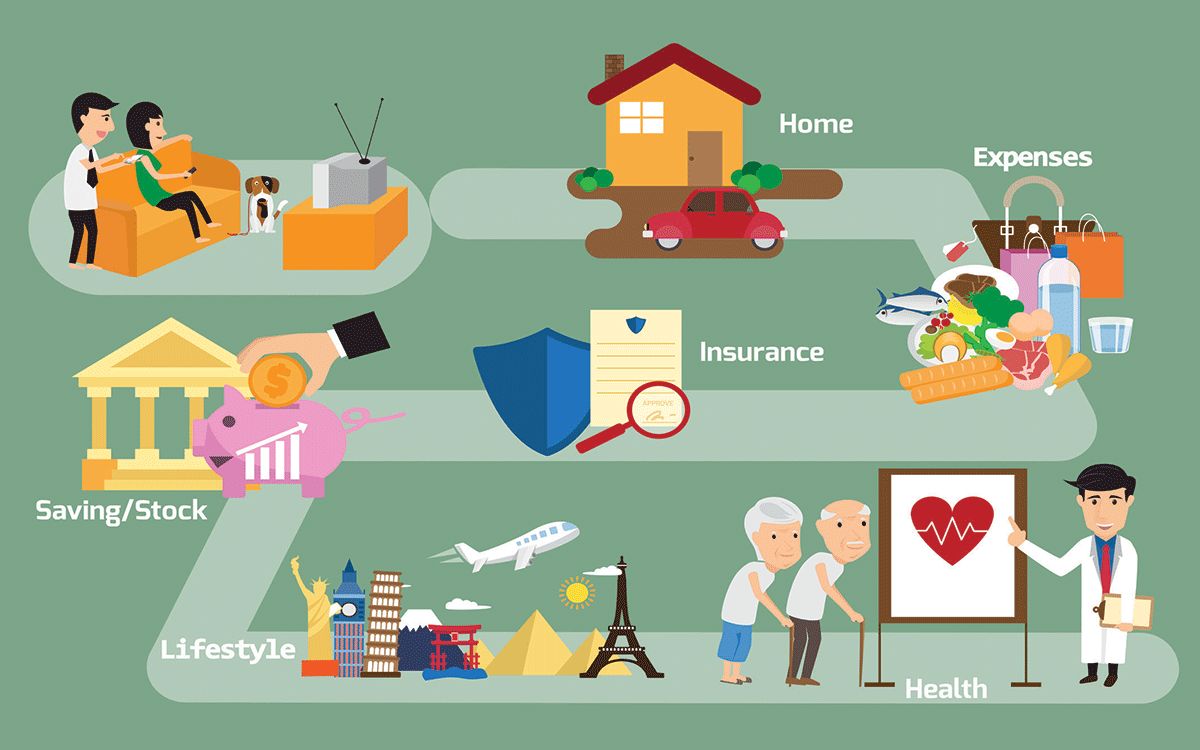

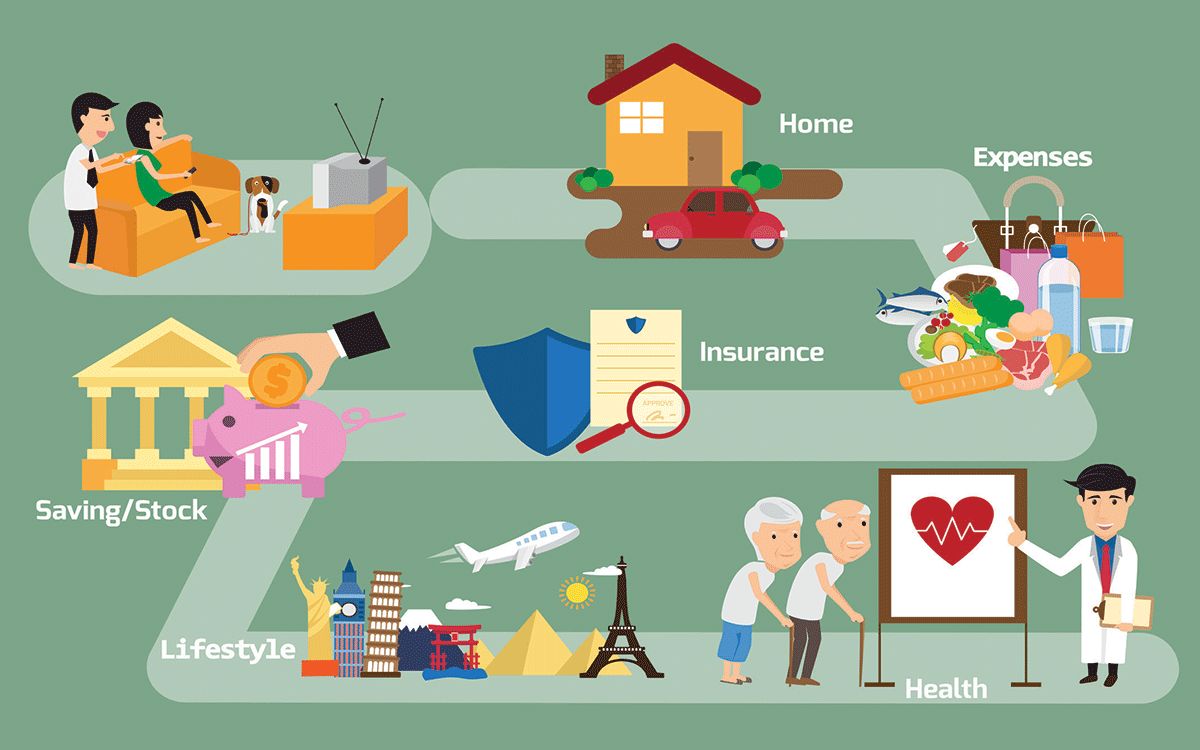

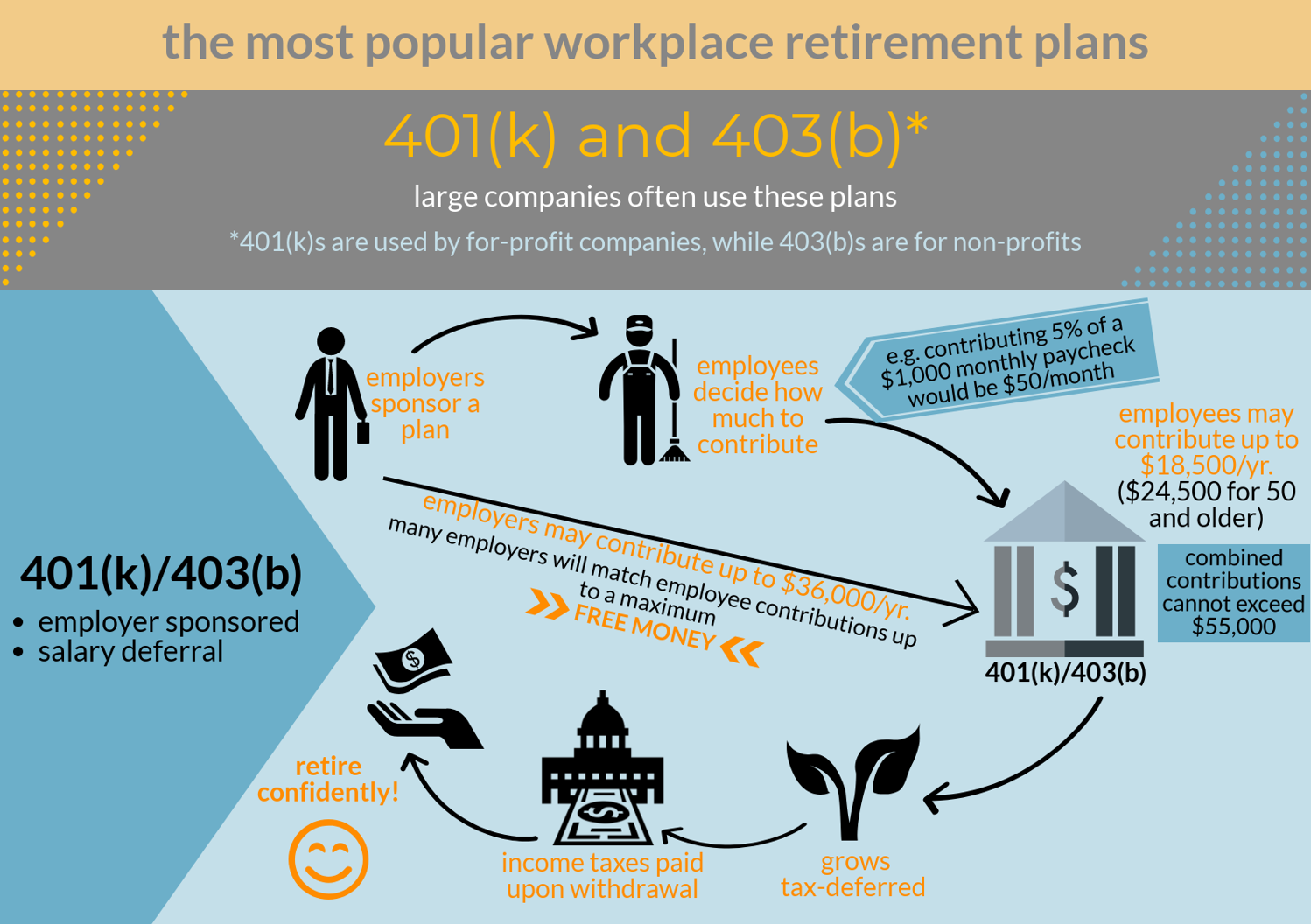

Retirement Plan 101. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. If you’ve ever committed to a large project like home renovations or organized a large. 25 years old:$325/month to $540/month. There are typically three ways to receive guaranteed lifetime income—social security, a defined benefit pension from a private employer or the government, and an annuity.

Retirement Planning 101 From afsa.org

Retirement Planning 101 From afsa.org

As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”! It is estimated that 10,000 americans will turn 60 every day for the next 20 years. 25 years old:$325/month to $540/month. Monthly retirement savings goals needed to accumulate $1 million by age 65: If you plan to retire at 65, that will leave you with 13 years to plan for.

It is estimated that 10,000 americans will turn 60 every day for the next 20 years.

A financial professional can help you. By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”! As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. If you’ve ever committed to a large project like home renovations or organized a large. If you plan to retire at 65, that will leave you with 13 years to plan for. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income.

Source: youtube.com

Source: youtube.com

Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. There are typically three ways to receive guaranteed lifetime income—social security, a defined benefit pension from a private employer or the government, and an annuity. 25 years old:$325/month to $540/month. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. A financial professional can help you.

Source: annuity.com

Source: annuity.com

It is estimated that 10,000 americans will turn 60 every day for the next 20 years. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. 25 years old:$325/month to $540/month. If you plan to retire at 65, that will leave you with 13 years to plan for. As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement.

Source: afsa.org

Source: afsa.org

A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. Monthly retirement savings goals needed to accumulate $1 million by age 65: There are typically three ways to receive guaranteed lifetime income—social security, a defined benefit pension from a private employer or the government, and an annuity.

Source: heritagefcu.com

Source: heritagefcu.com

Monthly retirement savings goals needed to accumulate $1 million by age 65: This makes retirement planning an extremely vital issue. As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. Basic planning for your retirement shouldn’t seem like an unsolvable mystery. If you’ve ever committed to a large project like home renovations or organized a large.

Source: summaglobal.com

Source: summaglobal.com

It is estimated that 10,000 americans will turn 60 every day for the next 20 years. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. If you plan to retire at 65, that will leave you with 13 years to plan for. 25 years old:$325/month to $540/month. By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”!

Source: thebalance.com

Source: thebalance.com

Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition. Basic planning for your retirement shouldn’t seem like an unsolvable mystery. As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. This makes retirement planning an extremely vital issue.

Source: simonandschuster.co.uk

Source: simonandschuster.co.uk

Monthly retirement savings goals needed to accumulate $1 million by age 65: There are typically three ways to receive guaranteed lifetime income—social security, a defined benefit pension from a private employer or the government, and an annuity. As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. A financial professional can help you.

Source: goplan101.com

Source: goplan101.com

By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”! As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition. If you’ve ever committed to a large project like home renovations or organized a large. 25 years old:$325/month to $540/month.

Source: wealthandfinance.net

Source: wealthandfinance.net

By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”! If you plan to retire at 65, that will leave you with 13 years to plan for. If you’ve ever committed to a large project like home renovations or organized a large. This makes retirement planning an extremely vital issue. Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition.

Source: youtube.com

Source: youtube.com

A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. This makes retirement planning an extremely vital issue. As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. 25 years old:$325/month to $540/month.

Source: thehungryjpeg.com

Source: thehungryjpeg.com

This makes retirement planning an extremely vital issue. This makes retirement planning an extremely vital issue. 25 years old:$325/month to $540/month. If you’ve ever committed to a large project like home renovations or organized a large. Monthly retirement savings goals needed to accumulate $1 million by age 65:

Source: thefinancialguys.com

Source: thefinancialguys.com

A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. There are typically three ways to receive guaranteed lifetime income—social security, a defined benefit pension from a private employer or the government, and an annuity. If you’ve ever committed to a large project like home renovations or organized a large. 25 years old:$325/month to $540/month. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age.

Source: blog.everythingretirement.com

Source: blog.everythingretirement.com

Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. Basic planning for your retirement shouldn’t seem like an unsolvable mystery. By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”! If you plan to retire at 65, that will leave you with 13 years to plan for.

Source: youtube.com

Source: youtube.com

Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition. This makes retirement planning an extremely vital issue. It is estimated that 10,000 americans will turn 60 every day for the next 20 years. Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition. By asking yourself the following questions, you’ll be well on your way to solving the conundrum that is “your future”!

Source: apexpwm.com.sg

Source: apexpwm.com.sg

If you plan to retire at 65, that will leave you with 13 years to plan for. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. A financial professional can help you. 25 years old:$325/month to $540/month. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income.

Source: pinterest.com

Source: pinterest.com

25 years old:$325/month to $540/month. Everyone planning for retirement can create a retirement plan including one, two, or all three of these sources of guaranteed income. A financial professional can help you. It is estimated that 10,000 americans will turn 60 every day for the next 20 years. Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition.

Source: youtube.com

Source: youtube.com

A financial professional can help you. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. If you plan to retire at 65, that will leave you with 13 years to plan for. There are typically three ways to receive guaranteed lifetime income—social security, a defined benefit pension from a private employer or the government, and an annuity. 25 years old:$325/month to $540/month.

Source: apexpwm.com.sg

Source: apexpwm.com.sg

Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition. As a second generation estate planning law firm, we at phelps laclair understand the anticipation of retirement. A good way to plan for this number is to take the average life expectancy (78 years old) and subtract that from your expected retirement age. If you plan to retire at 65, that will leave you with 13 years to plan for. Retirement planning is the process of deciding what your retirement goals are and the actions and decisions you need to undertake to bring these goals to fruition.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan 101 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.