Your 2021 retirement contribution limits images are available in this site. 2021 retirement contribution limits are a topic that is being searched for and liked by netizens today. You can Find and Download the 2021 retirement contribution limits files here. Find and Download all royalty-free images.

If you’re looking for 2021 retirement contribution limits images information connected with to the 2021 retirement contribution limits topic, you have come to the right blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

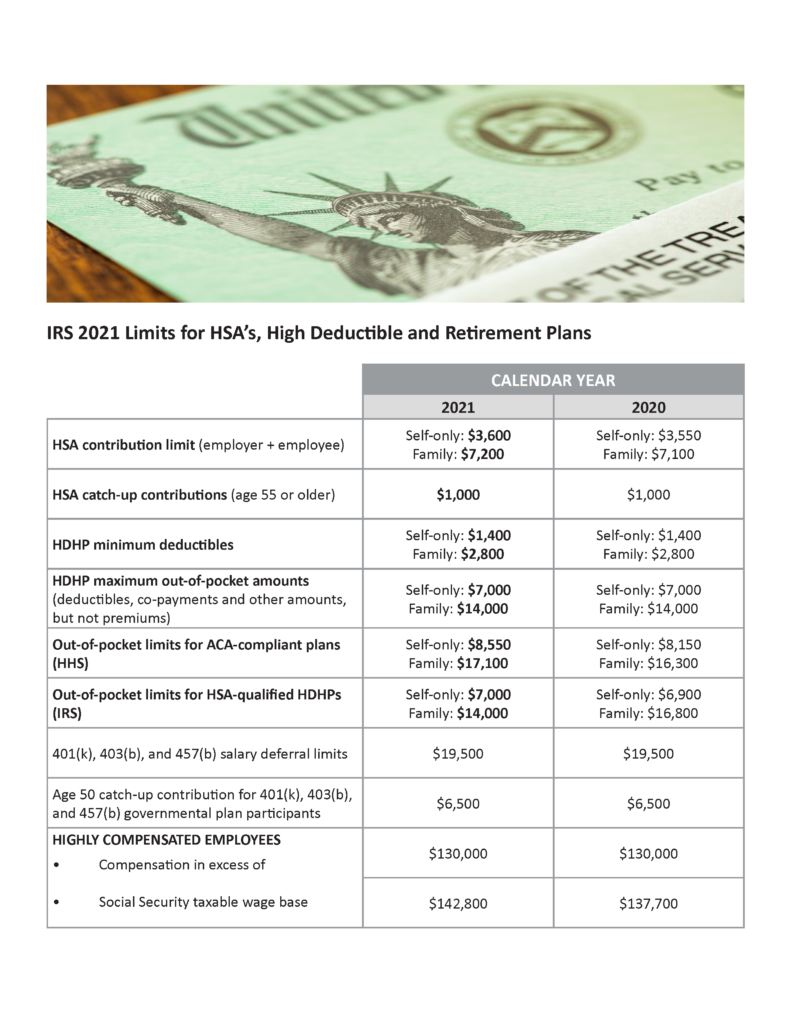

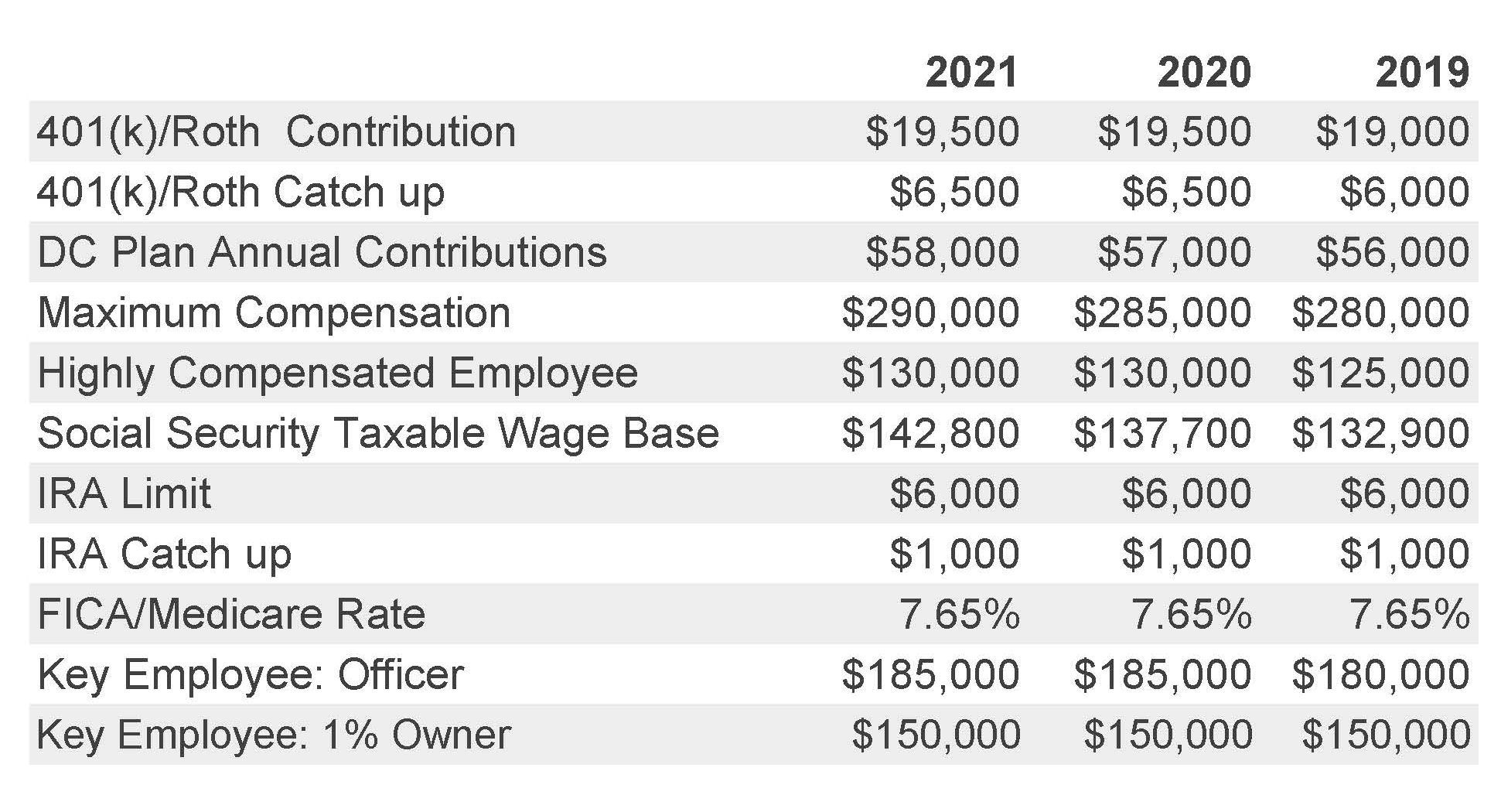

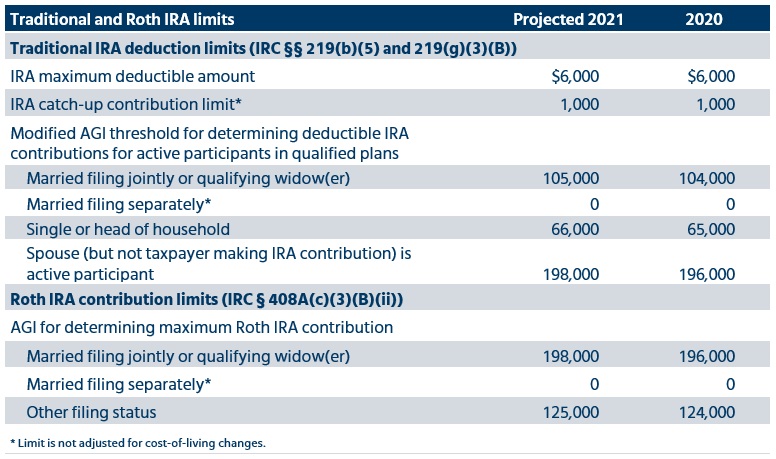

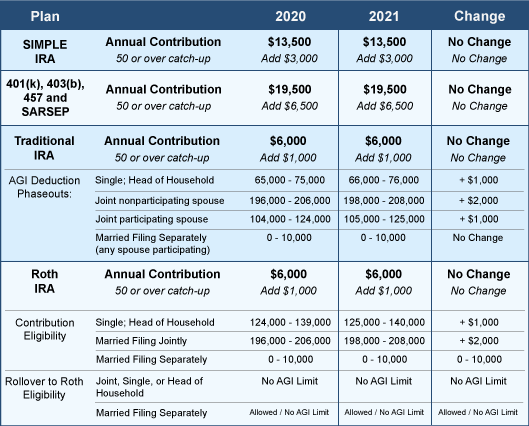

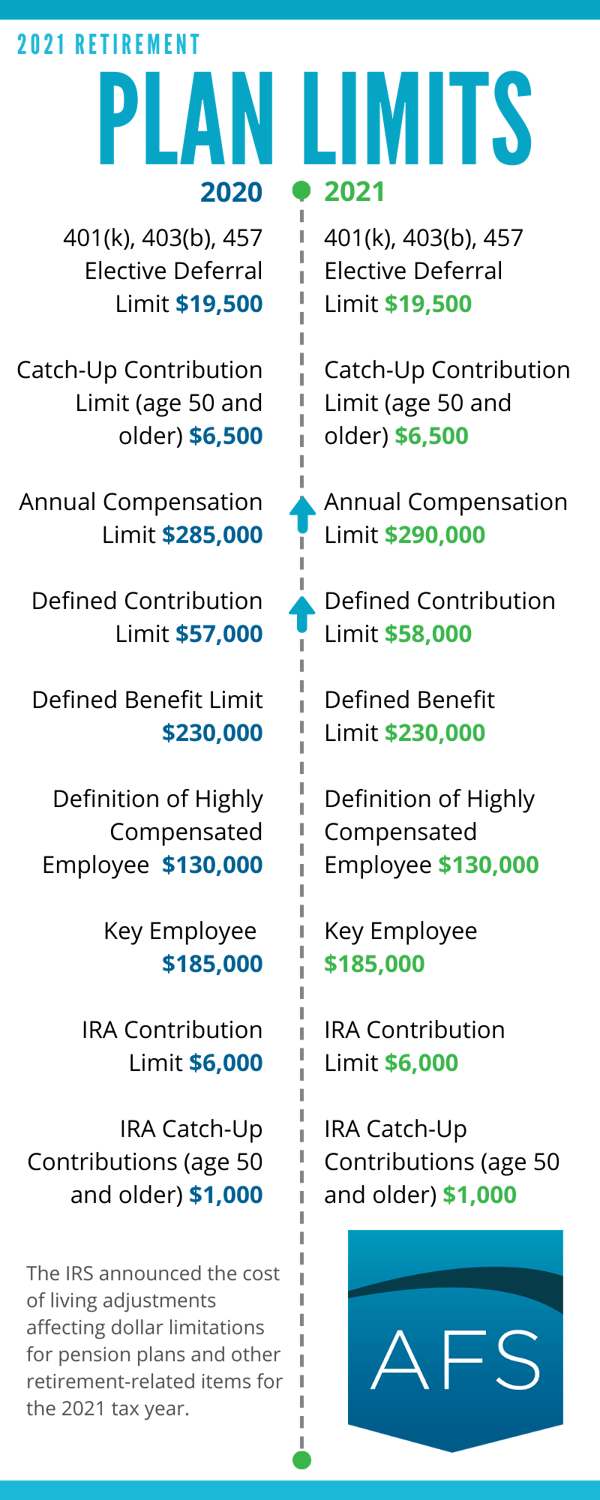

2021 Retirement Contribution Limits. Traditional ira* or roth ira** contribution limit: Contact us with any retirement planning questions. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than: $1,000 (2021) *active retirement plan participants may.

2021 Pension Plan Limits Comperio Retirement Consulting, Inc. From comperiorc.com

2021 Pension Plan Limits Comperio Retirement Consulting, Inc. From comperiorc.com

$6,000 ($7,000 if you�re age 50 or older), or. $1,000 (2021) active retirement plan participants may. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than: Contact us with any retirement planning questions. Traditional ira or roth ira** contribution limit:

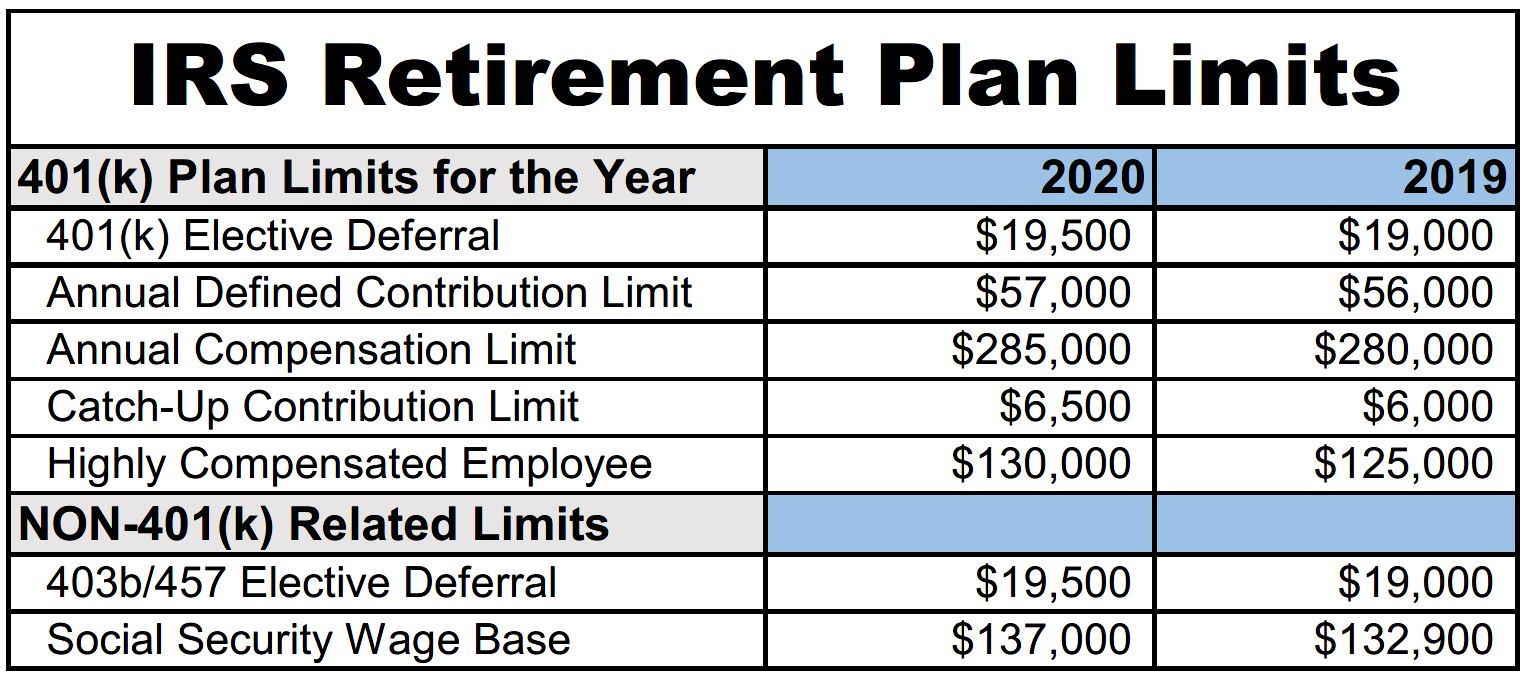

401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020.

Traditional ira* or roth ira** contribution limit: Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. $6,000 ($7,000 if you�re age 50 or older), or. As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. $1,000 (2021) *active retirement plan participants may.

![2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide] 2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2021_Retirement_401k_IRS_Contribution_Limits.jpg?width=1267&name=2021_Retirement_401k_IRS_Contribution_Limits.jpg) Source: griffinbenefits.com

Source: griffinbenefits.com

5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. Contact us with any retirement planning questions. If less, your taxable compensation for the year. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy.

Source: washfinancial.com

Source: washfinancial.com

$6,000 ($7,000 if you�re age 50 or older), or. Traditional ira* or roth ira** contribution limit: Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. Contact us with any retirement planning questions. If less, your taxable compensation for the year.

Source: sfgate.com

Source: sfgate.com

401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. Traditional ira* or roth ira** contribution limit: 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan.

Source: fosterthomas.com

Source: fosterthomas.com

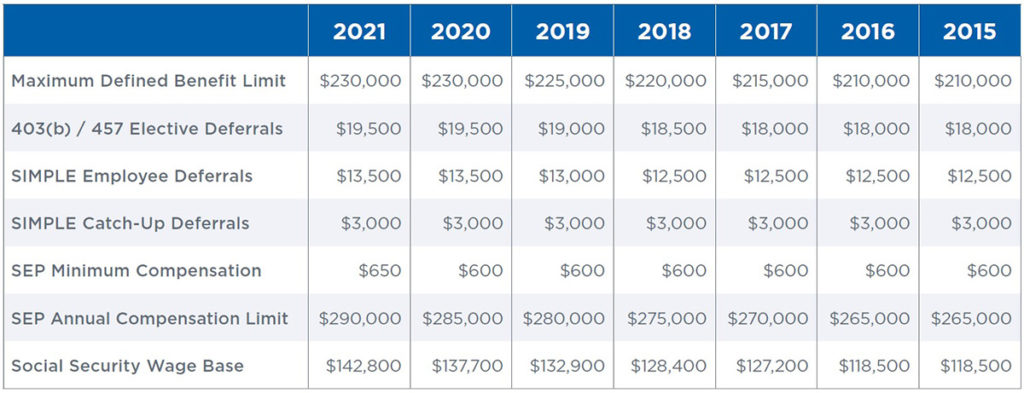

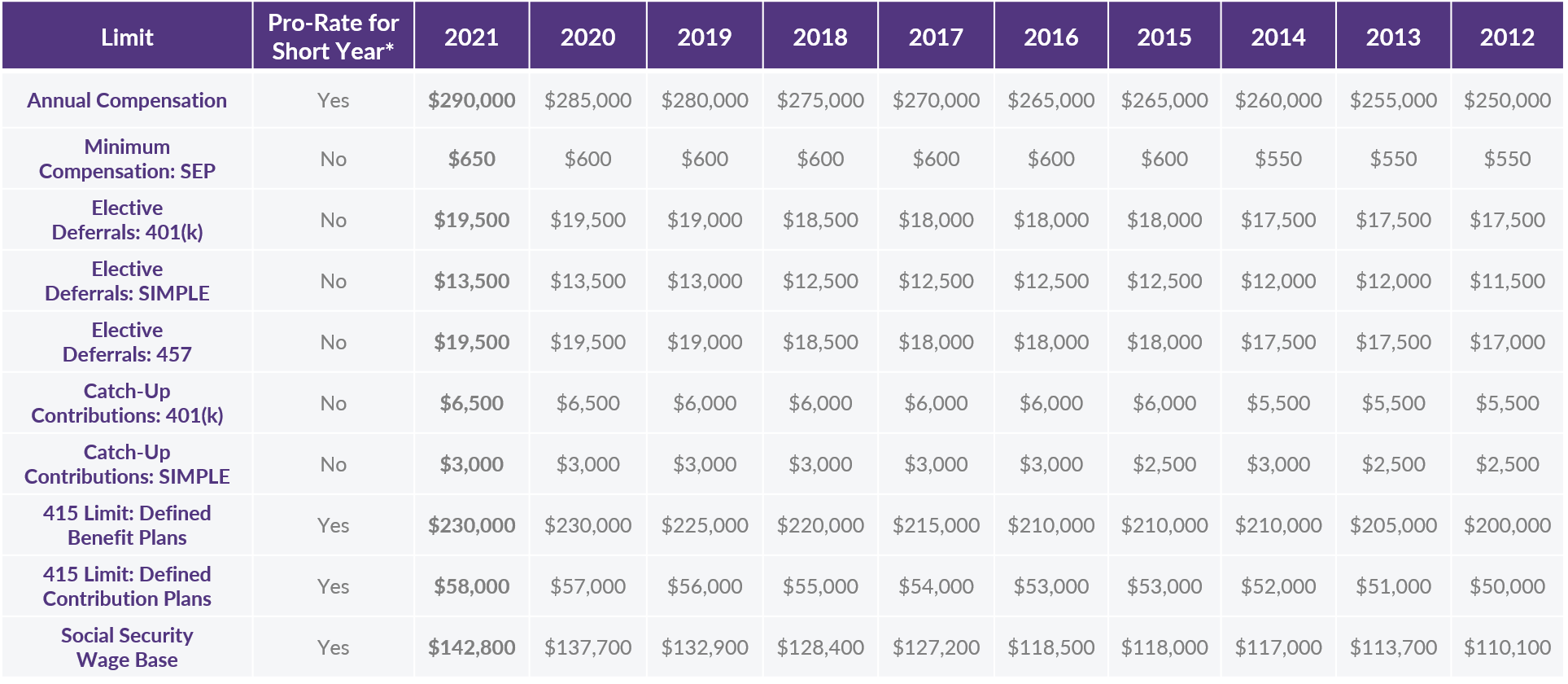

401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. Below are the 2021 tax year contribution/deferral limits. Contact us with any retirement planning questions. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan.

Source: integritybenefitpartners.com

Source: integritybenefitpartners.com

If less, your taxable compensation for the year. As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. Contact us with any retirement planning questions. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan.

Source: atlas401kplans.com

Source: atlas401kplans.com

As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. Traditional ira* or roth ira** contribution limit: For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than: If less, your taxable compensation for the year. Contact us with any retirement planning questions.

Source: trustok.com

Source: trustok.com

Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. $6,000 ($7,000 if you�re age 50 or older), or. Contact us with any retirement planning questions. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. Traditional ira* or roth ira** contribution limit:

Source: mercer.com

Source: mercer.com

If less, your taxable compensation for the year. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than: Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. Traditional ira* or roth ira** contribution limit: As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware.

Source: jdsupra.com

Source: jdsupra.com

Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. Below are the 2021 tax year contribution/deferral limits. Traditional ira* or roth ira** contribution limit: If less, your taxable compensation for the year. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020.

Source: marinerwealthadvisors.com

Source: marinerwealthadvisors.com

Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. Contact us with any retirement planning questions. Traditional ira* or roth ira** contribution limit: Below are the 2021 tax year contribution/deferral limits. As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware.

Source: hhmcpas.com

Traditional ira* or roth ira** contribution limit: $6,000 ($7,000 if you�re age 50 or older), or. Below are the 2021 tax year contribution/deferral limits. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020.

Source: newreay.blogspot.com

401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. $6,000 ($7,000 if you�re age 50 or older), or. As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. $1,000 (2021) *active retirement plan participants may. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy.

Source: gsdfinancially.com

Source: gsdfinancially.com

If less, your taxable compensation for the year. $6,000 ($7,000 if you�re age 50 or older), or. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. If less, your taxable compensation for the year. $1,000 (2021) *active retirement plan participants may.

Source: afs401k.com

Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than:

Source: theastuteadvisor.com

Source: theastuteadvisor.com

For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than: As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. Traditional ira* or roth ira** contribution limit: Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020.

Source: benefitadministrationcompany.com

Source: benefitadministrationcompany.com

$1,000 (2021) *active retirement plan participants may. $1,000 (2021) *active retirement plan participants may. 401(k) as an employee who participates in your employer�s 401(k), 403(b), 457, or the thrift savings plan offered by the federal government, your annual contribution limit will be $19,500, just as it was in 2020. Below are the 2021 tax year contribution/deferral limits. If less, your taxable compensation for the year.

Source: marinerwealthadvisors.com

Source: marinerwealthadvisors.com

Traditional ira* or roth ira** contribution limit: Please review your unique tax situation with a professional before significantly altering your retirement savings tax strategy. 5 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. Below are the 2021 tax year contribution/deferral limits. Traditional ira* or roth ira** contribution limit:

Source: northwestbank.com

Source: northwestbank.com

Below are the 2021 tax year contribution/deferral limits. As we now get 2021 underway, here are the contribution limits for various plans of which you should be aware. Traditional ira* or roth ira** contribution limit: For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can�t be more than: $1,000 (2021) *active retirement plan participants may.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2021 retirement contribution limits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.