Your Zero tax bracket in retirement images are ready. Zero tax bracket in retirement are a topic that is being searched for and liked by netizens today. You can Get the Zero tax bracket in retirement files here. Find and Download all free vectors.

If you’re searching for zero tax bracket in retirement images information connected with to the zero tax bracket in retirement interest, you have come to the ideal blog. Our website frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Zero Tax Bracket In Retirement. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. If your income is lowered enough, you may retire in a lower tax bracket. For a married couple, that figure is $78,750, puplava stated. This is happening for two reasons:

Matt Dietz How To Get 0 Tax Bracket From dietzagency.com

Matt Dietz How To Get 0 Tax Bracket From dietzagency.com

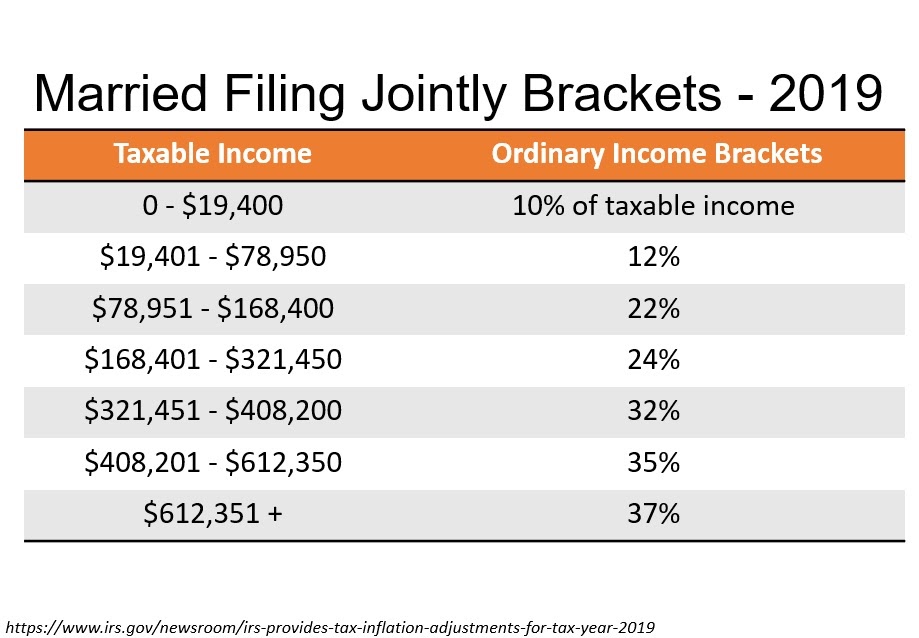

If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. For a married couple, that figure is $78,750, puplava stated. Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. This is happening for two reasons: But even if you retire in the same tax bracket, your effective tax rate may be lower.

Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum.

If your income is lowered enough, you may retire in a lower tax bracket. But even if you retire in the same tax bracket, your effective tax rate may be lower. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. How can i make my taxable income zero? For a married couple, that figure is $78,750, puplava stated. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets.

Source: financialsense.com

Source: financialsense.com

For a married couple, that figure is $78,750, puplava stated. If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. For a married couple, that figure is $78,750, puplava stated. But even if you retire in the same tax bracket, your effective tax rate may be lower.

An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. If your income is lowered enough, you may retire in a lower tax bracket. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. This is happening for two reasons: For a married couple, that figure is $78,750, puplava stated.

Source: slideshare.net

Source: slideshare.net

For a married couple, that figure is $78,750, puplava stated. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. For a married couple, that figure is $78,750, puplava stated. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. But even if you retire in the same tax bracket, your effective tax rate may be lower.

Source: taxw.blogspot.com

Source: taxw.blogspot.com

An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. This is happening for two reasons: If your income is lowered enough, you may retire in a lower tax bracket. For a married couple, that figure is $78,750, puplava stated. If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero.

Source: pinterest.com

Source: pinterest.com

How can i make my taxable income zero? If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. If your income is lowered enough, you may retire in a lower tax bracket. But even if you retire in the same tax bracket, your effective tax rate may be lower.

![[F.R.E.E] The Power of Zero How to Get to the 0 Tax Bracket and Tra… [F.R.E.E] The Power of Zero How to Get to the 0 Tax Bracket and Tra…](https://image.slidesharecdn.com/the-power-of-zero-how-to-get-to-the-0-tax-bracket-and-transform-your-retirement-revised-and-updated-191226160952/95/free-the-power-of-zero-how-to-get-to-the-0-tax-bracket-and-transform-your-retirement-revised-and-updated-for-kindle-3-1024.jpg?cb=1577376609) Source: pt.slideshare.net

Source: pt.slideshare.net

Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. But even if you retire in the same tax bracket, your effective tax rate may be lower. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. If your income is lowered enough, you may retire in a lower tax bracket.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. This is happening for two reasons: But even if you retire in the same tax bracket, your effective tax rate may be lower. If your income is lowered enough, you may retire in a lower tax bracket. Finally, a life insurance retirement plan, or lirp, is an accumulation tool.

Source: reddit.com

Source: reddit.com

An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. If your income is lowered enough, you may retire in a lower tax bracket. If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. But even if you retire in the same tax bracket, your effective tax rate may be lower.

Source: theivyag.com

Source: theivyag.com

This is happening for two reasons: An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. If your income is lowered enough, you may retire in a lower tax bracket. How can i make my taxable income zero?

Source: hengeholdcapital.com

Source: hengeholdcapital.com

Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. But even if you retire in the same tax bracket, your effective tax rate may be lower. If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. For a married couple, that figure is $78,750, puplava stated.

Source: physicianonfire.com

Source: physicianonfire.com

If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. For a married couple, that figure is $78,750, puplava stated. But even if you retire in the same tax bracket, your effective tax rate may be lower. How can i make my taxable income zero? Finally, a life insurance retirement plan, or lirp, is an accumulation tool.

Source: physicianonfire.com

Source: physicianonfire.com

For a married couple, that figure is $78,750, puplava stated. This is happening for two reasons: Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. For a married couple, that figure is $78,750, puplava stated. How can i make my taxable income zero?

Source: humaninvesting.com

Source: humaninvesting.com

For a married couple, that figure is $78,750, puplava stated. How can i make my taxable income zero? An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. But even if you retire in the same tax bracket, your effective tax rate may be lower.

Source: dietzagency.com

Source: dietzagency.com

Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. How can i make my taxable income zero? An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum. For a married couple, that figure is $78,750, puplava stated.

Source: lifeplanningtoday.com

Source: lifeplanningtoday.com

Finally, a life insurance retirement plan, or lirp, is an accumulation tool. This is happening for two reasons: If your income is lowered enough, you may retire in a lower tax bracket. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. Finally, a life insurance retirement plan, or lirp, is an accumulation tool.

How can i make my taxable income zero? But even if you retire in the same tax bracket, your effective tax rate may be lower. Finally, a life insurance retirement plan, or lirp, is an accumulation tool. If your income is lowered enough, you may retire in a lower tax bracket. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets.

Source: myjourneytoearlyretirement.com

Source: myjourneytoearlyretirement.com

For a married couple, that figure is $78,750, puplava stated. An experienced retirement planning attorney who understands tax law and probate law can help you develop a comprehensive retirement and estate plan that maximizes your income, investments, and assets. But even if you retire in the same tax bracket, your effective tax rate may be lower. For a married couple, that figure is $78,750, puplava stated. Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum.

Source: themoneyhabit.org

Source: themoneyhabit.org

How can i make my taxable income zero? If you�re single, the first $39,375 of dividend income or capital gains is taxed at zero. How can i make my taxable income zero? But even if you retire in the same tax bracket, your effective tax rate may be lower. Suggestion to consider for making income tax zero when income is rs 20.41 lakhs per annum.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title zero tax bracket in retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.