Your Yearly retirement distribution images are available in this site. Yearly retirement distribution are a topic that is being searched for and liked by netizens today. You can Find and Download the Yearly retirement distribution files here. Find and Download all royalty-free images.

If you’re looking for yearly retirement distribution images information connected with to the yearly retirement distribution keyword, you have visit the right blog. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

Yearly Retirement Distribution. You are retired and your 70th birthday was july 1, 2019. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. You reached age 72 on july 1, 2021. He can satisfy this, if he chooses, by making $30,000 of.

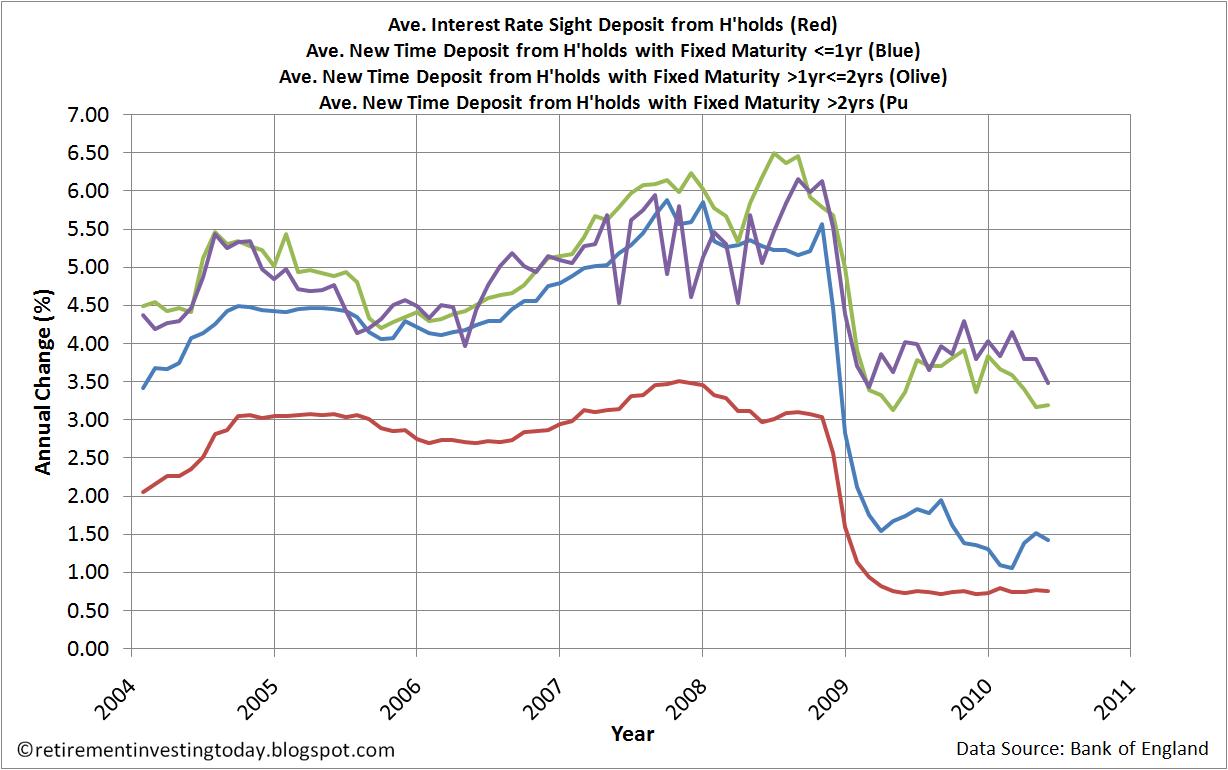

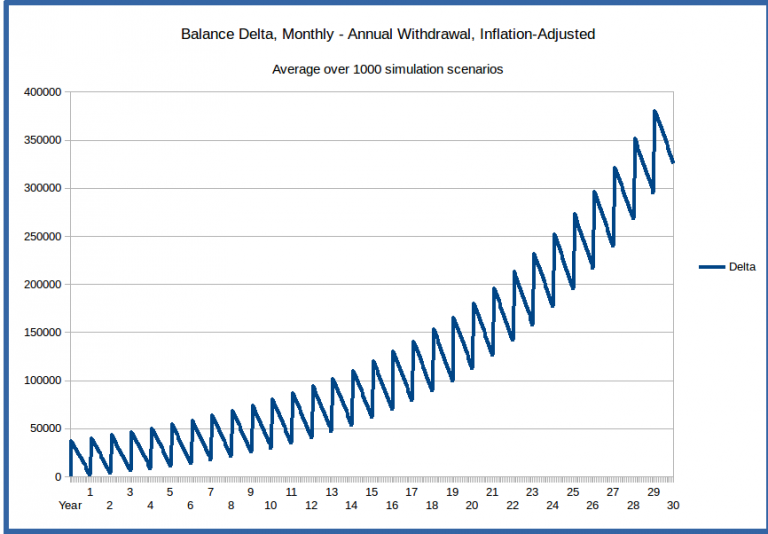

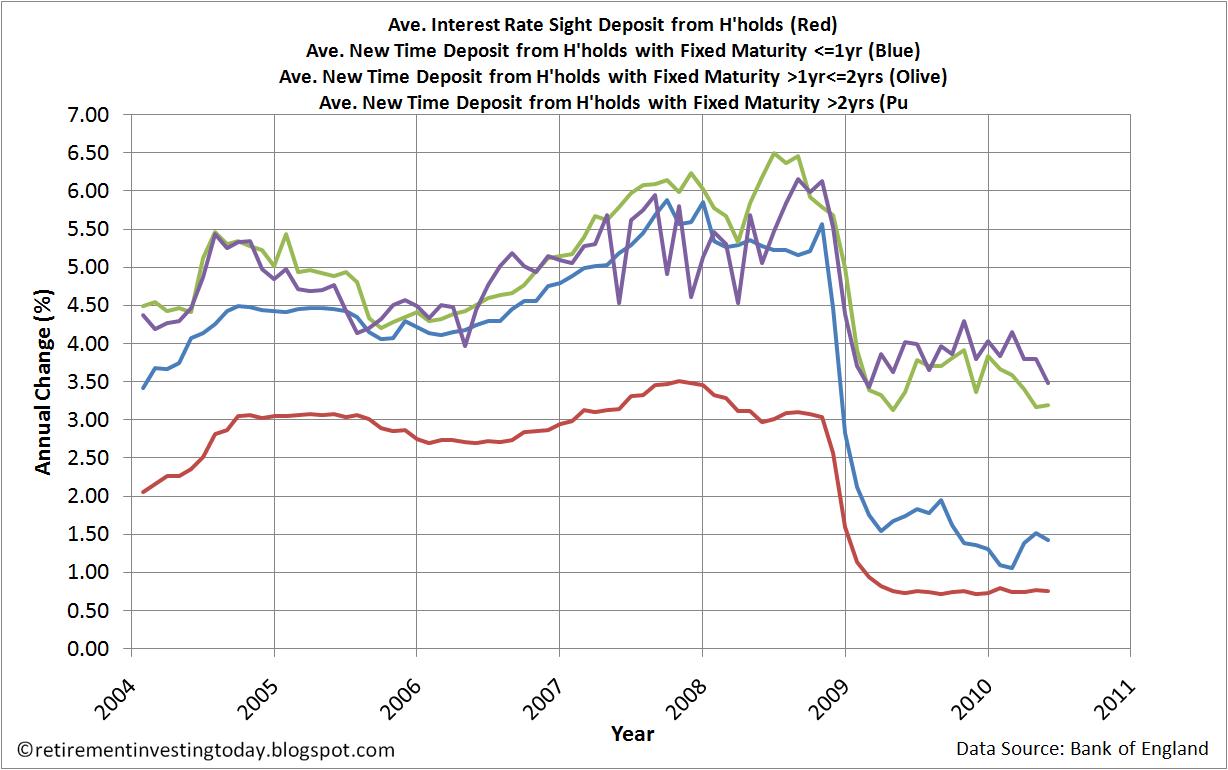

Retirement Investing Today Positive real savings rates are impossible From retirementinvestingtoday.com

Retirement Investing Today Positive real savings rates are impossible From retirementinvestingtoday.com

He can satisfy this, if he chooses, by making $30,000 of. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. Early distributions are withdrawals taken before the age of 59.5. Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5.

You reached age 72 on july 1, 2021.

You are retired and your 70th birthday was july 1, 2019. You are retired and your 70th birthday was july 1, 2019. However, if the retirement plan account is an ira or the account owner. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45. Early distributions are withdrawals taken before the age of 59.5. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires.

Source: personalcapital.com

Source: personalcapital.com

Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. However, if the retirement plan account is an ira or the account owner. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72.

Source: westwoodgroup.com

Source: westwoodgroup.com

Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45. You reached age 72 on july 1, 2021. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter.

![Average, Median, Top 1 Individual Percentiles [2019] DQYDJ Average, Median, Top 1 Individual Percentiles [2019] DQYDJ](http://cdn.dqydj.com/wp-content/uploads/2019/10/individual_income_percentile_usa_2018_2019-1024x682.png) Source: dqydj.com

Source: dqydj.com

You reached age 72 on july 1, 2021. Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. Early distributions are withdrawals taken before the age of 59.5. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72.

Source: flemingwatson.com

Source: flemingwatson.com

Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. You reached age 72 on july 1, 2021. Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45.

Source: financial-planning.com

Source: financial-planning.com

Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. Early distributions are withdrawals taken before the age of 59.5. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. You reached age 72 on july 1, 2021.

Source: livefreemd.com

Source: livefreemd.com

You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. You are retired and your 70th birthday was july 1, 2019. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter.

Source: damnthematrix.wordpress.com

Source: damnthematrix.wordpress.com

Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. You are retired and your 70th birthday was july 1, 2019. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires.

Source: researchgate.net

Source: researchgate.net

Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. You reached age 72 on july 1, 2021. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. Early distributions are withdrawals taken before the age of 59.5. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45.

Source: spreadsheetweb.com

Source: spreadsheetweb.com

Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. You are retired and your 70th birthday was july 1, 2019. Early distributions are withdrawals taken before the age of 59.5. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter.

Source: iammrfoster.com

Source: iammrfoster.com

You are retired and your 70th birthday was july 1, 2019. However, if the retirement plan account is an ira or the account owner. You are retired and your 70th birthday was july 1, 2019. He can satisfy this, if he chooses, by making $30,000 of. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together.

Source: galtonboard.com

Source: galtonboard.com

You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45. Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter. Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs.

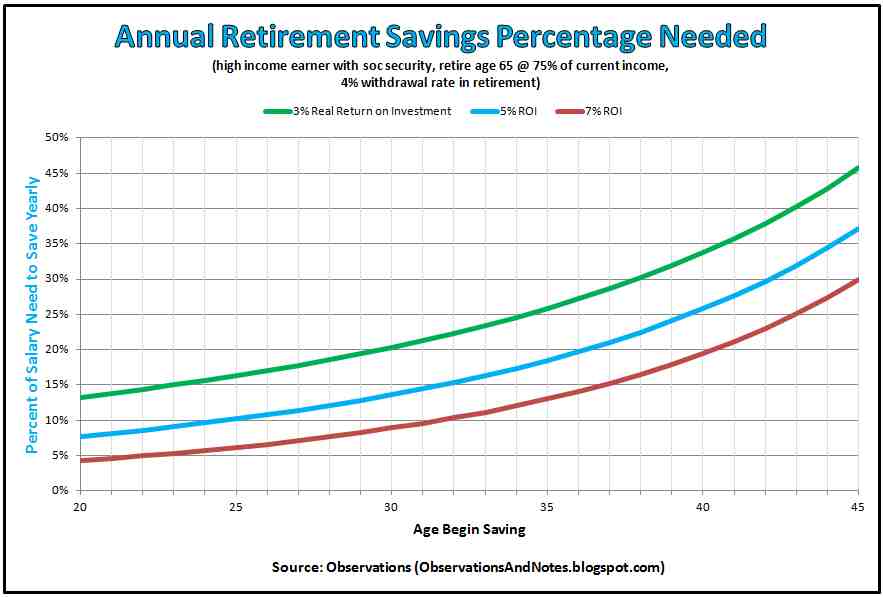

Source: observationsandnotes.blogspot.com

Source: observationsandnotes.blogspot.com

You reached age 72 on july 1, 2021. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. You are retired and your 70th birthday was july 1, 2019. Early distributions are withdrawals taken before the age of 59.5.

Source: rba.gov.au

Source: rba.gov.au

You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter. You reached age 72 on july 1, 2021. However, if the retirement plan account is an ira or the account owner. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72.

Source: forum.earlyretirementextreme.com

Source: forum.earlyretirementextreme.com

He can satisfy this, if he chooses, by making $30,000 of. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. Early distributions are withdrawals taken before the age of 59.5. You must take your first rmd (for 2021) by april 1, 2022, with subsequent rmds on december 31st annually thereafter. Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5.

Source: jsevy.com

Source: jsevy.com

Normal distributions are when money is a distributed after the official retirement age stated in the plan, usually 59.5. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. Early distributions are withdrawals taken before the age of 59.5. You reached age 72 on july 1, 2021. Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs.

Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72. So, for 2021, we have determined that paul’s rmd from the ira will be $36,134.45. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. However, if the retirement plan account is an ira or the account owner.

Source: retirementinvestingtoday.com

Source: retirementinvestingtoday.com

Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. Early distributions are withdrawals taken before the age of 59.5. You reached age 72 on july 1, 2021. You are retired and your 70th birthday was july 1, 2019. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together.

Source: retirementrocketscience.com

Source: retirementrocketscience.com

Qualified distributions are when the account owner withdraws funds from a qualified retirement plan recognized by the irs. Rather than pick a single method to use throughout retirement, talk to a financial advisor about how to make the following retirement withdrawal strategies work together. However, if the retirement plan account is an ira or the account owner. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. You reach age 70½ after december 31, 2019, so you are not required to take a minimum distribution until you reach 72.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title yearly retirement distribution by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.