Your What is the rule of 60 for retirement images are available. What is the rule of 60 for retirement are a topic that is being searched for and liked by netizens today. You can Download the What is the rule of 60 for retirement files here. Get all free vectors.

If you’re looking for what is the rule of 60 for retirement images information linked to the what is the rule of 60 for retirement topic, you have pay a visit to the right blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

What Is The Rule Of 60 For Retirement. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year. The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Disability retirement date means the first day of the.

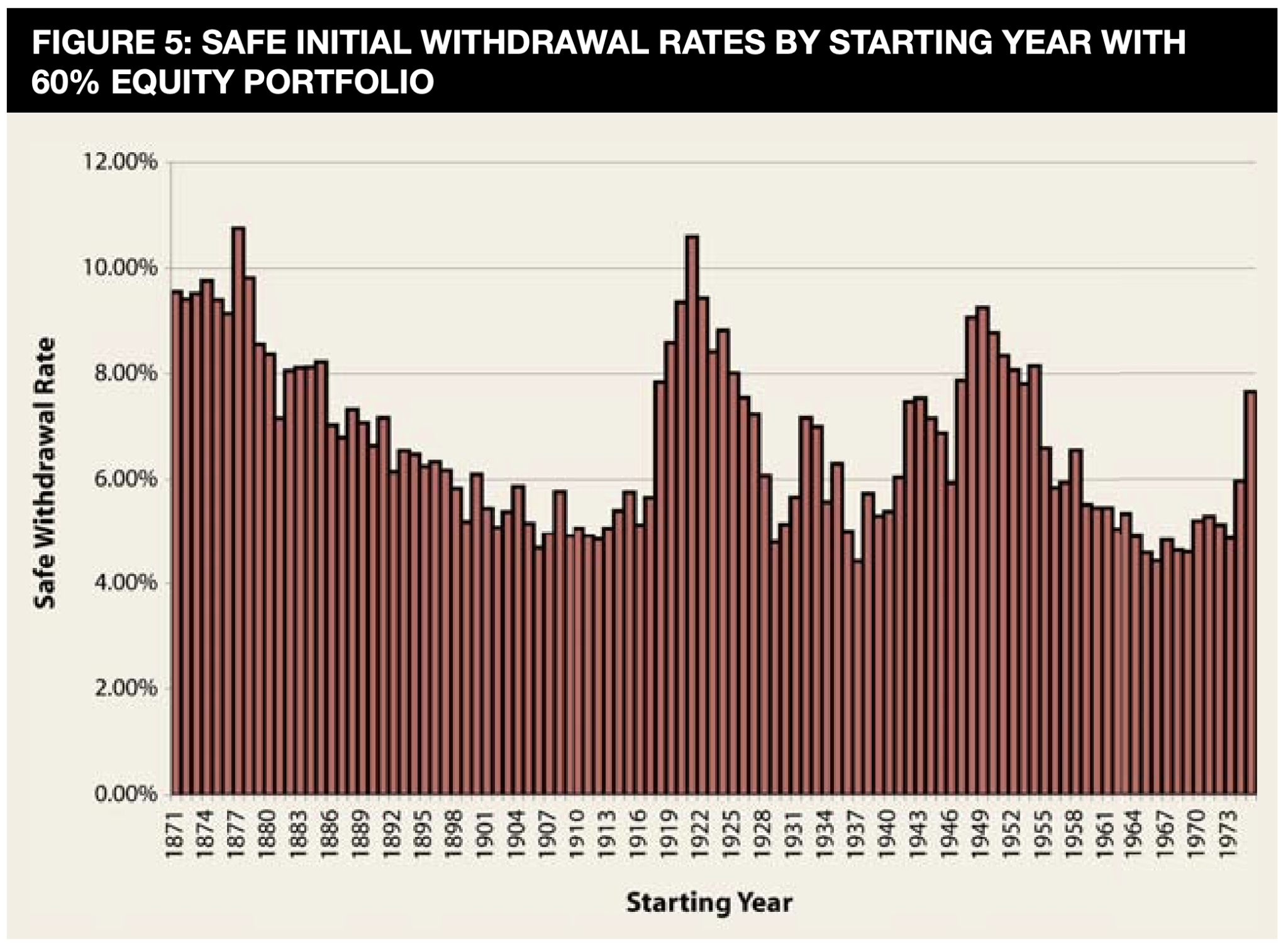

Safe Withdrawal Rates, Part 1 Retirement�s 4 Rule Seeking Alpha From seekingalpha.com

Safe Withdrawal Rates, Part 1 Retirement�s 4 Rule Seeking Alpha From seekingalpha.com

If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year. Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. The first step for retiring at 60 is to determine how much money you’ll need. Disability retirement date means the first day of the.

The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the.

For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year. Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. Rule of 60 means that the sum of a participant�s years of association and age must be at least 60.rule of 60 means the sum of a participant�s age and years of service, provided such sum equals or exceeds sixty (60) and the participant is credited with at least ten (10) years of service on the effective date. Related to rule of 60. How does the rule of 60 work? For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year.

Source: thekelleyfinancialgroup.com

Source: thekelleyfinancialgroup.com

The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open. Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. The first step for retiring at 60 is to determine how much money you’ll need. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5).

How does the rule of 60 work? The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Rule of 60 means that the sum of a participant�s years of association and age must be at least 60.rule of 60 means the sum of a participant�s age and years of service, provided such sum equals or exceeds sixty (60) and the participant is credited with at least ten (10) years of service on the effective date. The first step for retiring at 60 is to determine how much money you’ll need. If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings.

Source: fool.com

Source: fool.com

The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Related to rule of 60. Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open. How does the rule of 60 work? The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the.

Source: seekingalpha.com

Source: seekingalpha.com

The first step for retiring at 60 is to determine how much money you’ll need. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. The first step for retiring at 60 is to determine how much money you’ll need. Disability retirement date means the first day of the.

Related to rule of 60. The first step for retiring at 60 is to determine how much money you’ll need. Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5).

Source: seekingalpha.com

Source: seekingalpha.com

Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. How does the rule of 60 work? Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Related to rule of 60.

Source: murphywealth.co.uk

Source: murphywealth.co.uk

Related to rule of 60. Rule of 60 means that the sum of a participant�s years of association and age must be at least 60.rule of 60 means the sum of a participant�s age and years of service, provided such sum equals or exceeds sixty (60) and the participant is credited with at least ten (10) years of service on the effective date. The first step for retiring at 60 is to determine how much money you’ll need. How does the rule of 60 work? Related to rule of 60.

Source: seekingalpha.com

Source: seekingalpha.com

Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings. The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. How does the rule of 60 work? The first step for retiring at 60 is to determine how much money you’ll need.

Source: seekingalpha.com

Source: seekingalpha.com

Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open. The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Rule of 60 means that the sum of a participant�s years of association and age must be at least 60.rule of 60 means the sum of a participant�s age and years of service, provided such sum equals or exceeds sixty (60) and the participant is credited with at least ten (10) years of service on the effective date. If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings. How does the rule of 60 work?

Source: thaifrx.com

Source: thaifrx.com

This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). How does the rule of 60 work? Disability retirement date means the first day of the. If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings.

Source: pacificawealth.com

Source: pacificawealth.com

If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open. Disability retirement date means the first day of the. How does the rule of 60 work?

Source: superguide.com.au

Source: superguide.com.au

The first step for retiring at 60 is to determine how much money you’ll need. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings. For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year.

Related to rule of 60. Disability retirement date means the first day of the. How does the rule of 60 work? Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open.

Source: youtube.com

Source: youtube.com

The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Related to rule of 60. The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. How does the rule of 60 work? Disability retirement date means the first day of the.

Source: dividendsensei.com

Source: dividendsensei.com

The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax. How does the rule of 60 work? The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. The first step for retiring at 60 is to determine how much money you’ll need.

Source: moneytalksnews.com

Source: moneytalksnews.com

Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open. Related to rule of 60. For instance, if you are earning $100,000 a year before retiring, this benchmark suggests you probably can maintain your lifestyle on $70,000 a year. How does the rule of 60 work? The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the.

Source: fool.com

Source: fool.com

Qualified elector means an individual at least 18 years of age who is a citizen of the united states, a permanent resident of this state, and a resident of the district who registers with the supervisor of elections of a county within which the district lands are located when the registration books are open. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). Related to rule of 60. The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Disability retirement date means the first day of the.

Source: robberger.com

Source: robberger.com

The first step for retiring at 60 is to determine how much money you’ll need. The first step for retiring at 60 is to determine how much money you’ll need. This is a big change from withdrawing before age 60, where the rules mean tax is payable on some parts of your super benefit (see question 5). The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the. Remember, if you retire at 60 and withdraw your super savings, you miss out on the benefits of compound interest and the tax.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the rule of 60 for retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.