Your What is net pay images are available in this site. What is net pay are a topic that is being searched for and liked by netizens now. You can Find and Download the What is net pay files here. Get all free photos.

If you’re searching for what is net pay images information related to the what is net pay interest, you have come to the ideal blog. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

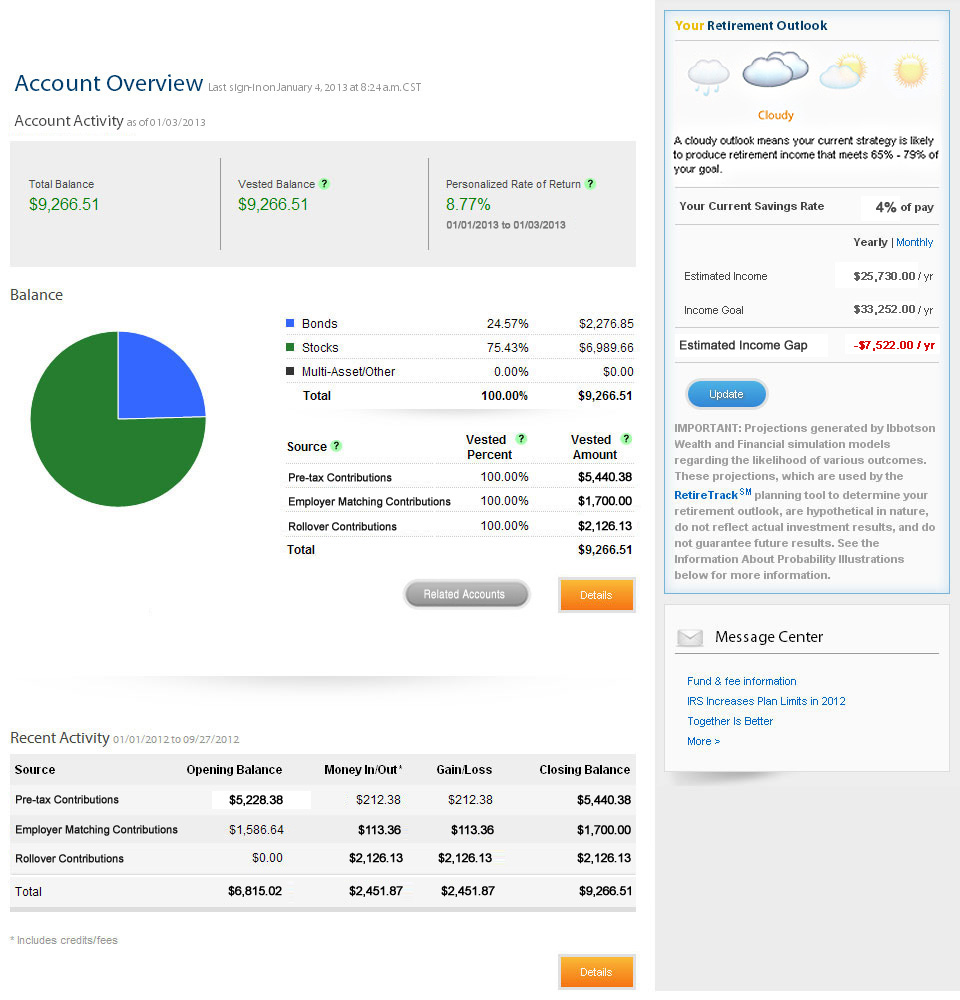

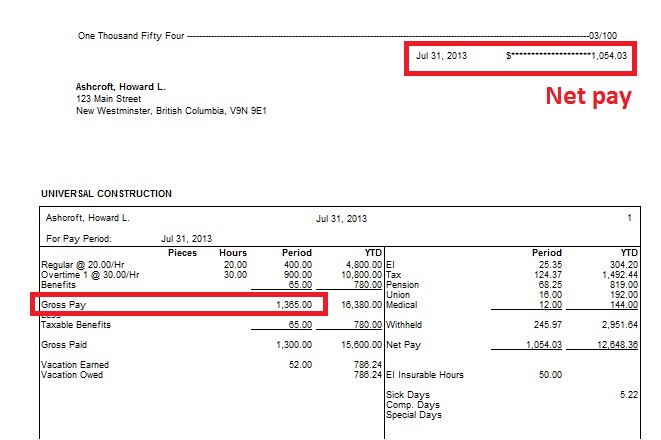

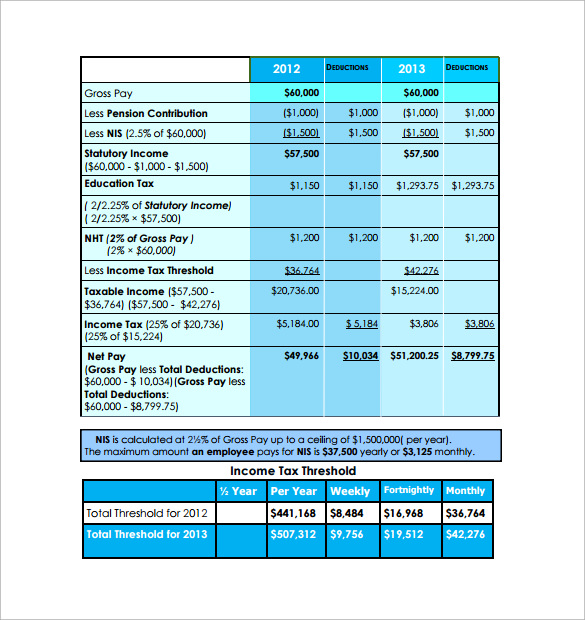

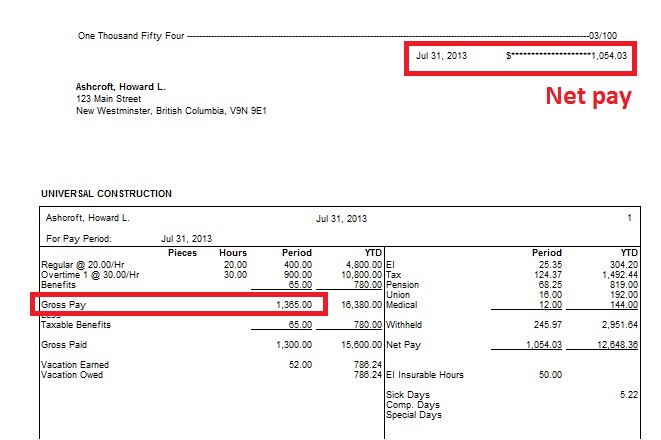

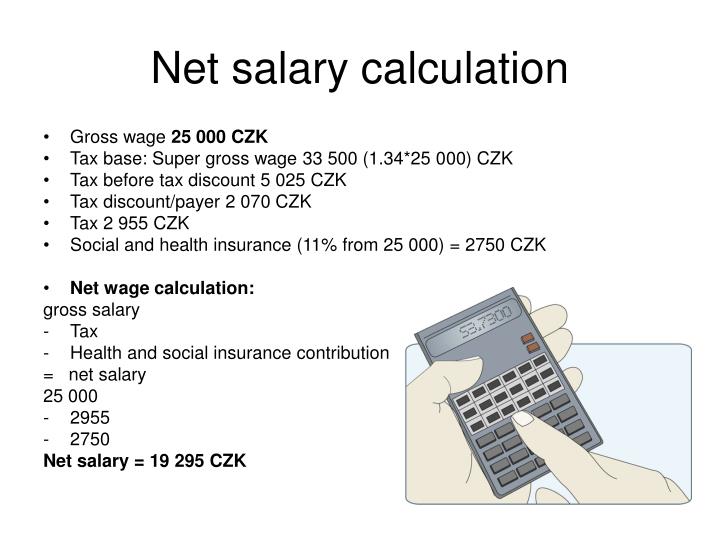

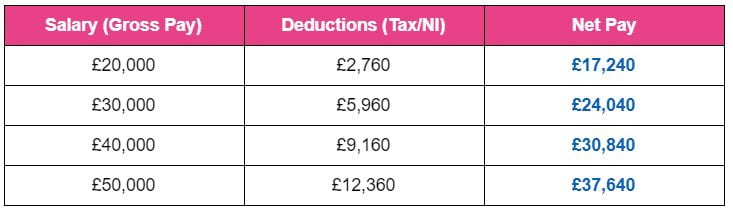

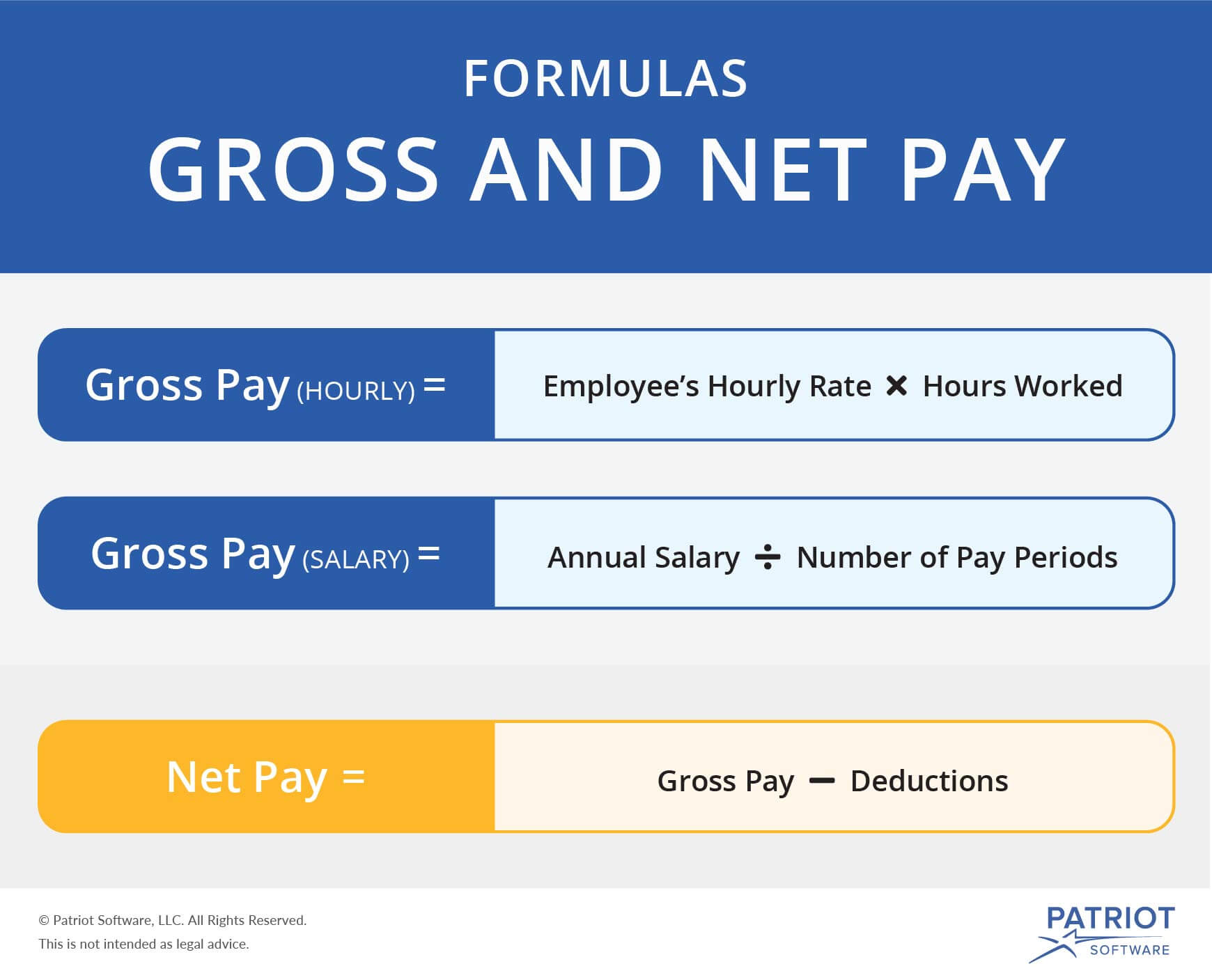

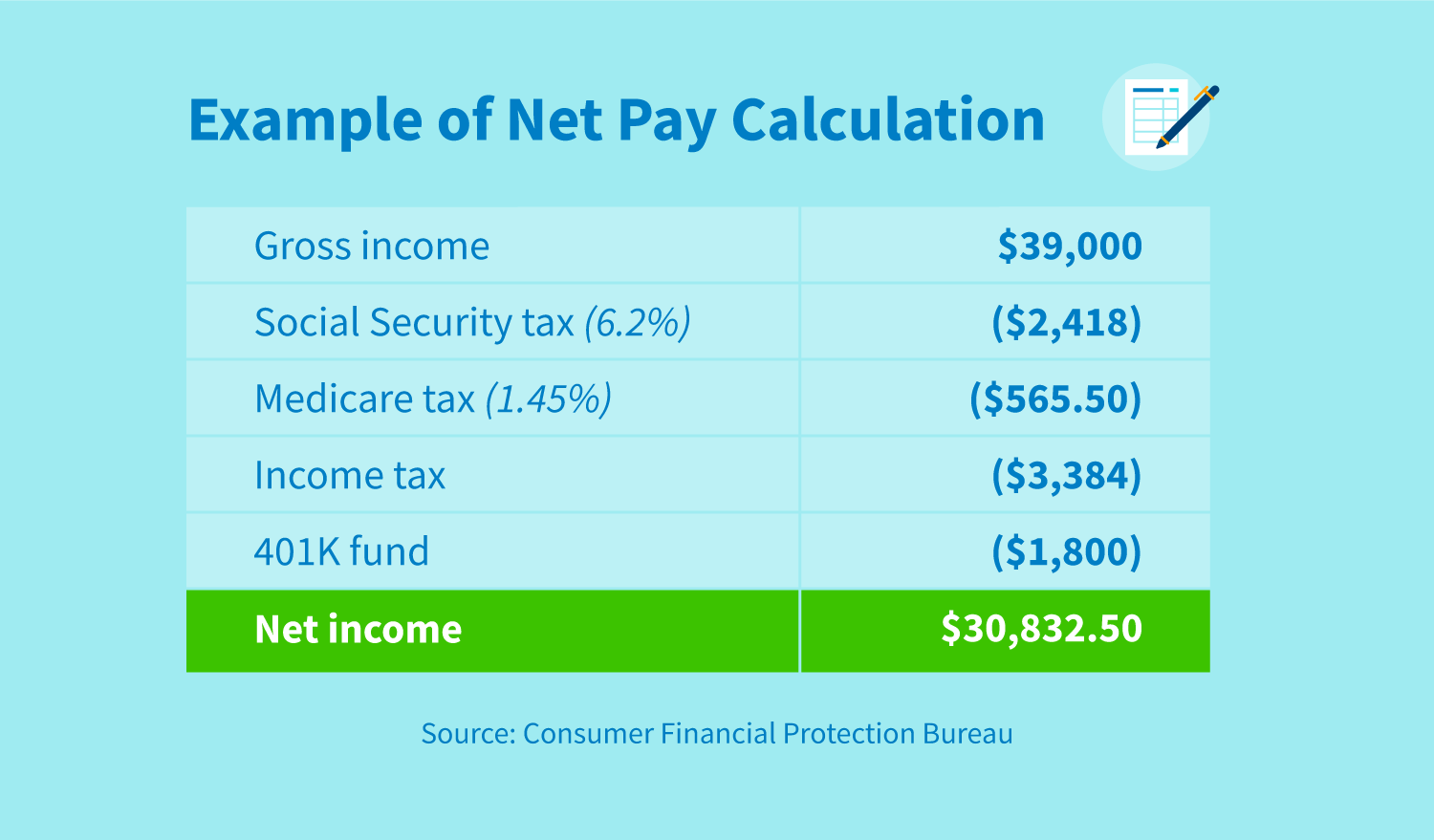

What Is Net Pay. 5 rows what is net pay? Net pay is an employee’s earnings after all deductions are taken out. This is the amount paid to each employee on payday. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay.

payrolladjusted gross amounts Sage 50 CA Payroll Sage 50 From sagecity.na.sage.com

payrolladjusted gross amounts Sage 50 CA Payroll Sage 50 From sagecity.na.sage.com

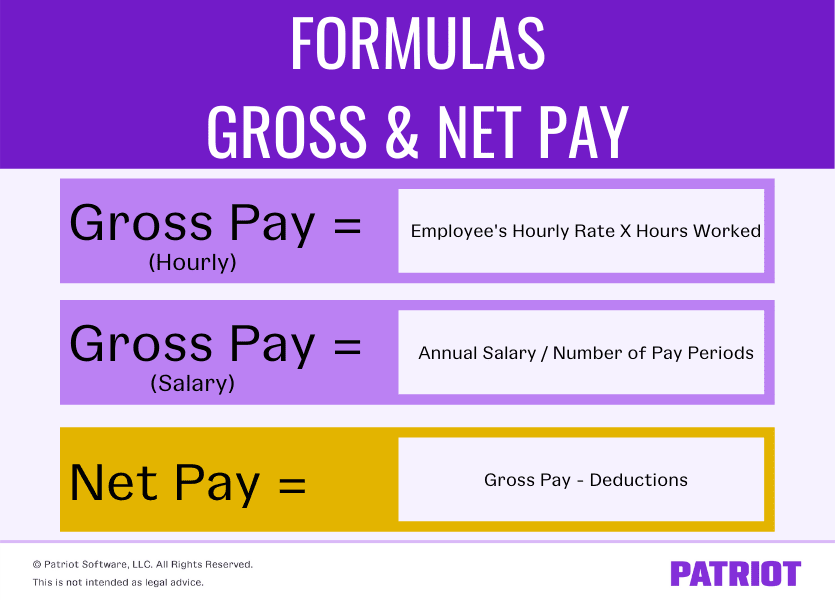

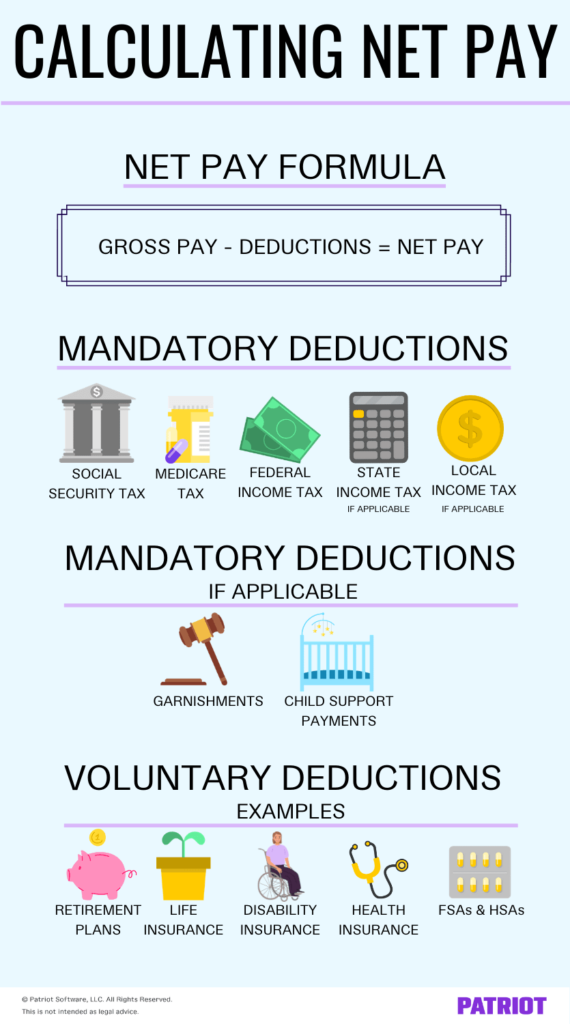

The key elements of the net pay calculation are noted. 5 rows what is net pay? Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Thus, the net pay calculation is: This is the amount paid to each employee on payday.

For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300.

Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. Net pay is an employee’s earnings after all deductions are taken out. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Other deductions come in the form of benefits, which may be optional.

Source: sampletemplates.com

Source: sampletemplates.com

Thus, the net pay calculation is: Other deductions come in the form of benefits, which may be optional. Net pay is an employee’s earnings after all deductions are taken out. 5 rows what is net pay? Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings.

Source: sagecity.na.sage.com

Source: sagecity.na.sage.com

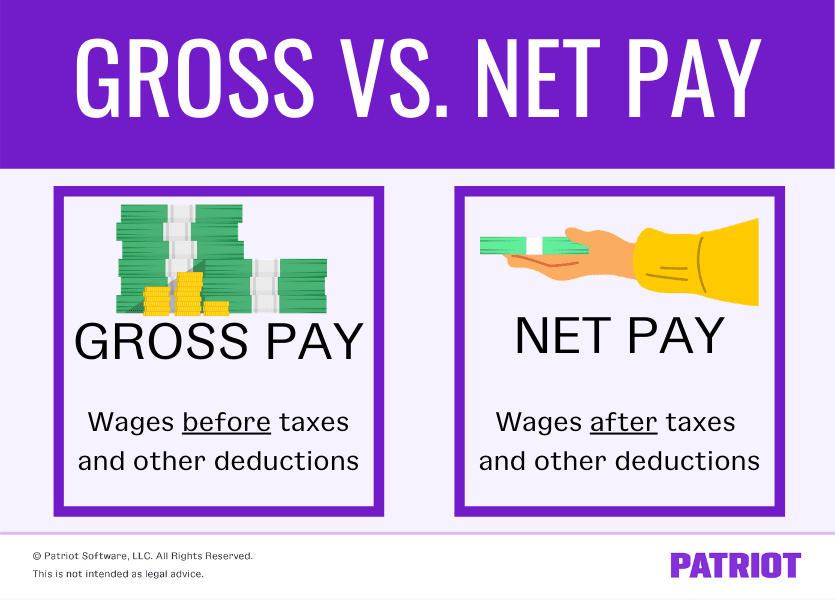

Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. The key elements of the net pay calculation are noted. Net pay is an employee’s earnings after all deductions are taken out. Health, dental and vision insurance, life insurance, or a. Other deductions come in the form of benefits, which may be optional.

Source: slideserve.com

Source: slideserve.com

5 rows what is net pay? This is the amount paid to each employee on payday. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. Net pay is an employee’s earnings after all deductions are taken out. Health, dental and vision insurance, life insurance, or a.

Source: serfu.com

Source: serfu.com

Health, dental and vision insurance, life insurance, or a. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. 5 rows what is net pay? Net pay is an employee’s earnings after all deductions are taken out. The key elements of the net pay calculation are noted.

Source: patriotsoftware.com

Source: patriotsoftware.com

For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Thus, the net pay calculation is: This is the amount paid to each employee on payday.

Source: mathsmutt.co.uk

Source: mathsmutt.co.uk

Other deductions come in the form of benefits, which may be optional. Other deductions come in the form of benefits, which may be optional. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. Thus, the net pay calculation is:

Source: creditrepair.com

Source: creditrepair.com

Health, dental and vision insurance, life insurance, or a. The key elements of the net pay calculation are noted. This is the amount paid to each employee on payday. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. 5 rows what is net pay?

Source: patriotsoftware.com

Source: patriotsoftware.com

For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. The key elements of the net pay calculation are noted. Health, dental and vision insurance, life insurance, or a.

Source: patriotsoftware.com

Source: patriotsoftware.com

Net pay is an employee’s earnings after all deductions are taken out. Health, dental and vision insurance, life insurance, or a. The key elements of the net pay calculation are noted. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. Thus, the net pay calculation is:

Source: lifeskillsinstructor.com

Source: lifeskillsinstructor.com

Net pay is an employee’s earnings after all deductions are taken out. Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. Other deductions come in the form of benefits, which may be optional. Thus, the net pay calculation is: Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay.

Source: worrkbox.com

Source: worrkbox.com

Thus, the net pay calculation is: Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. Thus, the net pay calculation is: 5 rows what is net pay?

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Health, dental and vision insurance, life insurance, or a. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. Thus, the net pay calculation is: This is the amount paid to each employee on payday. 5 rows what is net pay?

Source: youtube.com

Source: youtube.com

The key elements of the net pay calculation are noted. 5 rows what is net pay? The key elements of the net pay calculation are noted. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions.

Source: patriotsoftware.com

Source: patriotsoftware.com

The key elements of the net pay calculation are noted. Other deductions come in the form of benefits, which may be optional. Thus, the net pay calculation is: Health, dental and vision insurance, life insurance, or a. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions.

Source: quora.com

Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Thus, the net pay calculation is: Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. This is the amount paid to each employee on payday.

Source: wisegeek.com

Source: wisegeek.com

Net pay is an employee’s earnings after all deductions are taken out. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. 5 rows what is net pay? Net pay is an employee’s earnings after all deductions are taken out.

Source: patriotsoftware.com

Source: patriotsoftware.com

Obligatory deductions such as the fica mandated social security tax and medicare are withheld automatically from an employee’s earnings. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual�s gross pay. 5 rows what is net pay? The key elements of the net pay calculation are noted. Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions.

Source: bartleby.com

Source: bartleby.com

This is the amount paid to each employee on payday. This is the amount paid to each employee on payday. 5 rows what is net pay? Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. The key elements of the net pay calculation are noted.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is net pay by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.