Your Vrs early retirement images are ready. Vrs early retirement are a topic that is being searched for and liked by netizens today. You can Get the Vrs early retirement files here. Download all royalty-free images.

If you’re searching for vrs early retirement images information connected with to the vrs early retirement interest, you have visit the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

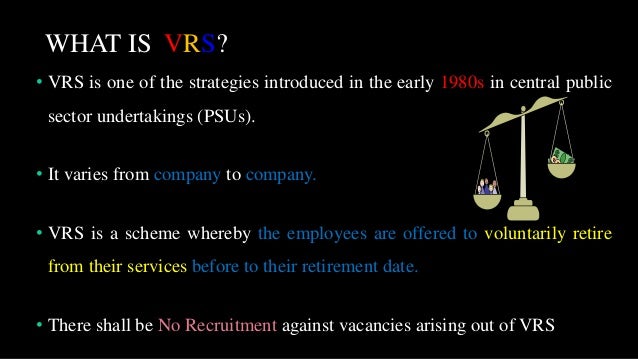

Vrs Early Retirement. 5 lakhs under section 10 (10c) of the income tax act. Additionally, the entire process is very transparent. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. They can do it at their will and wish.

Voluntary Retirement Scheme (VRS) ithought plan�s Essence of Planning From ithought.co.in

Voluntary Retirement Scheme (VRS) ithought plan�s Essence of Planning From ithought.co.in

Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Features of voluntary retirement scheme. Additionally, the entire process is very transparent. They can do it at their will and wish. 5 lakhs under section 10 (10c) of the income tax act.

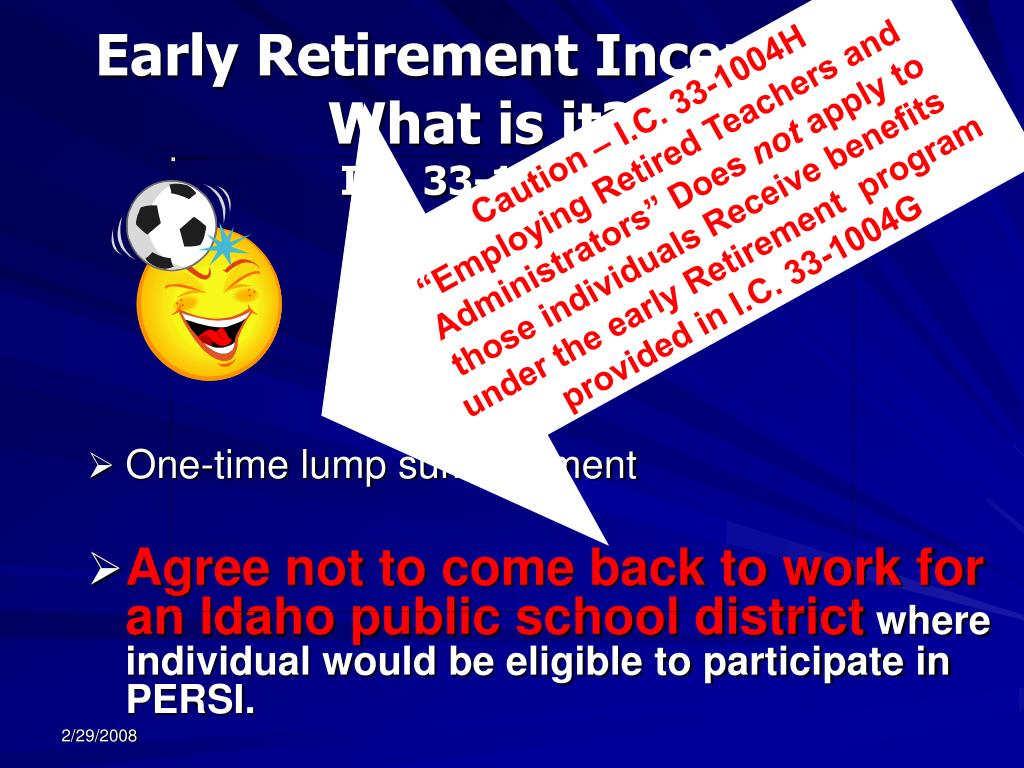

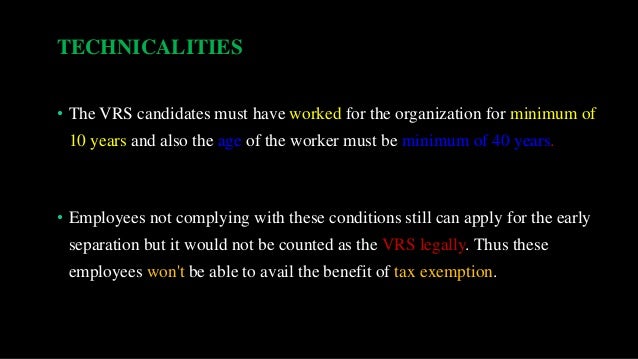

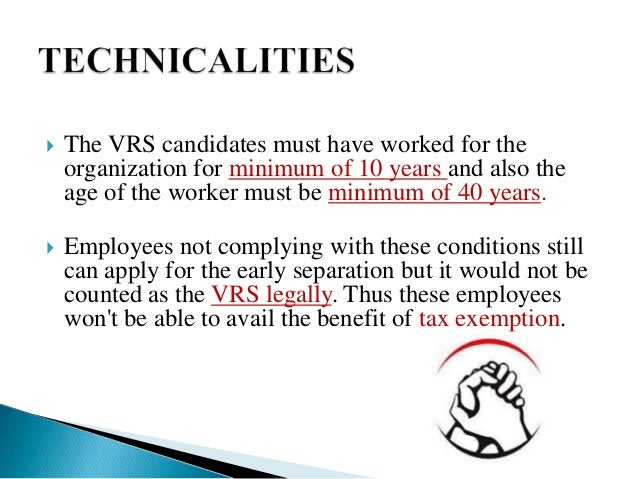

Employee must have completed 10 years of service or must be above 40 years of age to avail vrs.

Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. Additionally, the entire process is very transparent. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services. Vrs is voluntary and so no eligible employee can be forced to opt for it. As the name suggests, the scheme is voluntary.

Source: ithought.co.in

Source: ithought.co.in

Features of voluntary retirement scheme. Features of voluntary retirement scheme. Additionally, the entire process is very transparent. As the name suggests, the scheme is voluntary. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs.

Source: pinterest.com

Source: pinterest.com

As the name suggests, the scheme is voluntary. 5 lakhs under section 10 (10c) of the income tax act. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Nobody can force the employees into opting for early retirement. Additionally, the entire process is very transparent.

Source: businesstoday.in

Source: businesstoday.in

Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. Additionally, the entire process is very transparent. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. Vrs is voluntary and so no eligible employee can be forced to opt for it. Employee must have completed 10 years of service or must be above 40 years of age to avail vrs.

Source: pmmodiyojanaye.in

Source: pmmodiyojanaye.in

Nobody can force the employees into opting for early retirement. Additionally, the entire process is very transparent. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. Nobody can force the employees into opting for early retirement. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs.

Features of voluntary retirement scheme. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. As the name suggests, the scheme is voluntary. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. They can do it at their will and wish.

Source: aibsnloa.org

Source: aibsnloa.org

Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. Employee must have completed 10 years of service or must be above 40 years of age to avail vrs. Vrs is voluntary and so no eligible employee can be forced to opt for it. Nobody can force the employees into opting for early retirement. Features of voluntary retirement scheme.

Source: slideserve.com

Source: slideserve.com

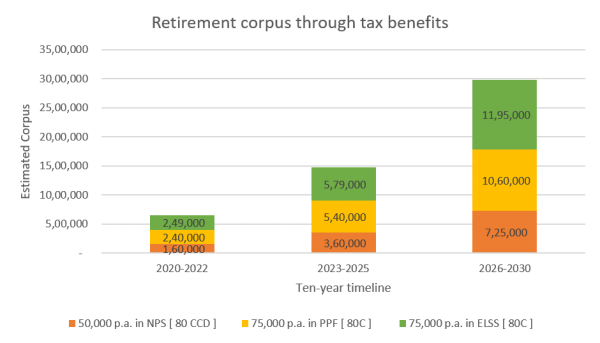

5 lakhs under section 10 (10c) of the income tax act. Vrs is voluntary and so no eligible employee can be forced to opt for it. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Nobody can force the employees into opting for early retirement. Additionally, the entire process is very transparent.

Source: rcps.org

Source: rcps.org

Additionally, the entire process is very transparent. Nobody can force the employees into opting for early retirement. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. They can do it at their will and wish. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs.

Source: sampletemplates.com

Source: sampletemplates.com

Nobody can force the employees into opting for early retirement. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. Additionally, the entire process is very transparent. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Nobody can force the employees into opting for early retirement.

Source: ithought.co.in

Source: ithought.co.in

Vrs is voluntary and so no eligible employee can be forced to opt for it. Vrs is voluntary and so no eligible employee can be forced to opt for it. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. Nobody can force the employees into opting for early retirement.

Source: veanea.org

Source: veanea.org

Employee must have completed 10 years of service or must be above 40 years of age to avail vrs. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. They can do it at their will and wish. Vrs is voluntary and so no eligible employee can be forced to opt for it.

Source: slideshare.net

Source: slideshare.net

Voluntary retirement scheme is a way to cut down surplus staff in an organisation. Nobody can force the employees into opting for early retirement. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services. Features of voluntary retirement scheme.

Source: planetconcerns.com

Source: planetconcerns.com

They can do it at their will and wish. Vrs is voluntary and so no eligible employee can be forced to opt for it. Voluntary retirement scheme is a way to cut down surplus staff in an organisation. Features of voluntary retirement scheme. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services.

Source: gemma.gov.mt

Source: gemma.gov.mt

First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. As the name suggests, the scheme is voluntary. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services. 5 lakhs under section 10 (10c) of the income tax act. Nobody can force the employees into opting for early retirement.

Source: slideshare.net

Source: slideshare.net

Features of voluntary retirement scheme. They can do it at their will and wish. 5 lakhs under section 10 (10c) of the income tax act. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs.

Source: ithought.co.in

Source: ithought.co.in

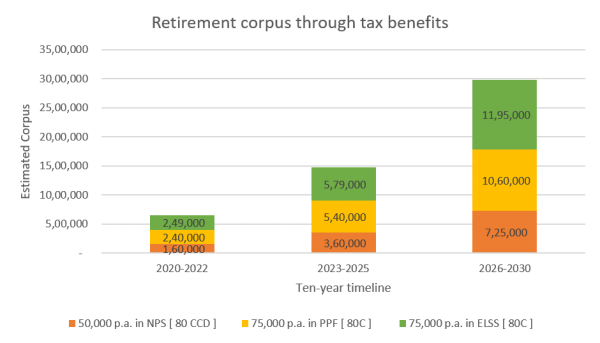

5 lakhs under section 10 (10c) of the income tax act. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Vrs is voluntary and so no eligible employee can be forced to opt for it. 5 lakhs under section 10 (10c) of the income tax act. Here, employees are offered an option to retire before their actual retirement date and are paid compensation for severance of their services.

Source: slideshare.net

Source: slideshare.net

Vrs is voluntary and so no eligible employee can be forced to opt for it. They can do it at their will and wish. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. As the name suggests, the scheme is voluntary.

Source: zeebiz.com

Source: zeebiz.com

First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. Companies clear provident fund (pf) and gratuity dues at the time of retirement under vrs. As the name suggests, the scheme is voluntary. First and foremost, vrs offer companies an empathetic way to relieve employees of their duties while improving their economic efficiency. 5 lakhs under section 10 (10c) of the income tax act.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title vrs early retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.