Your Using 401k to retire early images are ready in this website. Using 401k to retire early are a topic that is being searched for and liked by netizens today. You can Find and Download the Using 401k to retire early files here. Find and Download all free vectors.

If you’re looking for using 401k to retire early pictures information related to the using 401k to retire early topic, you have visit the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

Using 401k To Retire Early. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Some of the biggest proponents of early retirement are followers of the fire movement. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60. Up to 70% of all income during their.

If you Retire Early or Get Laid Off, Consider Transferring Your Former From mysolo401k.net

If you Retire Early or Get Laid Off, Consider Transferring Your Former From mysolo401k.net

Many employers match a portion of your contributions to the. The two biggest benefits of a 401 (k) plan are employer matching and tax deferral. Once we hit 60, then we will start taking distribution from our 401k and ira. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60. Some of the biggest proponents of early retirement are followers of the fire movement.

Once we hit 60, then we will start taking distribution from our 401k and ira.

For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. Some of the biggest proponents of early retirement are followers of the fire movement. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow.

Source: pinterest.com

Source: pinterest.com

However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. Some of the biggest proponents of early retirement are followers of the fire movement. Yes, you can take social security as early as age 62.

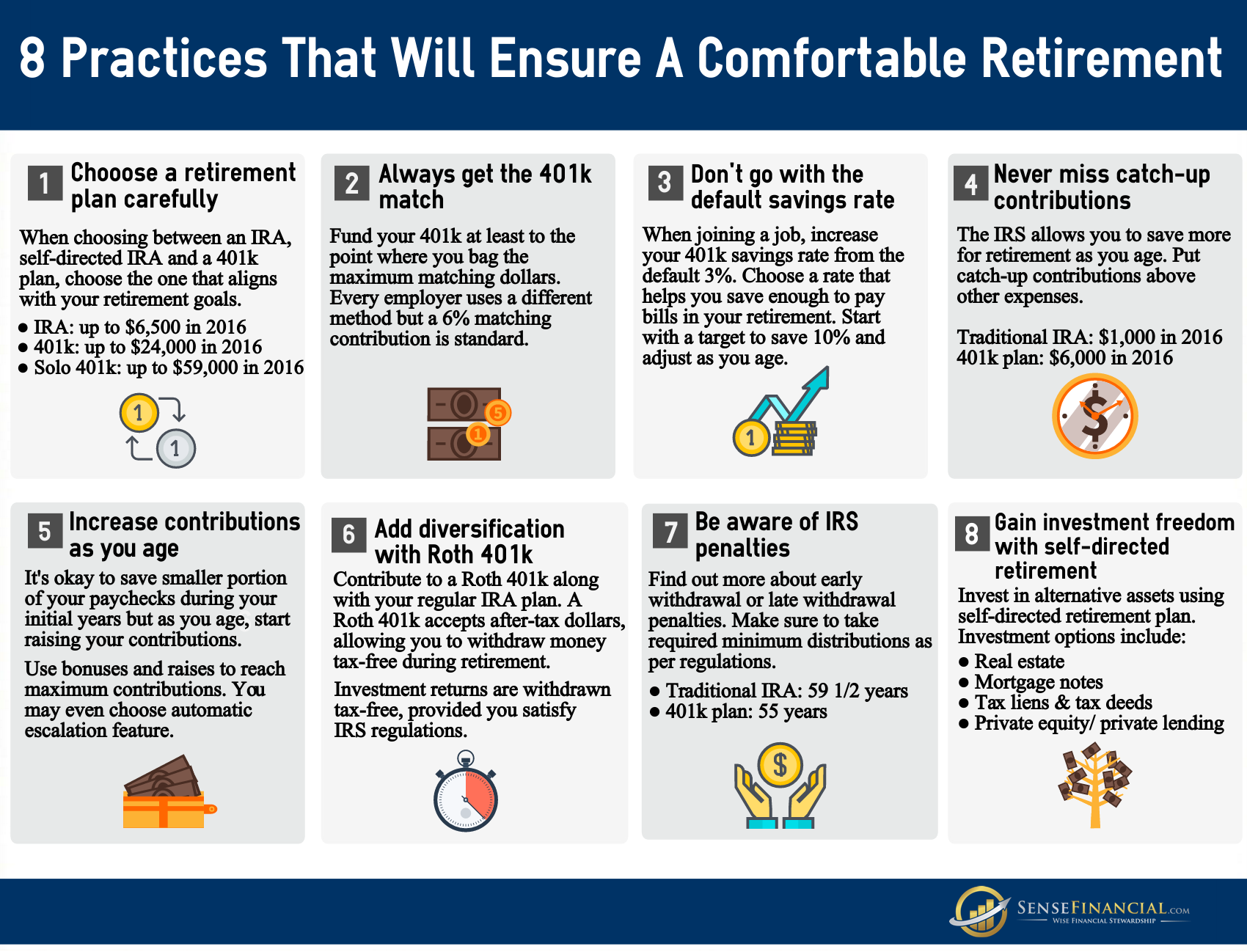

Source: sensefinancial.com

Source: sensefinancial.com

However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. Many employers match a portion of your contributions to the. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%.

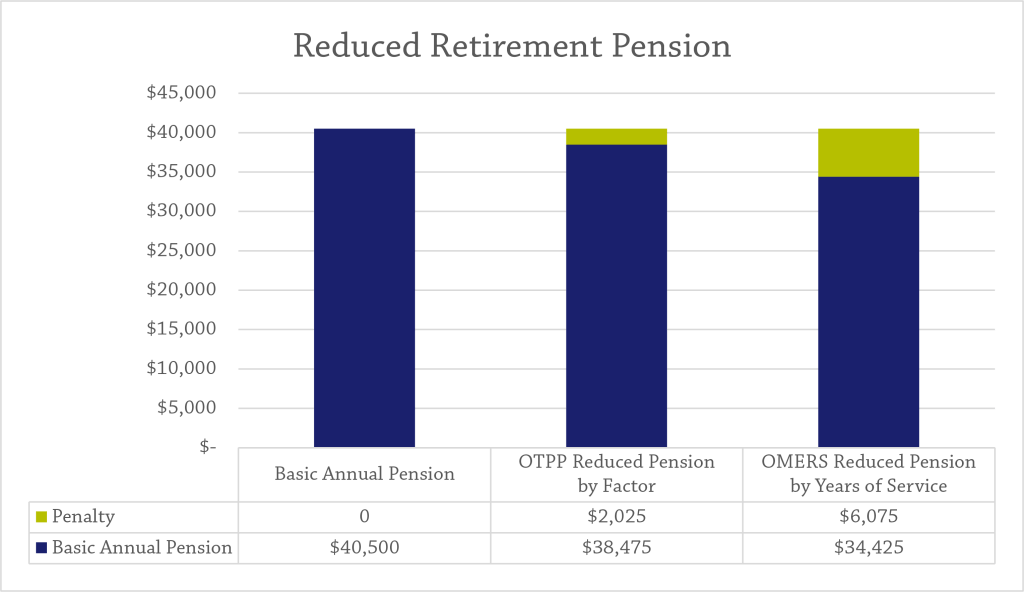

Source: erisacase.com

Source: erisacase.com

Up to 70% of all income during their. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Many employers match a portion of your contributions to the. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. Up to 70% of all income during their.

Source: pinterest.com

Source: pinterest.com

Up to 70% of all income during their. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60.

Source: pinterest.com

Source: pinterest.com

Once we hit 60, then we will start taking distribution from our 401k and ira. On the other hand, youll receive an 8% increase, plus. Why do some people retire early. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. Yes, you can take social security as early as age 62.

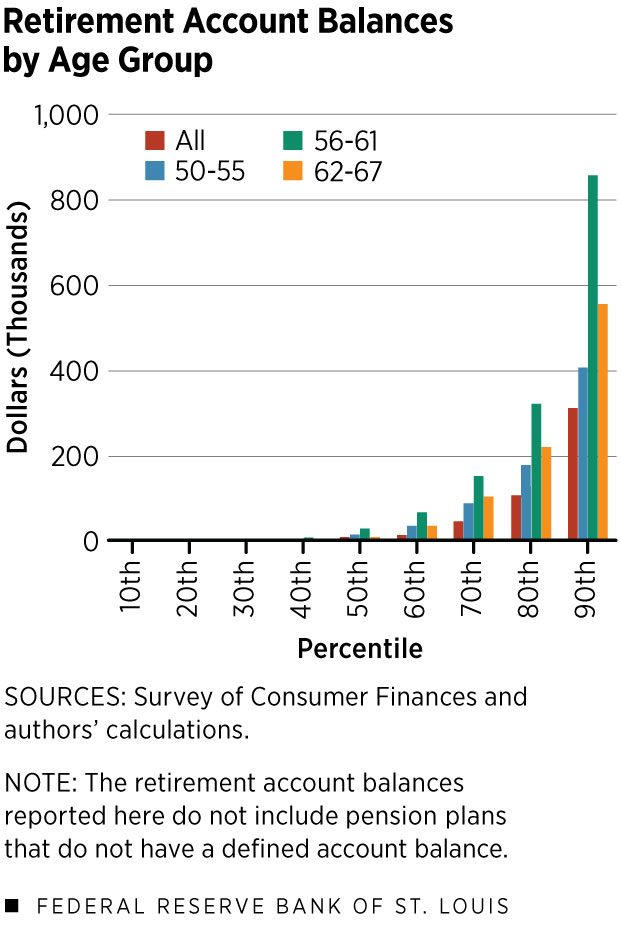

Source: seniorlifeadvisor.com

Source: seniorlifeadvisor.com

Once we hit 60, then we will start taking distribution from our 401k and ira. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. Yes, you can take social security as early as age 62. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60.

Source: pinterest.com

Source: pinterest.com

However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60. Some of the biggest proponents of early retirement are followers of the fire movement. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow.

Source: redrocksecured.com

Source: redrocksecured.com

The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. On the other hand, youll receive an 8% increase, plus. Up to 70% of all income during their. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow.

Source: sensefinancial.com

Source: sensefinancial.com

However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Once we hit 60, then we will start taking distribution from our 401k and ira. Many employers match a portion of your contributions to the. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65.

Source: pinterest.com

Source: pinterest.com

Many employers match a portion of your contributions to the. Once we hit 60, then we will start taking distribution from our 401k and ira. The two biggest benefits of a 401 (k) plan are employer matching and tax deferral. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. Some of the biggest proponents of early retirement are followers of the fire movement.

Source: mysolo401k.net

Source: mysolo401k.net

The two biggest benefits of a 401 (k) plan are employer matching and tax deferral. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. The two biggest benefits of a 401 (k) plan are employer matching and tax deferral. On the other hand, youll receive an 8% increase, plus. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60.

Source: pinterest.com

Source: pinterest.com

Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. Yes, you can take social security as early as age 62. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%.

Source: pinterest.com

Source: pinterest.com

Why do some people retire early. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Why do some people retire early. On the other hand, youll receive an 8% increase, plus. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%.

Source: pinterest.com

Source: pinterest.com

Once we hit 60, then we will start taking distribution from our 401k and ira. Many employers match a portion of your contributions to the. Up to 70% of all income during their. The two biggest benefits of a 401 (k) plan are employer matching and tax deferral. Yes, you can take social security as early as age 62.

Source: pinterest.com

Source: pinterest.com

Up to 70% of all income during their. Up to 70% of all income during their. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60.

Source: mymoneydesign.com

Source: mymoneydesign.com

Why do some people retire early. For my situation, this works well because we don’t need to withdraw from our 401k and ira until we’re 60. Yes, you can take social security as early as age 62. Fire stands for financial independence, retire early, and its based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later.

Source: teckbay.com

Source: teckbay.com

Many employers match a portion of your contributions to the. However, if youre in good health and have access to other sources of income, it usually pays to wait and let your benefit grow. Why do some people retire early. The two biggest benefits of a 401 (k) plan are employer matching and tax deferral. Up to 70% of all income during their.

Source: pinterest.com

Source: pinterest.com

Yes, you can take social security as early as age 62. The retirement funds are a big slice of the pie and they absolutely should be counted in your investable asset, even if you don’t plan to use them until later. Once we hit 60, then we will start taking distribution from our 401k and ira. Taking your benefit at 62 will reduce your lifetime payment, and spousal survivor benefit, by as much as 30%. Why do some people retire early.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title using 401k to retire early by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.