Your Us retirement images are ready. Us retirement are a topic that is being searched for and liked by netizens today. You can Download the Us retirement files here. Find and Download all free vectors.

If you’re looking for us retirement images information related to the us retirement interest, you have pay a visit to the ideal site. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Us Retirement. A retirement plan is a financial arrangement designed to replace employment income upon retirement. Social security is part of the retirement plan for almost every american worker. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue.

Military Retirement Shadow Boxes From starsandstripeswoodworks.com

Military Retirement Shadow Boxes From starsandstripeswoodworks.com

The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Social security is part of the retirement plan for almost every american worker.

The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer.

The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. Medicare benefits aren’t available until you turn 65. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. It provides replacement income for qualified retirees and their families. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you.

Source: etsy.com

Source: etsy.com

Medicare benefits aren’t available until you turn 65. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. It provides replacement income for qualified retirees and their families.

Source: insidethegates.org

Source: insidethegates.org

Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Social security is part of the retirement plan for almost every american worker. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you.

Source: abounaphoto.com

Source: abounaphoto.com

Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. Medicare benefits aren’t available until you turn 65.

Source: abounaphoto.com

Source: abounaphoto.com

This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. Social security is part of the retirement plan for almost every american worker. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. Medicare benefits aren’t available until you turn 65. A retirement plan is a financial arrangement designed to replace employment income upon retirement.

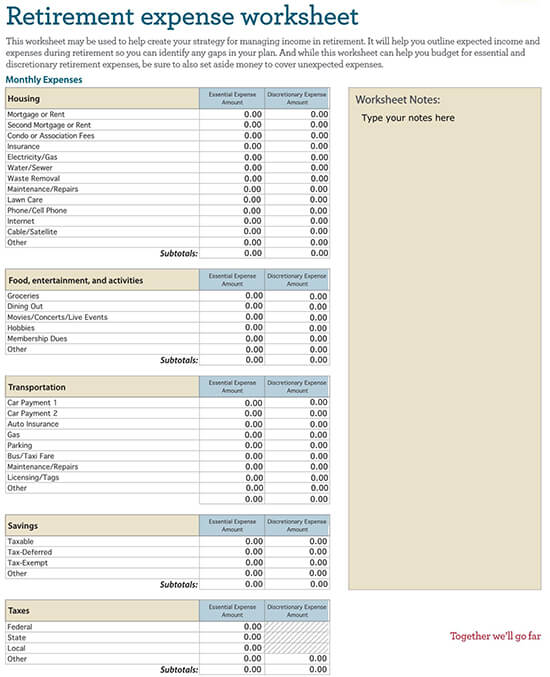

Source: thebalance.com

Source: thebalance.com

Social security is part of the retirement plan for almost every american worker. A retirement plan is a financial arrangement designed to replace employment income upon retirement. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer.

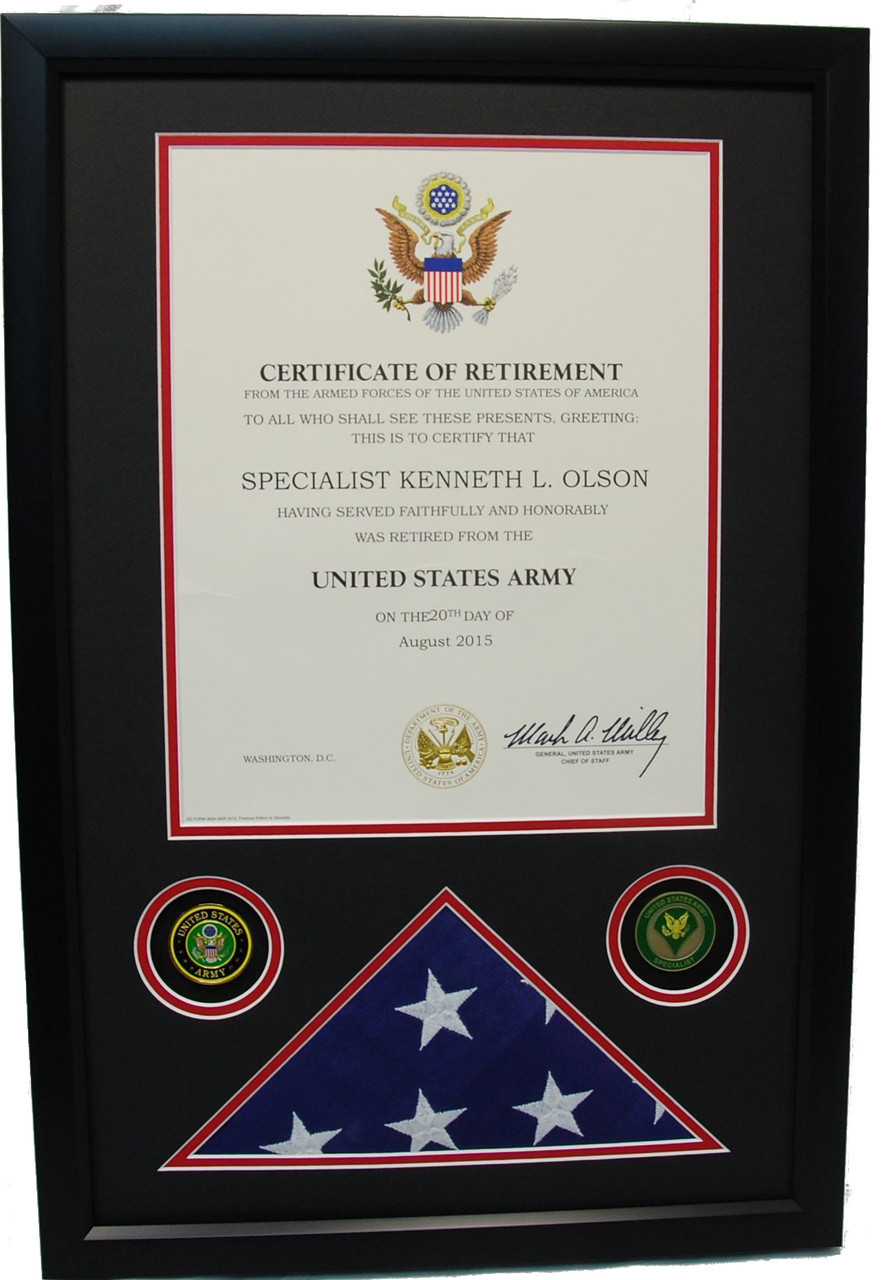

Source: starsandstripeswoodworks.com

Source: starsandstripeswoodworks.com

Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Medicare benefits aren’t available until you turn 65. Social security is part of the retirement plan for almost every american worker. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer.

Source: army.mil

Source: army.mil

Medicare benefits aren’t available until you turn 65. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. A retirement plan is a financial arrangement designed to replace employment income upon retirement.

Source: moneycrashers.com

Source: moneycrashers.com

Medicare benefits aren’t available until you turn 65. Social security is part of the retirement plan for almost every american worker. Medicare benefits aren’t available until you turn 65. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans.

Source: army.mil

Source: army.mil

Medicare benefits aren’t available until you turn 65. A retirement plan is a financial arrangement designed to replace employment income upon retirement. Social security is part of the retirement plan for almost every american worker. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66.

Source: militarymemoriesandmore.com

Source: militarymemoriesandmore.com

Medicare benefits aren’t available until you turn 65. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. It provides replacement income for qualified retirees and their families.

Source: abounaphoto.com

Source: abounaphoto.com

It provides replacement income for qualified retirees and their families. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. Medicare benefits aren’t available until you turn 65. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans.

Source: handcraftedplaques.com

Source: handcraftedplaques.com

The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. Social security is part of the retirement plan for almost every american worker. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue.

Source: nobleworkscards.com

Source: nobleworkscards.com

Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. Social security is part of the retirement plan for almost every american worker. Medicare benefits aren’t available until you turn 65.

Source: army.mil

Source: army.mil

A retirement plan is a financial arrangement designed to replace employment income upon retirement. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. It provides replacement income for qualified retirees and their families. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you.

Source: etsy.com

Source: etsy.com

It provides replacement income for qualified retirees and their families. It provides replacement income for qualified retirees and their families. Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. You can’t collect the full amount of social security you’re entitled to until full retirement age for the year you were born, which is usually after age 66. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions.

Source: nobleworkscards.com

Source: nobleworkscards.com

This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Medicare benefits aren’t available until you turn 65. It provides replacement income for qualified retirees and their families.

Source: walmart.com

Source: walmart.com

A retirement plan is a financial arrangement designed to replace employment income upon retirement. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you. A retirement plan is a financial arrangement designed to replace employment income upon retirement. Social security is part of the retirement plan for almost every american worker.

Source: blushingdrops.com

Source: blushingdrops.com

Federal tax aspects of retirement plans in the united states are based on provisions of the internal revenue. Medicare benefits aren’t available until you turn 65. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. The average retirement age in the united states is 65 for men and 63 for women, but you might find that you have to wait longer. This section of our website helps you better understand the program, the application process, and the online tools and resources available to you.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title us retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.