Your The shockingly simple math behind early retirement images are available. The shockingly simple math behind early retirement are a topic that is being searched for and liked by netizens now. You can Download the The shockingly simple math behind early retirement files here. Get all royalty-free photos and vectors.

If you’re searching for the shockingly simple math behind early retirement images information related to the the shockingly simple math behind early retirement keyword, you have pay a visit to the right site. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

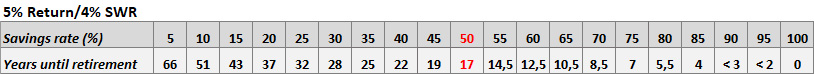

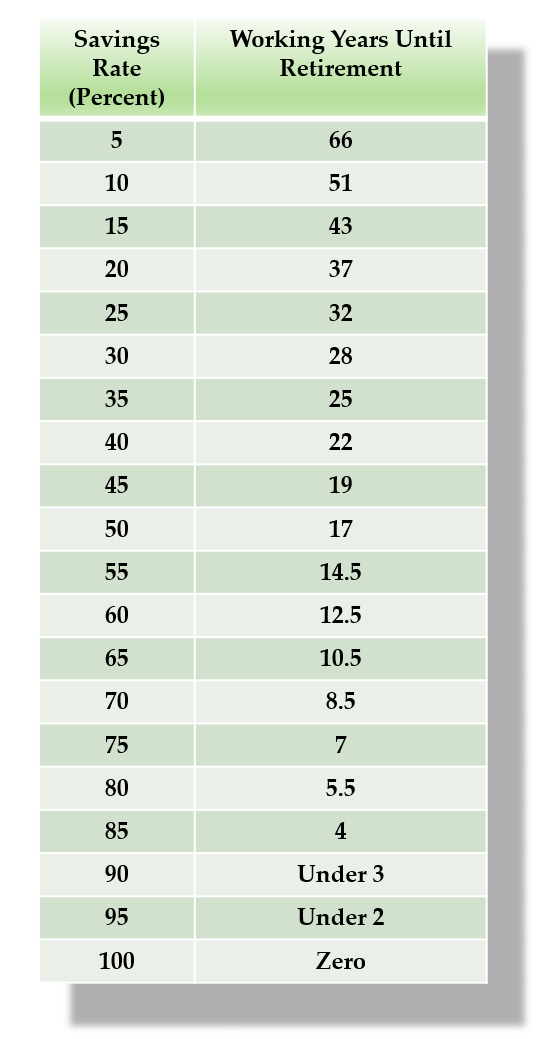

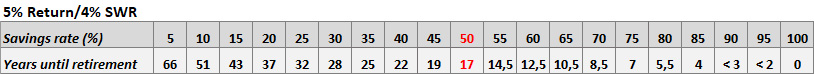

The Shockingly Simple Math Behind Early Retirement. 10% savings rate = 51 years of work before retirement. Money mustache entitled “the shockingly simple math behind early retirement”. Here is another view of the results from this chart: Even starting retirement just one year apart can make a massive difference.

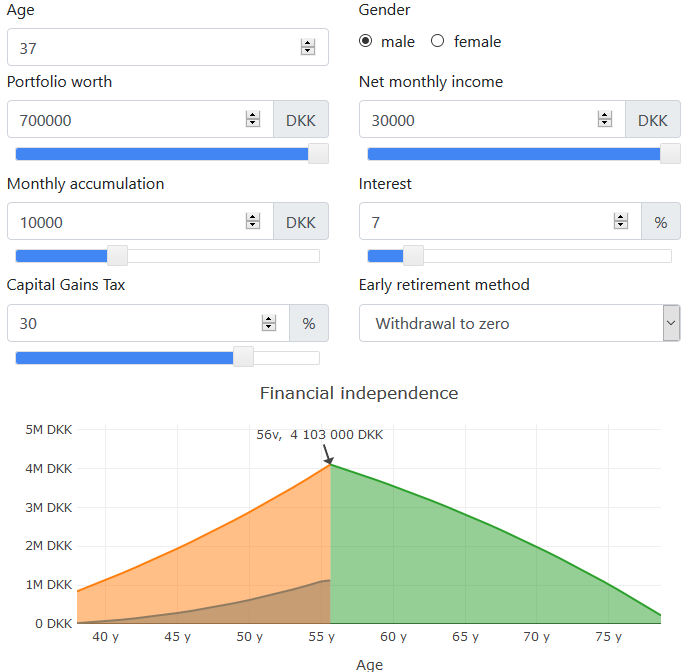

The (Shockingly) Simple Math Behind Early Retirement Total Balance From totalbalance.blog

The (Shockingly) Simple Math Behind Early Retirement Total Balance From totalbalance.blog

His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. Pull the pin in 1969 and you’d have run out of money in 1996. 10% savings rate = 51 years of work before retirement. If you’re new to this whole idea of early retirement and are eager to learn “how it works”, i’d urge you to take a gander at the great article from the one and only mr. That doesn’t sound simple to me. Even starting retirement just one year apart can make a massive difference.

It turns out that the “shockingly simple” math is based on these two equations:

This is the blog post that shows you how to be wealthy enough to retire in ten years. Even starting retirement just one year apart can make a massive difference. 10% savings rate = 51 years of work before retirement. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. That doesn’t sound simple to me. Money mustache, we talk about all sorts of fancy stuff like investment fundamentals, lifestyle changes that save money, entrepreneurial ideas that help you make money, and philosophy that allows.

Source: mrmoneymustache.com

Source: mrmoneymustache.com

Even starting retirement just one year apart can make a massive difference. Here is another view of the results from this chart: 5% savings rate = 66 years of work before retirement. Even starting retirement just one year apart can make a massive difference. 10% savings rate = 51 years of work before retirement.

Source: youtube.com

Source: youtube.com

Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016. The united states rate of 6% is on the far left at almost 60 years. Even starting retirement just one year apart can make a massive difference. Money mustache, we talk about all sorts of fancy stuff like investment fundamentals, lifestyle changes that save money, entrepreneurial ideas that help you make money, and philosophy that allows. 5% savings rate = 66 years of work before retirement.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

If you’re new to this whole idea of early retirement and are eager to learn “how it works”, i’d urge you to take a gander at the great article from the one and only mr. 5% savings rate = 66 years of work before retirement. Money mustache entitled “the shockingly simple math behind early retirement”. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. This is the blog post that shows you how to be wealthy enough to retire in ten years.

Source: pinterest.com

Source: pinterest.com

This is the blog post that shows you how to be wealthy enough to retire in ten years. Here is another view of the results from this chart: 5% savings rate = 66 years of work before retirement. If you’re new to this whole idea of early retirement and are eager to learn “how it works”, i’d urge you to take a gander at the great article from the one and only mr. 10% savings rate = 51 years of work before retirement.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Money mustache entitled “the shockingly simple math behind early retirement”. That doesn’t sound simple to me. 5% savings rate = 66 years of work before retirement. More ambitious rates of 50%, for example, are in the middle at 17 years to retirement. Money mustache entitled “the shockingly simple math behind early retirement”.

Source: mrmoneymustache.com

Source: mrmoneymustache.com

5% savings rate = 66 years of work before retirement. Money mustache, we talk about all sorts of fancy stuff like investment fundamentals, lifestyle changes that save money, entrepreneurial ideas that help you make money, and philosophy that allows. It turns out that the “shockingly simple” math is based on these two equations: Money mustache entitled “the shockingly simple math behind early retirement”. Even starting retirement just one year apart can make a massive difference.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

It turns out that the “shockingly simple” math is based on these two equations: Here is another view of the results from this chart: That doesn’t sound simple to me. The united states rate of 6% is on the far left at almost 60 years. Even starting retirement just one year apart can make a massive difference.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

More ambitious rates of 50%, for example, are in the middle at 17 years to retirement. Pull the pin in 1969 and you’d have run out of money in 1996. More ambitious rates of 50%, for example, are in the middle at 17 years to retirement. The united states rate of 6% is on the far left at almost 60 years. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of.

Source: mrmoneymustache.com

Source: mrmoneymustache.com

Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016. Even starting retirement just one year apart can make a massive difference. Pull the pin in 1969 and you’d have run out of money in 1996. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. It turns out that the “shockingly simple” math is based on these two equations:

Source: pinterest.com

Source: pinterest.com

More ambitious rates of 50%, for example, are in the middle at 17 years to retirement. Here is another view of the results from this chart: It turns out that the “shockingly simple” math is based on these two equations: Pull the pin in 1969 and you’d have run out of money in 1996. Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016. That doesn’t sound simple to me. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. 5% savings rate = 66 years of work before retirement. 10% savings rate = 51 years of work before retirement.

Source: pinterest.com

Source: pinterest.com

That doesn’t sound simple to me. 10% savings rate = 51 years of work before retirement. This is the blog post that shows you how to be wealthy enough to retire in ten years. Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016. If you’re new to this whole idea of early retirement and are eager to learn “how it works”, i’d urge you to take a gander at the great article from the one and only mr.

Source: totalbalance.blog

Source: totalbalance.blog

Pull the pin in 1969 and you’d have run out of money in 1996. That doesn’t sound simple to me. Pull the pin in 1969 and you’d have run out of money in 1996. 10% savings rate = 51 years of work before retirement. Even starting retirement just one year apart can make a massive difference.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

That doesn’t sound simple to me. Even starting retirement just one year apart can make a massive difference. Money mustache, we talk about all sorts of fancy stuff like investment fundamentals, lifestyle changes that save money, entrepreneurial ideas that help you make money, and philosophy that allows. Money mustache entitled “the shockingly simple math behind early retirement”. Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

The shockingly simple math behind early retirement. This is the blog post that shows you how to be wealthy enough to retire in ten years. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016. Pull the pin in 1969 and you’d have run out of money in 1996.

Source: totalbalance.blog

Source: totalbalance.blog

Money mustache, we talk about all sorts of fancy stuff like investment fundamentals, lifestyle changes that save money, entrepreneurial ideas that help you make money, and philosophy that allows. The shockingly simple math behind early retirement. Money mustache entitled “the shockingly simple math behind early retirement”. That doesn’t sound simple to me. More ambitious rates of 50%, for example, are in the middle at 17 years to retirement.

Source: mrmoneymustache.com

Source: mrmoneymustache.com

The shockingly simple math behind early retirement. 5% savings rate = 66 years of work before retirement. His calculations are based on an average return (after tax and inflation) of 5% and a safe withdrawal rate (swr) of. It turns out that the “shockingly simple” math is based on these two equations: Money mustache entitled “the shockingly simple math behind early retirement”.

Source: mrmoneymustache.com

Source: mrmoneymustache.com

If you’re new to this whole idea of early retirement and are eager to learn “how it works”, i’d urge you to take a gander at the great article from the one and only mr. Retire in 1968 with a million dollars (inflation adjusted) all in aussie equities and you’re up to nearly 5 million as of 2016. If you’re new to this whole idea of early retirement and are eager to learn “how it works”, i’d urge you to take a gander at the great article from the one and only mr. Money mustache entitled “the shockingly simple math behind early retirement”. Pull the pin in 1969 and you’d have run out of money in 1996.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the shockingly simple math behind early retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.