Your Schedule c retirement plan options images are ready in this website. Schedule c retirement plan options are a topic that is being searched for and liked by netizens today. You can Find and Download the Schedule c retirement plan options files here. Find and Download all free images.

If you’re searching for schedule c retirement plan options pictures information linked to the schedule c retirement plan options interest, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Schedule C Retirement Plan Options. Required minimum distributions are waived in 2020. Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information. Can be repaid over 3 years. Unlike a standard 401 (k) plan, the employer must make:

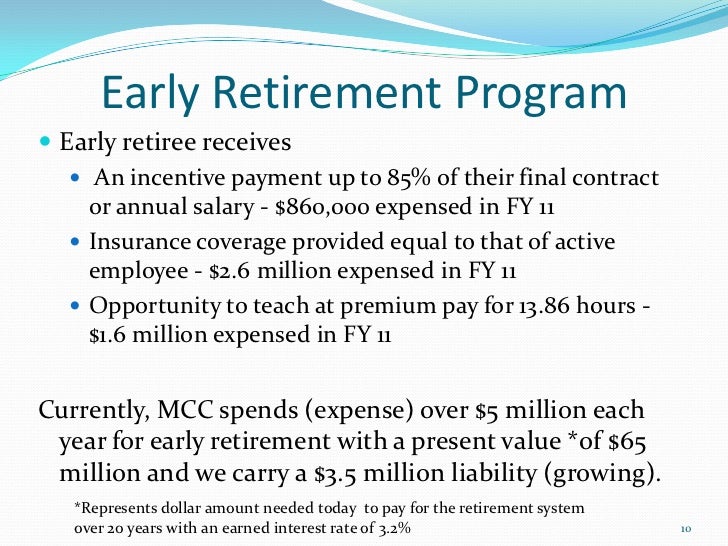

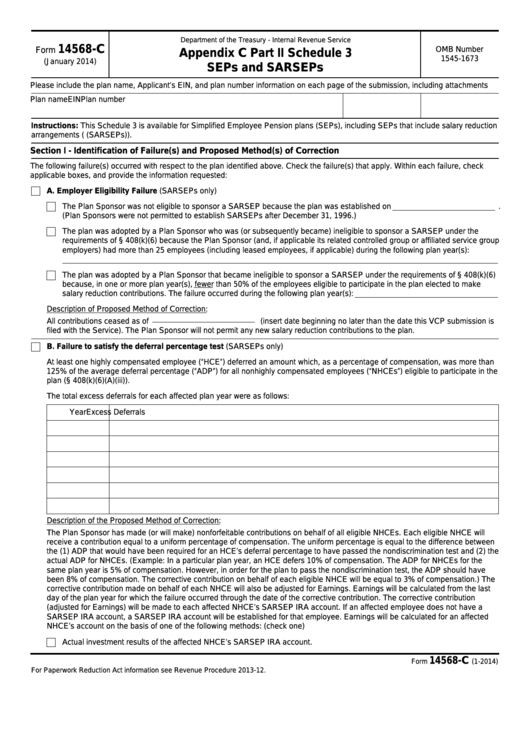

2017 Retirement Plan Comparison Table for Small Businesses From slideshare.net

2017 Retirement Plan Comparison Table for Small Businesses From slideshare.net

Plan loan limits and repayments may be extended. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Required minimum distributions are waived in 2020. This is effective for plan years beginning in 2009 and is. Joe must pay $14,130 in se taxes. Get details on coronavirus relief for retirement plans and iras.

Required minimum distributions are waived in 2020.

Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information. Get details on coronavirus relief for retirement plans and iras. Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Required minimum distributions are waived in 2020. A 403 (b) plan is an annuity plan for.

Source: opusfinancialsolutions.com

Source: opusfinancialsolutions.com

Under a simple 401 (k) plan, an employee can elect to defer some compensation. Joe must pay $14,130 in se taxes. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information. This is effective for plan years beginning in 2009 and is.

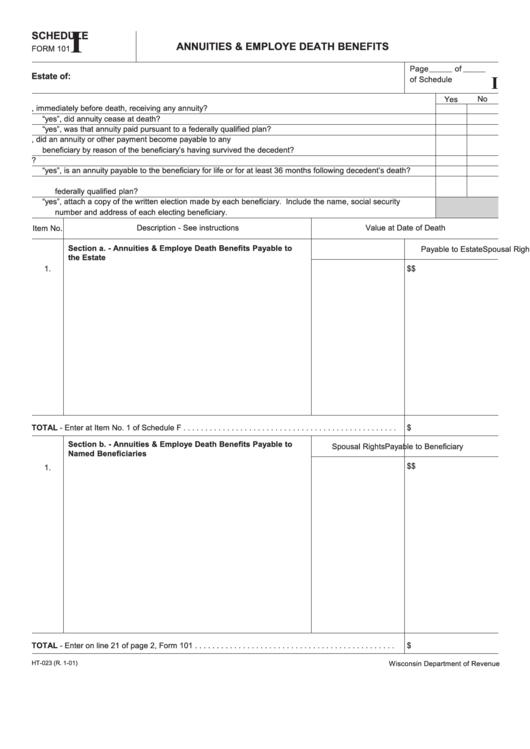

Source: formsbank.com

Source: formsbank.com

Plan loan limits and repayments may be extended. Under a simple 401 (k) plan, an employee can elect to defer some compensation. Joe must pay $14,130 in se taxes. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information.

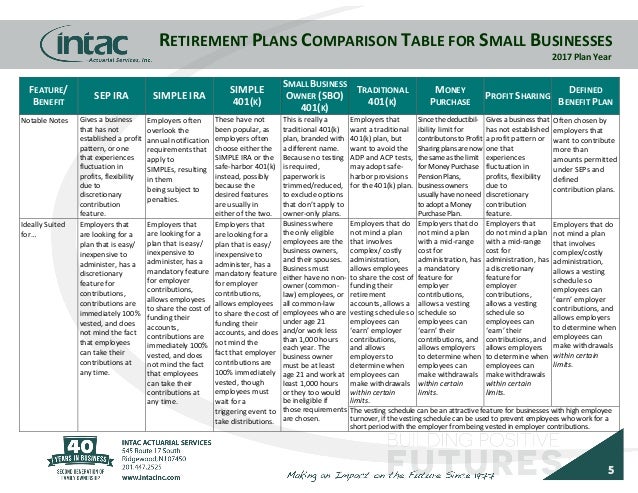

Source: emjay.gwrs.com

Source: emjay.gwrs.com

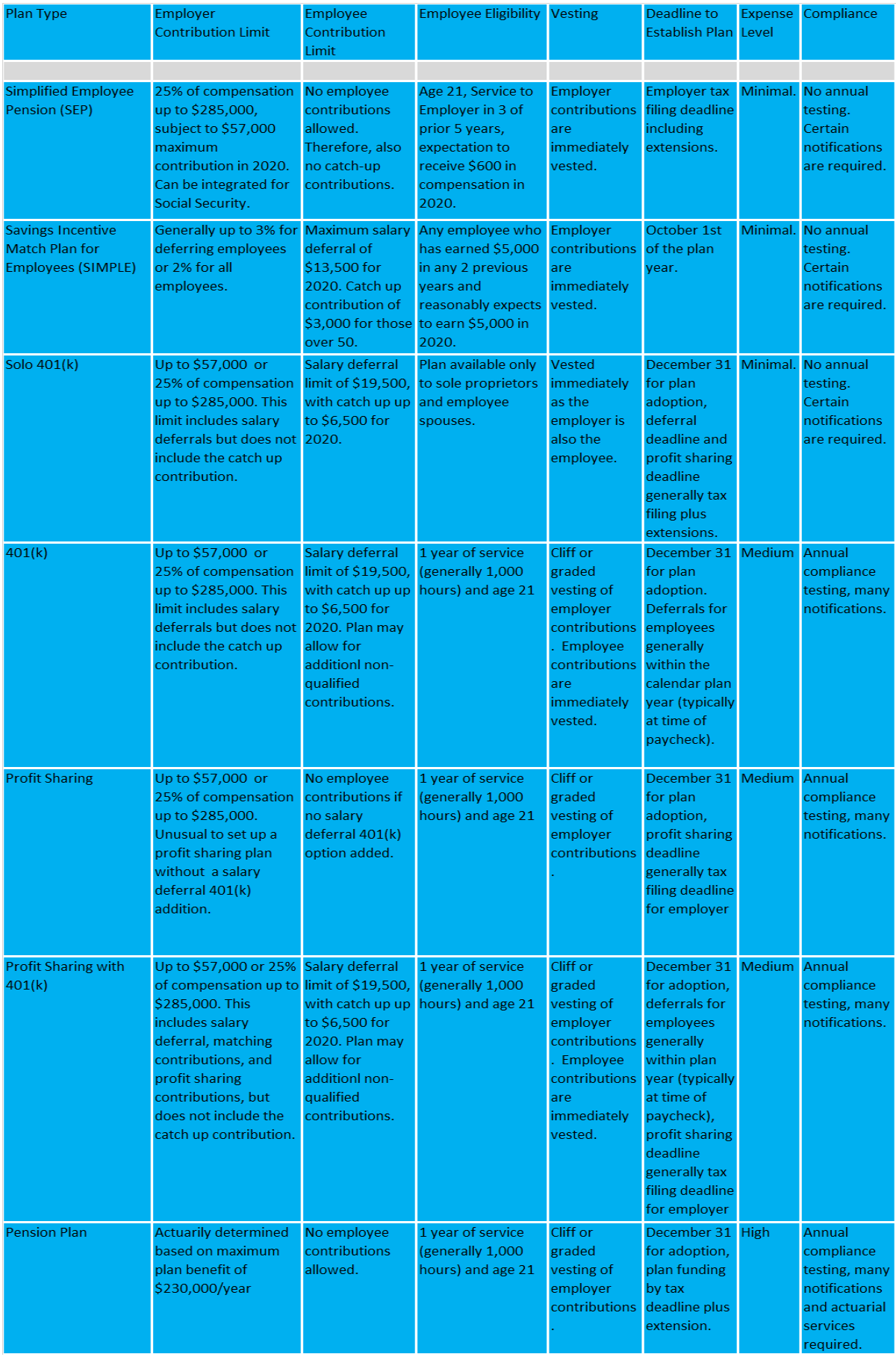

Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. This is effective for plan years beginning in 2009 and is. Plan loan limits and repayments may be extended. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Under a simple 401 (k) plan, an employee can elect to defer some compensation.

Source: cookmartin.com

Source: cookmartin.com

Can be repaid over 3 years. A 403 (b) plan is an annuity plan for. Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. This is effective for plan years beginning in 2009 and is. Under a simple 401 (k) plan, an employee can elect to defer some compensation.

Source: formsbank.com

Source: formsbank.com

Plan loan limits and repayments may be extended. Unlike a standard 401 (k) plan, the employer must make: Plan loan limits and repayments may be extended. Get details on coronavirus relief for retirement plans and iras. This is effective for plan years beginning in 2009 and is.

Source: investopedia.com

Source: investopedia.com

Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Unlike a standard 401 (k) plan, the employer must make: Plan loan limits and repayments may be extended. Required minimum distributions are waived in 2020.

Source: formsbank.com

Source: formsbank.com

A 403 (b) plan is an annuity plan for. Plan loan limits and repayments may be extended. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Required minimum distributions are waived in 2020.

Source: slideshare.net

Source: slideshare.net

Joe must pay $14,130 in se taxes. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Required minimum distributions are waived in 2020. Unlike a standard 401 (k) plan, the employer must make: Joe must pay $14,130 in se taxes.

Source: andersonadvisors.com

Source: andersonadvisors.com

Joe must pay $14,130 in se taxes. A 403 (b) plan is an annuity plan for. Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information. Can be repaid over 3 years. Joe must pay $14,130 in se taxes.

Source: roosagency.com

Source: roosagency.com

This is effective for plan years beginning in 2009 and is. Joe must pay $14,130 in se taxes. Unlike a standard 401 (k) plan, the employer must make: This is effective for plan years beginning in 2009 and is. Required minimum distributions are waived in 2020.

Source: rbsllc.net

Source: rbsllc.net

The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Under a simple 401 (k) plan, an employee can elect to defer some compensation. A 403 (b) plan is an annuity plan for. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Unlike a standard 401 (k) plan, the employer must make:

Joe must pay $14,130 in se taxes. Under a simple 401 (k) plan, an employee can elect to defer some compensation. This is effective for plan years beginning in 2009 and is. Get details on coronavirus relief for retirement plans and iras. Required minimum distributions are waived in 2020.

Source: brenteugenides.com

Source: brenteugenides.com

Can be repaid over 3 years. Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Get details on coronavirus relief for retirement plans and iras.

Source: westernstatesfinancial.com

Source: westernstatesfinancial.com

Can be repaid over 3 years. Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information. Joe must pay $14,130 in se taxes. A 403 (b) plan is an annuity plan for.

Source: clarity123.net

Source: clarity123.net

A 403 (b) plan is an annuity plan for. A 403 (b) plan is an annuity plan for. Get details on coronavirus relief for retirement plans and iras. This is effective for plan years beginning in 2009 and is. Plan loan limits and repayments may be extended.

Source: smallbiztaxguy.com

Source: smallbiztaxguy.com

This is effective for plan years beginning in 2009 and is. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Can be repaid over 3 years. Up to $14,000 in 2022 ($13,500 in 2021 and in 2020; Plan loan limits and repayments may be extended.

Source: retirementbenefitstoday.blogspot.com

Source: retirementbenefitstoday.blogspot.com

A 403 (b) plan is an annuity plan for. Unlike a standard 401 (k) plan, the employer must make: Joe must pay $14,130 in se taxes. Plan loan limits and repayments may be extended. Under a simple 401 (k) plan, an employee can elect to defer some compensation.

Source: investopedia.com

Source: investopedia.com

The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Can be repaid over 3 years. Schedule c or gather fee compensation information needed for the schedule c filing and therefore may disregard the following information. Statistical summary of schedule c data on private pension plans including plan counts, participant counts, and direct and indirect compensation on service providers. Required minimum distributions are waived in 2020.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title schedule c retirement plan options by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.