Your Save for retirement at 40 images are available. Save for retirement at 40 are a topic that is being searched for and liked by netizens today. You can Download the Save for retirement at 40 files here. Download all royalty-free images.

If you’re searching for save for retirement at 40 images information linked to the save for retirement at 40 keyword, you have come to the right blog. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

Save For Retirement At 40. You also need to invest the money properly to reach retirement with a big. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. But, saving at 40 for retirement is just one part of the story. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like.

![]() What to Do When You’re Age 40 With No Retirement Savings From mybanktracker.com

What to Do When You’re Age 40 With No Retirement Savings From mybanktracker.com

For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. But, saving at 40 for retirement is just one part of the story. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. You also need to invest the money properly to reach retirement with a big. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties.

But, saving at 40 for retirement is just one part of the story.

For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. You also need to invest the money properly to reach retirement with a big.

Source: time.com

Source: time.com

But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. You also need to invest the money properly to reach retirement with a big. But, saving at 40 for retirement is just one part of the story.

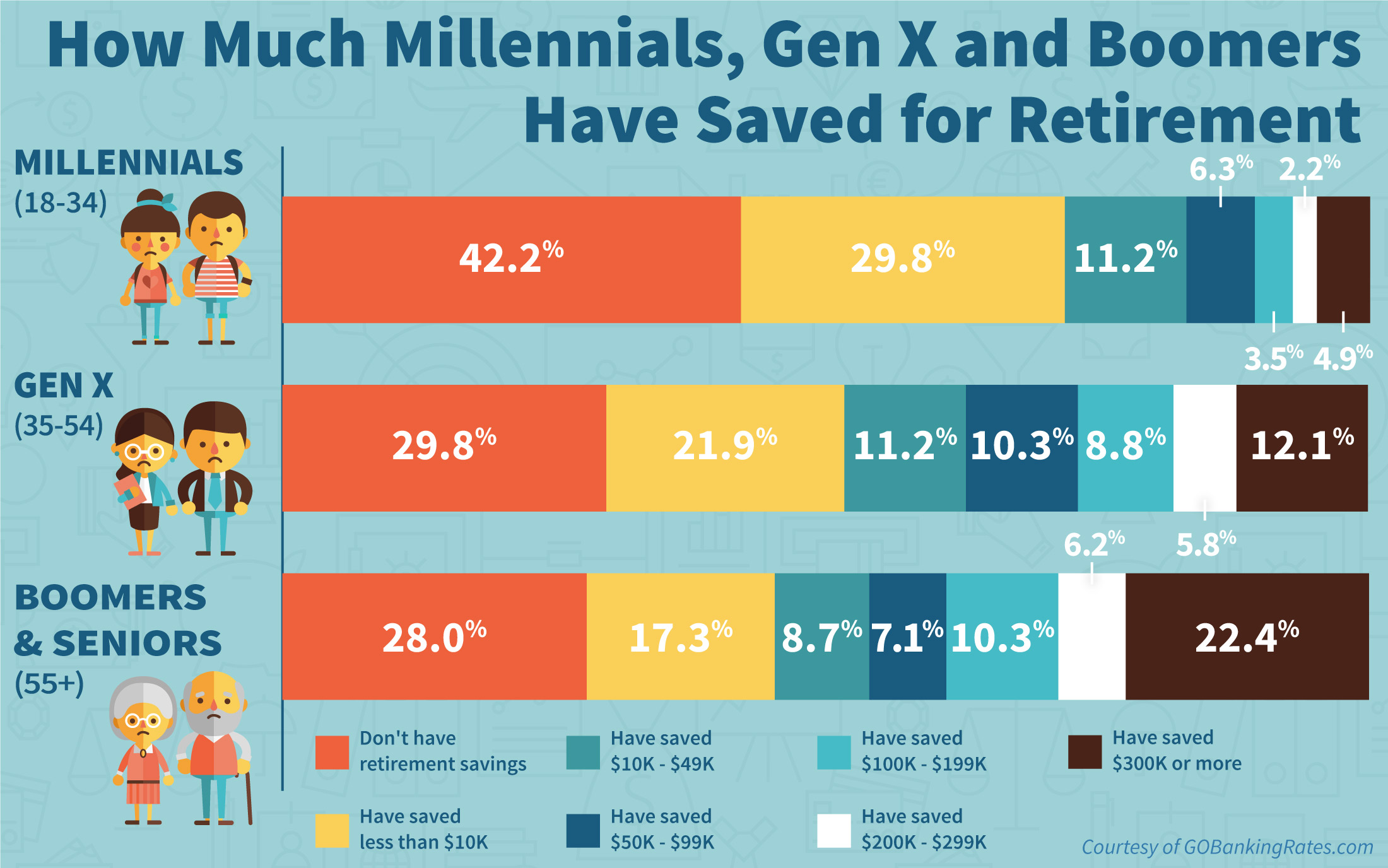

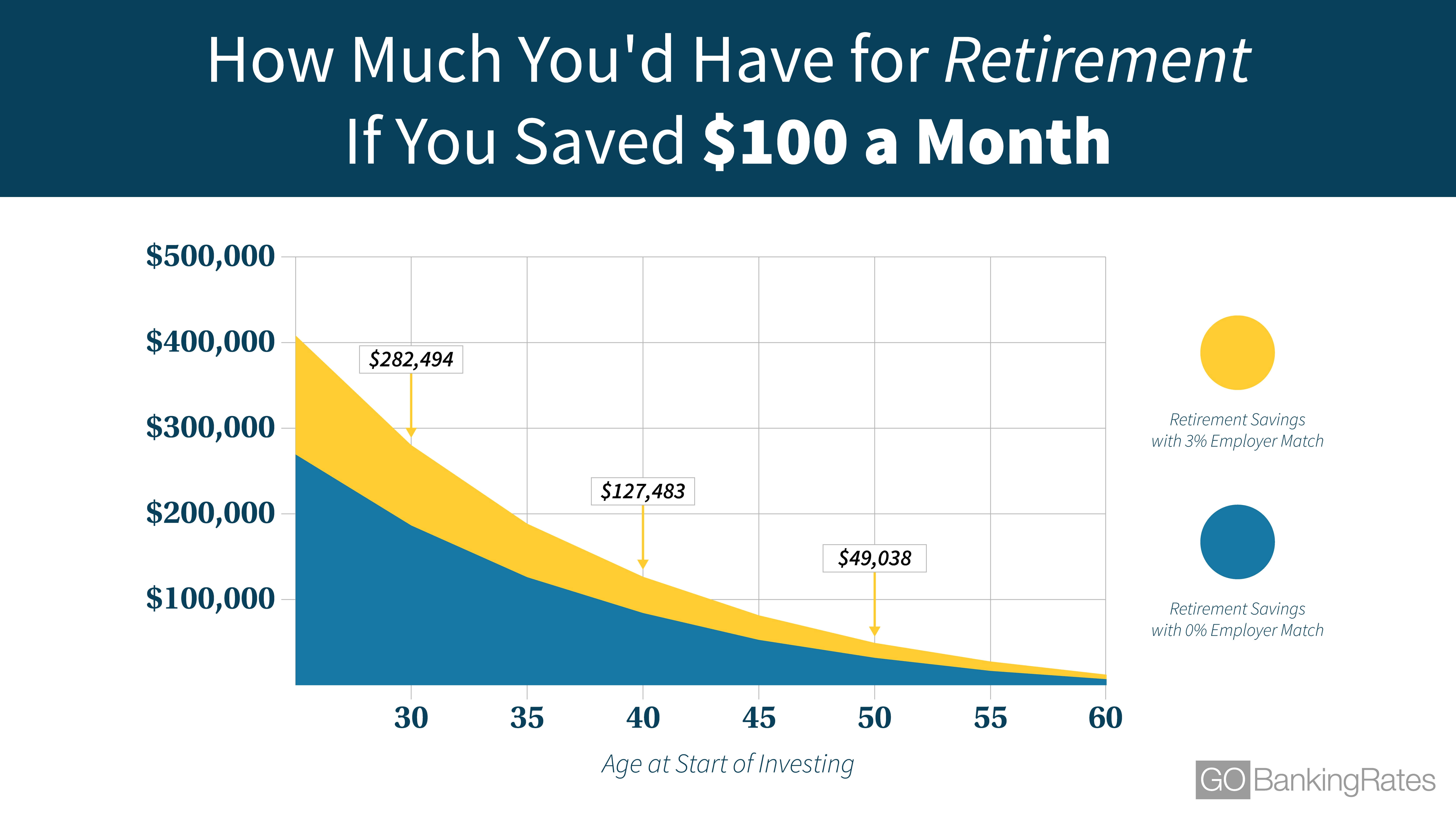

Source: gobankingrates.com

Source: gobankingrates.com

For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. You also need to invest the money properly to reach retirement with a big. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like.

Source: pinterest.com

Source: pinterest.com

For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. You also need to invest the money properly to reach retirement with a big. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties.

Source: 401kmaneuver.com

Source: 401kmaneuver.com

But, saving at 40 for retirement is just one part of the story. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. You also need to invest the money properly to reach retirement with a big.

Source: pinterest.com

Source: pinterest.com

For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. You also need to invest the money properly to reach retirement with a big.

![]() Source: mybanktracker.com

Source: mybanktracker.com

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement.

Source: makingsenseofcents.com

Source: makingsenseofcents.com

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. You also need to invest the money properly to reach retirement with a big. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties.

Source: marketrealist.com

Source: marketrealist.com

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. You also need to invest the money properly to reach retirement with a big.

Source: pinterest.com

Source: pinterest.com

For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. But, saving at 40 for retirement is just one part of the story. You also need to invest the money properly to reach retirement with a big. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties.

Source: plungedindebt.com

Source: plungedindebt.com

For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like.

Source: pinterest.com

Source: pinterest.com

For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. But, saving at 40 for retirement is just one part of the story. You also need to invest the money properly to reach retirement with a big.

Source: youtube.com

Source: youtube.com

For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties.

Source: youtube.com

Source: youtube.com

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. You also need to invest the money properly to reach retirement with a big. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement.

Source: madammoney.com

Source: madammoney.com

You also need to invest the money properly to reach retirement with a big. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. But, saving at 40 for retirement is just one part of the story.

Source: pinterest.co.uk

Source: pinterest.co.uk

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. But, saving at 40 for retirement is just one part of the story.

Source: thecoinstudy.com

Source: thecoinstudy.com

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. But, saving at 40 for retirement is just one part of the story. You also need to invest the money properly to reach retirement with a big.

Source: sensefinancial.com

Source: sensefinancial.com

Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. For investors in their 40s, many experts say retirement savings should be the first priority after paying for essentials like. Special tax rules such as internal revenue code 72 (t) can help avoid these penalties. But, saving at 40 for retirement is just one part of the story. For example, an individual who earned $150,000 per year before retirement would need $120,000 per year in retirement.