Your Retirement withdrawal calculator images are ready in this website. Retirement withdrawal calculator are a topic that is being searched for and liked by netizens now. You can Get the Retirement withdrawal calculator files here. Get all free photos.

If you’re looking for retirement withdrawal calculator pictures information connected with to the retirement withdrawal calculator keyword, you have visit the ideal site. Our site always gives you suggestions for viewing the highest quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

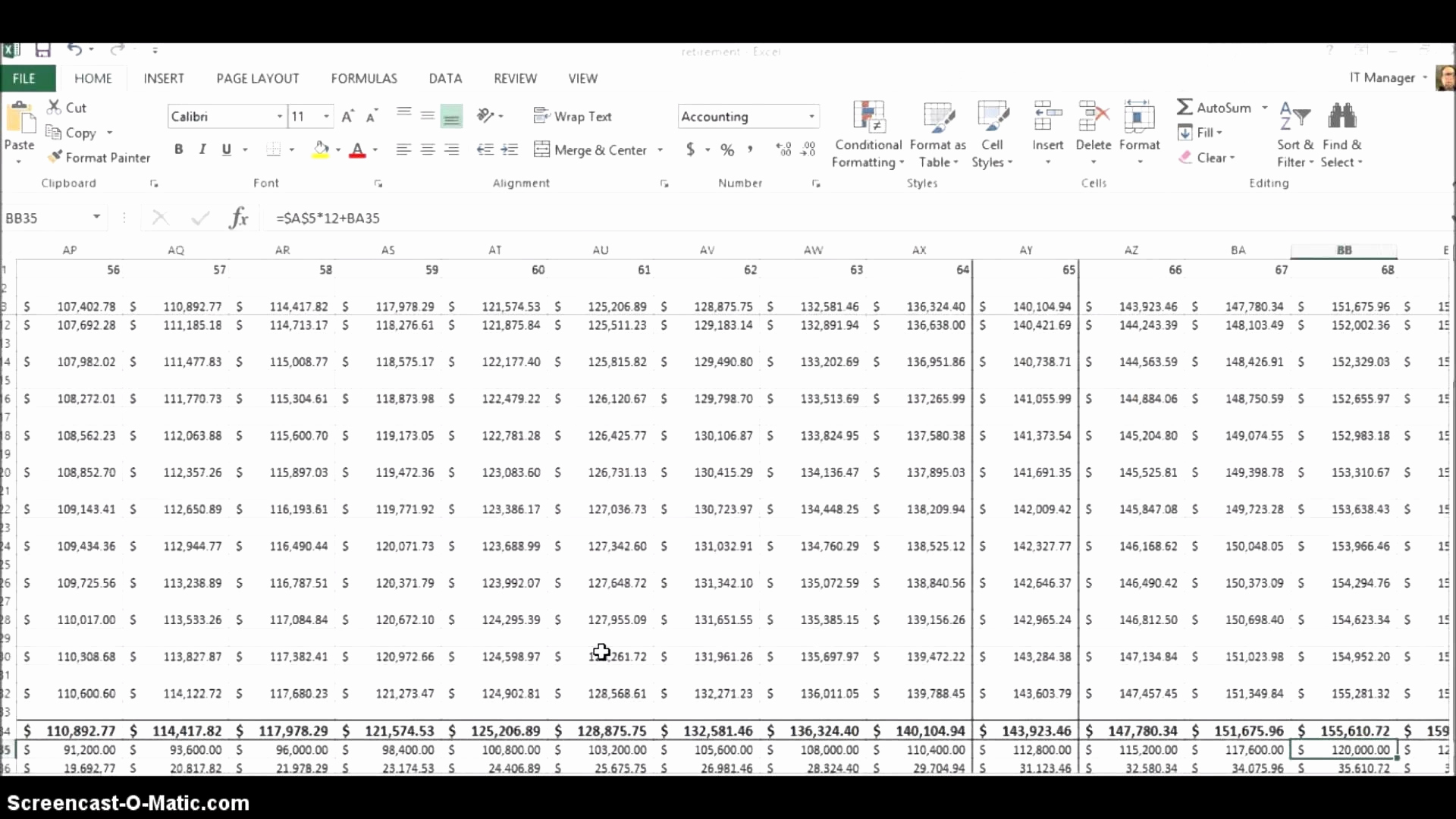

Retirement Withdrawal Calculator. 25=years until you retire (age 40 to age 65) 35=years of retirement. This calculation estimates the amount a person can withdraw every month in retirement. And from then on you should increase the amount to keep pace with inflation. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account.

FREE 6+ Sample Retirement Withdrawal Calculator Templates in Excel From sampletemplates.com

FREE 6+ Sample Retirement Withdrawal Calculator Templates in Excel From sampletemplates.com

2,702,947.50 or 2702947.5=amount saved at time of retirement. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. This calculation estimates the amount a person can withdraw every month in retirement. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. 5=interest rate (compounded annually) 3.5=inflation rate. Retirement withdrawal calculator terms and definitions:

This calculation estimates the amount a person can withdraw every month in retirement.

You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. 2,702,947.50 or 2702947.5=amount saved at time of retirement. There are no international stocks used in this calculator. Retirement withdrawal calculator terms and definitions: For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly.

Source: sampletemplates.com

Source: sampletemplates.com

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. Retirement withdrawal calculator terms and definitions: 2,702,947.50 or 2702947.5=amount saved at time of retirement. This calculation estimates the amount a person can withdraw every month in retirement.

Source: sampletemplates.com

Source: sampletemplates.com

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. 25=years until you retire (age 40 to age 65) 35=years of retirement. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly.

Source: sampletemplates.com

Source: sampletemplates.com

25=years until you retire (age 40 to age 65) 35=years of retirement. And from then on you should increase the amount to keep pace with inflation. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. 2,702,947.50 or 2702947.5=amount saved at time of retirement. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

Source: sampletemplates.com

Source: sampletemplates.com

How much can you withdraw after retirement? Retirement withdrawal calculator terms and definitions: You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. 2,702,947.50 or 2702947.5=amount saved at time of retirement. 5=interest rate (compounded annually) 3.5=inflation rate.

Source: sampletemplates.com

Source: sampletemplates.com

And from then on you should increase the amount to keep pace with inflation. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. And from then on you should increase the amount to keep pace with inflation. 2,702,947.50 or 2702947.5=amount saved at time of retirement. How much can you withdraw after retirement?

Source: laobingkaisuo.com

Source: laobingkaisuo.com

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. 25=years until you retire (age 40 to age 65) 35=years of retirement. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. There are no international stocks used in this calculator.

Source: sampletemplates.com

Source: sampletemplates.com

This calculation estimates the amount a person can withdraw every month in retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement. 25=years until you retire (age 40 to age 65) 35=years of retirement. There are no international stocks used in this calculator. And from then on you should increase the amount to keep pace with inflation.

Source: templatehaven.com

Source: templatehaven.com

How much can you withdraw after retirement? How much can you withdraw after retirement? You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. 25=years until you retire (age 40 to age 65) 35=years of retirement. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly.

Source: sampletemplates.com

Source: sampletemplates.com

25=years until you retire (age 40 to age 65) 35=years of retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement. Retirement withdrawal calculator terms and definitions: The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time.

Source: sampletemplates.com

Source: sampletemplates.com

Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. 5=interest rate (compounded annually) 3.5=inflation rate. 25=years until you retire (age 40 to age 65) 35=years of retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement.

Source: cnbam.org

Source: cnbam.org

This calculation estimates the amount a person can withdraw every month in retirement. 5=interest rate (compounded annually) 3.5=inflation rate. And from then on you should increase the amount to keep pace with inflation. Retirement withdrawal calculator terms and definitions: 25=years until you retire (age 40 to age 65) 35=years of retirement.

Source: sampletemplates.com

Source: sampletemplates.com

You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. Retirement withdrawal calculator terms and definitions: Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. This calculation estimates the amount a person can withdraw every month in retirement.

Source: db-excel.com

Source: db-excel.com

You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. How much can you withdraw after retirement? And from then on you should increase the amount to keep pace with inflation. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. 5=interest rate (compounded annually) 3.5=inflation rate.

Source: sampletemplates.com

Source: sampletemplates.com

There are no international stocks used in this calculator. 25=years until you retire (age 40 to age 65) 35=years of retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement. 5=interest rate (compounded annually) 3.5=inflation rate. This calculation estimates the amount a person can withdraw every month in retirement.

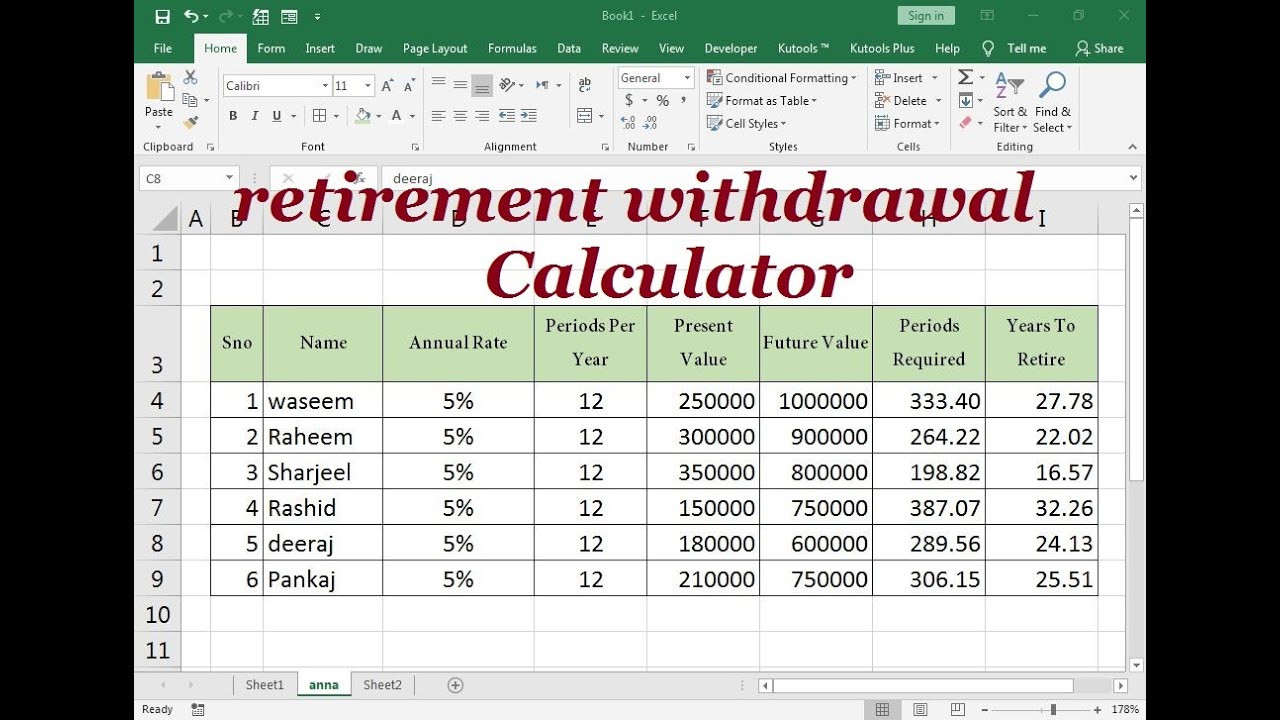

Source: youtube.com

Source: youtube.com

There are no international stocks used in this calculator. 5=interest rate (compounded annually) 3.5=inflation rate. 2,702,947.50 or 2702947.5=amount saved at time of retirement. Retirement withdrawal calculator terms and definitions: You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time.

Source: sampletemplates.com

Source: sampletemplates.com

You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. And from then on you should increase the amount to keep pace with inflation. There are no international stocks used in this calculator. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

Source: e-database.org

Source: e-database.org

How much can you withdraw after retirement? This calculation estimates the amount a person can withdraw every month in retirement. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly. How much can you withdraw after retirement?

Source: formtemplate.org

Source: formtemplate.org

Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. How much can you withdraw after retirement? There are no international stocks used in this calculator. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars (1,000 dollars monthly.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement withdrawal calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.