Your Retirement tax images are ready in this website. Retirement tax are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement tax files here. Download all royalty-free images.

If you’re searching for retirement tax images information related to the retirement tax topic, you have pay a visit to the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

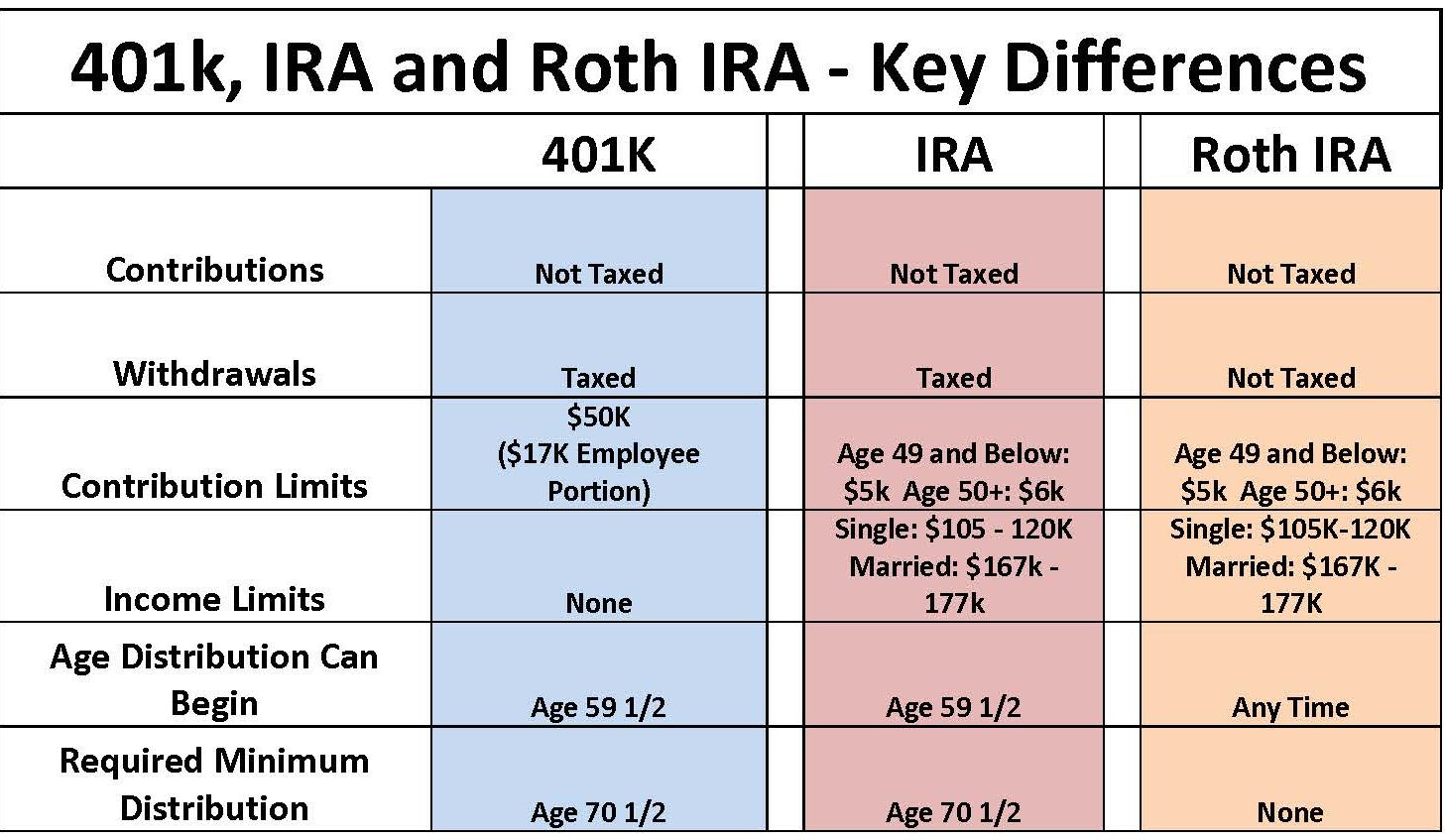

Retirement Tax. Indonesian income tax for retirees. All of these accounts are used for retirement income and all of them are taxable. However, in practice, we haven�t heard of anyone having to pay this tax on their global income. Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income.

Tax Free Retirement Plan YouTube From youtube.com

Tax Free Retirement Plan YouTube From youtube.com

Ad our guidebook will teach you the key issues many face & how to overcome them. In some cases, people put their retirement income in a 403 (b). Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income. Indonesian income tax for retirees. There are commonly two different ways that people withdraw their. Yes, they can and they do.

Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira.

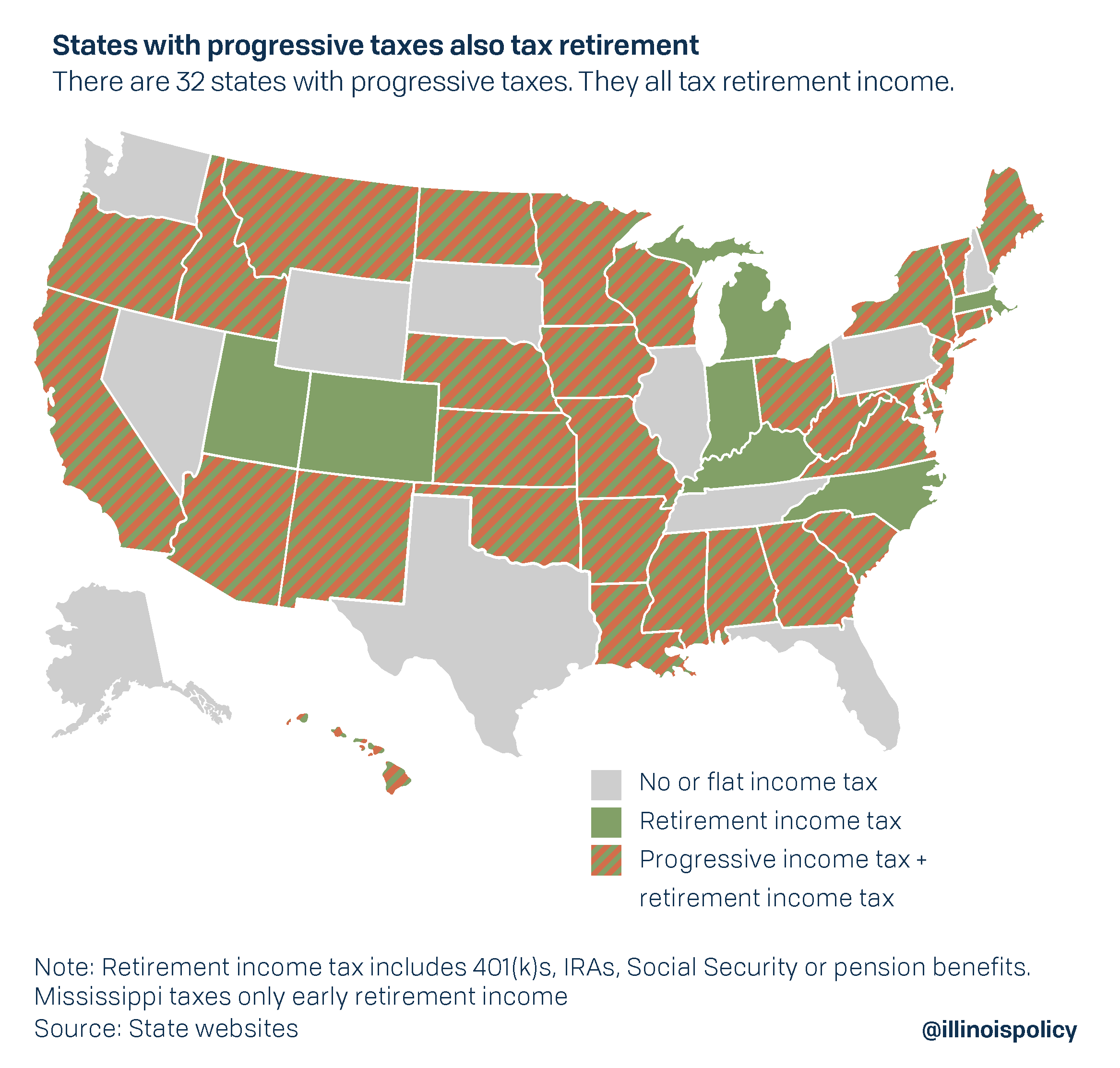

Yes, they can and they do. Individual retirement arrangements, or iras, provide tax incentives for people to make investments that can provide financial security for their retirement. There are commonly two different ways that people withdraw their. In some cases, people put their retirement income in a 403 (b). Retirees have specific financial concerns, and some states have taxes that are friendlier to those needs. Overview of retirement tax friendliness.

Source: mcbeathfinancialgroup.com

Source: mcbeathfinancialgroup.com

All of these accounts are used for retirement income and all of them are taxable. Yes, they can and they do. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual. Overview of retirement tax friendliness. Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira.

Source: bettergov.org

Source: bettergov.org

Overview of retirement tax friendliness. In some cases, people put their retirement income in a 403 (b). There are commonly two different ways that people withdraw their. Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income. All of these accounts are used for retirement income and all of them are taxable.

Source: bluewatersfinancial.com

Source: bluewatersfinancial.com

Indonesian income tax for retirees. In some cases, people put their retirement income in a 403 (b). Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income. One of the best strategies is. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual.

Source: illinoispolicy.org

Source: illinoispolicy.org

These accounts can be set up with a bank or other financial institution, a life insurance company, mutual. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual. Ad our guidebook will teach you the key issues many face & how to overcome them. However, in practice, we haven�t heard of anyone having to pay this tax on their global income. Of special interest to retirees are generally issues such as whether social security benefits are taxable at the state level, what property taxes will be levied and how retirement account and pension.

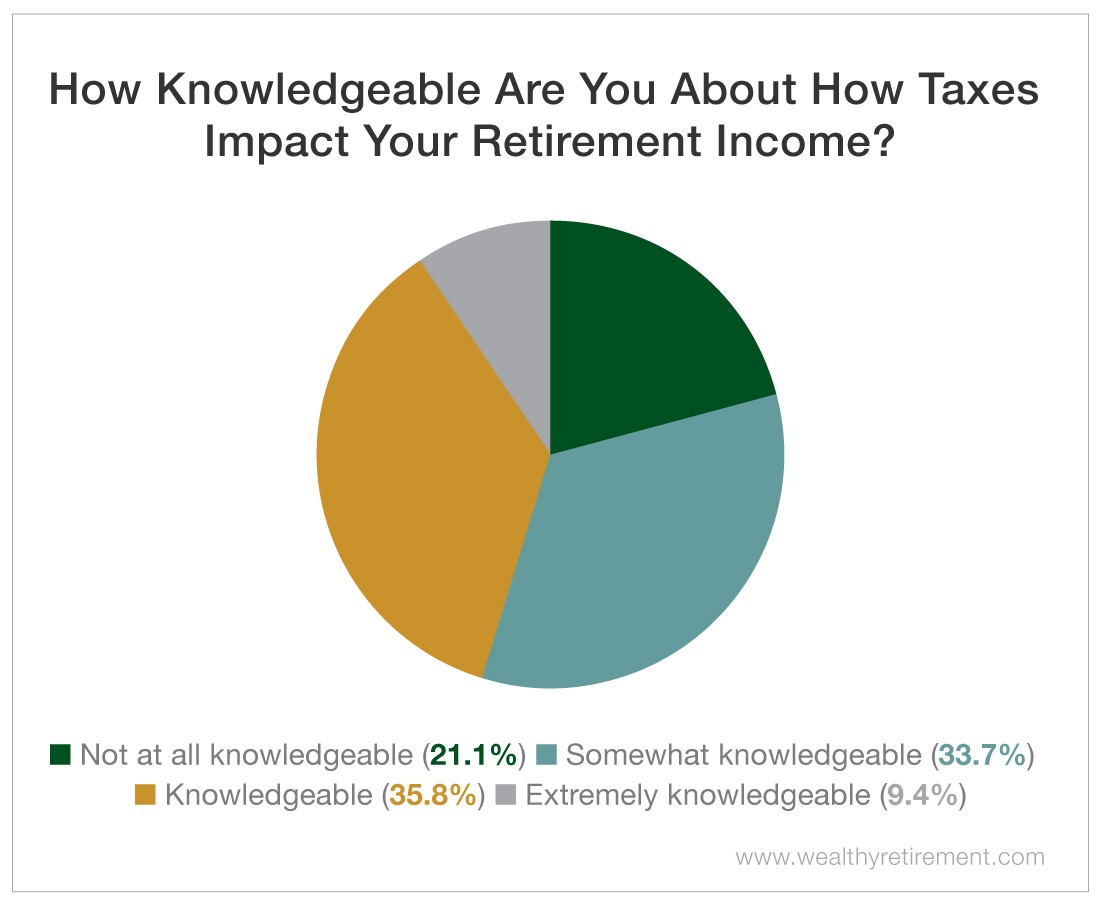

Source: wealthyretirement.com

Source: wealthyretirement.com

In some cases, people put their retirement income in a 403 (b). Most retirees rely on a few different sources of income, and there are ways to minimize taxes on each of them. Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. There are commonly two different ways that people withdraw their. In some cases, people put their retirement income in a 403 (b).

Source: stonybrookvillage.com

Source: stonybrookvillage.com

Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. All of these accounts are used for retirement income and all of them are taxable. Yes, they can and they do. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual. In some cases, people put their retirement income in a 403 (b).

Source: benavest.com

Source: benavest.com

These accounts can be set up with a bank or other financial institution, a life insurance company, mutual. Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income. There are commonly two different ways that people withdraw their. Yes, they can and they do. Ad our guidebook will teach you the key issues many face & how to overcome them.

Source: youtube.com

Source: youtube.com

Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. Yes, they can and they do. Overview of retirement tax friendliness. Most retirees rely on a few different sources of income, and there are ways to minimize taxes on each of them. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual.

Source: youtube.com

Source: youtube.com

Individual retirement arrangements, or iras, provide tax incentives for people to make investments that can provide financial security for their retirement. Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income. Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. Most retirees rely on a few different sources of income, and there are ways to minimize taxes on each of them. Of special interest to retirees are generally issues such as whether social security benefits are taxable at the state level, what property taxes will be levied and how retirement account and pension.

Source: money.cnn.com

Source: money.cnn.com

Ad our guidebook will teach you the key issues many face & how to overcome them. Retirees have specific financial concerns, and some states have taxes that are friendlier to those needs. Indonesian income tax for retirees. Overview of retirement tax friendliness. One of the best strategies is.

Source: thebalance.com

Source: thebalance.com

In some cases, people put their retirement income in a 403 (b). One of the best strategies is. Indonesian income tax for retirees. Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. There are commonly two different ways that people withdraw their.

Source: youtube.com

Source: youtube.com

Yes, they can and they do. Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. Retirees have specific financial concerns, and some states have taxes that are friendlier to those needs. One of the best strategies is. Of special interest to retirees are generally issues such as whether social security benefits are taxable at the state level, what property taxes will be levied and how retirement account and pension.

Source: arizonataxadvisors.com

Source: arizonataxadvisors.com

In some cases, people put their retirement income in a 403 (b). All of these accounts are used for retirement income and all of them are taxable. Of special interest to retirees are generally issues such as whether social security benefits are taxable at the state level, what property taxes will be levied and how retirement account and pension. Ad our guidebook will teach you the key issues many face & how to overcome them. Ad our guidebook will teach you the key issues many face & how to overcome them.

Source: raderfinancial.com

Source: raderfinancial.com

Overview of retirement tax friendliness. However, in practice, we haven�t heard of anyone having to pay this tax on their global income. Of special interest to retirees are generally issues such as whether social security benefits are taxable at the state level, what property taxes will be levied and how retirement account and pension. Ad our guidebook will teach you the key issues many face & how to overcome them. In some cases, people put their retirement income in a 403 (b).

Source: fidelity.com

Source: fidelity.com

However, in practice, we haven�t heard of anyone having to pay this tax on their global income. There are commonly two different ways that people withdraw their. Individual retirement arrangements, or iras, provide tax incentives for people to make investments that can provide financial security for their retirement. Ira withdrawals, as well as withdrawals from 401(k) plans, 403(b) plans, and 457 plans, are reported on your tax return as ordinary income. Most retirees rely on a few different sources of income, and there are ways to minimize taxes on each of them.

Retirees have specific financial concerns, and some states have taxes that are friendlier to those needs. Individual retirement arrangements, or iras, provide tax incentives for people to make investments that can provide financial security for their retirement. Most retirees rely on a few different sources of income, and there are ways to minimize taxes on each of them. Retirees have specific financial concerns, and some states have taxes that are friendlier to those needs. Ad our guidebook will teach you the key issues many face & how to overcome them.

Source: retirementtaxinfo.net

Source: retirementtaxinfo.net

All of these accounts are used for retirement income and all of them are taxable. Ad our guidebook will teach you the key issues many face & how to overcome them. All of these accounts are used for retirement income and all of them are taxable. One of the best strategies is. However, in practice, we haven�t heard of anyone having to pay this tax on their global income.

Source: incomeinvestors.com

Source: incomeinvestors.com

Ad our guidebook will teach you the key issues many face & how to overcome them. Overview of retirement tax friendliness. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual. Most people take their retirement income and put it in a special account, such as a 401 (k) or an ira. However, in practice, we haven�t heard of anyone having to pay this tax on their global income.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.