Your Retirement tax elimination act of 2022 images are ready. Retirement tax elimination act of 2022 are a topic that is being searched for and liked by netizens today. You can Get the Retirement tax elimination act of 2022 files here. Download all royalty-free images.

If you’re looking for retirement tax elimination act of 2022 pictures information connected with to the retirement tax elimination act of 2022 topic, you have come to the ideal blog. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Retirement Tax Elimination Act Of 2022. The bill also (1) appropriates funds to cover reductions in transfers to the social security and railroad retirement trust funds resulting. Introduced in house (02/03/2022) senior citizens tax elimination act. Subtraction for public safety employee retirement income a subtraction is enac. On january 27, 2022 in the house:

PNM Ordered to Issue Rate Credits in 2022 and 2023 for San Juan From tristatehomepage.com

PNM Ordered to Issue Rate Credits in 2022 and 2023 for San Juan From tristatehomepage.com

This bill repeals the inclusion of any social security or tier i railroad retirement benefits in gross income for income tax purposes. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Subtraction for public safety employee retirement income a subtraction is enac. First reading ways and means. Hearing 2/23 at 1:00 p.m. Governor larry hogan just passed the largest state tax cut package in our state�s history.

Subtraction for public safety employee retirement income a subtraction is enac.

Favorable with amendments report by budget and taxation: Governor larry hogan just passed the largest state tax cut package in our state�s history. On january 27, 2022 in the house: This bill repeals the inclusion of any social security or tier i railroad retirement benefits in gross income for income tax purposes. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. On january 19, 2022 in the house:

Source: savinopartners.com

Source: savinopartners.com

On january 19, 2022 in the house: On january 27, 2022 in the house: First reading ways and means. Hearing 2/23 at 1:00 p.m. Hearing 2/23 at 1:00 p.m.

Source: adopteesearch.info

Source: adopteesearch.info

Favorable with amendments report by budget and taxation: Hearing 2/23 at 1:00 p.m. Subtraction for public safety employee retirement income a subtraction is enac. Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement. Favorable with amendments report by budget and taxation:

Source: cbsnews.com

Source: cbsnews.com

Introduced in house (02/03/2022) senior citizens tax elimination act. Introduced in house (02/03/2022) senior citizens tax elimination act. Favorable with amendments report by budget and taxation: Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement. The bill also (1) appropriates funds to cover reductions in transfers to the social security and railroad retirement trust funds resulting.

Source: the-sun.com

Source: the-sun.com

Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Favorable with amendments report by budget and taxation: This bill repeals the inclusion of any social security or tier i railroad retirement benefits in gross income for income tax purposes. On january 27, 2022 in the house: Governor larry hogan just passed the largest state tax cut package in our state�s history.

Source: njac.org

Source: njac.org

Hearing 2/23 at 1:00 p.m. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Governor larry hogan just passed the largest state tax cut package in our state�s history. Favorable with amendments report by budget and taxation: This bill repeals the inclusion of any social security or tier i railroad retirement benefits in gross income for income tax purposes.

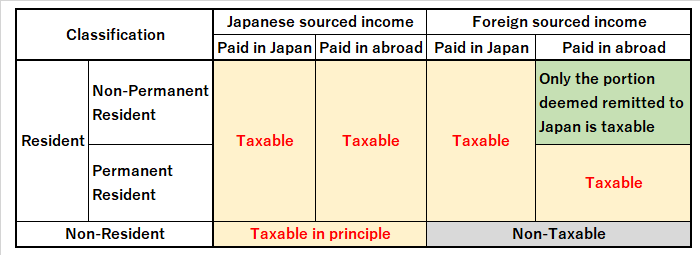

Source: grantthornton.com

Source: grantthornton.com

Favorable with amendments report by budget and taxation: Hearing 2/23 at 1:00 p.m. Hearing 2/23 at 1:00 p.m. Favorable with amendments report by budget and taxation: Governor larry hogan just passed the largest state tax cut package in our state�s history.

Source: financialplanningqld.com.au

Source: financialplanningqld.com.au

The bill also (1) appropriates funds to cover reductions in transfers to the social security and railroad retirement trust funds resulting. Favorable with amendments report by budget and taxation: On january 27, 2022 in the house: Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Introduced in house (02/03/2022) senior citizens tax elimination act.

Source: mosbdc.com

Source: mosbdc.com

On january 27, 2022 in the house: Favorable with amendments report by budget and taxation: First reading ways and means. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement.

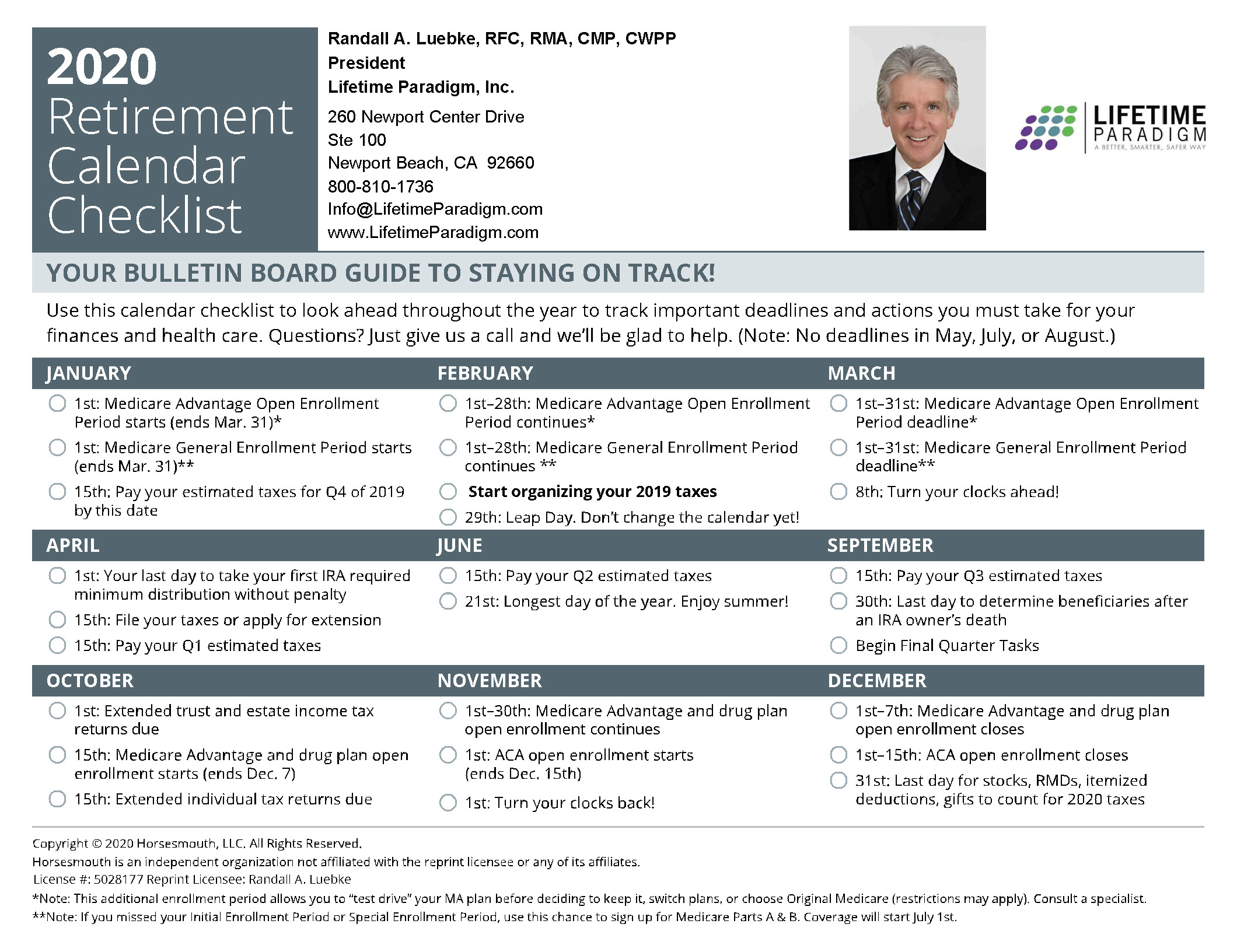

Source: thinkoutsidethetaxbox.com

Source: thinkoutsidethetaxbox.com

Governor larry hogan just passed the largest state tax cut package in our state�s history. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement. Governor larry hogan just passed the largest state tax cut package in our state�s history. Hearing 2/23 at 1:00 p.m.

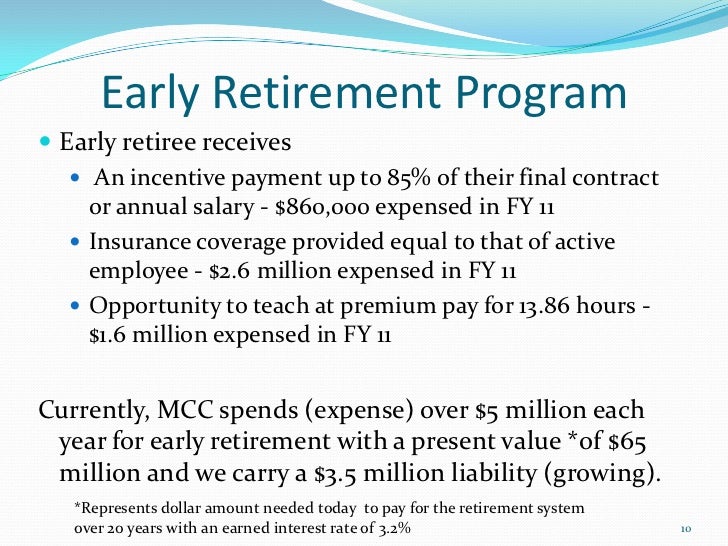

Source: lifetimeparadigm.com

Source: lifetimeparadigm.com

Hearing 2/23 at 1:00 p.m. Favorable with amendments report by budget and taxation: First reading ways and means. Hearing 2/23 at 1:00 p.m. Hearing 2/23 at 1:00 p.m.

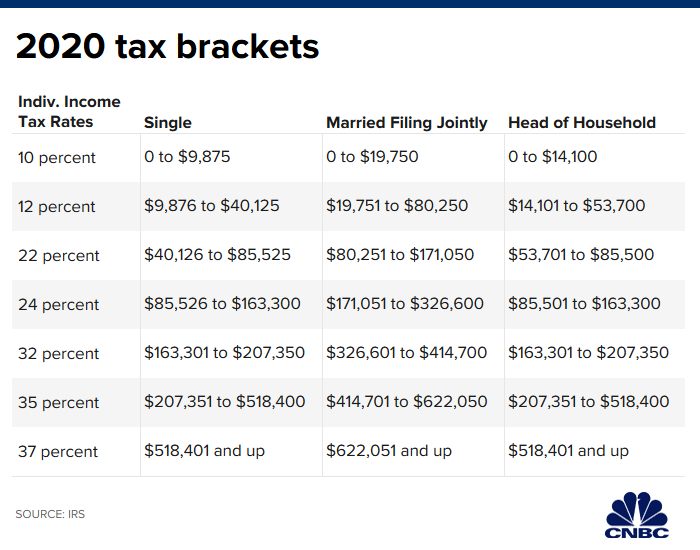

Source: taxpolicycenter.org

Source: taxpolicycenter.org

First reading ways and means. On january 27, 2022 in the house: Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement. Subtraction for public safety employee retirement income a subtraction is enac. Introduced in house (02/03/2022) senior citizens tax elimination act.

Source: nbr.com

Source: nbr.com

Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Favorable with amendments report by budget and taxation: This bill repeals the inclusion of any social security or tier i railroad retirement benefits in gross income for income tax purposes. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. On january 27, 2022 in the house:

Source: cleanthedarnair.org

Source: cleanthedarnair.org

Subtraction for public safety employee retirement income a subtraction is enac. Subtraction for public safety employee retirement income a subtraction is enac. On january 27, 2022 in the house: On january 19, 2022 in the house: Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement.

Source: mihanstore.info

Source: mihanstore.info

First reading ways and means. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Subtraction for public safety employee retirement income a subtraction is enac. Introduced in house (02/03/2022) senior citizens tax elimination act. First reading ways and means.

Source: peterswar.net

Source: peterswar.net

Hearing 2/23 at 1:00 p.m. Hearing 2/23 at 1:00 p.m. First reading ways and means. Hearing 2/23 at 1:00 p.m. Subtraction for public safety employee retirement income a subtraction is enac.

Source: angeliachaffin.blogspot.com

Source: angeliachaffin.blogspot.com

Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. On january 27, 2022 in the house: On january 19, 2022 in the house: Governor larry hogan just passed the largest state tax cut package in our state�s history. Favorable with amendments report by budget and taxation:

Source: mihanstore.info

Source: mihanstore.info

First reading ways and means. This bill repeals the inclusion of any social security or tier i railroad retirement benefits in gross income for income tax purposes. Introduced in house (02/03/2022) senior citizens tax elimination act. First reading ways and means. Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement.

Source: illinois.retiredamericans.org

Source: illinois.retiredamericans.org

Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement. Maryland has enacted the retirement tax elimination act of 2022, which provides income tax subtractions for the retirement income of certain taxpayers, in addition to an income tax credit for certain elderly taxpayers. Hearing 2/23 at 1:00 p.m. Subtraction for public safety employee retirement income a subtraction is enac. Marylanders 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement tax elimination act of 2022 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.